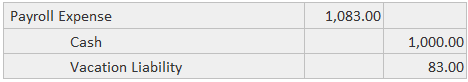

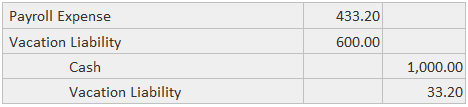

Accrued liabilities result from non-transaction economic events. Their recognition is generally triggered not by transactions but when a financial statement date is passed. Typically, accrued liabilities are very short-term in nature. Indeed, many are paid by the time financial statements are released. Unless there is special significance concerning the nature of the accrual, all accrued liabilities are summarized as a single item on the balance sheet. Payments to employees for holidays, vacations, and sick leave are better matched with the periods in which they actually work rather than those in which absence occurs. The implementation of the approach requires the accrual of liability for the difference between the payroll expense (including compensated absences) and the amount actually paid. Then, when a compensated absence occurs, payment to the employee represents a settlement of the accrued liability rather than an additional expense. Consider this simple example for a single employee for a year. The terms of employment allow 20 days of paid vacation per year and salary of $26,100. After allowing for 104 weekend days, there are 261 (365 less 104) compensated days even though the employee works only 241 days out of the year. Thus, the compensation is $100 per compensation day ($26,100 divided by 261 days), but the employer's expense is $108.30 per working day ($26,100 divided by 241 days). The $8.30 difference is accrued every working day as a vacation liability. When vacation days are taken, the liability is debited instead of Payroll Expense. The following entry would be made in the journal for a 10-day pay period (ignoring payroll taxes and withholdings) in which no vacation is taken: For a pay period in which the employee works for 4 days and takes 6 days of vacation, the following journal entry would be made: Definition and Explanation

Example of Accrued Liabilities

The expense is computed for 10 days at $108.30 per day.

The payroll expense is computed for 4 days at $108.30. The debit to the vacation liability is computed for 6 days at $100; the cash payment is for 10 days at $100; finally, the credit to vacation liability is computed for 4 working days at $8.30.

Accrued Liabilities FAQs

An accrued liability is a debt or obligation that has been incurred but not yet paid by the company. It typically includes unpaid wages, taxes, interest expenses, and other miscellaneous expenses due to suppliers or creditors.

Yes, accrued liabilities are recorded as current liabilities on the balance sheet and will appear under that heading.

Companies calculate their accrued liabilities by taking into account all outstanding obligations from the general ledger accounts such as salaries and wages, sales tax payable, commissions payable, rent payable, etc., and adding them up to arrive at the total amount of liabilities for the period.

The primary difference between an accrued liability and a payable is that with an accrued liability, the company has not yet been billed for the goods or services, while with payables, the company has already received an invoice.

Companies can manage their accrued liabilities through careful budgeting and forecasting to ensure that all expenses are accounted for promptly and by regularly reviewing vendors and suppliers to make sure invoices are paid on time. Additionally, having up-to-date financial statements can be beneficial in helping to identify any potential areas of concern when it comes to managing accrued liabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.