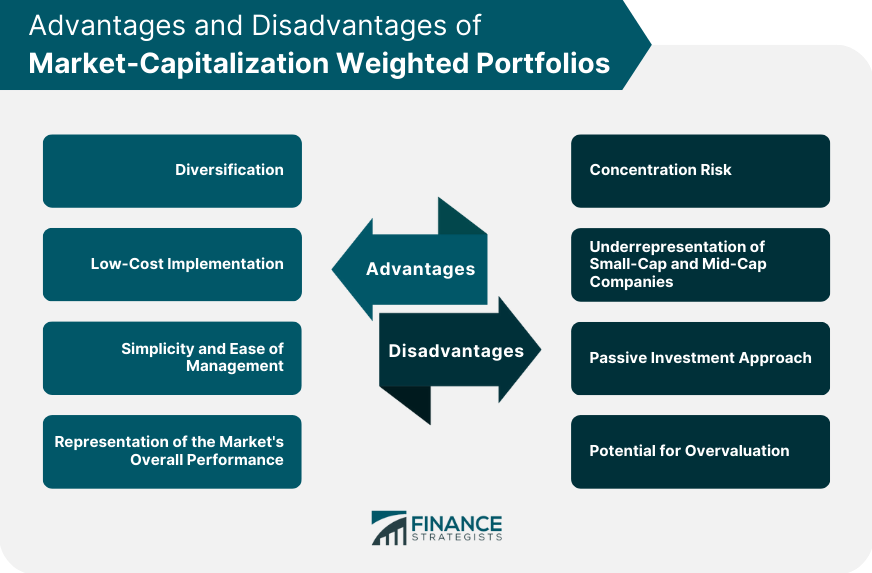

A market capitalization-weighted portfolio is an investment strategy where the weight of each security is determined by its market capitalization. This approach favors larger companies, potentially increasing risk but offering diversification and low costs. Market capitalization, or market cap, is a financial metric used to measure the size and value of a publicly traded company. It represents the total market value of a company's outstanding shares of stock. Market capitalization is calculated by multiplying a company's share price by the number of its outstanding shares. The formula is as follows: Companies are often classified into categories based on their market capitalization: Large-Cap Companies: Typically have a market cap of $10 billion or more. These companies are well-established and financially stable, offering relatively lower risk and stable returns. Mid-Cap Companies: Generally have a market cap between $2 billion and $10 billion. These companies may offer a balance between growth potential and stability. Small-Cap Companies: Usually have a market cap of less than $2 billion. These companies may offer higher growth potential but come with increased risk and volatility. Constructing a market capitalization-weighted portfolio involves the following steps: To maintain a market cap-weighted portfolio, periodic reviews and adjustment of asset weights are necessary. This may involve: Periodic Review and Adjustment of Asset Weights: Rebalance the portfolio to align with the current market capitalization of the assets, typically done quarterly or annually. Handling Corporate Actions: Adjust the portfolio to account for corporate actions, such as stock splits, mergers, or acquisitions, that may affect the market cap of assets. Monitoring and Managing Risk: Continuously assess the portfolio's risk and adjust the asset allocation accordingly to meet investment objectives. Market cap-weighted portfolios offer diversification benefits by investing in a wide range of companies with different market capitalizations. Since market cap-weighted portfolios are often passively managed, they typically have lower fees and operational costs compared to actively managed portfolios. Market cap-weighted portfolios are relatively simple to construct and manage, making them an attractive option for investors with limited time or expertise in active portfolio management. Market cap-weighted portfolios are designed to reflect the market's overall performance, allowing investors to track and benchmark their returns against the broader market. Market cap-weighted portfolios tend to be heavily invested in large-cap companies, which may lead to concentration risk and underexposure to smaller, potentially higher-growth companies. Since market cap-weighted portfolios focus on large-cap companies, small-cap and mid-cap companies may need to be more represented, limiting potential growth opportunities and diversification benefits. Market cap-weighted portfolios follow a passive investment approach, which may not be suitable for investors looking to outperform the market or actively manage their investments. Market cap-weighted portfolios may invest in overvalued companies, as their weights are determined by market capitalization, which is influenced by market sentiment and stock price movements. Equal-weighted portfolios assign the same weight to each asset, regardless of market capitalization. This strategy offers increased exposure to small-cap and mid-cap companies and reduces concentration risk. Fundamental-weighted portfolios use fundamental metrics, such as earnings or book value, to determine asset weights. This strategy may reduce overvaluation risk and provide better exposure to undervalued companies. Smart beta strategies combine passive and active management elements, using rules-based approaches to weight assets based on value, quality, or momentum. Active portfolio management involves selecting individual assets based on research and analysis, aiming to outperform the market or achieve specific investment objectives. Market capitalization-weighted portfolios are commonly used in index funds and ETFs, including: S&P 500 Index: Tracks the performance of 500 large-cap U.S. companies, weighted by market capitalization. FTSE 100 Index: Represents the 100 largest UK-listed companies, weighted by market capitalization. MSCI World Index: Covers developed market large- and mid-cap companies across 23 countries, weighted by market capitalization. Market cap-weighted indices serve as benchmarks for comparing the performance of investment portfolios and funds. Market cap-weighted portfolios offer a passive, low-cost investment strategy for individual investors seeking exposure to a broad range of assets and market segments. In addition to the previously discussed points, it is crucial to consider how market capitalization-weighted portfolios perform under various market conditions. During bull markets, when stock prices are generally rising, market cap-weighted portfolios may experience strong gains, as large-cap companies often drive the overall market performance. In bear markets, characterized by declining stock prices, market cap-weighted portfolios may experience losses as the overall market suffers. During periods of increased market volatility, market cap-weighted portfolios may experience fluctuations in value, as large-cap companies can be more sensitive to market sentiment and economic conditions. Market capitalization-weighted portfolios offer investors a simple, low-cost, diversified investment approach. However, potential drawbacks, such as concentration risk and underexposure to smaller companies, may warrant consideration. Investors should carefully evaluate their investment objectives and risk tolerance before choosing a portfolio strategy and consider alternative approaches if necessary. Future trends and developments in market cap-weighted portfolios may continue to shape the investment landscape and offer new opportunities for investors.What Is a Market Capitalization-Weighted Portfolio?

Market Capitalization

Definition of Market Capitalization

Calculation of Market Capitalization

Market Cap Categories

Market Cap-Weighted Portfolio Construction

Building a Market Cap-Weighted Portfolio

1. Identifying the Target Universe of Assets: Determine the set of assets (stocks, bonds, or other securities) to include in the portfolio, such as a specific sector or market index.

2. Calculating Individual Market Caps for Each Asset: Compute the market capitalization for each security in the target universe.

3. Determining Asset Weights Based on Market Caps: Calculate the proportionate weight of each asset in the portfolio by dividing its market cap by the total market cap of all assets in the target universe.

4. Allocating Investment Funds According to Asset Weights: Invest in each asset according to its weight in the portfolio.

Rebalancing and Maintenance a Market Cap-Weighted Portfolio

Advantages of Market Cap-Weighted Portfolios

Diversification

Low-Cost Implementation

Simplicity and Ease of Management

Representation of the Market's Overall Performance

Disadvantages of Market Cap-Weighted Portfolios

Concentration Risk

Underrepresentation of Small-Cap and Mid-Cap Companies

Passive Investment Approach

Potential for Overvaluation

Alternatives to Market Cap-Weighted Portfolios

Equal-Weighted Portfolios

Fundamental-Weighted Portfolios

Smart Beta Strategies

Active Portfolio Management

Practical Applications and Examples

Market Cap-Weighted Index Funds and ETFs

Benchmarking and Performance Measurement

Investment Strategy for Individual Investors

Evaluating Market Cap-Weighted Portfolios in Different Market Conditions

This section examines the potential impact of bull markets, bear markets, and periods of market volatility on market-cap-weighted portfolios.Bull Markets

However, the focus on large-cap companies may cause investors to miss out on some of the more significant gains that smaller, high-growth companies achieve.Bear Markets

However, the allocation to large-cap companies may provide some level of downside protection, as these companies are generally more stable and financially robust than smaller companies.Periods of Market Volatility

While the diversification benefits of market cap-weighted portfolios can help mitigate some of the risks associated with market volatility, investors should be prepared for potential short-term fluctuations in their portfolio value.Conclusion

Market Capitalization-Weighted Portfolio FAQs

A market capitalization-weighted portfolio is a type of investment portfolio where the weighting of each individual security is determined by its market capitalization, meaning that the larger companies have a greater influence on the portfolio's overall performance.

A market capitalization-weighted portfolio is constructed by allocating a percentage of the portfolio's total value to each security based on its market capitalization. This means that larger companies will have a higher percentage allocation than smaller ones.

One advantage of investing in a market capitalization-weighted portfolio is that it is a passive investment strategy that is simple and low-cost to maintain. Additionally, the portfolio will closely track the overall market's performance, which can provide diversification and potentially reduce risk.

One disadvantage of investing in a market capitalization-weighted portfolio is that it can lead to overconcentration in a few large companies, which may increase risk. Additionally, it may not capture the potential outperformance of smaller companies that are less heavily represented in the market.

The performance of a market capitalization-weighted portfolio is measured by comparing its returns to a benchmark index, such as the S&P 500 or the Russell 2000. If the portfolio's returns closely track the benchmark, it is considered to perform well.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.