An excess deferral occurs when an individual contributes more than the allowable annual contribution limit to one or more tax-deferred retirement accounts, such as a 401(k) plan or a 403(b) plan, in a given tax year. The Internal Revenue Service (IRS) sets annual contribution limits for these types of retirement accounts, and exceeding these limits can result in unintended tax consequences. Excess deferrals can happen for a variety of reasons, including misunderstandings of the contribution limits, errors made by employers in processing contributions, or changes in employment where an individual contributes to multiple retirement plans within the same year. To initiate the correction process, the individual should contact the retirement account's financial institution and follow the necessary steps to request a withdrawal of the excess deferral and any associated earnings. It's important to note that the withdrawn earnings may be subject to income tax and, in some cases, an additional early withdrawal penalty. A 401(k) plan is a popular employer-sponsored retirement savings plan that allows employees to contribute a portion of their pre-tax income toward retirement investments. Employers often match employee contributions up to a certain percentage, providing an additional incentive for employees to save for retirement. A 403(b) plan is similar to a 401(k) plan but specifically designed for employees of tax-exempt organizations, such as educational institutions, religious organizations, and nonprofit entities. These plans allow employees to contribute pre-tax income to retirement investments, and employers may also provide matching contributions. A Savings Incentive Match Plan for Employees (SIMPLE) IRA (Individual Retirement Arrangement) is a retirement plan designed for small businesses and self-employed individuals. Employers and employees contribute to the employee's IRA account. SIMPLE IRAs are easier to set up and administer than traditional 401(k) or 403(b) plans, making them an attractive option for small businesses. A Simplified Employee Pension (SEP) IRA is a retirement plan allowing employers to contribute to their employees' retirement savings. The plan is designed for small businesses and self-employed individuals. Employers can contribute a percentage of an employee's income up to a certain limit, and employees are not required to contribute to their SEP IRA. Understanding the limits on annual retirement plan contributions is essential for preventing excess deferrals. These limits vary depending on the type of retirement plan and the individual's age. 401(k) and 403(b) Plans: These plans have an annual contribution limit that is subject to change due to cost-of-living adjustments. As of 2024, the limit is $23,000 for individuals under the age of 50. SIMPLE IRA Plans: The annual contribution limit for a SIMPLE IRA is lower than that of a 401(k) or 403(b) plan. As of 2024, the limit is $16,000 for individuals under the age of 50. SEP IRA Plans: The contribution limit for a SEP IRA is based on a percentage of the employee's income, up to a maximum of $69,000 in 2024. Individuals aged 50 and older can make additional catch-up contributions to their retirement accounts. These limits are also subject to cost-of-living adjustments. Catch-up contributions allow older individuals to save more for retirement as they approach retirement age. As of 2024, the catch-up contribution limits are: 401(k) and 403(b) plans: $7,500 SIMPLE IRA plans: $3,500 The Internal Revenue Service adjusts retirement plan contribution limits to account for inflation and changes in the cost of living. These adjustments are typically announced annually, usually towards the end of the calendar year, and take effect in the following year. There are several reasons excess deferrals may occur. Understanding these causes can help you take the necessary steps to prevent and address excess contributions in your retirement accounts. Excess deferrals can result from miscommunication between employees and employers, such as misunderstandings about contribution limits or the timing of contributions. Employees need to clarify their desired contribution amounts with their employers and ensure that both parties agree regarding contribution limits. Individuals who participate in multiple retirement plans may inadvertently contribute too much when the combined total of their contributions is within the annual limit. Coordinating contributions across all retirement accounts is crucial to prevent excess deferrals. Miscalculating contribution limits can lead to excess deferrals, especially when factoring in catch-up contributions or coordinating between multiple retirement plans. Understanding the contribution limits for each retirement plan and double-checking your calculations can help prevent this issue. Employers and plan administrators may make mistakes in processing contributions, resulting in excess deferrals. Regularly reviewing your retirement plan statements and communicating with your employer or plan administrator can help identify and rectify such errors. Excess deferrals can have several negative consequences, both short- and long-term. Awareness of these consequences can motivate individuals to prevent and address excess contributions in their retirement accounts. Excess deferrals can result in double taxation, as the excess amounts are taxed when contributed and again when withdrawn from the retirement account. This can significantly reduce the overall value of your retirement savings. Individuals with excess deferrals may face penalties and fees if the excess amounts are not corrected in a timely manner. The IRS may impose a 6% excise tax on excess contributions that are withdrawn after the deadline. Excess deferrals can negatively impact retirement savings, as the excess amounts are not invested in the retirement account and may be subject to taxes and penalties. This can reduce the growth potential of your retirement savings and hinder your ability to achieve your long-term financial goals. Identifying excess deferrals early and taking corrective action can help minimize the potential tax liabilities and penalties associated with excess contributions. Regularly monitoring your annual contributions to retirement plans is essential for identifying excess deferrals. Review your account statements, pay stubs, and any correspondence from your employer or plan administrator to ensure your contributions are accurate and within the allowable limits. Maintain open communication with your employer and plan administrators to ensure that your contributions are accurate and within the allowable limits. Notify them immediately if you identify any discrepancies in your contributions or if you need to make adjustments to your contribution amounts. If you identify an excess deferral, you must request a return of the excess amount by April 15th of the following year to avoid penalties and taxes. To do this, contact your plan administrator and provide them with the necessary information to process the return of the excess contribution. The deadline for requesting a return of excess deferrals is April 15th of the year following the year in which the excess deferral occurred. Please meet this deadline to avoid penalties and additional taxes. When the excess deferral is returned to you, it is generally considered taxable income for the year in which the excess occurred. Be prepared to report this income on your tax return and pay any applicable taxes. Addressing excess deferrals as soon as they are identified can help minimize potential tax liabilities and penalties. Monitor your retirement accounts and work with your employer or plan administrator to correct any excess contributions. Taking proactive measures to prevent excess deferrals can help you avoid the potential consequences associated with excess contributions and maximize your retirement savings. Educate yourself about the current contribution limits for your retirement plans, including catch-up contribution provisions for individuals aged 50 and older. Stay up-to-date on any changes to these limits due to cost-of-living adjustments. Reviewing your retirement plan statements helps you track your contributions and ensure that you stay within the allowable limits. Look for any discrepancies in your contributions and address them promptly. If you participate in multiple retirement plans, coordinate your contributions to ensure that your combined total does not exceed the annual limits. This may require careful planning and communication with your employers or plan administrators. Maintain open lines of communication with your employer and plan administrators to ensure that your contributions are accurately recorded and within the allowable limits. Discuss any changes to your contribution amounts or concerns about excess deferrals as they arise. Excess deferrals can occur when an individual contributes more than the allowable annual contribution limit to one or more tax-deferred retirement accounts. The IRS sets annual contribution limits for these types of retirement accounts, and exceeding these limits can result in unintended tax consequences. Excess deferrals can happen for various reasons, including misunderstandings of contribution limits, employer errors, or changes in employment where an individual contributes to multiple retirement plans within the same year. To correct excess deferrals, an individual should contact the retirement account's financial institution and follow the necessary steps to request a withdrawal of the excess deferral and any associated earnings. Excess deferrals can have several negative consequences, such as double taxation, possible penalties and fees, and an impact on retirement savings. To prevent excess deferrals, individuals should understand contribution limits, regularly review retirement plan statements, coordinate contributions across multiple retirement plans, and establish clear communication with employers and plan administrators. By monitoring annual contributions, communicating with employers and plan administrators, and taking corrective action promptly, individuals can minimize potential tax liabilities and penalties associated with excess contributions and maximize their retirement savings.What Is an Excess Deferral?

Types of Retirement Plans Where Excess Deferrals May Occur

401(k) Plans

403(b) Plans

SIMPLE IRA Plans

SEP IRA Plans

Limits on Annual Retirement Plan Contributions and Understanding Excess Deferral

Maximum Annual Contribution Limits

Catch-Up Contributions for Individuals Aged 50 and Older

Adjustments for Cost-of-Living Changes

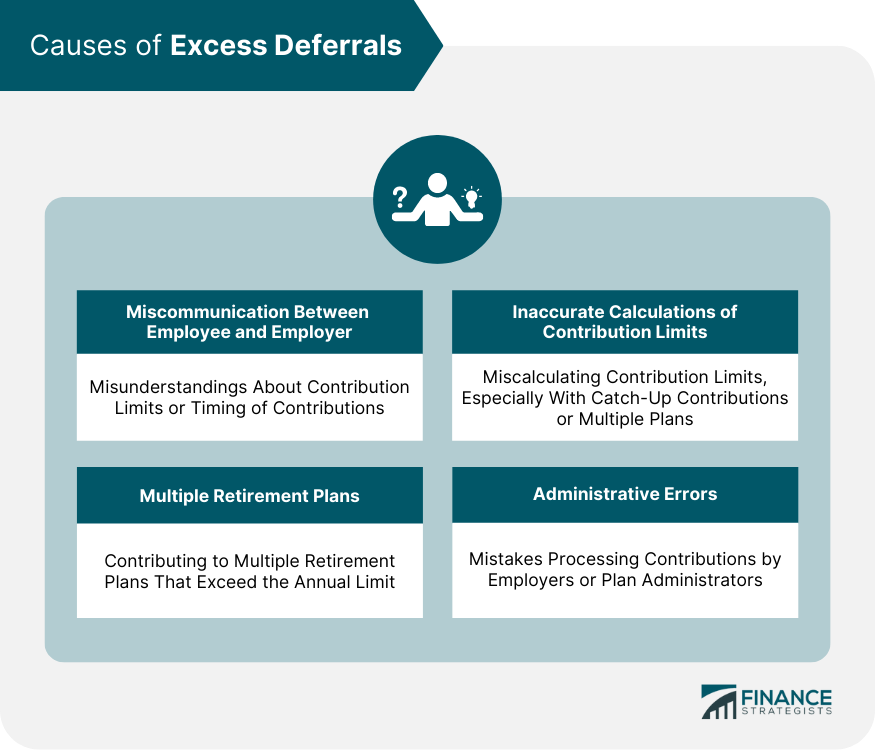

Causes of Excess Deferrals

Miscommunication Between Employee and Employer

Multiple Retirement Plans

Inaccurate Calculations of Contribution Limits

Administrative Errors

Consequences of Excess Deferrals

Double Taxation

Possible Penalties and Fees

Impact on Retirement Savings

Identifying and Correcting Excess Deferrals

Monitoring Annual Contributions

Communicating With Employers and Plan Administrators

Requesting a Return of Excess Deferrals

Deadline for Requesting Return

Tax Implications

Correcting Excess Deferrals in a Timely Manner

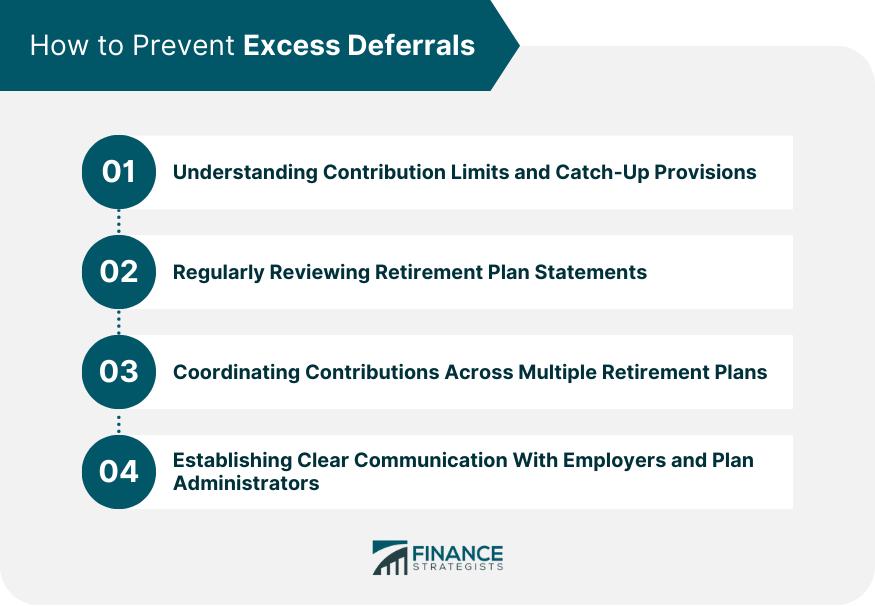

Preventing Excess Deferrals

Understanding Contribution Limits and Catch-Up Provisions

Regularly Reviewing Retirement Plan Statements

Coordinating Contributions Across Multiple Retirement Plans

Establishing Clear Communication With Employers and Plan Administrators

Conclusion

Excess Deferral FAQs

An excess deferral occurs when an employee contributes more than the allowed limit to their employer-sponsored retirement plan, such as a 401(k) or 403(b).

The excess deferral amount and any earnings attributed to it must be distributed from the retirement plan to the employee by April 15th of the year after the excess deferral occurred. The excess deferral amount is subject to income tax and an additional 6% excise tax if not corrected in a timely manner.

The maximum amount that an employee can contribute to a 401(k) or 403(b) plan in 2024 is $23,000, and an additional catch-up contribution of $7,500 can be made if the employee is over 50 years old.

Yes, an employer can be penalized for allowing excess deferrals in a retirement plan. The IRS can assess excise taxes and other penalties on the employer for failing to administer the plan in compliance with tax regulations.

If an excess deferral is not corrected by April 15th of the year following the year the excess deferral occurred, the excess amount is subject to income tax and an additional 6% excise tax. However, correcting the excess deferral and avoiding further penalties may still be possible by taking advantage of certain IRS correction programs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.