Retirement confidence is an individual's belief in their ability to retire comfortably and maintain a desirable standard of living during their retirement years. It is a crucial aspect of financial planning, as it determines how people prepare for their post-career lives. Various factors influence retirement confidence, including personal finances, health, age, and economic conditions. There are several self-assessment tools available to help individuals gauge their retirement confidence. Online surveys and questionnaires can provide a quick and easy way to evaluate one's financial preparedness for retirement. Additionally, financial planning software can offer a more in-depth analysis of an individual's current financial status and long-term retirement goals. Financial advisors and retirement planning services can offer expert advice and guidance in assessing retirement confidence. These professionals can help individuals understand their financial situation, identify potential challenges, and recommend strategies to boost their confidence in achieving a comfortable retirement. 1. Savings and Investments: The amount of money saved and invested for retirement can significantly impact an individual's confidence in their ability to retire comfortably. 2. Pension Plans and Social Security: Employer-sponsored pension plans and government-provided Social Security benefits contribute to an individual's retirement income, affecting their confidence in their ability to maintain their desired standard of living. 3. Debt Management: High levels of debt can negatively impact retirement confidence, as it may limit an individual's ability to save for retirement or cover expenses during retirement. 4. Expected Expenses in Retirement: Estimating future expenses, such as housing, utilities, and medical costs, is essential to understand how much income will be needed in retirement. 1. Age and Life Expectancy: An individual's age and expected lifespan can impact their retirement confidence, as it determines the number of years they need to plan for and the amount of savings required. 2. Health Status and Medical Costs: Health concerns and potential medical costs during retirement can significantly influence retirement confidence, as healthcare expenses can be substantial. 3. Family Circumstances: Family dynamics, such as the need to support adult children or aging parents, can affect retirement confidence and the resources required for a comfortable retirement. 1. Inflation and Cost of Living: Inflation and the cost of living can impact an individual's retirement confidence, as it affects the purchasing power of their savings and the expenses they will face during retirement. 2. Market Performance and Investment Returns: Market performance and investment returns can impact retirement confidence, as it influences the growth of an individual's retirement savings. 3. Government Policies Affecting Retirement: Changes in government policies, such as adjustments to Social Security benefits or tax laws, can influence retirement confidence. 1. Identifying Goals and Objectives: Clearly outlining retirement goals and objectives helps create a roadmap for achieving a comfortable retirement. 2. Estimating Retirement Income and Expenses: A thorough analysis of projected retirement income and expenses is essential to understand the financial resources required for a secure retirement. 3. Developing a Risk Management Plan: Implementing a risk management plan can help individuals prepare for potential financial challenges during retirement, such as market volatility and healthcare costs. 1. Emergency Fund: Establishing an emergency fund can provide a financial safety net, improving retirement confidence by ensuring that unexpected expenses do not derail retirement plans. 2. Retirement Savings Vehicles: Utilizing retirement savings vehicles, such as 401(k)s and IRAs, can help individuals accumulate wealth for retirement and take advantage of tax benefits. 3. Diversified Investment Portfolio: Creating a diversified investment portfolio can help manage risk and improve retirement confidence by promoting long-term growth and stability. 1. Financial Advisors: Financial advisors can provide expert advice on retirement planning, helping individuals identify potential challenges and develop strategies to boost their retirement confidence. 2. Retirement Planning Workshops and Seminars: Attending workshops and seminars can provide valuable insights into retirement planning, offering individuals the opportunity to learn from experts and share experiences with others in similar situations. 3. Online Resources and Communities: Leveraging online resources and joining retirement planning communities can provide individuals with valuable information and support, helping them stay informed and maintain their retirement confidence. One of the most significant fears individuals face when planning for retirement is the possibility of outliving their savings. The high cost of healthcare is another common concern for retirees. Planning for potential healthcare expenses, considering long-term care insurance, and maintaining a healthy lifestyle can help address this fear and improve retirement confidence. Some individuals may worry about not receiving adequate support from family members or government programs during retirement. Communicating with family members about expectations and staying informed about government policies and benefits can help alleviate these concerns and enhance retirement confidence. Market fluctuations and investment risks can significantly impact retirement savings. Diversifying investments, working with a financial advisor, and developing a risk management plan can help manage these risks and maintain retirement confidence. Regularly reviewing and updating the retirement plan can help individuals stay on track and adapt to changing circumstances, ensuring their retirement goals remain achievable. Keeping up-to-date on market trends and economic changes can help individuals make informed decisions about their retirement planning and maintain their confidence in their ability to retire comfortably. Life changes and personal circumstances can impact retirement plans. Adapting to these changes and adjusting retirement strategies as needed can help individuals maintain their retirement confidence. Connecting with friends, family, and professionals for support and advice can help individuals navigate the challenges of retirement planning and maintain their retirement confidence. Retirement confidence is a crucial aspect of financial planning that determines how people prepare for their post-career lives. It is influenced by various factors, including personal finances, health, age, and economic conditions. Assessing retirement confidence can be done through self-assessment tools and professional guidance. Strategies to boost retirement confidence include creating a comprehensive retirement plan, prioritizing savings and investments, and utilizing professional guidance. Overcoming common retirement fears, such as outliving retirement savings, high healthcare costs, inadequate support from family or government, and market volatility and investment risks, can also improve retirement confidence. Maintaining retirement confidence requires regularly reviewing and updating the retirement plan, staying informed about market trends and economic changes, adapting to life changes and personal circumstances, and seeking support from friends, family, and professionals. By following these strategies and overcoming common fears, individuals can maintain a confident and secure retirement.What Is Retirement Confidence?

Assessing Retirement Confidence

Self-Assessment Tools

Professional Assessment

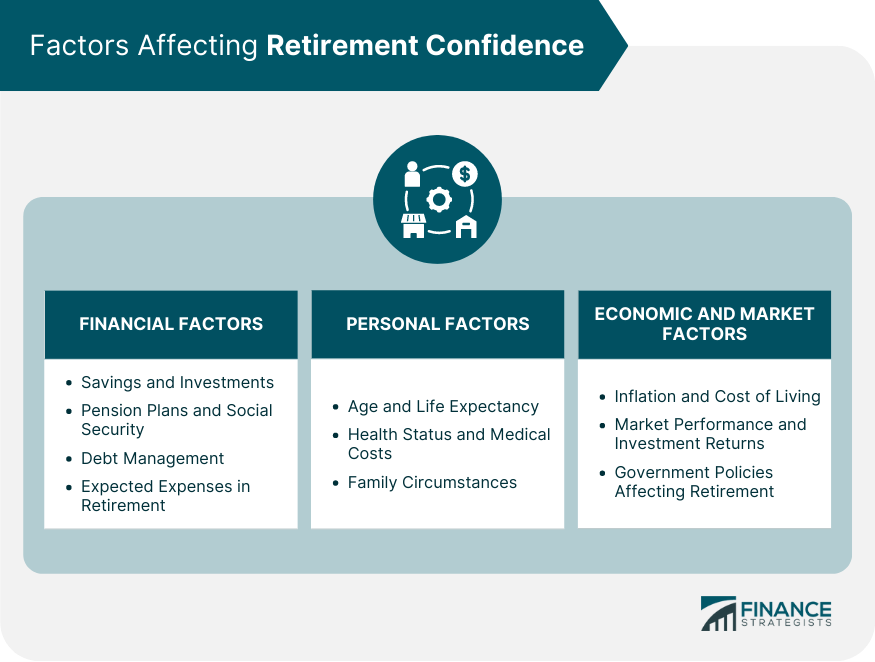

Factors Affecting Retirement Confidence

Financial Factors

Personal Factors

Economic and Market Factors

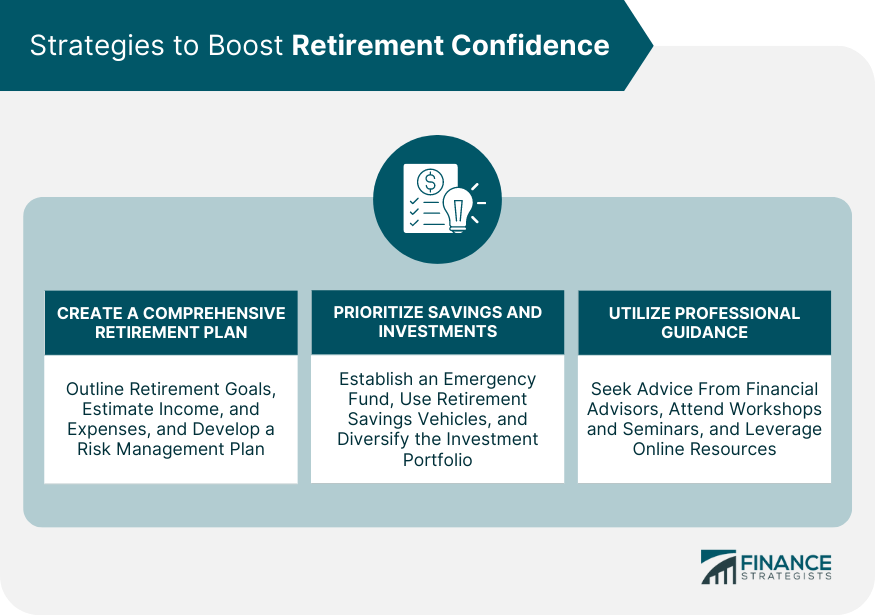

Strategies to Boost Retirement Confidence

Creating a Comprehensive Retirement Plan

Prioritizing Savings and Investments

Utilizing Professional Guidance

Overcoming Common Retirement Fears

Outliving Retirement Savings

Developing a comprehensive retirement plan, prioritizing savings and investments, and adjusting withdrawal rates during retirement can help mitigate this risk and improve retirement confidence.High Healthcare Costs

Inadequate Support from Family or Government

Market Volatility and Investment Risks

Maintaining Retirement Confidence

Regularly Reviewing and Updating the Retirement Plan

Staying Informed About Market Trends and Economic Changes

Adapting to Life Changes and Personal Circumstances

Seeking Support from Friends, Family, and Professionals

Conclusion

Retirement Confidence FAQs

Retirement confidence refers to an individual's belief in their ability to retire comfortably and maintain a desirable standard of living during their retirement years. It is essential because it influences how people prepare for their post-career lives and helps them make informed decisions about their financial planning.

Self-assessment tools, such as online surveys, questionnaires, and financial planning software, can help individuals evaluate their financial preparedness for retirement. By identifying potential challenges and areas for improvement, these tools can guide individuals in making adjustments to their retirement planning, ultimately boosting their retirement confidence.

Some strategies to boost retirement confidence include creating a comprehensive retirement plan, prioritizing savings and investments, diversifying the investment portfolio, and utilizing professional guidance from financial advisors or retirement planning workshops. Implementing these strategies can help individuals feel more confident about their ability to achieve a comfortable retirement.

Maintaining retirement confidence involves regularly reviewing and updating the retirement plan, staying informed about market trends and economic changes, adapting to life changes and personal circumstances, and seeking support from friends, family, and professionals. These actions can help individuals stay on track with their retirement goals and maintain their confidence in their ability to retire comfortably.

Common fears that can negatively impact retirement confidence include outliving retirement savings, high healthcare costs, inadequate support from family or government, and market volatility and investment risks. Addressing these concerns through proactive planning and risk management strategies can help alleviate these fears and improve overall retirement confidence.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.