Where Philadelphia, PA Banks & Credit Unions Serve

Philadelphia, the City of Brotherly Love, is a vibrant and culturally rich metropolis that boasts a plethora of landmarks, top employers, major highways and streets, and neighborhoods. From the iconic Liberty Bell and Independence Hall to the towering Comcast Center and the bustling Reading Terminal Market, Philadelphia is a city steeped in history, innovation, and diversity. The city is home to some of the country's top employers, including Comcast, the University of Pennsylvania Health System, and the Children's Hospital of Philadelphia, among others. Its major highways and streets, including I-95, I-76, and Broad Street, make it easily accessible from all corners of the region, while its neighborhoods, such as Center City, University City, and Old City, offer a unique blend of charm, character, and modern amenities.

Philadelphia, PA Banking Related Services

Insurance Broker

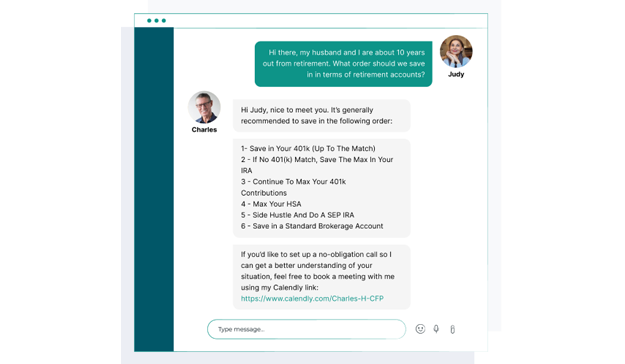

Retirement Planning

Wealth Management

Financial Advisor

Mortgage Loan Officer

Tax Services

Estate Planning Lawyer

Philadelphia, PA Financial Resources

Philadelphia, PA Chamber of Commerce

Philadelphia, PA City Hall

Philadelphia, PA Public Library

FREQUENTLY ASKED QUESTIONS

Personal, Business & Online Bank FAQs

Philadelphia, PA is home to a plethora of popular banking services that cater to the financial needs of its diverse population. From traditional brick-and-mortar banks to online banking platforms, Philadelphians have access to a wide range of financial institutions. One unique aspect of the banking landscape in Philadelphia is the prevalence of community banks that prioritize personalized service and community involvement. These banks often have deep roots in the neighborhoods they serve and are committed to supporting local businesses and organizations. In addition to community banks, Philadelphia also has a growing number of fintech startups that offer innovative financial products and services. Whether you prefer a traditional bank or a cutting-edge fintech platform, Philadelphia's banking scene has something for everyone.

Philadelphia, PA is an ideal destination for anyone seeking to avail banking services. The city boasts of a thriving banking industry that has been in existence for over three centuries. With a population of over 1.5 million people, Philadelphia has a diverse range of banking options that cater to the needs of its residents. One of the most notable features of the city's banking industry is the presence of several community banks that offer personalized services to their customers. These banks have deep roots in the local community and are committed to providing financial solutions that meet the unique needs of their clients. Additionally, Philadelphia is home to some of the largest banks in the country, which offer a wide range of services, including investment banking, wealth management, and corporate banking. With such a diverse range of banking options, Philadelphia is the perfect place for anyone looking to avail banking services.

The bank in Phoenixville, PA is a bustling hub of financial activity, providing a wide range of services to its customers. From personal checking and savings accounts to business loans and investment opportunities, this bank has it all. One of the most unique aspects of this particular bank is its commitment to the local community. Phoenixville, PA is a town steeped in history, and this bank recognizes that fact by actively supporting local initiatives and charities. Whether it's sponsoring a local festival or donating to a local food bank, this bank is dedicated to making a positive impact on the community it serves. With its knowledgeable staff and state-of-the-art technology, this bank is the go-to destination for all your financial needs in Phoenixville, PA.

Residents of Philadelphia, PA should visit a bank when they need to access financial services and products. With its bustling city streets and diverse population, Philadelphia is a hub of economic activity, making it a prime location for banking services. Whether you need to open a checking or savings account, apply for a loan, or seek financial advice, there are plenty of banks throughout the city that can cater to your needs. In fact, Philadelphia is home to several major financial institutions, including Wells Fargo, PNC Bank, and Citizens Bank, each offering a range of banking options to help residents manage their finances. So, whether you're a student, working professional, or retiree, there are plenty of reasons to visit a bank in Philadelphia.

A bank in Philadelphia, PA must possess a multitude of important qualities to thrive in this bustling city. Firstly, they must offer top-notch customer service that caters to the diverse population of Philadelphia. With a rich history and cultural significance, the city demands a bank that understands the unique needs of its residents. Additionally, a bank in Philadelphia must provide reliable and secure financial services that can handle the fast-paced nature of the city's economy. This requires a bank with cutting-edge technology and a deep understanding of the financial landscape in Philadelphia. Furthermore, a bank in this city must also prioritize community involvement and social responsibility. Philadelphia is a city that values giving back and investing in its local neighborhoods, and a bank that shares these values will undoubtedly be well-received. Overall, a bank in Philadelphia, PA must possess a combination of exceptional customer service, technological prowess, and a commitment to community involvement to truly thrive in this vibrant city.

Philadelphia, PA is home to several top banks that have been serving the community for decades. Among these banks are Wells Fargo, Citizens Bank, and PNC Bank. Each of these banks has a unique history and reputation in the financial industry. Wells Fargo, for example, has been in Philadelphia since the 1800s and has a strong presence in the city's financial district. Citizens Bank, on the other hand, is known for its commitment to community involvement and has sponsored various events and initiatives throughout Philadelphia. Lastly, PNC Bank is recognized for its innovative technology and digital banking services that cater to the modern needs of customers. Despite the fierce competition, these banks have managed to thrive in Philadelphia's bustling financial landscape, which is a testament to their resilience and adaptability.

Banks in Philadelphia, PA have numerous ways of gaining profit, ranging from traditional methods to innovative approaches. One particular way is by providing loans to small businesses that are essential to the city's economy. Philadelphia has a thriving small business community, and banks capitalize on this by offering loans with competitive interest rates and flexible repayment terms. Additionally, banks in Philadelphia also generate revenue through fees charged for various services, such as wire transfers, ATM usage, and overdraft protection. They also invest in the stock market and other financial instruments to generate returns on their investments. Furthermore, banks in Philadelphia are increasingly adopting digital banking solutions to cater to the tech-savvy population of the city. This includes online banking, mobile banking, and digital wallets, which provide convenience to customers and reduce operational costs for banks. Overall, banks in Philadelphia, PA have a diverse range of revenue streams that enable them to remain profitable in a competitive industry.