Where Tax Accountants in New York, NY Serve

New York, NY is a bustling metropolis that is home to a plethora of landmarks, top employers, major highways and streets, and diverse neighborhoods. From the iconic Statue of Liberty to the towering Empire State Building, the city boasts a rich history and cultural heritage. Some of the top employers in the city include JPMorgan Chase, Citigroup, and Verizon, while major highways and streets like the Brooklyn-Queens Expressway and Broadway serve as vital arteries for the city's transportation system. The city is also home to a variety of neighborhoods, each with its own unique character and charm, from the trendy SoHo and Greenwich Village to the bustling Times Square and the historic Harlem. Overall, New York, NY is a vibrant and dynamic city that offers something for everyone.

Financial Services Related to Tax Planning in New York, NY

Banks and Credit Unions

Insurance Broker

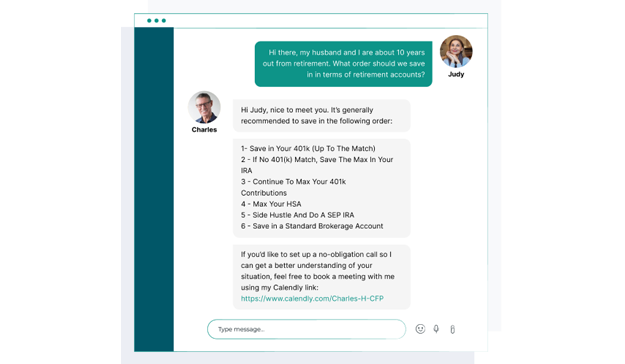

Retirement Planning

Wealth Management

Financial Advisor

Mortgage Loan Officer

Estate Planning Lawyer

New York, NY Financial Resources

New York, NY Chamber of Commerce

New York, NY City Hall

New York, NY Public Library

FREQUENTLY ASKED QUESTIONS

Income Tax Preparation FAQs

New York, NY boasts a plethora of tax services that cater to different needs and preferences. From individual tax preparation to corporate tax planning, the city offers a wide range of tax services that are tailored to meet the demands of its diverse population. Whether you are looking for a tax consultant to help you navigate the complexities of federal and state tax codes or a tax attorney to represent you in legal disputes with the IRS, New York, NY has got you covered. In fact, with its bustling financial district and high concentration of wealthy individuals and businesses, the city is home to some of the most specialized and sophisticated tax services in the country. From boutique tax firms that focus on niche areas of tax law to big accounting firms that offer a full range of tax and financial services, New York, NY is a hub of tax expertise and innovation.

Hiring a tax services provider in New York, NY can offer numerous advantages to residents. With the complex tax laws and regulations in New York, NY, it can be challenging for individuals to navigate the tax system on their own. A tax services provider can help residents save time and money by ensuring that they are taking advantage of all available deductions and credits. Additionally, New York, NY has a high cost of living, which means that residents may have more complex tax situations, such as owning multiple properties or having investment income. A tax services provider can help residents manage these complexities and avoid costly mistakes. Furthermore, with the recent changes to federal tax laws, it is more important than ever for New York, NY residents to seek professional tax assistance to ensure that they are in compliance with all regulations.

A tax service provider in New York, NY must possess a multitude of important qualities to be successful in this competitive market. Firstly, they must have an in-depth understanding of the complex tax laws and regulations unique to New York City. The city's tax code is notoriously intricate, and a provider must be able to navigate it with ease. Additionally, they must be able to communicate effectively with clients who come from diverse backgrounds and industries. New York is a melting pot of cultures and businesses, and a provider must be able to adapt to each client's unique needs. Furthermore, they must be detail-oriented and have excellent organizational skills to ensure that all necessary documents and filings are completed accurately and on time. Finally, a successful tax service provider in New York, NY must have a strong reputation and a track record of success, as word-of-mouth referrals are crucial in this industry.

In order to file income taxes in New York, NY, there are several documents that tax preparers require. These include W-2 forms, 1099 forms, and any other documents that show income earned throughout the year. Additionally, taxpayers must provide documentation for any deductions they plan to claim, such as receipts for charitable donations or medical expenses. It is important to note that New York, NY has specific tax laws and regulations that may differ from other states, so it is crucial to work with a tax preparer who is knowledgeable about these intricacies. Furthermore, taxpayers may need to provide additional documentation if they have income from sources outside of the United States or if they are self-employed. Overall, it is important to gather all necessary documents and work with a qualified tax preparer to ensure compliance with New York, NY tax laws.

Tax preparation services in New York, NY can cost anywhere from $150 to $1,000 depending on the complexity of the tax return and the experience of the tax preparer. This is due in part to the high cost of living and doing business in New York City, as well as the complexity of the tax code and regulations in the state. Additionally, New York has some of the highest state and local taxes in the country, which can add to the complexity of tax preparation and increase the cost of services. Despite these challenges, there are many reputable tax preparation services available in New York, NY that can help individuals and businesses navigate the tax code and minimize their tax liability.

Tax season in New York, NY is a hectic time for tax preparers. With the city's vast population and diverse economy, tax preparers have to navigate through a myriad of tax laws and regulations, making the process of filing taxes a complex and time-consuming one. Typically, it takes tax preparers around two weeks to file taxes for their clients in New York, NY. However, this timeline can vary depending on the complexity of the tax returns. For instance, if a client has multiple sources of income or investments, it may take longer to file their taxes. Additionally, the city's high cost of living means that tax preparers have to charge higher fees to cover their expenses, which can also impact the timeline for filing taxes. Despite these challenges, tax preparers in New York, NY are committed to providing their clients with accurate and timely tax filing services.

New York, NY residents often face a variety of tax problems due to the city's complex tax system. One of the most common issues is the high property taxes, which can be a significant burden for homeowners. Additionally, New York City has a unique tax system that includes a city income tax, sales tax, and a variety of other taxes and fees. This can make it difficult for residents to understand their tax obligations and ensure they are paying the correct amount. Another common problem is the complexity of the state tax code, which can be overwhelming for individuals and businesses alike. Finally, New York's high cost of living can make it difficult for residents to afford their tax bills, especially if they are facing unexpected expenses or a loss of income.