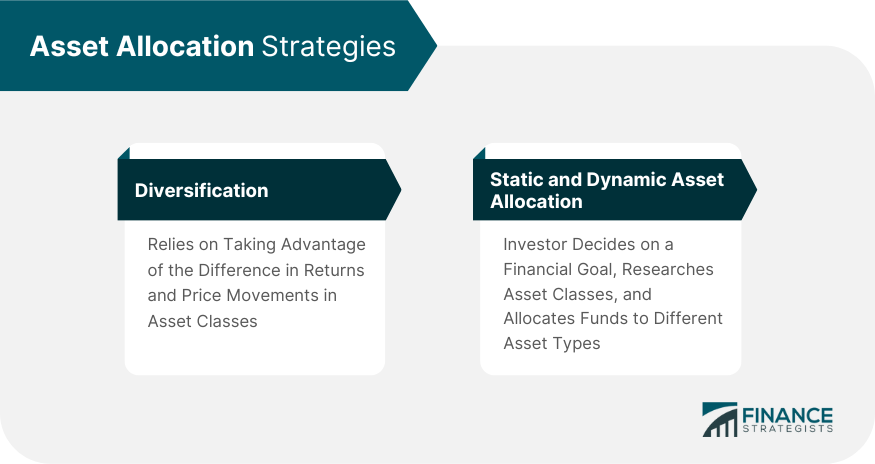

Asset allocation refers to the distribution of different types of asset classes across an investment portfolio. Common asset classes are: That definition can be expanded to include other types and forms of assets, such as: The overarching goal of asset allocation is to multiply returns. The pace and nature of those returns changes with age and risk tolerance. At a younger age, you might invest in riskier and speculative investments, willing to take a loss here and a profit there, with the goal of making as much money as possible. The same investing cycle undergoes a strategic shift to more conservative and income-generating instruments as you reach retirement. Have questions about Asset Allocations? Click here. Asset allocation determines the behavior of your portfolio. If you have assets with a volatile price history, such as cryptocurrencies or stocks, then returns for your portfolio will swing between extremes. On the other hand, a portfolio consisting of safe instruments produces consistent returns. Assets are generally allocated between three asset classes: The returns of your portfolio depend on the percentage composition for each of these asset classes. For example, stocks are considered the riskiest of all three classes and an investment portfolio with a higher percentage of stocks will have more volatile returns. On the other hand, bonds are considered safe instruments. Therefore, a portfolio with a higher percentage of bonds in it should have fewer price swings and more predictable returns. Cash is the most liquid of all investments and is used for emergency situations. By balancing the composition of these asset classes, an investor can minimize risk and maximize the upside of these investments. There is no magic formula to determine optimal numbers for asset allocation. Fund managers and investors have long adhered to the 60/40 rule, first popularized by Jack Bogle–inventor of the exchange-traded fund–in the 1970s. In this rule, 60 percent of money is allocated towards stocks and 40 percent towards bonds. But the 60/40 rule has fallen out of favor with fund managers in recent years due to a variety of factors. For example, bond markets have become more volatile even as a number of alternative assets, such as cryptocurrencies and hedge funds, have increased the number of speculative instruments to multiple returns. There is a wealth of research and literature that discusses the correlation between age and asset allocation. The crux of this discussion is that investing choices change with age. As one gets older, there is a marked tilt towards stability—less risk and more income. The earlier you begin investing, the more risk you are allowed. After a certain age threshold, say 50 years, the exposure to risk should be minimized. Safe assets, like bonds, should become a greater part of your investing portfolio. Several providers in the market utilize the age-based approach to design their products. For example, target-date funds work backwards from a future retirement date to construct an investing portfolio. They use traditional portfolio management techniques and may begin by investing heavily in stocks and, as the target date approaches, rebalance the portfolio composition to emphasize returns from bonds. While the age-based approach is a good roadmap to plan for retirement, it is not the only one. Each individual’s risk tolerance and priorities are unique and based on his or her circumstances in life. Consider the case of an investor who begins investing in his 20s and loads up on risk through his 30s. A crash in the stock market in his 40s wipes out a considerable portion of his portfolio. Answers to these questions lead us to another factor that influences asset allocation, namely risk tolerance. The amount of risk that you can tolerate can be completely independent of age and be a function of your circumstances in life. Research has found that returns and risk tolerance are determinants for asset allocation for most fund managers. Returns determine the amount of money that you will generate from your investment, while your risk tolerance ensures that you remain solvent despite adverse market movements. Two common asset allocation strategies are: This type of asset allocation was popularized by the Modern Portfolio Theory developed by Harry Markovitz. Stock markets and bonds do not always move in tandem. A strategy of diversification relies on taking advantage of the difference in returns and price movements in asset classes. Investors can use the absence of correlation at certain times between these two asset classes to rebalance their portfolios constantly. The same approach can be utilized for asset classes that have an inverse correlation with the broader markets i.e., they move in the opposite direction, to minimize risk during a downturn. The growing popularity of index funds in the last two decades has made diversification less effective. According to available research, index funds, which are less diversified and tend to have several good and bad holdings in their portfolio at the same time, outperform diversified active funds. In response, investment firms are fashioning new ways to divvy up assets. Investment firm Merrill Lynch unveiled a bucket-based approach in 2013. The bucket-based approach emphasized a goal-based approach to investment advice. The firm’s CEO told investors to separate their asset allocation into three categories: The proportion of speculative assets and risk tolerance in buckets increased from personal to aspirational. In a static asset allocation, the investor decides on a financial goal, researches asset classes, and allocates funds to different asset types. The horizon for this type of asset allocation is long-term and changes, if any, to the portfolio are made infrequently. In contrast, changes to a portfolio that uses a dynamic asset allocation strategy are frequent. Such portfolios may be rebalanced on a daily, weekly, or monthly basis depending on the state of markets. The financial goal may become a moving target, considering the changes. Research has proved that dynamic asset allocations are superior to their static counterparts because they allow for more flexibility. This flexibility allows managers and investors to rebalance and minimize losses in response to market downturns.

Basics of Asset Allocation

Three Basic Asset Classes

The 60/40 Rule

Factors That Affect Asset Allocation

Age

Risk Tolerance

Asset Allocation Strategies

Diversification

Index Funds

Bucket-Based Approach

Static and Dynamic Asset Allocation

Asset Allocation FAQs

Asset allocation refers to the distribution of different types of asset classes across an investment portfolio. The overarching goal of asset allocation is to multiply returns. The pace and nature of those returns changes with age and risk tolerance.

Assets are generally allocated between three asset classes: stocks, bonds, and cash. In recent times, it has expanded to include other types and forms of assets, such as options, real estate, gold, and cryptocurrencies.

There is a wealth of research and literature that discusses the correlation between age and asset allocation. The crux of this discussion is that investing choices change with age. As one gets older, there is a marked tilt towards less risk and more income.

Fund managers and investors have long adhered to the 60/40 rule, first popularized by Jack Bogle–inventor of the exchange-traded fund–in the 1970s. In this rule, 60 percent of money is allocated towards stocks and 40 percent towards bonds.

Investment firm Merrill Lynch unveiled a bucket-based approach in 2013. The bucket-based approach emphasized a goal-based approach to investment advice. The firm’s CEO told investors to separate their asset allocation into three categories: personal risk, market risk, and aspirational. The proportion of speculative assets and risk tolerance in buckets increased from personal to aspirational.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.