First in, first out (FIFO) is an inventory costing method that assumes the costs of the first goods purchased are the costs of the first goods sold. In terms of flow of cost, the principle that FIFO follows is clearly reflected in its name. Specifically, FIFO assumes that the first cost received in stores is the first cost that goes out from the stores. In other words, under FIFO, the cost of materials is charged to production in the order of purchases. Earlier costs recorded in materials ledger cards are used for costing requisitions, and the balance consists of units received later. The FIFO method of costing is based on the assumption that the various lots of materials that are purchased are used in the same order in which they are received. That is to say, the materials are issued from the oldest supply in stock in this method of costing. The materials used in a job or process are charged at the price of their original purchase. This is why FIFO is often referred to as the original price method. The return of excess materials, initially issued to the factory for a particular job, to the storeroom is treated as the oldest stock on hand. It is placed on the materials card balance ahead of all the units on hand at the same price as it was issued to the factory. The following are the main advantages of the FIFO method of costing: The following are the disadvantages and drawbacks of the FIFO method of costing: Consider the following: Required: Shows the value of the stock on hand using the FIFO method.First In, First Out (FIFO): Definition

FIFO Method of Costing: Explanation

Advantages of FIFO Method of Costing

Disadvantages of FIFO Method of Costing

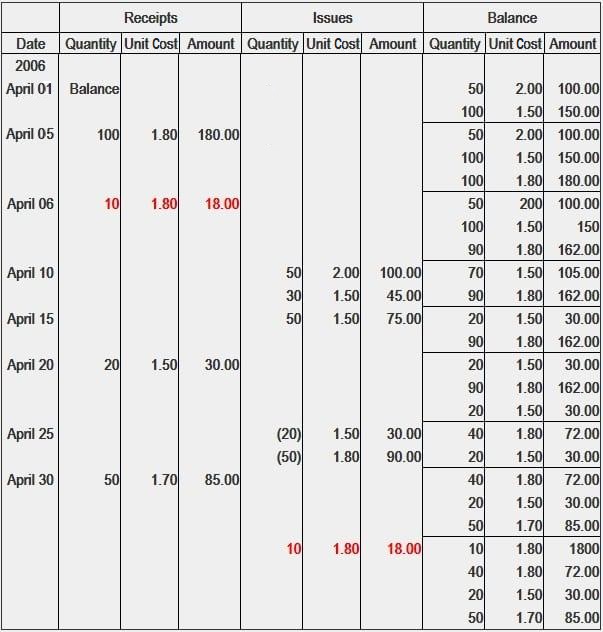

Example

Solution

First In, First Out (FIFO) Method Problem and Solution FAQs

The FIFO method is legal because it enforces that the oldest expenses and therefore costs should be deducted from assets. This enforces that all payments and costs are accounted for according to the number of days they were in use.

It is generally said that the FIFO method of costing is the most practical because it follows a natural flow. The first costs are used first, so employees know which materials are being used for production and how much they cost.

A negative trait of the FIFO method of costing is that it does not follow a natural flow. Therefore, when materials are returned from the factory to the storeroom they will be valued at costs that were not their original purchase prices. This can lead to overvaluation in closing inventory and material used in production.

The total cost of these materials would be $100 so each unit would have a value of $10 in inventory.

The FIFO method of costing is mostly used in accounting for goods that are sold. It is also advantageous to use with larger items because it helps keeping track of costs. The FIFO method of costing is an accounting principle that states the cost of a good should be the cost of the first goods bought or produced. The other alternative is the LIFO (last in, first out) method of costing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.