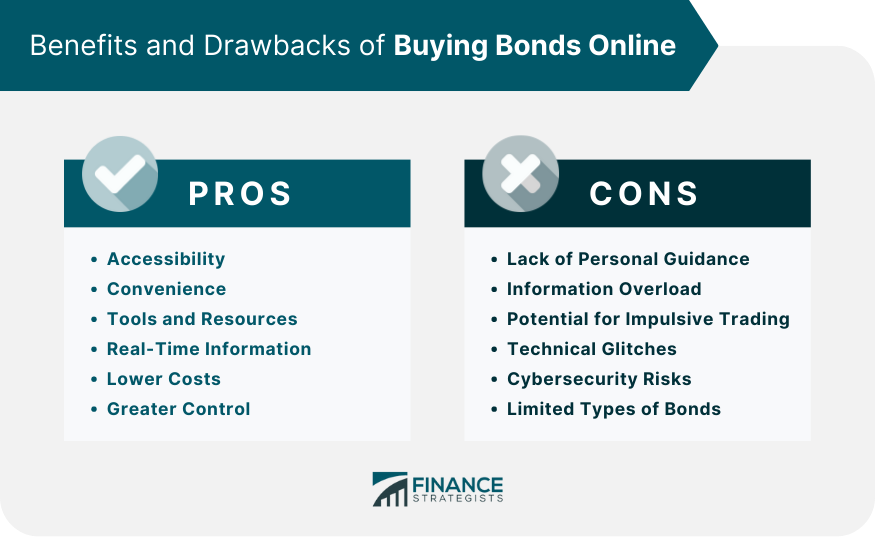

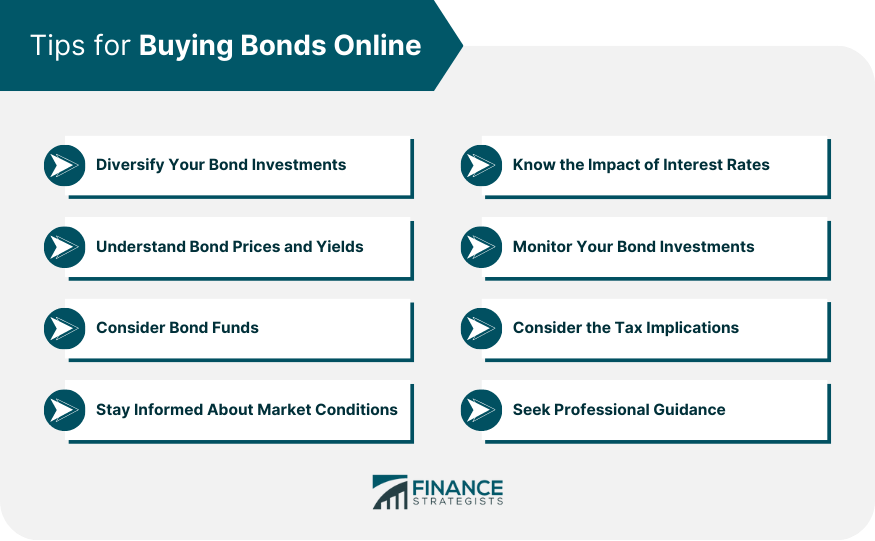

Bonds are fixed-income instruments that corporations, governments, and municipalities issue to raise capital. In return for the capital provided, the issuer pays interest over a set period and repays the principal amount when the bond matures. There are several types of bonds. Government bonds are issued by national governments and are considered relatively safe. Municipal bonds are issued by states, cities, or counties and are often tax-exempt. Corporate bonds are issued by corporations and offer higher yields, albeit with greater risk. Finally, there are also agency bonds, sovereign bonds, and other more complex types of bonds. Bonds add diversification to an investment portfolio. They offer a steady stream of income and are generally less risky than equities. Furthermore, their prices often move in the opposite direction of stocks, offering a cushion during stock market downturns. The first step is to research potential bond investments. Online brokerage platforms typically provide various tools to help with this, including bond screeners and research resources. These tools can help you filter bonds based on factors like issuer, yield, maturity date, and credit rating. Once you've identified a bond you want to buy, the next step is to place an order. This involves entering information like the type of bond, the quantity you want to purchase, and the price you're willing to pay. Most platforms also provide options for different types of orders, such as market orders (buy or sell immediately at the best available price) and limit orders (buy or sell only at a specific price or better). After your order is placed, the brokerage platform's trading system processes it. If the bond is available at your specified price (or better), your order is matched with a seller, and the trade is executed. After the trade is executed, there's a settlement process, during which the bonds are transferred to your account, and the payment is transferred to the seller. This process usually takes one to three business days. TreasuryDirect is the U.S. Department of the Treasury's online portal, which allows individual investors to purchase and manage their portfolio of U.S. government securities directly. This includes Treasury bonds, notes, bills, and other government-backed securities. The primary advantage of TreasuryDirect is that it allows investors to buy U.S. government securities directly from the source, avoiding any broker fees. However, it doesn't offer other types of bonds like corporate or municipal bonds. TD Ameritrade is a comprehensive trading platform that offers access to both primary and secondary bond markets. Its extensive educational resources are particularly beneficial for those seeking to understand the intricacies of bond trading. E*Trade’s robust bond trading platform is notable for its Bond Resource Center, which provides an array of tools to help investors navigate the bond market, including a bond screener and a bond ladder builder. Fidelity stands out for its impressive research capabilities. Their bond research center provides real-time news, expert insights, and advanced analytics. Fidelity's excellent customer service is also a key strength. Interactive Brokers offers access to bonds in over 25 countries, making it an excellent choice for investors looking to diversify their bond portfolio internationally. This platform is favored by active and experienced traders. Charles Schwab's platform is suitable for both novice and experienced investors. It offers a range of tools to help investors analyze potential investments, including a bond ladder tool and a detailed bond screener. Their educational resources are also quite comprehensive. Online platforms give you access to a wide array of bonds, including government, corporate, and municipal bonds. This opens up opportunities for diversifying your investment portfolio. You can research potential investments, monitor your portfolio, and execute trades whenever and wherever it's convenient for you, whether that's at home, at work, or on the go. All you need is a device with an internet connection. Online platforms typically offer a range of tools and resources to assist with your investment decisions. These may include bond screeners to help you identify potential investments, research tools to analyze different bonds, and educational resources to learn more about bond investing. With online trading, you have access to real-time information. This includes current bond prices, market news, and economic data. This allows you to make timely investment decisions and respond quickly to changing market conditions. Online trading platforms often have lower fees compared to traditional brokerages. This is because online platforms can automate many of the processes involved in buying and selling bonds, reducing their operating costs. These savings can be passed on to you in the form of lower fees. Buying bonds online gives you greater control over your investment decisions. You can execute trades immediately, without having to go through a broker. You also have the flexibility to make investment decisions based on your schedule and investment goals. Unlike traditional brokerages where you have a broker to provide advice and guidance, online trading often lacks this personal touch. While many platforms offer educational resources, you are largely on your own when it comes to decision-making. If you are a novice investor, this can seem daunting. Understanding bond prices, yields, maturities, and other aspects of bond investing can be complex. Too much information, especially if you don't fully understand it, can lead to confusion and misinformed decisions. With the convenience and immediacy of online trading, there's a risk of impulsive trading. Making quick decisions without thorough analysis can lead to poor investment outcomes. It's important to remember that successful investing often requires patience and careful consideration. Online platforms depend on technology, which can sometimes fail. Technical glitches, though rare, can occur and might affect your ability to execute trades. In severe cases, these glitches can lead to losses. Although online platforms take stringent measures to protect your information, cybersecurity threats do exist. Hackers could potentially gain access to your account and your personal information, leading to financial loss and privacy concerns. While online platforms provide access to a wide array of bonds, not all types of bonds may be available. For example, certain municipal bonds or niche bonds might not be listed on your platform. Diversification is a fundamental principle in investing, and it holds true for bonds. Putting all your money into one bond or type exposes you to unnecessary risk. You can invest in a mix of government bonds, municipal bonds, and corporate bonds. Within these categories, you can diversify further by investing in bonds with different maturity dates, interest rates, and credit ratings. Bond prices and yields move in opposite directions: when bond prices go up, yields go down, and vice versa. This inverse relationship is due to the fixed nature of a bond's interest payments. When market interest rates fall, a bond's fixed interest payments become more attractive, driving up the price of the bond. For some investors, buying individual bonds may be daunting. This is where bond funds come in. Bond funds are mutual funds that invest in a diverse portfolio of bonds. They offer several benefits, including professional management and instant diversification. However, bond funds do come with additional fees and can have different risk profiles compared to individual bonds. Factors to watch include changes in interest rates, economic data releases, political events, and news related to specific bond issuers. By staying informed about these factors, you can anticipate potential changes in bond prices and yields, and adjust your investment strategy accordingly. When interest rates rise, bond prices generally fall. This is because new bonds issued in the market will offer higher interest payments, making existing bonds less attractive. If you're investing in a low-interest-rate environment, be aware of the risk that bond prices may fall if interest rates rise. Once you've purchased bonds, it's important to regularly monitor your investments. This involves tracking the performance of your bonds and assessing whether they continue to meet your investment objectives. It's crucial to consider the tax implications of your bond investments. The interest income from most bonds is subject to federal income tax. However, some bonds, such as municipal bonds, are often tax-exempt. Understanding the tax implications can help you maximize your after-tax returns. A financial advisor can assist in comprehending bond market intricacies, crafting personalized investment strategies, and managing your portfolio. Their expertise can help you to become a more confident and knowledgeable bond investor, enabling you to independently handle your investments. Bonds are long-term debts that offering a steady stream of income and relative stability compared to equities. The process of buying bonds online can be summarized into four steps: research, order placement, execution, and settlement. Popular platforms include TreasuryDirect, TD Armitrade, E*Trade, Fidelity, Interactive Brokers, and Charles Schwab. Buying bonds online provides numerous benefits, including accessibility, convenience, real-time information, lower costs, greater control, and a wide range of tools and resources to aid in investment decisions. However, there are certain drawbacks to buying bonds online that investors should be aware of. These include the lack of personal guidance, the potential for information overload, the risk of impulsive trading, technical glitches that can affect trades, and cybersecurity risks. To navigate the bond market successfully, it is recommended to diversify bond investments, understand the bond prices and yields, and stay informed about market conditions and the impact of interest rates. Consideration should also be given to bond funds as an alternative investment option. Monitoring bond investments regularly, considering tax implications, and seeking professional guidance when needed are also essential strategies for successful bond investing.Overview of Bonds

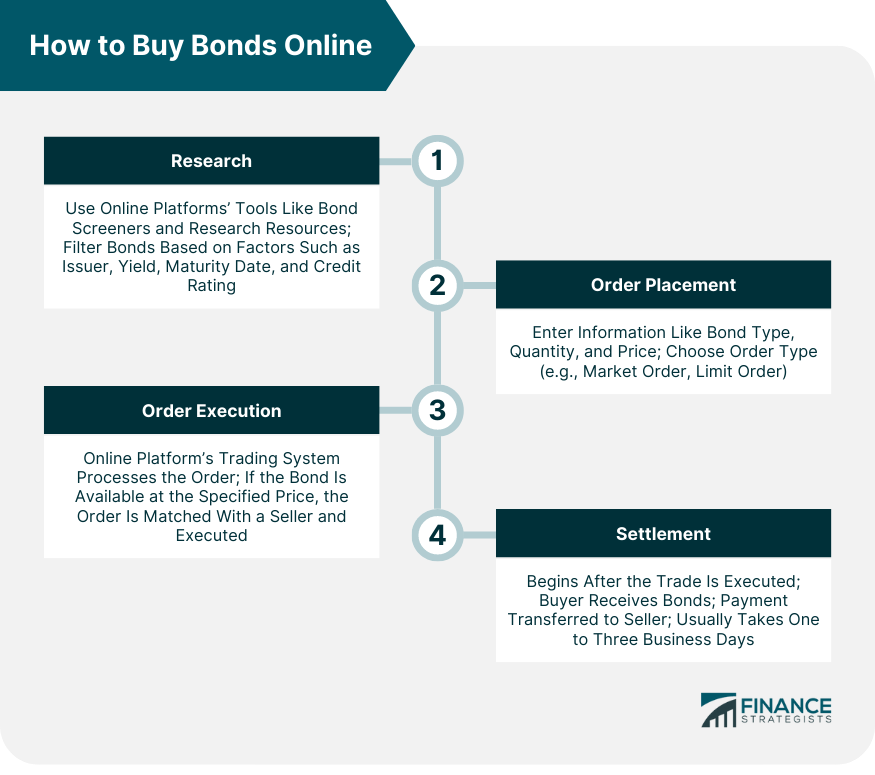

How to Buy Bonds Online

Research

Order Placement

Order Execution

Settlement

Popular Online Platforms for Buying Bonds

TreasuryDirect

TD Ameritrade

E*Trade

Fidelity

Interactive Brokers

Charles Schwab

Benefits of Buying Bonds Online

Accessibility

Convenience

Tools and Resources

Real-Time Information

Lower Costs

Greater Control

Drawbacks of Buying Bonds Online

Lack of Personal Guidance

Information Overload

Potential for Impulsive Trading

Technical Glitches

Cybersecurity Risks

Limited Types of Bonds

Tips for Buying Bonds Online

Diversify Your Bond Investments

Understand Bond Prices and Yields

Consider Bond Funds

Stay Informed About Market Conditions

Know the Impact of Interest Rates

Monitor Your Bond Investments

Consider the Tax Implications

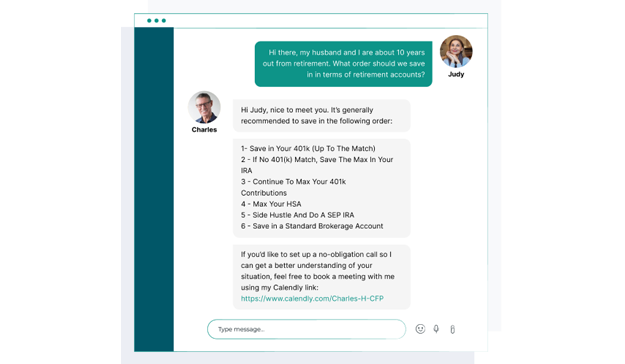

Seek Professional Guidance

Final Thoughts

How to Buy Bonds Online FAQs

Yes, buying bonds online is suitable for investors of all levels of experience. Online platforms often provide educational resources and tools to assist beginners in understanding bond investing. It's important to research and familiarize yourself with the basics of bond investing before making any investment decisions.

Online trading platforms generally offer lower fees compared to traditional brokerages. However, it's essential to review the fee structure of each platform, as costs can vary. Fees may include transaction fees, annual maintenance fees, or other charges. Reading the platform's fee schedule and understanding the associated costs will help you make informed decisions.

While rare, technical glitches can occur with online trading platforms. If you encounter any technical issues during the buying process, it's advisable to contact the platform's customer support immediately. They will guide you through the resolution process and ensure that your trades are executed correctly. It's recommended to have alternative means of accessing your account or placing trades in case of technical difficulties.

Online platforms offer a wide range of bonds, including government, corporate, and municipal bonds. However, availability may vary, and certain niche or municipal bonds may not be listed on all platforms.

Monitoring market conditions is crucial. Stay informed about interest rate movements, economic data, and news affecting bond issuers. Understanding these factors helps you make informed decisions about timing your bond trades.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.