The Black-Scholes option pricing model is a mathematical formula that calculates the theoretical value of European call and put options. The model's importance lies in its ability to determine fair option prices based on various factors. The model's foundation rests on the concept of hedging, which involves offsetting the risk of price movements. It also uses partial differential equations to create a risk-neutral framework for option pricing. The significance of the Black-Scholes Model cannot be overstated, as it has had a profound impact on both academia and the financial industry. One of the key contributions of the BSOPM is its ability to derive a theoretical price for an option based on certain inputs such as the stock price, the option's strike price, the time until expiration, the volatility of the underlying asset, and the risk-free interest rate. Prior to the development of the Black-Scholes Model, options pricing was primarily based on intuition, resulting in inefficiencies and inconsistencies in the market. The model's ability to produce a fair value for an option has greatly enhanced market efficiency and transparency, leading to a dramatic increase in options trading volume and liquidity. Another crucial impact of the Black-Scholes Model has been its role in the development of financial risk management. By providing a quantifiable approach to options pricing, the model has facilitated the creation of sophisticated hedging strategies that enable market participants to manage and mitigate risks associated with their positions. There are several assumptions involved in the Black-Scholes Option Pricing Model. The model assumes European options, which means they can only be exercised at expiration. This simplifies calculations but limits its applicability to American options that can be exercised at any time. The Black-Scholes model assumes that the underlying asset does not pay dividends during the option's life. This can create inaccuracies when pricing options on dividend-paying stocks. The model relies on the efficient market hypothesis, which asserts that market prices fully reflect all available information. This means that arbitrage opportunities are assumed to be non-existent. The model assumes a constant risk-free interest rate, which is used to discount future cash flows. Changes in interest rates can impact option prices and introduce inaccuracies. The Black-Scholes model assumes that asset prices follow a lognormal distribution. This simplifies calculations but may not accurately represent real-world price movements. The model assumes constant volatility, which means that the price fluctuation rate remains stable over the option's life. In reality, volatility can change significantly, affecting option prices. The following are the components considered in the Black-Scholes Formula: The call option pricing component calculates the theoretical value of a call option, which gives the holder the right to buy an asset at a predetermined price. The put option pricing component calculates the theoretical value of a put option, which gives the holder the right to sell an asset at a predetermined price. The Greek letters, or "Greeks," measure the sensitivity of option prices to changes in various factors. Delta: Delta measures an option's price sensitivity to changes in the underlying asset's price. Gamma: Gamma measures the rate of change in Delta relative to changes in the underlying asset's price. Vega: Vega measures an option's price sensitivity to changes in the underlying asset's volatility. Theta: Theta measures the rate of change in an option's price relative to time decay. Rho: Rho measures an option's price sensitivity to changes in the risk-free interest rate. The Black-Scholes Option Pricing Model can be used in several different areas, including: The Black-Scholes model is widely used in financial markets to determine option prices, which in turn influence investment decisions and risk management strategies. In corporate finance, the model is used to value employee stock options and make informed decisions regarding compensation packages. The Black-Scholes model helps investors and financial institutions manage risk by understanding the potential impacts of various factors on option prices. The model is frequently incorporated into algorithmic trading strategies to identify and exploit mispriced options. The Black-Scholes Option Pricing Model also has several limitations. The Black-Scholes model's assumptions are often violated in real-world scenarios, which can lead to inaccuracies in option pricing and risk management. The model's assumption of constant volatility is often unrealistic, as volatility can change significantly over time. This can result in mispriced options and ineffective hedging strategies. The Black-Scholes model assumes a lognormal distribution of asset prices, which may not account for extreme events or price jumps. This limitation can lead to significant discrepancies between theoretical and actual option prices. Several alternative models have been developed to address the limitations of the Black-Scholes model, such as the binomial and trinomial tree models, stochastic volatility models, and jump-diffusion models. The binomial model, introduced by Cox, Ross, and Rubinstein in 1979, involves constructing a tree of possible stock prices over time. Each node represents a potential stock price, and the tree branches into two possible outcomes at every time step: an increase or decrease in price. By assigning probabilities to each outcome, the model traces the stock price's potential paths and calculates the option price by working backward from the expiration date. The trinomial tree model, a more advanced version of the binomial model, adds a third possible outcome at each time step: no change in the stock price. This additional branch allows for a more accurate representation of the underlying asset's potential price movements. Both binomial and trinomial tree models are particularly useful for American-style options, which can be exercised at any time before expiration, unlike European-style options. One limitation of the Black-Scholes Model is its assumption of constant volatility for the underlying asset. However, in reality, asset volatility often fluctuates over time. Stochastic volatility models address this issue by incorporating a random process to model the underlying asset's volatility. The Heston model, introduced by Steven Heston in 1993, is a prominent example of a stochastic volatility model. It allows for a more realistic representation of market behavior by accounting for changes in volatility and correlation between the asset price and its volatility. Jump-diffusion models, such as the Merton jump-diffusion model, incorporate both continuous price movements and discontinuous jumps into the pricing framework. By accounting for these sudden shifts in asset prices, jump-diffusion models provide a more comprehensive understanding of option pricing in volatile and unpredictable markets. Despite its limitations, the Black-Scholes model remains a cornerstone of modern finance due to its simplicity and widespread adoption. It serves as a benchmark for option pricing and continues to inform investment and risk management strategies. Future research will likely focus on improving the model's assumptions and incorporating more realistic features, such as stochastic volatility and jumps in asset prices. This ongoing research will help refine option pricing models and enhance their practical applications in finance.Definition of Black-Scholes Option Pricing Model

Impact of the Black-Scholes Option Pricing Model

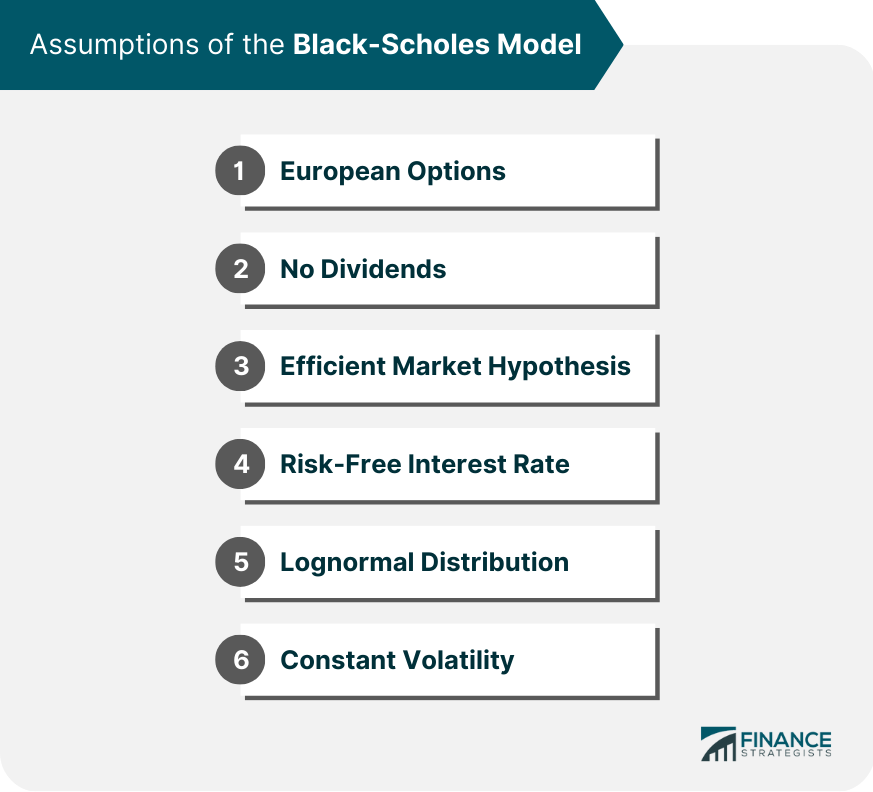

Assumptions of the Black-Scholes Model

European Options

No Dividends

Efficient Market Hypothesis

Risk-Free Interest Rate

Lognormal Distribution

Constant Volatility

Components of the Black-Scholes Formula

Call Option Pricing

Put Option Pricing

Greek Letters

Practical Applications of the Black-Scholes Model

Financial Markets

Corporate Finance

Risk Management

Algorithmic Trading

Limitations and Critiques of the Black-Scholes Model

Violations of Assumptions

Inaccurate Volatility Estimates

Inability to Predict Extreme Events

Alternatives to the Black-Scholes Model

Binomial Tree Model

Trinomial Tree Model

Stochastic Volatility Models

Jump-Diffusion Models

Conclusion

Black-Scholes Option Pricing Model FAQs

It's a mathematical formula used to determine the theoretical value of a European call or put option based on certain variables.

The variables include the current stock price, the option's strike price, the time to expiration, the risk-free interest rate, and the option's implied volatility.

The model assumes constant volatility, no dividends, and efficient markets, which may not always hold true in real-world scenarios.

The model was developed by Fischer Black, Myron Scholes, and Robert Merton in 1973.

The model is commonly used by financial analysts, traders, and investors to determine fair prices for options contracts and to manage their risk exposure.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.