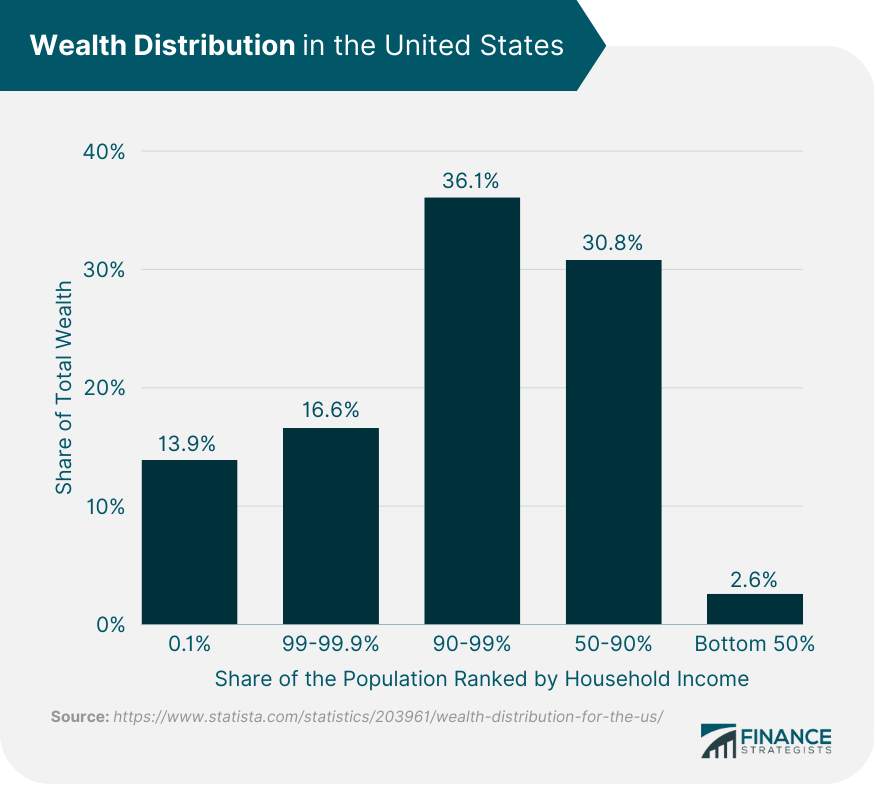

Wealth is the value of all the resources of an individual, community, company, or country. The combined value of everything a person or entity owns that is exchangeable for money, products, or services determines their wealth. These resources might take the form of both tangible and intangible assets. Only after removing all liabilities from the overall market worth of the assets can the value be established. Licenses, trademarks, a brand's name, and computer software are a few examples of intangible assets. Intangible assets are more difficult to value than tangible assets but are significant to a company's success. Real estate property, stocks, cash, inventory, equipment, automobiles, and others are a few common tangible assets. The essence of wealth is the collection and preservation of precious or uncommon resources for eventual use. Wealth is measured differently by individuals, businesses, and nations. Measuring wealth for individuals takes into account all their assets, whether tangible or financial. Property, homes, cars, bank accounts, investment portfolios, and other assets are included. An individual's wealth value is called net worth or the excess of assets over liabilities. Income plays a vital role in producing wealth, such that the larger the income can mean, the wealthier the individual. An equivalent of an individual’s net worth is shareholder’s equity or book value for businesses. It is the amount that shareholders or business owners have after paying off the liabilities. A significant amount of net assets will increase a company's wealth. Nations use Gross Domestic Product (GDP) to measure their wealth. GDP is the value of the total final goods and services produced within a country in a given year. The latest data from 2023, the United States has the most wealth, measured by its $26.95 trillion GDP. China follows this with a $17.79 trillion GDP, Germany with $4.43 trillion, Japan with $4.23 trillion, and India with $3.73 trillion. According to Statista, wealth is not evenly distributed in the U.S. As of the third quarter of 2023, the top 10% of earners owned more than 66% of the total wealth in the country. The top 1% owns 20.5% of the total wealth. In comparison, the bottom 50% of earners only earn 2.6%. A detailed plan with clear milestones is essential to develop true, long-lasting wealth. Here are some concrete strategies you can take to achieve financial success. A financial plan can help you determine if you are on track to reach your financial objectives or whether you need to adjust your expenditures. The plan can include consolidating debt, opening bank or brokerage accounts, starting a savings routine, or developing an investing strategy. Financial plans may cover years, months, or even decades, depending on your goals' time range. Financial plans are also often adaptable, making room for potential life changes or unforeseen circumstances. Reducing debts is one of the most effective ways to free up cash flow and build wealth. Pay off high-interest debt first and consider consolidating your loans to have a lower interest rate. Cut back on expenses where possible and invest the money you save. For businesses, the repercussions of not paying your obligations are frequently catastrophic. They could involve the dismissal of employees, the confiscation of stock, or expensive legal actions initiated by your creditors. The risk of government intervention may be far worse. The government will go after your assets if you do not pay the taxes you owe. Find ways to bring in additional income and accelerate wealth accumulation. Consider taking on a side hustle or looking for a higher-paying job. You may also want to invest in passive income-generating assets. You might use several different tactics to increase your earnings. When attempting to increase revenue, it is crucial to have reasonable expectations. You can start looking for ways to reduce spending, such as cutting off entertainment costs. You can also automate your savings so that a certain percentage of your income is transferred to your savings account before you even see it. Having a savings goal and a savings plan will be a good idea. Eventually, this will help you reach your targets gradually. When investing, you have two choices: an active strategy or a passive one. In an active investing strategy, stocks are bought or sold in reaction to changes in the market. You may reduce risk rapidly, launch profitable business ventures, and amass riches. On the other hand, it demands constant market monitoring, a thorough understanding of how it functions, and the capacity for prudent decision-making rapidly. Passive investing follows a more hands-off approach and emphasizes long-term rewards. The focus is enabling your portfolio to create income through diligent risk diversification across various assets. Income is the money obtained periodically in exchange for goods or services. Wealth can be described as the assets or property a person possesses throughout his lifetime. The funds derived from production factors are considered income. Wealth is the market value of an individual's or family's collection of assets. While wealth is accumulated over time, earning income takes a limited period. Income can help build wealth, but it is not a measure of wealth. An individual's income from many sources, including wages, home equity, capital gains, business/profession, and other sources, is subject to income tax. A wealth tax is imposed on an individual's or family's wealth. Wealth management can be considered a comprehensive service that includes investment management, financial planning, tax planning, and estate preparation. Utilizing insurance to safeguard assets and family may benefit some. In contrast, others prefer portfolio rebalancing to adjust assets to retain the risk and reward ratio. Diversification or investing in multiple assets to mitigate the impact of losses in any one asset is a common wealth management technique. Wealth management is often seen as a high-end service. Certain wealth management businesses may impose a minimum threshold of investment assets or net worth. A wealth manager can help in your quest to protect and grow your wealth. Wealth measures the value of all physical and intangible assets belonging to an individual, community, company, or country. Individuals measure wealth based on their net worth, businesses consider shareholder’s equity, and governments use GDP and GNI. There are ways to grow wealth. Start with creating a financial plan, managing debt, increasing earnings, saving money, and investing wisely. Wealth management strategies can be beneficial after a certain level of wealth is attained and may need the support of a wealth management service. What Is Wealth?

How to Measure Wealth

For Individuals

For Businesses

For Nations

Wealth Distribution in the U.S.

How to Build Wealth

Create a Financial Plan

Manage Debts

Increase Earnings

Save Money

Invest Wisely

Wealth vs Income

Wealth Management

Final Thoughts

Wealth FAQs

Wealth is the total value of money and other assets, such as property, investments, and resources, owned by an individual, family, community, company, or country. The combined value of everything a person or entity owns, exchangeable for money, products, or services, defines their wealth.

Income is the money acquired periodically in exchange for goods or services. Wealth can be described as the assets and property that an individual possesses throughout their lifetime and takes time to accumulate, unlike income.

Creating a financial plan, managing debts, increasing earnings, saving money, and investing are some of the most effective ways to build wealth. Automating savings, investing in assets that generate passive income, and creating a diversified portfolio is essential for building wealth.

You can measure wealth by calculating the total value of assets and investments owned by an individual or family, less any debt owed or liabilities.

Wealth management is creating, preserving, and transferring wealth for future generations. It involves strategic planning to help individuals manage their finances, investments, and taxes to increase their overall wealth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.