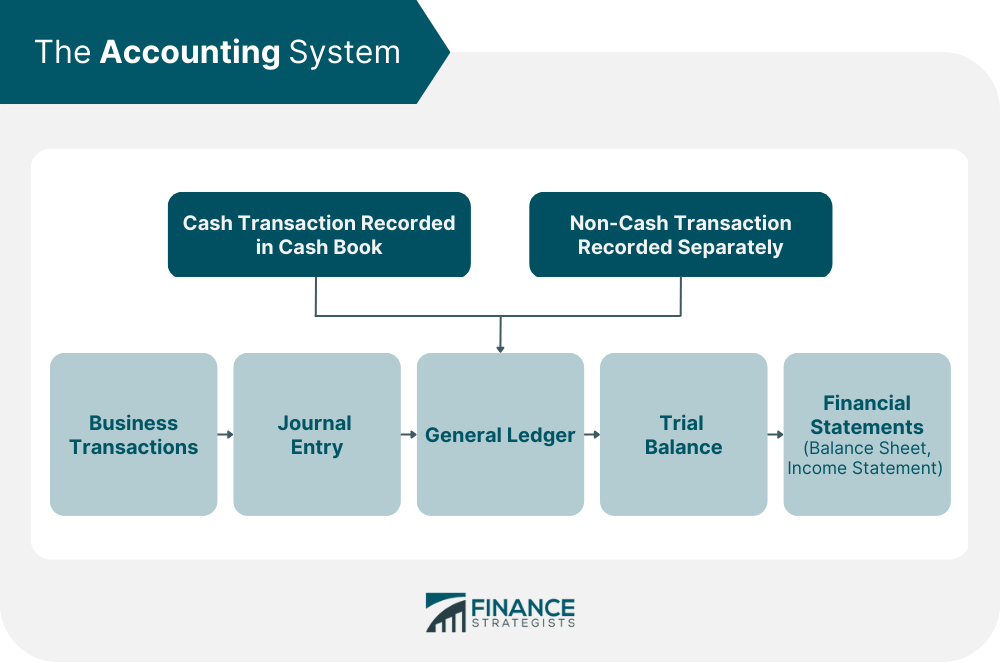

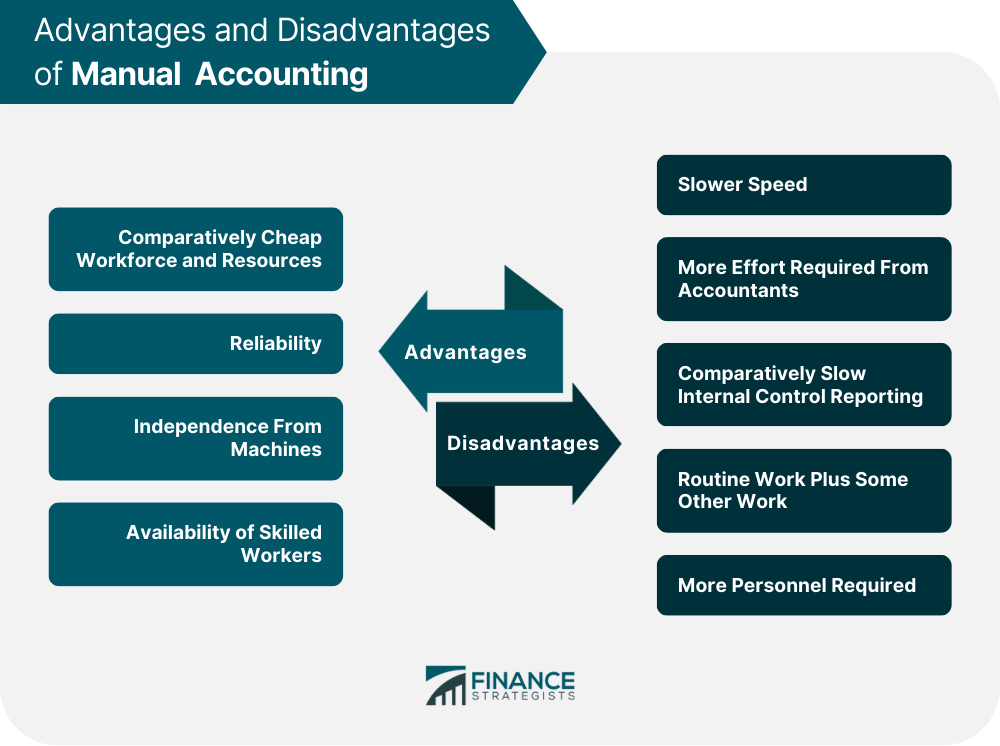

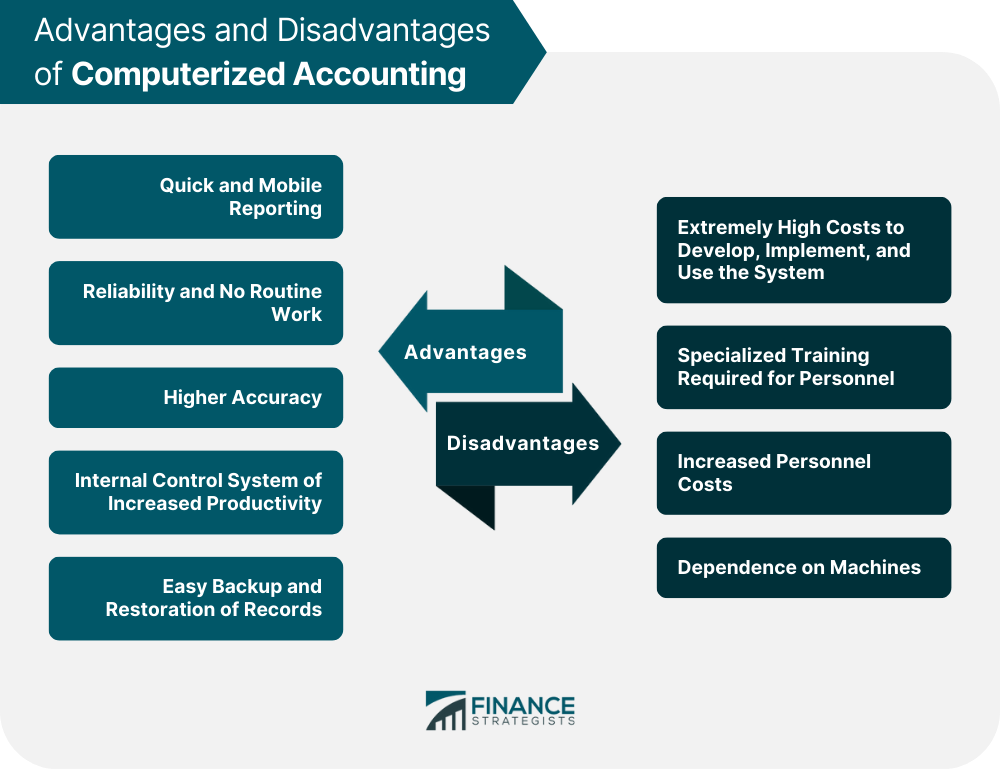

To understand what computerized accounting is, it's essential to know how accounting systems can be represented. So, let's examine the figure below. The purpose of accounting is to provide financial information that is useful for decision-making. Accounting can be viewed as a system (or a process) that converts data into useful information. The information processes include recording, maintaining, and reporting. Numerous processes are involved in every business. Some are simple, while others are complex or cumbersome. As a business grows, acquires new customers, enters new markets, and keeps pace with constant changes in statutory regulations, it needs to maintain accurate and up-to-date accounting, inventory, and statutory records. This is where computerized accounting helps. Computerized accounting simplifies, integrates, and streamlines all business processes both easily and cost-effectively. Accounting for the financial transactions of a business is an important function in daily operations. Developing and using a proper accounting system ensures that all transactions are recorded correctly and accurately on the enterprise's general ledger. Technological advances ease the accounting process for many businesses. Accounting is an important part of every enterprise. Businesses are required to keep books on their credits and debits. So, which is best for a business idea: people or software? Many accountants and auditors describe accounting as a language of business that is accepted in all countries. Every company applies accounting because it is generally accepted. Companies must disclose specific financial and management information to the government, public, and other users. In fact, accounting is an indispensable tool in the business decision-making process. With the development of information technologies, many computer products (software) have emerged that make accounting straightforward for users. To stay competitive, large enterprises analyze the performance of all organizational cells (starting from unskilled workers and operating personnel, and finishing with top managers and other key personnel). They seek out all the deviations from the plan and their impact. It is the responsibility of an enterprise's management team to implement measures and procedures to avoid deviations of this kind in the future. These procedures are known as internal controls, and they include the following five elements: Each element, after being assessed separately, is brought together with the others to derive a holistic rating of organizational performance. Manual accounting implies that employees perform the whole accounting cycle manually on a periodic basis; they calculate, journalize transactions, prepare ledgers, cast trial balances, and prepare financial statement reports and other routines. Of course, in large organizations, manual accounting tasks of this kind take substantial time, resources, and effort. On the other hand, computerized accounting implies that the only thing that employees do is record transactions in a computer, which then completes the other steps involved in the accounting cycle automatically or by a request. However, this view of computerized accounting is very simplified. This is because transactions are a complex category consisting of not only sales or acquisitions but also depreciation, premiums, dividends, and the calculation of wages. So, despite the fact that computers provide accurate calculations and generate smart reports, computerized accounting also consumes substantial time, resources, and effort. For this reason, it is difficult to assess which type of accounting is faster and more economical. If manual accounting requires qualified accountants to keep a record of business transactions, computerized accounting requires accountants who can use specific software and, thus, who command a higher wage. Software can run calculations faster than humans, but computers don't know what's needed until a human provides clear instructions. In addition, depending on the complexity and size of an organization, a suitable computerized accounting system can cost an enormous sum. Also, compared to manual accounting, computerized accounting provides a better internal control report system for any given period of time. This is because computers can control thousands of indicators simultaneously and deliver notifications to the relevant party when specific indicators are abnormal. By contrast, manual control takes more time. The advantages of manual accounting include: The disadvantages of manual accounting include: The advantages of computerized accounting include: The disadvantages of computerized accounting include: Both computerized accounting and manual accounting have advantages and disadvantages, but they perform the same task and the final result is the same. The main differences between these types of accounting boil down to cost, speed, and mobility. In small and medium-sized businesses, manual accounting is usually preferred and can be used without undermining quality. By contrast, large corporations apply complex accounting systems that cost a lot, but the effects of these applications exceed all expectations. Apart from the disadvantages, computerized accounting suffers from certain limitations relating to its operation. These are as follows: These limitations cited can be set right by establishing UPS, using trained accounting personnel, and implementing robust control and security measures. Although computerized accounting is considered to be fairly costly, it is preferred by modern enterprises due to its speed, mobility, and accuracy. Note: The methodology relating to computerized accounting is not discussed here in detail.

Need for Computerized Accounting

Manual vs Computerized Accounting

Advantages and Disadvantages of Manual and Computerized Accounting

Advantages of Manual Accounting

Disadvantages of Manual Accounting

Advantages of Computerized Accounting

Disadvantages of Computerized Accounting

Comparison

Limitations of Computerized Accounting

Computerized Accounting FAQs

Manual accounting offers several benefits including cheap workforce, independence from machines, availability of skilled workers, reliability and no routine work. However, it tends to be slower than computerized accounting with its mobile reporting facility. Furthermore, it involves greater effort from accountants as they have to input data in the system and do some other work in addition. Furthermore, this system requires more personnel to handle it.

Computerized accounting systems suffer from certain limitations such as power failure (caused by storms, lightning strikes and power outages), virus attacks (that could shut down the entire system), hackers, and hardware or programming errors. In addition to this, inadequately programmed systems can also result in more harm than help.

Manual accounting suffers from human error while using it. Moreover, data input into a system is a tedious task which needs proper training. It also requires more people to handle accounts and other related works. The processing time is comparatively higher in manual accounting than in computerized accounting systems where information gets displayed almost instantly.

The speed of work tends to be much slower when compared with computerized system; however, it is more reliable and accurate. The use of computers can result in data entry errors which may result in misreporting. Moreover, computerized accounting requires high-qualified professionals to make use of them; hence if any error occurs, it becomes hard to detect the mistake at earlier stages.

The speed and reliability of computerized systems outshine manual accounting. It offers quick reporting facility and is highly accurate. The workflow can be easily managed in this system, and it is not expensive to maintain them as well. In spite of these many benefits, companies still prefer manual accounting over computerized accounting for their own reasons.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.