Where Chicago, IL Banks & Credit Unions Serve

Chicago, IL is a vibrant city that boasts a plethora of landmarks, top employers, major highways and streets, and neighborhoods that make it a must-visit destination. From the iconic Willis Tower and the historic Navy Pier to the world-renowned Art Institute of Chicago and the bustling Magnificent Mile, there is no shortage of things to see and do in this bustling metropolis. When it comes to top employers, Chicago is home to some of the biggest names in business, including Boeing, Walgreens, and United Airlines. The city is also a major hub for transportation, with major highways like I-90, I-94, and I-290 running through its bustling streets. As for neighborhoods, Chicago is a city of diversity, with each area offering its own unique charm and character. From the trendy streets of Wicker Park and Logan Square to the historic architecture of the Gold Coast and the charming shops and restaurants of Lincoln Park, there is truly something for everyone in this city.

Chicago, IL Banking Related Services

Insurance Broker

Retirement Planning

Wealth Management

Financial Advisor

Mortgage Loan Officer

Tax Services

Estate Planning Lawyer

Chicago, IL Financial Resources

Chicago, IL Chamber of Commerce

Chicago, IL City Hall

Chicago, IL Public Library

FREQUENTLY ASKED QUESTIONS

Personal, Business & Online Bank FAQs

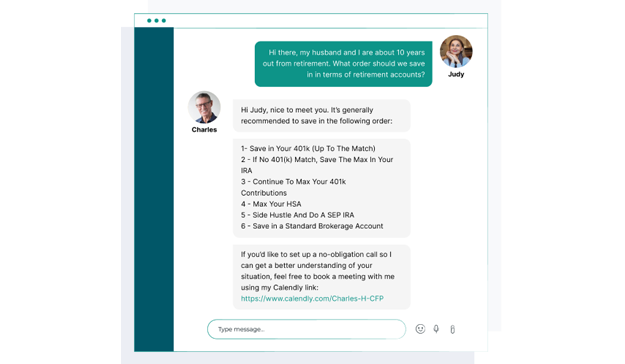

Chicago, IL is a bustling city that offers a variety of popular banking services to its residents. From traditional brick-and-mortar banks to online banking options, Chicagoans have a plethora of choices when it comes to managing their finances. One unique aspect of banking in Chicago is the prevalence of community banks that cater specifically to the needs of local neighborhoods. These smaller banks often offer personalized service and a deep understanding of the local economy. In addition, many of the larger banks in Chicago offer innovative financial products, such as mobile banking apps and virtual financial advisors. Overall, the banking landscape in Chicago is diverse and competitive, providing residents with a range of options to meet their financial needs.

Chicago, IL is undoubtedly the best place to avail banking services. It is home to some of the most renowned banks in the world, including JPMorgan Chase, Bank of America, and Citigroup. The Windy City's financial district, located in the Loop, is a bustling hub of activity, where financial institutions offer a plethora of services to their customers. One of the most significant advantages of banking in Chicago is the city's robust and diverse economy. With a GDP of over $700 billion, Chicago's economy is one of the most robust in the world, offering ample opportunities for businesses and individuals to thrive. Additionally, Chicago's banking sector is highly regulated, ensuring that customers receive the highest level of service and protection. Overall, Chicago's vibrant financial sector, combined with its strong economy and regulatory framework, make it the ideal place to avail banking services.

The banks in Chicago, IL are known for their robust financial services and innovative solutions. With a population of over 2.7 million people, Chicago is the third-largest city in the United States. The city is home to a diverse range of businesses, from small startups to multinational corporations, and the banks in Chicago cater to the needs of all these businesses. One of the most specific things about Chicago is its location on Lake Michigan, which provides a unique opportunity for the banks to offer marine financing services. The banks in Chicago offer a wide range of services, including personal and business banking, wealth management, investment banking, and more. They also provide loans and credit lines to businesses and individuals, helping them achieve their financial goals. The banks in Chicago are committed to providing excellent customer service and building long-term relationships with their clients, making them an integral part of the city's financial ecosystem.

Chicago, IL residents should visit a bank during specific hours of operation. With the city's bustling and diverse population, it's important to take note of the bank's hours of operation in order to avoid the long lines and wait times. Additionally, Chicago's unpredictable weather patterns can be a factor in determining when to visit a bank. With harsh winters and hot summers, it's important to plan ahead and visit the bank during the cooler parts of the day to avoid discomfort. Furthermore, Chicago's thriving business community may require residents to visit a bank during peak hours to conduct important transactions or meetings. Overall, it's crucial for Chicago residents to consider the time of day, weather conditions, and business demands when planning a visit to the bank.

Chicago, IL is a bustling city with a thriving economy, making it a hub for banking. A bank in Chicago must possess several key qualities to succeed in this competitive environment. Firstly, it must have a strong reputation for reliability and trustworthiness. Chicagoans are no strangers to financial scandals and are wary of institutions that do not have a proven track record of integrity. Secondly, a bank in Chicago must be able to offer a wide range of services to cater to the diverse needs of its customers. With a population of over 2.7 million people, Chicago is a melting pot of cultures and backgrounds, each with its unique financial requirements. Finally, a bank in Chicago must be able to adapt to the rapidly changing technological landscape. The Windy City is home to several tech giants, and its residents expect their banks to keep up with the latest trends and innovations. A bank that can offer cutting-edge digital services and seamless integration with other financial apps will undoubtedly have a competitive edge in the Chicago market.

Chicago, IL is home to some of the largest and most prominent banks in the country. Among these top banks are JPMorgan Chase, Bank of America, and Citibank. These financial institutions have a significant presence in the city, with numerous branches and ATMs scattered throughout its neighborhoods. However, what sets Chicago apart from other cities is its rich history in banking. The city has been a hub for finance since the 19th century, with the establishment of the Chicago Board of Trade and the Chicago Mercantile Exchange. Today, Chicago remains a major player in the financial industry, with its banks continuing to innovate and adapt to the changing needs of their customers. From traditional banking services to cutting-edge digital platforms, Chicago's top banks offer a wide range of financial solutions to meet the diverse needs of the city's residents and businesses.

Banks in Chicago, IL gain profit through a variety of means. One common strategy is to offer loans and mortgages to individuals and businesses at competitive interest rates. This allows banks to earn interest on the funds they lend out. Another way banks in Chicago, IL generate revenue is by investing in the stock market and other financial instruments. Additionally, banks may charge fees for various services such as ATM usage, wire transfers, and overdraft protection. However, one unique aspect of banking in Chicago, IL is the city's thriving commercial real estate market. Many banks in the city specialize in providing financing for commercial real estate projects, which can be highly profitable. This specialization has allowed banks in Chicago, IL to establish themselves as leaders in the commercial real estate industry, further increasing their profits.