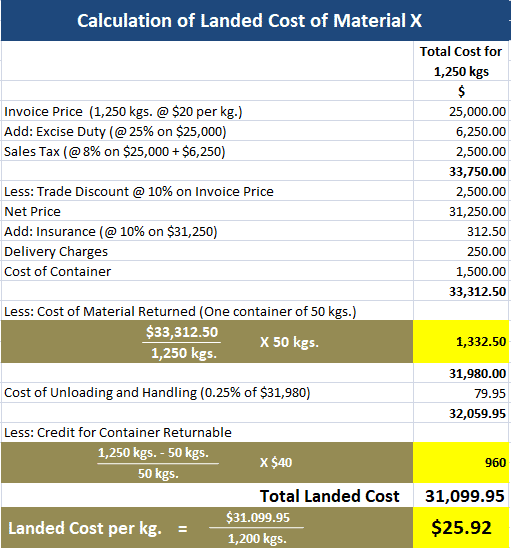

One of the main objectives of cost accounting is to ascertain accurate costs. Accuracy of costs depends upon knowing the cost of materials consumed and the labor used to produce a particular product. Material is the most important element of cost. For this reason, it should be valued and charged to cost units properly. Valuation of materials can be studied from two main vantage points: The valuation of the materials received/purchased is made based on the actual cost, which consists of the following: The expenses under (3) above are, of course, incurred in connection with materials purchased. However, from the viewpoint of convenience and practicability, these are not included in the cost of materials purchased but are treated as part of overhead. In connection with the calculation of the cost of materials purchased, the following items require a special mention: Discount may be expressed as a concession or reduction in the invoice price of materials bought that is allowed by the supplier to the buyer or customer. Discount is divided into three parts: (a) Trade Discount: A reduction of the selling price (or invoice price) allowed by the seller to the buyer on account of a business custom or usage. The amount of trade discount received by the purchaser is deducted from the invoice price of the materials purchased. (b) Quantity Discount: A special concession or reduction of the selling price allowed by the seller to the buyer on account of bulk purchases. A quantity discount is offered to encourage bulk orders, where the rate varies according to the quantity ordered and purchased by the buyer. Quantity discount is also deducted from the invoice price of the materials purchased to calculate their cost. (c) Cash Discount: A concession or allowance allowed by the creditor (or supplier) to the debtor (or customer) on account of ready cash payment or payment before the expiry of the specified credit period. Cash discount represents interest on the amount due for the unexpired credit period. As such, cash discount is treated as a financial item that should not be deducted from the cost of the materials purchased. When materials are supplied, suppliers generally send them in containers. The treatment of the cost of containers involves the following considerations: Consider the case of materials that are supplied in non-returnable containers for which no separate charge has been made in the invoice. In this case, no treatment is needed in respect of containers to calculate the cost of materials. If the containers have some realizable value, this should be estimated and deducted either from the cost of materials or factory overhead. If materials have been supplied in non-returnable containers, which have been charged separately and are neither returnable nor possess any realizable value, their price should be included in the cost of materials. If materials have been supplied in returnable containers which have been charged separately and can be returned to the supplier or resold, the difference between their cost price and returnable value should be included in the cost of materials. If the materials are supplied in returnable containers on which the buyer is to receive credit for the full price charged (by the supplier) on their return, the cost of containers is not included in the cost of materials. This is based on the presumption that the materials will be returned to the supplier in due course. A manufacturer purchases 5,000 units of material X — 51 at $15 per unit less a trade discount of 2% on the invoice price. Freight paid was $1,000, carriage & cartage $200, and octroi $750. The expenses for purchasing, receiving, and storing the material for the year amounted to $5,000. Required: Determine the cost of the material per unit. Note: The expenses for purchasing, receiving, and storing are not needed to calculate the cost of materials purchased for the purpose of convenience in accounting. A consignment consisted of two chemicals A and B. The invoice gave the following data: A shortage of 200 kgs. in A and 128 kgs. in B was noticed due to breakages. Required: What is the stock rate you would adopt for pricing issues, assuming a provision of 5% toward further deterioration? The following details are available regarding a consignment of 1,250 kgs. of material X. The cost of containers is $60 per container for 50 kgs. of material, while rebate is allowed at $40 per container if returned within 6 weeks, which is a normal feature. One container load of material was rejected on inspection and not accepted. The cost of unloading and handling was 0.25% of the cost of the materials ultimately accepted. Required: Based on the above, determine the landed cost per kg. of material X.Valuation of Materials: Definition

Valuation of Materials Purchased/Received

Discount

Cost of Containers

Non-returnable containers are not charged separately by the supplier

Non-returnable containers are charged separately by the supplier

Returnable containers are charged separately by the supplier

Examples

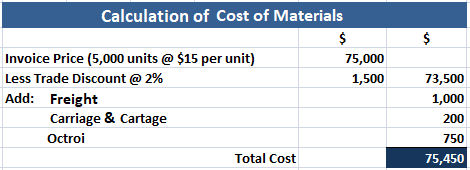

Example 1

Solution

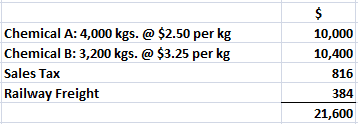

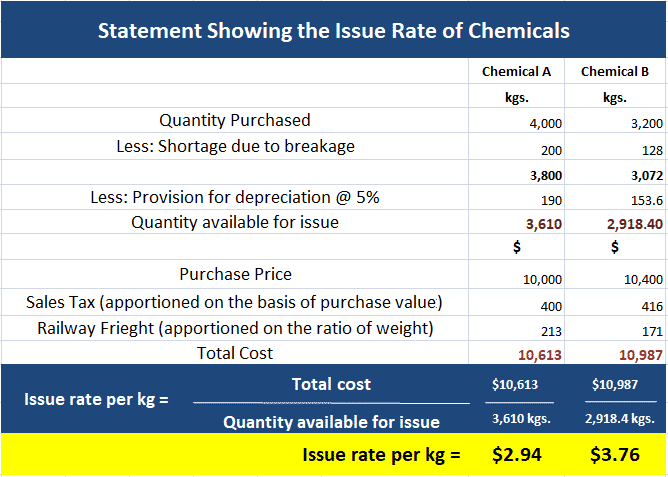

Example 2

Solution

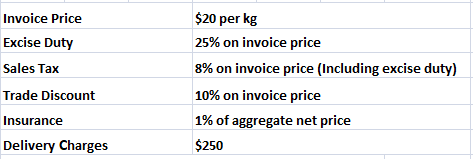

Solution

Valuation of Materials Purchased/Received FAQs

The concept of valuation means determining the true value in money (of a transaction) and usually involves several steps: discussion, research, and review. The purpose is to arrive at a figure which has an accurate understanding.

The main difference is that a trading discount offers some form of incentive, while a cash discount offers an interest-free period.

Unloading and handling costs should be treated as a part of the cost of materials purchased.

The basis for this treatment arises from the fact that material supplied in non-returnable containers cannot be returned to the supplier or resold, while material in returnable containers can be returned to the supplier or resold.

Expenses incurred in the process of purchasing, receiving and storing materials.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.