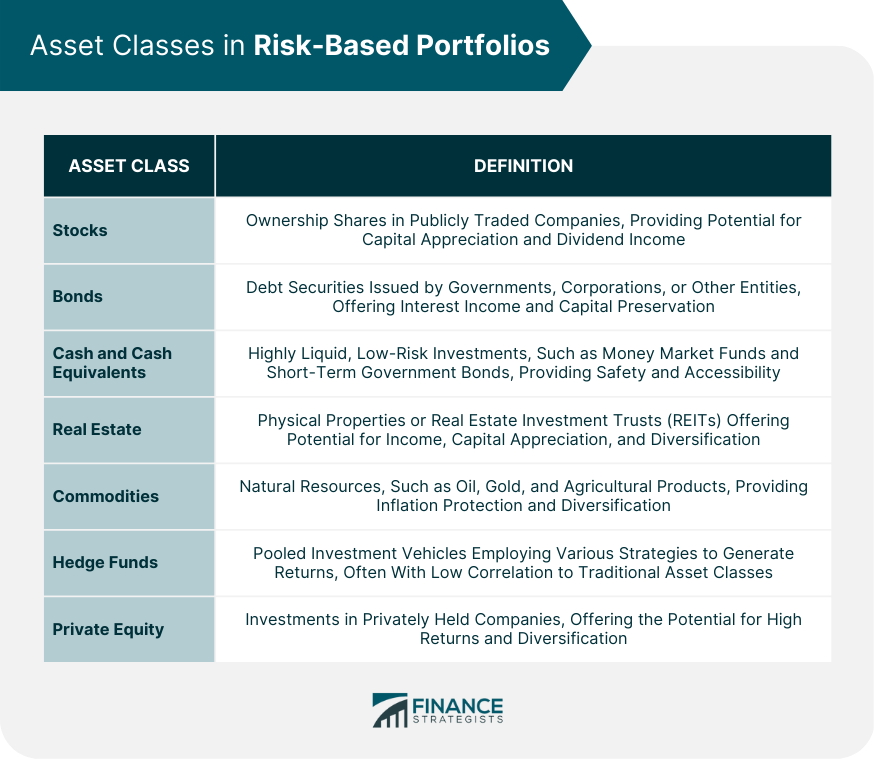

A risk-based portfolio refers to an investment strategy that emphasizes managing and controlling various types of risks associated with investing. This approach helps investors build a diversified portfolio tailored to their unique risk tolerance, financial goals, and time horizon. Risk management is crucial in investing because it helps investors protect their capital while achieving their financial objectives. By understanding and managing investment risks, investors can make more informed decisions and improve their overall portfolio performance. The primary goals of a risk-based portfolio approach are to balance risk and return, optimize portfolio performance, and achieve long-term financial goals. This method involves assessing risk tolerance, allocating assets accordingly, and continuously monitoring and adjusting the portfolio as needed. Market risk is the potential for investments to lose value due to fluctuations in the overall financial markets. Factors like economic conditions, political events, and investor sentiment can all impact market risk. Credit risk refers to the possibility that a borrower may default on their debt obligations, causing a loss for the investor. It is especially relevant when investing in bonds, corporate debt, or other fixed-income securities. Liquidity risk is the risk that an investor may not be able to buy or sell an asset quickly enough, or at a desirable price, due to a lack of market participants. This can result in losses, especially during periods of market stress or volatility. Inflation risk is the risk that the purchasing power of an investment will decline over time as prices rise. It is particularly relevant for fixed-income investments, as their returns may not keep up with the rate of inflation. Interest rate risk is the potential for investment values to fluctuate due to changes in interest rates. It is especially important for bond investors, as rising interest rates can lead to declining bond prices. Currency risk is the possibility that changes in exchange rates will negatively impact the value of an investment denominated in a foreign currency. Political risk involves the potential for changes in government policies or political instability to affect the value of investments. This risk is especially relevant for investments in emerging or frontier markets. Operational risk refers to the risk of losses resulting from inadequate or failed internal processes, people, or systems. It can impact investments in individual companies or entire industries. Financial Goals and Time Horizon: An investor's financial objectives and the time they have to achieve them can significantly impact their risk tolerance. Investment Experience and Knowledge: Investors with more experience and knowledge may be more comfortable taking on additional risks. Emotional Factors: Personal attitudes towards risk-taking and an individual's capacity to handle market fluctuations can also influence risk tolerance. Risk tolerance questionnaires and tools help investors evaluate their comfort with different levels of risk. These assessments typically involve a series of questions related to financial goals, investment experience, and emotional factors. Risk tolerance can change over time as an investor's financial situation, goals, and personal circumstances evolve. Regular reassessments help ensure that an investor's portfolio remains aligned with their risk tolerance and financial objectives. Diversification involves spreading investments across various asset classes and individual securities to minimize risk. A well-diversified portfolio can help protect investors from significant losses and improve overall returns. Stocks: Ownership shares in publicly traded companies, providing potential for capital appreciation and dividend income. Bonds: Debt securities issued by governments, corporations, or other entities, offering interest income and capital preservation. Cash and Cash Equivalents: Highly liquid, low-risk investments, such as money market funds and short-term government bonds, providing safety and accessibility. Real Estate: Physical properties or real estate investment trusts (REITs) offering potential for income, capital appreciation, and diversification. Commodities: Natural resources, such as oil, gold, and agricultural products, providing inflation protection and diversification. Hedge Funds: Pooled investment vehicles employing various strategies to generate returns, often with low correlation to traditional asset classes. Private Equity: Investments in privately held companies, offering the potential for high returns and diversification. Strategic asset allocation involves setting long-term investment targets based on an investor's risk tolerance and financial goals. Tactical asset allocation involves making short-term adjustments to the portfolio in response to changing market conditions or opportunities. Risk budgeting involves allocating a specific amount of risk to each asset class or investment based on its contribution to the overall portfolio risk. Risk parity is a strategy that aims to equalize the risk contributions from each asset class, regardless of their expected returns. Modern Portfolio Theory (MPT): A framework for constructing portfolios that maximize expected returns for a given level of risk. Black-Litterman Model: A method for incorporating investor views and market equilibrium assumptions to generate optimal portfolio weights. Monte Carlo Simulation: A technique for modeling the probability distribution of portfolio returns under different market scenarios. Sharpe Ratio: Measures risk-adjusted returns by dividing excess return over the risk-free rate by the portfolio's standard deviation. Sortino Ratio: Similar to the Sharpe Ratio, but focuses on downside risk by considering only negative deviations from the target return. Treynor Ratio: Evaluates risk-adjusted returns by dividing excess return over the risk-free rate by the portfolio's beta, a measure of market risk. Information Ratio: Compares a portfolio's active return against its tracking error, which measures deviations from a benchmark index. Regular monitoring of a risk-based portfolio helps investors identify potential issues, such as underperforming assets or increased risk exposure, and make necessary adjustments to stay on track with their financial goals. Calendar-based Rebalancing: Realigning a portfolio's asset allocation at predetermined time intervals, such as quarterly or annually. Threshold-based Rebalancing: Adjusting a portfolio when asset allocations deviate from target allocations by a specified percentage. Dynamic Rebalancing: Continuously monitoring and adjusting a portfolio in response to changing market conditions and investment opportunities. When rebalancing a portfolio, investors should consider potential tax implications and transaction costs, which can impact overall returns. Risk-based portfolio management helps investors achieve their financial goals while managing and mitigating investment risks. This approach can lead to improved portfolio performance, capital preservation, and more informed decision-making. Despite its benefits, risk-based portfolio management has some challenges and limitations. Market conditions can change rapidly, and historical performance may not predict future results. Additionally, accurately assessing risk tolerance and selecting the appropriate investments can be complex tasks. As technology and data analytics continue to advance, investors can expect new tools and methods for managing risk in their portfolios. These advancements may include artificial intelligence and machine learning-based approaches to portfolio optimization, improved risk assessment techniques, and the development of more sophisticated risk management tools. Risk-based portfolio management is an essential component of successful investing. By understanding various types of investment risks, assessing risk tolerance, and employing appropriate asset allocation strategies, investors can build a diversified portfolio that balances risk and return, helping them achieve their long-term financial goals. As technology and market trends continue to evolve, risk-based portfolio management is likely to become even more sophisticated and effective in the future.What Is a Risk-Based Portfolio?

Types of Investment Risks

Market Risk

Credit Risk

Liquidity Risk

Inflation Risk

Interest Rate Risk

Currency Risk

Political Risk

Operational Risk

Risk Tolerance Assessment

Individual Risk Tolerance Factors

Risk Tolerance Questionnaires and Tools

Periodic Reassessment of Risk Tolerance

Asset Allocation in Risk-Based Portfolios

Diversification Principles

Traditional Asset Classes

Alternative Asset Classes

Strategic vs Tactical Asset Allocation

Risk-Based Portfolio Construction

Risk Budgeting and Risk Parity

Portfolio Optimization Techniques

Risk-Adjusted Performance Metrics

Portfolio Monitoring and Rebalancing

Importance of Regular Monitoring

Rebalancing Strategies

Tax Considerations and Transaction Costs

Conclusion

Risk-Based Portfolio FAQs

A risk-based portfolio is a collection of investments that are chosen based on an investor's risk tolerance. It is designed to manage risk by balancing the potential return of investments with their level of risk.

A traditional portfolio is typically designed to maximize returns, regardless of the level of risk involved. A risk-based portfolio, on the other hand, is designed to manage risk by balancing potential returns with risk.

A risk-based portfolio may include a variety of investments, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The specific investments included in a risk-based portfolio will depend on an investor's risk tolerance, investment goals, and financial situation.

Risk tolerance is typically determined by assessing an investor's financial situation, investment goals, and overall risk aversion. A financial advisor can help an investor determine their risk tolerance and create a risk-based portfolio that is appropriate for their needs.

A risk-based portfolio can provide a number of benefits, including better risk management, the ability to tailor investments to an investor's risk tolerance, and potentially higher returns over the long term. Additionally, a risk-based portfolio can help investors achieve their investment goals while minimizing the impact of market volatility on their portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.