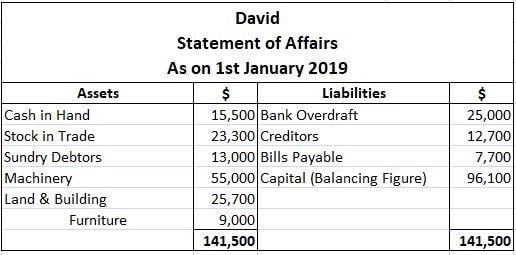

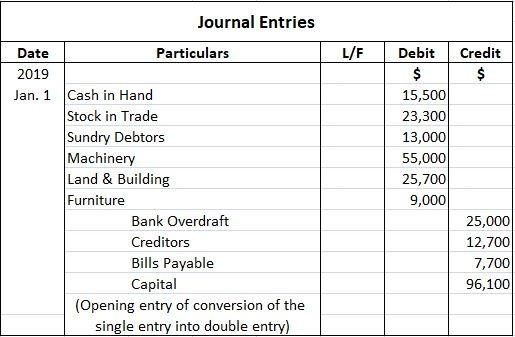

The single entry system is a bookkeeping system in which, sometimes, both aspects of a transaction are recorded, whereas other times, only one aspect of a transaction is recorded. In certain cases, the complete transaction is not recorded. In small businesses, a major problem arises in that due to shortages of time and experience, it is not possible to maintain full accounting records under the double entry system. Furthermore, small businesses generally can't afford to hire outside staff to maintain these records. However, every business needs to know about its trading results after specific intervals of time. For this reason, we can say that any sets of procedures that are aimed at ascertaining the profit or loss of a business, and that do not involve maintaining records under the double entry system, are generally referred to as single entry systems. It is also worth noting that the single entry does not mean the single entry of a transaction. Instead, it only indicates the incomplete nature of the records kept under this system. In fact, single entry systems are a mixture of double entry, single entry, and no entry. Under the single entry system, some transactions are completely recorded. For example, cash allocated from debtors is recorded in the debtor's account as well as the cash account. Also, some transactions are partially recorded, such as cash purchases. Likewise, certain transactions are not recorded at all (e.g., bad debts and depreciation). In a nutshell, the single entry is a system in which accounting records are not recorded exactly like the double entry system. Given that the records are not kept under the double entry system, they are considered incomplete records. In turn, this means that a trial balance cannot be prepared. This can result in fraud and misappropriation. The single entry system can be classified into three types: Under this system, only personal accounts are kept. That is to say, nominal accounts and real accounts are not kept. Under this system, personal accounts and a cash book are kept. Under this system, some subsidiary books along with personal accounts and a cash book are kept. There are two approaches used to determine the profit or loss under the single entry system: If the books of a business are maintained under the single entry system, then profit or loss cannot be calculated using the trading account and profit and loss account. The reason for this is that the records kept under the single entry system are incomplete. To calculate the profit or loss under the single entry system, the following fundamental equation for the balance sheet can be used: Capital (Net Worth) = Assets — Liabilities This method is also known as the statement of affairs method. This is because, using this method, two balance sheets (statements of affairs) are prepared. The first statement of affairs prepared at the start of the year will show "Opening Capital," whereas the second statement prepared at the end of the year will give "Closing Capital." By comparing "Opening Capital" and "Closing Capital," we can calculate the profit or loss. If closing capital is greater than opening capital, this indicates an increase in capital (i.e., "Profit"). On the other hand, if "Closing Capital" is less than "Opening Capital," it indicates a decrease in the capital, corresponding to a loss for the period. The above formula can be written down in the form of the following statement: Mr. John, who keeps his books using the single entry system, has told you that his capital on 31 December 2019 was $40,500, and on 1 January 2019, it was $25,800. He further informs you that he has withdrawn $3,500 for personal purposes. He has invested further capital of $5,000. Required: You are required to prepare a statement of profit and loss for the year ended on 31 December 2019. A trader keeps his books using the single entry system. He started his business on 1 January 2019 with a total capital amount of $100,000. On 1 July 2019, he borrowed $40,000 at 10% p.a. Additionally, on 31 December 2019, his assets and liabilities (besides the above) were: The trader drew $2,500 for personal use. During the year, he further invested $25,000 through the sale of his private property. Required: Ascertain the trader's profit or loss for the year. This approach is applicable where the double entry system is maintained. In this approach, every transaction is analyzed and the net result of the business is calculated. Under this approach, a sequence of steps is adopted, as described in this section. First of all, transactions are recorded in the journal. After recording transactions, these are classified into the ledger. In turn, to check the arithmetical accuracy of the work done, a trial balance is prepared from the ledger. Adjusting entries are then passed to record the internal transactions, including depreciation. The next step is to prepare the second trial balance, which is called the adjusted trial balance, to incorporate adjusting entries. From the trial balance, nominal accounts are subsequently transferred to the trading account and profit and loss account. Finally, the trading account and profit and loss account indicate the gross profit and net profit of the business. When a business grows rapidly, then at some future point, the single entry system will no longer be workable. In such situations, the single entry system should be converted into a double entry system. Conversion into the double entry system may be one of the following: Under the prospective effect, the conversion takes place from the date on which the arrangements are made for conversion. This ensures that the books can be maintained under double entry system in the future. To convert from the single entry system into the double entry system with the prospective effect, the following requirements must be satisfied: (i). A statement of assets and liabilities on a given date must be prepared. (ii). Cash in hand should be counted. (iii). Bank balance should be verified through a bank passbook. (iv). From a personal account, a list of debtors and creditors should be prepared. (v). Valuation of stock and other assets such as machinery and furniture must be conducted. (vi). Outstanding liabilities for salary, rent, and so on must be included. (vii). The access of assets over liabilities will provide the opening capital. (viii). The balance may be entered in the journal in the form of opening entries under the double entry system. (ix). All subsequent transactions must be passed through the journal and posted into the ledger according to the principles of the double entry system. David maintains his own books using the single entry system. The following assets and liabilities, as recorded on 1 January 2019, are available from his records as follows: Required: Convert from the single entry system into the double entry system. Under the retrospective effect, the conversion may take place with an effect from a date already passed. Conversion with retrospective effect depends on the following requirements: (i). An opening statement of affairs may be constructed. (ii). An opening journal entry debiting the respective assets and crediting the respective liabilities may be passed. (iii). Total credit purchases and total credit sales may be calculated. (iv). Credit purchases may be posted to the purchases account and credit sales may be posted to the sales account in the ledger. (v). The items of receipts and payments (debit and credit sides) in the cashbook may be posted to the appropriate accounts in the ledger, except items relating to personal accounts. These are already been posted to appropriate accounts under the single entry system. (vi). Pick up item from personal accounts for which no double entry has already been affected. (vii). Any other items that have not been handled must be carefully identified and incorporated through journal entries. Following the above steps, it is straightforward to convert from any single entry system into the double entry system. Bookkeepers can enter and pass all transactions in conformity with the double-entry system. Given that this process makes incomplete records complete, a trial balance can also be prepared, which is useful for the trading account, profit and loss account, and balance sheet. The above methods are laborious compared to the shortcut method. That's why this method is also called the abridged method. This method is suitable when a summary of cash and other transactions is given. Also, beginning and ending information regarding assets and liabilities should be available. Under this method, the trading account, profit and loss account, and balance sheet are prepared. The following items, if missing, can be identified from the data available.What Is the Single Entry System?

Introduction to the Single Entry System in Accounting

Types of Single Entry System

1. Pure Single Entry System

2. Simple Single Entry System

3. Quasi Single Entry System

Features of the Single Entry System

Limitations of the Single Entry System

Difference Between Single Entry and Double Entry System

Double Entry System

Single Entry System

(i) Both aspects of an entry are recorded

Both aspects of an entry

may not be recorded

(ii) Personal, real, and nominal accounts are kept

Only personal accounts are maintained

(iii) Cash book, general ledger, debtor's ledger, and creditor's ledger are maintained

Only the debtor's ledger and the creditor's ledger are kept

(iv) Mathematical accuracy can be checked as the trial balance is available

Trial balance cannot be prepared, meaning that mathematical accuracy cannot be checked

(v) Trading account and profit and loss account can be prepared

Due to the absence of the trial balance, the trading account and profit and loss account cannot be prepared

(vi) Various accounting ratios can be computed

Important ratios like the gross profit ratio and net profit ratio cannot be computed

(vii) A scientific system that follows a specific set of rules

The system is unscientific and does not follow any set of rules

How to Determine Profit and Loss Under Single Entry System

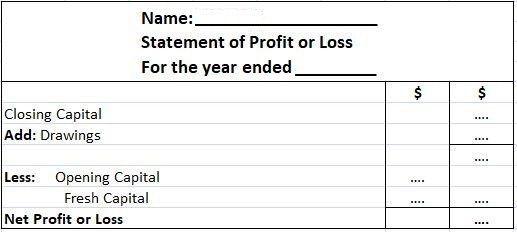

1. The Balance Sheet Approach (Net Worth Approach)

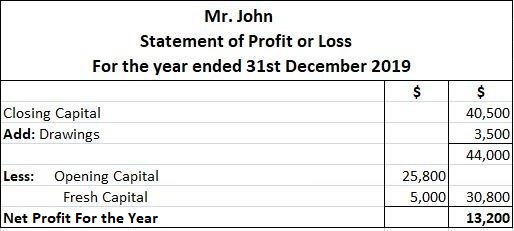

Example 1

Solution

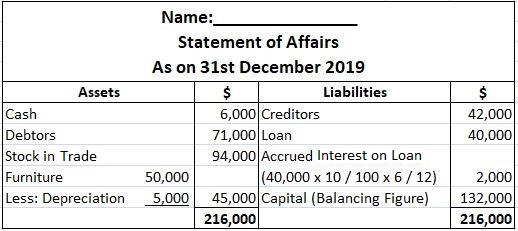

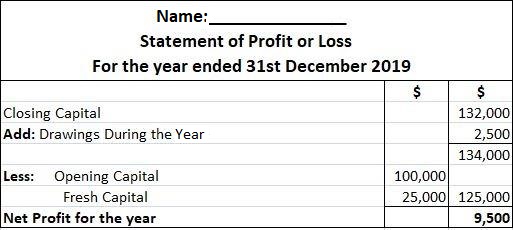

Example 2

Solution

2. Transaction Approach (Conversion Method)

Conversion Into Double Entry System

1. Conversion With Prospective Effect

Example

Solution

2. Conversion With Retrospective Effect

3. Shortcut Method

Single Entry System in Accounting FAQs

The single entry system is a simplified bookkeeping system where all transactions are recorded in a single journal. Only the debit and credit aspects of each transaction are entered, without reference to account names.

Some of the advantages of using the single entry system are as follows:it is an easy-to-use bookkeeping system.Small businesses and sole proprietors can maintain their books using this method.This accounting method doesn't require much expertise to be used.

The double entry system of accounting is a complete and systematic bookkeeping system where each transaction is recorded twice, once as a debit entry and once as a credit entry, with both entries relating to accounts in the general ledger. If one account is debited, another account must be credited. The individual accounts are usually named for the class of transactions to which they relate.

Some of the advantages of using the double entry system are as follows:all transactions and their effects on the ledger accounts will be recorded.It provides a complete and systematic record keeping system.It is considered by many professionals to be superior for financial reporting purposes.

The cash book and journal should be used under the single entry system. The ledger is not generally used in this system, although it may be used to record the totals of certain account heads.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.