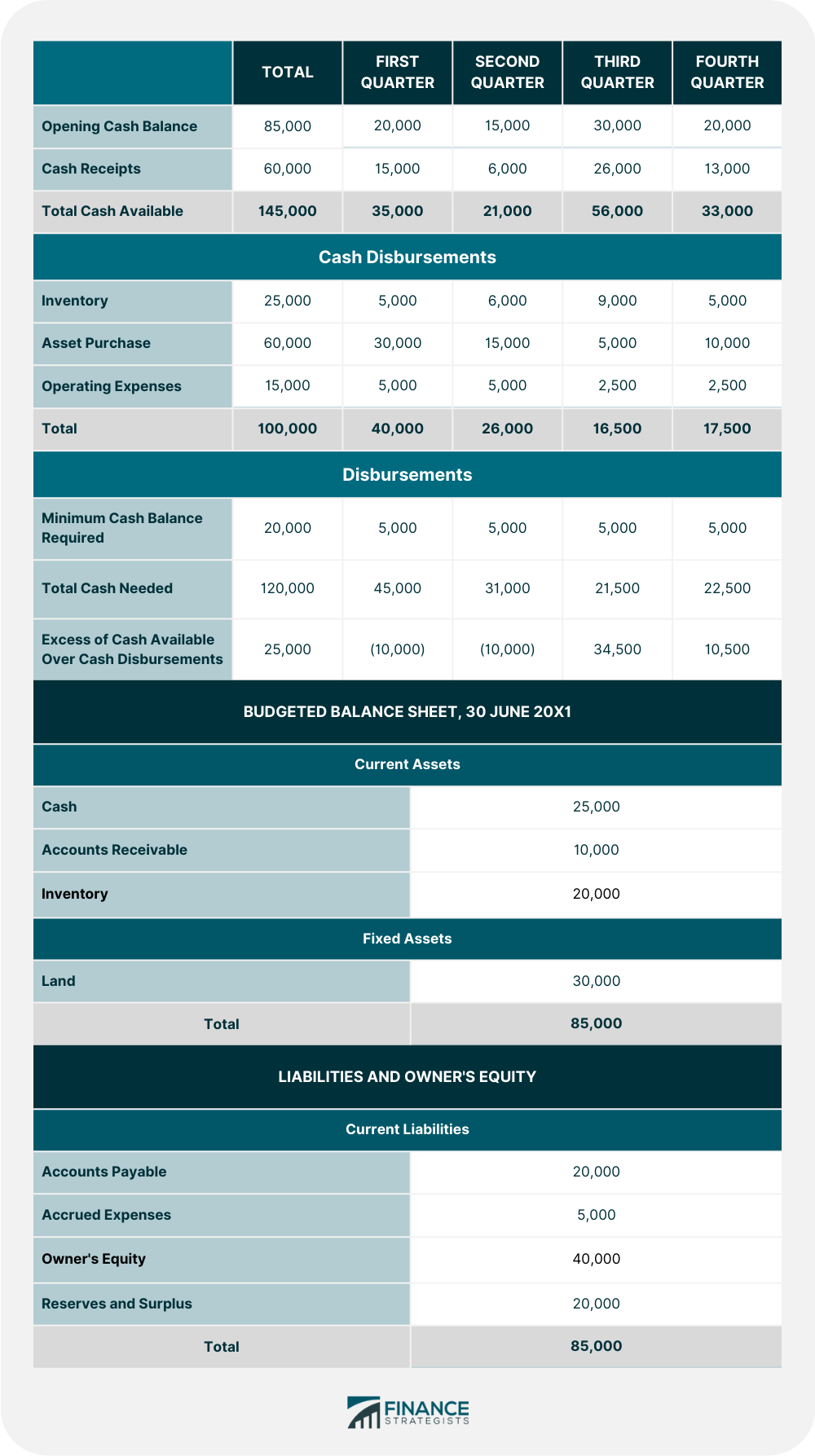

The implementation of a budget is the responsibility of the budget director. The success of the entire exercise of budgeting depends on two important factors. First, proper and clear communication to all key people involved in the implementation of the budget. These stakeholders should have a clear understanding of what is expected of them and how to achieve the goals. Second, cooperation and encouragement from the top management in achieving the budget targets. The company's leading managers and executives should be willing to reward people who meet budget goals. Ideally, top management and staff working at the lower levels of management should collaborate to prepare and implement the budget successfully. Shown below are the budgeted statements of cash receipts and cash disbursements for the XYZ Company for the year ended 30 June 20x1.Example

Implementation of Budget FAQs

A budget is the total estimated costs for an organization to achieve its objectives, given planned expenditures on products or services, within the set time frame. A good budget includes specific information about revenue and costs, as well as financing requirements.

To implement a budget, we must first allocate resources to meet our targets. For each resource, we make an estimate of how much is required for the given period. We also indicate whether there will be any carry-over balances from previous periods. Carry-over balances are amounts that were not used in the previous periods and can be carried over into the current period to help meet requirements. Next, we determine how our spending will be financed. If financing is not available, then it should be identified whether there are any funds that could be used to finance overspending in this area. After allocating resources, we can identify whether there are negative or positive Cash Flows for each of our proposed plans.

In order to determine whether a budget has been implemented, we need to know what the original targets were and compare them with real figures. Once we have these two sets of numbers, it is relatively easy to identify where the plan was met and where it was not.

The budget director is responsible for the implementation of the budget. This person will have to ensure that all stakeholders are kept informed and encourage them to meet their targets in order to achieve overall success.

There are many people who need to be communicated with in order to implement a budget. These include: - Top management (for encouragement and cooperation) - The board of directors (to report on progress and discuss any difficulties we might encounter) - Senior managers (who will be responsible for the day to day implementation of the budget – they can also provide valuable feedback) - Staff at lower levels, such as supervisors and department heads (who must be told how the budget affects them, what they are expected to do, and how they can meet their targets)

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.