Microcap stocks, also known as penny stocks, are shares of publicly traded companies with a very small market capitalization. Market capitalization is calculated by multiplying the number of outstanding shares of a company by its current stock price. Microcap stocks are typically companies with a market capitalization of less than $300 million, though some sources define it as less than $50 million. By comparison, large-cap stocks are companies with a market capitalization of $10 billion or more, while mid-cap and small-cap stocks fall in between. Microcap stocks are usually traded on over-the-counter (OTC) markets, such as the OTC Bulletin Board (OTCBB) or the Pink Sheets, rather than major stock exchanges like the New York Stock Exchange (NYSE) or Nasdaq. This is because microcap companies are often in their early stages and do not meet the strict requirements for listing on major stock exchanges. Microcap stocks work similarly to other types of stocks, in that investors purchase shares of a company in the hopes that the company will grow and the stock price will increase, resulting in a profit. However, microcap stocks are typically issued by companies with a smaller market capitalization than other types of stocks, and they are often traded on OTC markets rather than major stock exchanges. This can make microcap stocks more susceptible to market manipulation and volatility, and investors should take care to perform extensive research and due diligence before investing. While microcap stocks can offer high growth potential, they also come with higher risks, so it is crucial to diversify your portfolio and maintain a long-term perspective. Investing in microcap stocks requires a careful balance of risk and reward, and investors should be prepared to do their research and manage their investments strategically. Aside from their small market capitalization, microcap stocks have several other characteristics that set them apart from other types of stocks. Microcap stocks are known for their high volatility, meaning their prices can fluctuate dramatically over short periods of time. This is due in part to their relatively low trading volume and lack of analyst coverage, which can make them more susceptible to market manipulation. While microcap companies are often riskier investments, they also have the potential for higher returns than more established companies. This is because a small, growing company can experience rapid growth that translates into higher stock prices. However, the reverse is also true: if the company fails to grow or goes bankrupt, investors can lose their entire investment. As with any investment, there are both advantages and disadvantages to investing in microcap stocks. Here are some of the most important: High Growth Potential: Microcap stocks can offer investors the potential for high returns due to their small size and the potential for rapid growth. Diversification: Investing in microcap stocks can help diversify your portfolio, reducing your overall risk. Undervalued Opportunities: Microcap stocks are often underfollowed and undervalued by analysts, creating opportunities for investors who are willing to do their research. Accessibility: Microcap stocks are often easier to buy and sell than larger, more established companies, as they are traded on OTC markets. High-Risk: Microcap stocks are often riskier investments due to their small size and limited liquidity. There is a higher risk of losing your entire investment if the company fails. Lack of Transparency: Microcap companies are often less transparent than larger, more established companies, which can make it harder for investors to make informed decisions. Market Manipulation: Microcap stocks are more susceptible to market manipulation due to their low trading volume and lack of analyst coverage. Scams and Fraud: Microcap stocks are sometimes used as vehicles for scams and fraud, making it important for investors to do their due diligence before investing. If you are interested in investing in microcap stocks, there are several strategies you can use to increase your chances of success: As with any investment, it is important to do your due diligence before investing in microcap stocks. This means researching the company's financials, management team, competitive landscape, and growth prospects. Look for companies with a strong track record of growth and a solid business plan. While microcap stocks can offer high growth potential, they are also riskier investments. To mitigate your risk, consider diversifying your portfolio by investing in a variety of stocks across different sectors and market capitalizations. Before investing in a microcap stock, it is important to have a clear understanding of the potential returns and risks. Set a target price for the stock and be prepared to sell if the stock price falls below that level. Microcap stocks are sometimes used as vehicles for scams and fraud. Look for red flags such as overly promotional language, vague or misleading disclosures, and unverifiable claims of success. Be wary of companies with a history of regulatory violations or lawsuits. Investing in microcap stocks requires patience and a long-term perspective. Do not be swayed by short-term fluctuations in the stock price. Instead, focus on the underlying fundamentals of the company and its growth prospects over the long term. There have been several successful microcap stocks throughout history. One example is Monster Beverage Corporation (MNST), which was founded in 1935 as a small soda company. In the 1990s, the company shifted its focus to energy drinks and began to experience rapid growth. Today, Monster Beverage Corporation has a market capitalization of over $35 billion and is traded on the Nasdaq stock exchange. Another example of a successful microcap stock is Amazon.com (AMZN), which was founded in 1994 as an online bookstore. In the years since, the company has expanded into a wide range of businesses, including cloud computing, streaming media, and artificial intelligence. Today, Amazon.com has a market capitalization of over $1 trillion and is one of the most valuable companies in the world. Microcap stocks can offer investors high growth potential, but they also come with higher risks. As a result, it is crucial to perform extensive research, diversify your portfolio, and maintain a long-term perspective. You should look for companies with a strong track record of growth and a solid business plan while avoiding those with red flags such as regulatory violations and overly promotional language. However, navigating the world of stocks can be challenging, especially for novice investors. That is why it is highly recommended to hire the services of an expert in wealth management who can help you manage risks and make informed investment decisions. A wealth management advisor can provide personalized advice tailored to your financial goals and risk tolerance, ensuring that your investments align with your overall financial plan.What Is a Microcap Stock?

How Microcap Stock Works

Characteristics of Microcap Stocks

Volatility

Potential for High Returns

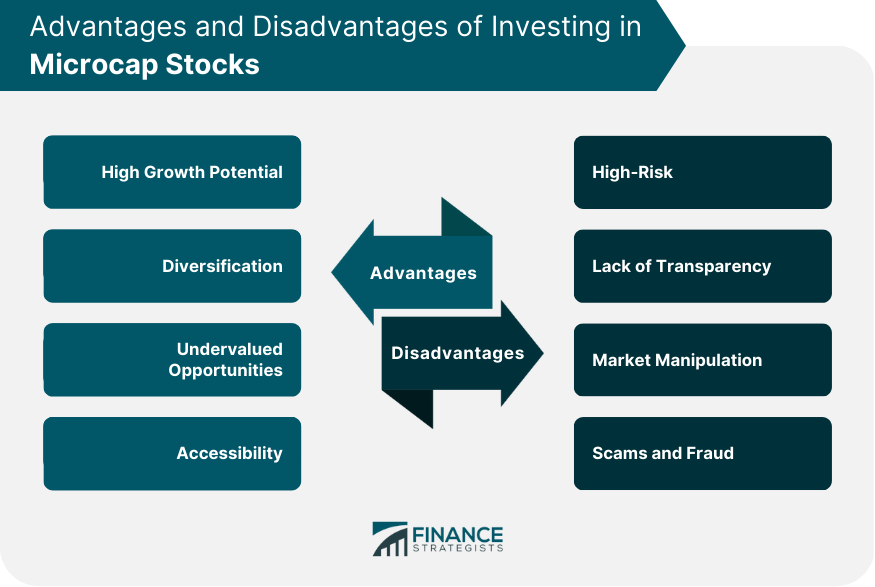

Advantages and Disadvantages of Investing in Microcap Stocks

Advantages

Disadvantages

Strategies for Investing in Microcap Stocks

Do Your Research

Diversify Your Portfolio

Set a Target Price

Watch for Red Flags

Be Patient

Microcap Stock Examples

The Bottom Line

Microcap Stock FAQs

A microcap stock is a share of a publicly traded company with a very small market capitalization, usually less than $300 million, traded on over-the-counter (OTC) markets rather than major stock exchanges like the NYSE or Nasdaq.

Microcap stocks can offer investors the potential for high returns, diversification, and undervalued opportunities due to being underfollowed and undervalued by analysts. They are also often easier to buy and sell than larger, more established companies.

Microcap stocks are often riskier investments due to their small size, limited liquidity, lack of transparency, and susceptibility to market manipulation. They are also sometimes used as vehicles for scams and fraud.

Investing in microcap stocks requires extensive research, diversification, and patience. Investors should look for companies with a strong track record of growth and a solid business plan while avoiding red flags such as regulatory violations and overly promotional language.

Microcap stocks can offer high growth potential, but they are also riskier investments due to their small size, limited liquidity, and susceptibility to market manipulation. It is crucial to do your research and diversify your portfolio before investing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.