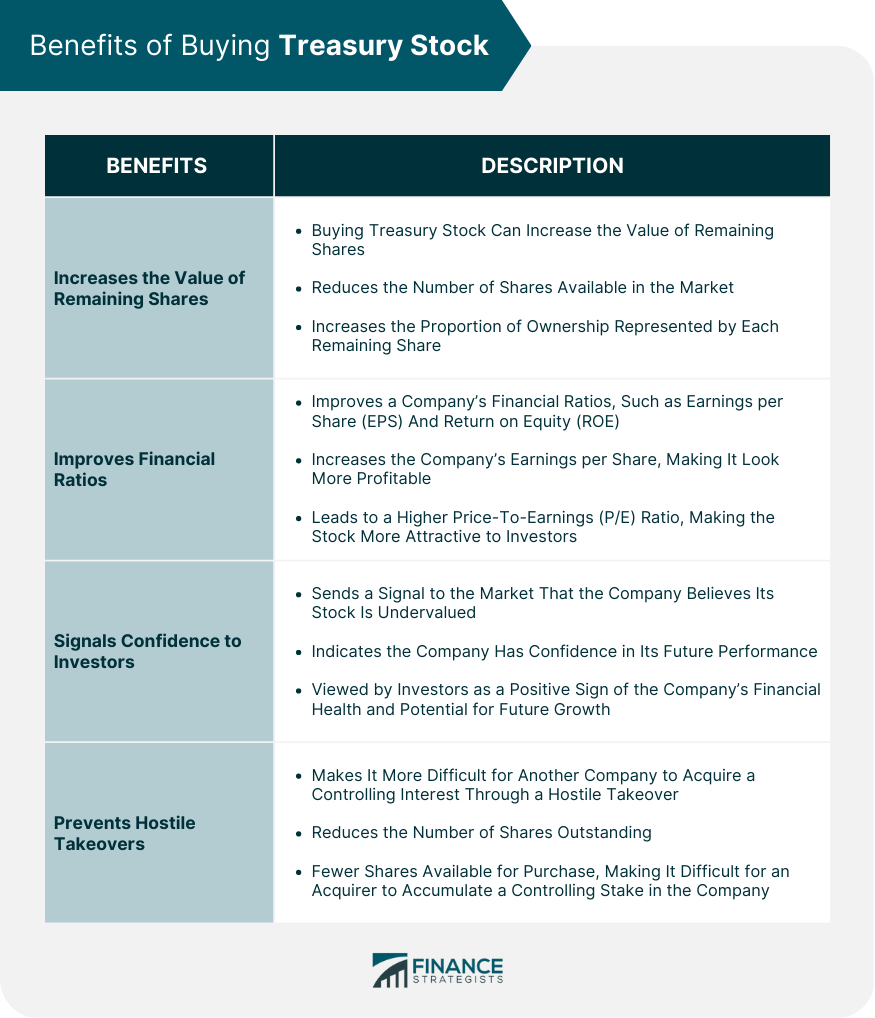

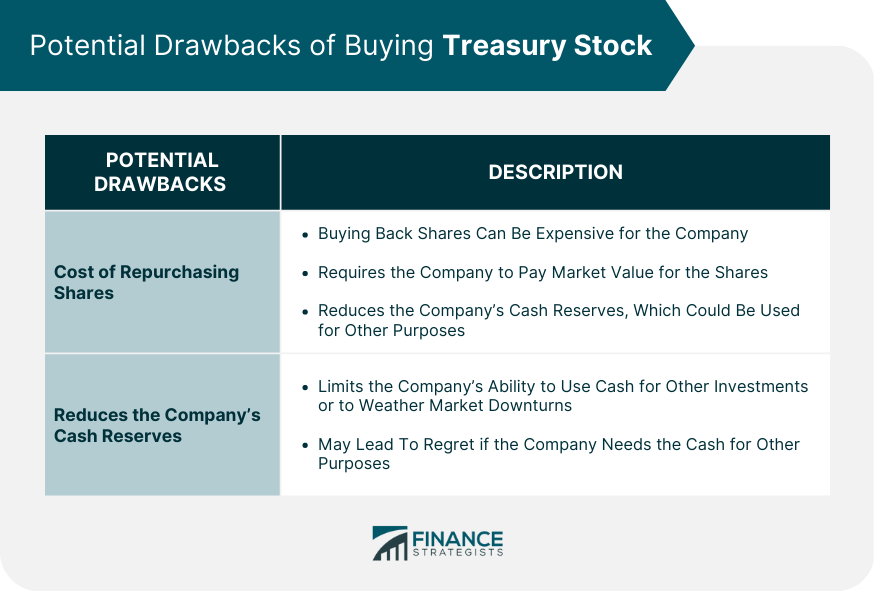

Treasury stock refers to shares of a company's own stock that have been repurchased by the company and are held in its treasury. While it might seem counterintuitive for a company to buy back its own stock, there are several reasons why companies choose to do so. These are the benefits of buying a treasury stock: One of the most significant benefits of buying treasury stock is that it can increase the value of the remaining shares. When a company buys back its own stock, it reduces the number of shares available in the market, increasing the proportion of ownership represented by each remaining share. As a result, this can drive up the price of the remaining shares. Another benefit of buying treasury stock is improving a company's financial ratios, such as earnings per share (EPS) and return on equity (ROE). Since buying back shares reduces the number of outstanding shares, this increases the company's earnings per share, making it look more profitable. The improved EPS can also lead to a higher price-to-earnings (P/E) ratio, making the stock more attractive to investors. Additionally, reducing the number of outstanding shares can increase the return on equity since there are fewer shares to dilute the ownership of existing shareholders. When a company buys back its own shares, it sends a signal to the market that it believes its stock is undervalued and that it has confidence in its future performance. This can be an important signal to investors, who may view the buyback as a positive sign of the company's financial health and potential for future growth. Buying back shares can also make it more difficult for another company to acquire a controlling interest in the company through a hostile takeover. By reducing the number of shares outstanding, there are fewer shares available for purchase, making it more difficult for an acquirer to accumulate a controlling stake in the company. The following are the potential drawbacks of buying treasury stock: One of the drawbacks of buying back shares is that it can be expensive for the company. Since the company is buying its own stock on the open market, it has to pay market value for the shares, which can be expensive. This can reduce the company's cash reserves, which could be used for other purposes, such as investing in the business or paying dividends to shareholders. Another potential drawback of buying back shares is that it reduces the company's cash reserves, which could be used for other purposes. If the company needs the cash for other investments or to weather a downturn in the market, it may regret having spent the money on buying back its own shares. Finally, a company's growth prospects and investment opportunities can also influence its decision to buy back shares. If the company has limited opportunities for growth or has excess cash that it cannot use for profitable investments, it may choose to buy back its own shares as a way to return value to shareholders. The following are some examples of companies buying treasury stocks: Apple Inc. is one of the largest companies in the world and has a significant amount of cash on its balance sheet. In recent years, Apple has used some of this cash to buy back its own shares. In December 2022, the company made a $19.48 billion share in a buyback program for that quarter alone. These buyback programs have helped to boost the company's EPS and return on equity, while also increasing the value of the remaining shares. Another tech giant that has used treasury stock to boost its financial performance is Microsoft Corporation. In September 2021, the company made a $7.072 billion share in a buyback program. The buybacks have helped to drive up the company's EPS and return on equity, while also sending a signal to investors that the company is confident in its future growth prospects. Berkshire Hathaway Inc., led by famed investor Warren Buffett, has also used treasury stock to return value to shareholders. In 2022, the company repurchased a record $7.9 billion of its own stock. Buffett has long been an advocate of using buybacks as a way to return value to shareholders, and the company's buybacks have helped to boost its financial ratios and increase the value of the remaining shares. Buying treasury stock can be a way for companies to improve their financial performance, increase the value of remaining shares, and return value to shareholders, making it an essential aspect of strategic wealth management. As a regulatory body, the U.S. Securities and Exchange Commission (SEC) closely monitors and governs such corporate financial activities to ensure compliance with established rules and protect investors' interests. However, there are also potential drawbacks to buying back shares, such as the cost of repurchasing shares and reducing the company's cash reserves. Companies need to carefully consider all factors before deciding to buy back their own shares.Why Would a Company Buy Treasury Stock?

Benefits of Buying Treasury Stock

Increases the Value of Remaining Shares

Improves Financial Ratios

Signals Confidence to Investors

Prevents Hostile Takeovers

Potential Drawbacks of Buying Treasury Stock

Cost of Repurchasing Shares

Reduces the Company's Cash Reserves

Company's Growth and Investment Opportunities

Examples of Companies Buying Treasury Stock

Apple Inc.

Microsoft Corporation

Berkshire Hathaway Inc.

Final Thoughts

Why Would a Company Buy Treasury Stock? FAQs

Treasury stock refers to shares of a company's own stock that have been repurchased by the company and are held in its treasury.

Buying treasury stock can increase the value of remaining shares, improve financial ratios, signal confidence to investors, and prevent hostile takeovers.

The cost of repurchasing shares and reducing the company's cash reserves are potential drawbacks of buying treasury stock.

Companies use treasury stock to provide shares for employee compensation plans, reduce dilution from stock-based compensation, and as a means of returning capital to shareholders.

A company's financial performance and cash flow, stock price and market conditions, and growth prospects and investment opportunities can all influence its decision to buy treasury stock.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.