Where New York, NY Banks & Credit Unions Serve

New York, NY is a bustling metropolis filled with iconic landmarks such as the Statue of Liberty, Empire State Building, and Central Park. Its top employers include JPMorgan Chase, Citigroup, and Verizon, contributing to its thriving economy. The city is connected by major highways such as the Brooklyn-Queens Expressway and the FDR Drive, as well as famous streets like Broadway and Fifth Avenue. Neighborhoods range from the trendy SoHo to the diverse and vibrant Harlem, offering a unique experience for every visitor.

New York, NY Banking Related Services

Insurance Broker

Retirement Planning

Wealth Management

Financial Advisor

Mortgage Loan Officer

Tax Services

Estate Planning Lawyer

New York, NY Financial Resources

New York, NY Chamber of Commerce

New York, NY City Hall

New York, NY Public Library

FREQUENTLY ASKED QUESTIONS

Personal, Business & Online Bank FAQs

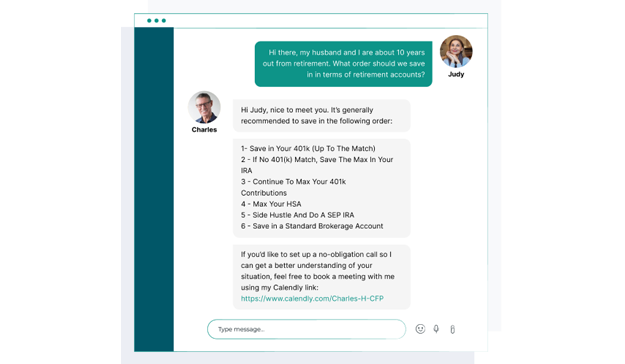

New York, NY is renowned for its diverse range of banking services that cater to the financial needs of its residents and businesses. From traditional savings and checking accounts to investment services, credit cards, and loans, the banking industry in New York offers a plethora of options to choose from. One specific aspect that sets New York's banking services apart is their focus on digital banking and mobile apps. With the fast-paced lifestyle of the city, New Yorkers demand convenient and quick access to their finances, and the banking industry has responded by providing cutting-edge digital services that allow customers to manage their accounts, transfer funds, and even deposit checks from their smartphones. In addition, many banks in New York offer personalized financial advice and wealth management services to help customers achieve their financial goals. With such a broad range of banking services available, it's no wonder why New York is considered a financial hub and a leader in the banking industry.

New York, NY is undoubtedly the best place to avail banking services owing to its unparalleled financial infrastructure. The city boasts of a thriving financial ecosystem, with Wall Street being the epicenter of global finance. The presence of numerous top-tier banks, including JPMorgan Chase, Citigroup, and Goldman Sachs, among others, further reinforces the city's position as a banking hub. Additionally, the city is home to the Federal Reserve Bank of New York, which is responsible for implementing monetary policy in the United States. The city's banking services are also supported by a robust regulatory framework, with the New York State Department of Financial Services and the Federal Deposit Insurance Corporation ensuring the safety and soundness of banks operating in the city. In essence, New York, NY's banking services are characterized by a level of sophistication, diversity, and reliability that is unmatched by any other city in the world.

A bank in New York, NY is a financial institution that provides a wide range of services to its customers. From deposit accounts to loans, credit cards, and investment opportunities, banks in New York, NY are a one-stop-shop for all your financial needs. The bustling city of New York, NY is home to some of the largest and most prestigious banks in the world, with a long history of financial innovation and excellence. In this fast-paced and dynamic city, banks must stay ahead of the curve, constantly adapting to changing market conditions and customer needs. With a diverse population and a thriving business community, New York, NY banks must be able to serve a wide range of customers, from small business owners to high net worth individuals and multinational corporations. Despite the challenges of operating in such a complex and competitive environment, banks in New York, NY continue to thrive, providing essential financial services to millions of customers every day.

New York, NY residents should visit a bank during the weekdays, preferably in the morning or early afternoon, to avoid the rush hour traffic and long queues. With the fast-paced lifestyle in the city that never sleeps, it is essential to plan ahead and manage one's finances efficiently. Moreover, with the increasing number of fraudulent activities and cybercrimes, it is crucial to visit the bank in person to ensure the safety of one's assets. New York, NY is known for its vibrant and diverse culture, and the banks in the city reflect the same. From traditional banks to modern fintech startups, there is an array of options available for the residents to choose from. However, it is advisable to research and compare the different services and charges before selecting a bank. In conclusion, visiting a bank in New York, NY can be an overwhelming experience, but with proper planning and research, it can be a smooth and hassle-free process.

When considering the important qualities of a bank in New York, NY, it is essential to take into account the fast-paced and ever-changing nature of the city. A bank that operates in this bustling metropolis must possess a level of flexibility and adaptability that can keep up with the dynamic needs of its customers. Additionally, the bank must have a deep understanding of the unique financial landscape of New York, which includes a vast array of industries and businesses that require specialized banking services. Furthermore, the bank must prioritize innovation and technology, as the city is home to some of the most advanced and cutting-edge financial technology companies in the world. Overall, a successful bank in New York, NY must be able to navigate the complexities of the city's financial ecosystem while providing top-notch customer service and innovative solutions to meet the needs of its clients.

New York, NY is home to some of the top banks in the world. One such bank is JPMorgan Chase, which has its headquarters in Manhattan. With over 250,000 employees worldwide, JPMorgan Chase is one of the largest banks in the world and has a significant presence in New York City. Another top bank in New York is Citigroup, which also has its headquarters in Manhattan. Citigroup has a global network spanning over 160 countries and offers a wide range of financial services to its clients. Additionally, Bank of America, which has its headquarters in Charlotte, North Carolina, has a significant presence in New York City. The bank has over 4,300 branches and serves over 66 million customers worldwide. What makes New York City unique is its position as a global financial hub, attracting some of the world's top banks to establish their headquarters there.

Banks in New York, NY, like any other financial institutions, gain profit through a multitude of ways. One of the most common ways is through interest income, which is generated from loans and investments. However, due to the highly competitive market in New York, banks have to be innovative in their approach to gain a competitive edge. For instance, some banks invest in sophisticated technology to provide customers with a seamless digital banking experience. Additionally, banks in New York, NY also offer a range of specialized financial services, such as wealth management and investment banking, to cater to the needs of high net worth individuals and corporations. Another unique aspect of New York, NY is its status as a global financial hub, which attracts a large number of foreign investors, further boosting the profitability of banks in the city.