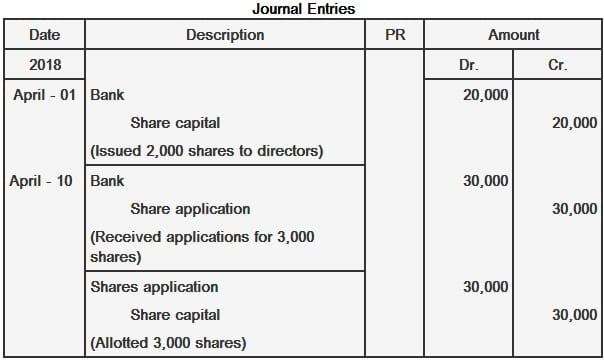

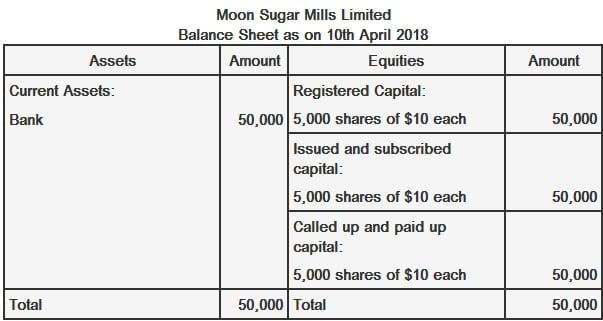

When a company receives its certificate of incorporation, it is important for the company's directors to take the necessary steps to raise the required capital. A brief overview of these steps is given in this section. Step 1: The directors of a public limited company issue a prospectus, inviting the public to apply to purchase the company's shares. Step 2: Prospective shareholders apply for the purchase of shares on the prescribed forms. Step 3: The applications, along with a specified amount, are sent to the company's banker by the prescribed date. After the closing date, the banker sends these applications to the company's directors. Step 4: The directors scrutinize the applications. If the subscription is within the issued capital, the directors allot shares to all applicants. Step 5: The applicants are informed about the allotment of the shares using an allotment letter. The applicants become the company's shareholders as soon as they receive the letter of allotment. Step 6: The directors may reject some applications. In this case, the company issues letters of regret to those applicants. The bank is directed to return the money to these applicants within ten days of the decision being made. Step 7: If the company's directors do not want to take the risk of issuing shares, then they can transfer the risk to specialized persons known as underwriters. Step 8: The underwriters, in exchange for a commission, either issue the shares to applicants or take ownership of any shares that cannot be sold in the market. Shares can be issued at the following three prices: If shares are issued at a price that is equal to their nominal value (or face value), this is referred to as the issuance of shares at par. For instance, a share of $10 is issued at $10. If shares are issued at a price that exceeds their nominal value (or face value), this is referred to as the issuance of shares at premium. For example, if a share of $10 is issued at $12, $2 is the premium on the issuance of shares. If shares are issued at a price that is less than their face value, this is referred to as the issuance of shares at discount. For instance, if a share of $10 is issued at $8, $2 is the discount. Shares can be paid for in the following ways: Lump-sum payment of shares means that the amount payable on the application of each share will be the full nominal amount of the shares. If shares are issued to the directors or underwriters and the amount is received in a lump sum, the accounting entry is made as follows: If shares are issued to the public after receiving the application money through the bank, the accounting entry would be: On receipt of applications If shares are issued for the services rendered by the promoters for the formation of the company, the journal entry would be the following: If more shares are applied for than are issued (i.e., oversubscription of shares), the amount of oversubscription will be refunded in full. In this case, the following accounting entry is made: Moon Sugar Mills Limited was formed with a nominal capital of $50,000 divided into 5,000 ordinary shares of $10 each. On 1 April 2018, the company issued 2,000 shares as fully paid to the directors and the remaining 3,000 shares were offered to the public for subscription. The amount was called in a lump sum, which was paid on 10 April 2009. Required: Explanation and Steps for Issuance of Shares

Sale Price of Shares

At Par

At Premium

At Discount

Payment of Shares

Lump-sum Payment

Accounting Entries

Bank ----------------- DR

Share Capital ------------ CR

Bank ----------------- DR

Share Application ------------ CR

On allotment of shares

Share Application ----------------- DR

Share Capital----------------------------- CR

Preliminary Expenses ----------------- DR

Share Capital -------------------------------------- CR

Oversubscription of shares

Share Application ----------------- DR

Bank -------------------------------------- CR

Example

Solution

Procedure for Issuance of Shares FAQs

If there is any deviation from the prescribed procedure (i.e., any procedural irregularity occurs during issuance of shares), the company will be taxable under section 56(2)(x) of the Income-tax Act, 1961.

When any unauthorized person takes part in the board meeting, it is an act of company. The act is perform by "the person who has acted as if he/she were a director or other officer". He will liable for tax under section 56(2)(x) and 58.

The procedural requirement laid down in section 73 must be complied by issuing companies for issue of shares.

i) The special resolution passed by the board authorizes the allotment of bonus shares , ii) The company must enter in the share registry that a special resolution has been passed authorizing the issue of bonus shares.

A 'proxy' means "a person nominated by another for appointment as his legal representative".

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.