A Real Estate Exchange-Traded Fund (ETF) is a type of exchange-traded fund that invests in companies that own, manage, or finance real estate properties. Real estate ETFs can invest in a variety of real estate companies, including REITs, real estate development companies, and homebuilding companies. Real estate ETFs can provide investors with a diversified portfolio of real estate investments with the convenience of buying and selling shares on an exchange. The purpose of real estate ETFs is to provide investors with a convenient way to invest in the real estate market. Real estate ETFs offer the potential for capital appreciation and income, similar to individual real estate investments, but with lower risks and greater diversification. Real estate ETFs also offer the benefits of liquidity, low costs, and transparency. Real estate is a crucial component of many investors' portfolios because it has historically provided attractive returns and low correlations with other asset classes such as stocks and bonds. Real estate ETFs allow investors to gain exposure to the real estate market with less risk and greater diversification than individual real estate investments. Real estate ETFs can also be an efficient way to gain exposure to specific real estate sectors, such as residential or commercial real estate, or geographic regions. Real estate ETFs can be classified into three main types: equity real estate ETFs, mortgage real estate ETFs, and hybrid real estate ETFs. Equity real estate ETFs invest in companies that own and manage real estate properties, such as REITs and real estate development companies. These companies generate revenue from renting, leasing, or selling their properties. Equity real estate ETFs can provide investors with exposure to the real estate market and the potential for capital appreciation and income. Mortgage real estate ETFs invest in companies that invest in mortgage or mortgage-backed securities. These companies generate revenue from the interest and principal payments on the mortgages they hold. Mortgage real estate ETFs can provide investors with exposure to the real estate market and the potential for income. Hybrid real estate ETFs invest in a combination of equity and mortgage real estate investment trusts. These ETFs can provide investors with exposure to both the equity and debt sides of the real estate market. Real estate ETFs offer several advantages over individual real estate investments, including diversification, lower costs, liquidity, and transparency. Real estate ETFs invest in a portfolio of real estate companies, providing investors with diversification across different real estate sectors and geographic regions. This can help reduce the risk of investing in a single real estate company or property. Real estate ETFs generally have lower fees and expenses than individual real estate investments. This is because ETFs invest in a portfolio of securities, which can be traded more efficiently than individual properties. ETFs also benefit from economies of scale, which can reduce trading costs. Real estate ETFs are traded on stock exchanges like other exchange-traded funds, making them highly liquid. This means that investors can easily buy and sell shares of real estate ETFs at any time during the trading day. This makes real estate ETFs a convenient way to invest in the real estate market without the challenges of buying and selling individual properties. Real estate ETFs are required to disclose their holdings on a regular basis, providing investors with transparency and visibility into the underlying securities in the portfolio. This can help investors make informed decisions about their investment choices. While real estate ETFs offer many advantages, they also come with risks that investors should be aware of. The main risks associated with real estate ETFs are market risks, interest rate risks, credit risks, and liquidity risks. Real estate ETFs are subject to market risks, such as economic downturns, changes in interest rates, and geopolitical events. These risks can cause real estate values to decline, resulting in losses for investors. Real estate values are sensitive to changes in interest rates, which can affect the cost of borrowing and the demand for real estate. When interest rates rise, the cost of borrowing increases, which can reduce the demand for real estate and lower real estate values. This can impact the performance of real estate ETFs that invest in real estate companies. Real estate companies that issue debt securities can be subject to credit risks, such as default or bankruptcy. If a real estate company defaults on its debt, it can negatively impact the performance of real estate ETFs that invest in the company. While real estate ETFs are highly liquid, the underlying securities in the portfolio may not be. This can create liquidity risks for investors if they need to sell their shares during a period of market stress or volatility. When choosing a real estate ETF, investors should consider several factors, including asset allocation, expense ratio, liquidity, performance history, and management team. Investors should consider the asset allocation of the real estate ETF, including the types of real estate companies and geographic regions included in the portfolio. This can help investors ensure that the ETF aligns with their investment goals and risk tolerance. Investors should also consider the expense ratio of the real estate ETF. Lower expense ratios can help increase the net returns for investors over time. Investors should ensure that the real estate ETF is highly liquid, with sufficient trading volume and tight bid-ask spreads. Investors should review the historical performance of the real estate ETF, including its returns and volatility, over different market conditions. Finally, investors should consider the management team of the real estate ETF. This includes the experience and track record of the portfolio managers, as well as the overall investment strategy and approach. Real estate ETFs have become a popular way for investors to gain exposure to the real estate market with less risk and greater diversification. Real estate ETFs offer several advantages, including diversification, lower costs, liquidity, and transparency. However, investors should also be aware of the risks associated with real estate ETFs, including market risks, interest rate risks, credit risks, and liquidity risks. When choosing a real estate ETF, investors should consider several factors, including asset allocation, expense ratio, liquidity, performance history, and management team. Overall, real estate ETFs can be a valuable addition to a diversified investment portfolio, providing investors with exposure to the real estate market and the potential for long-term returns.Definition of Real Estate ETFs

Types of Real Estate ETFs

Equity Real Estate ETFs

Mortgage Real Estate ETFs

Hybrid Real Estate ETFs

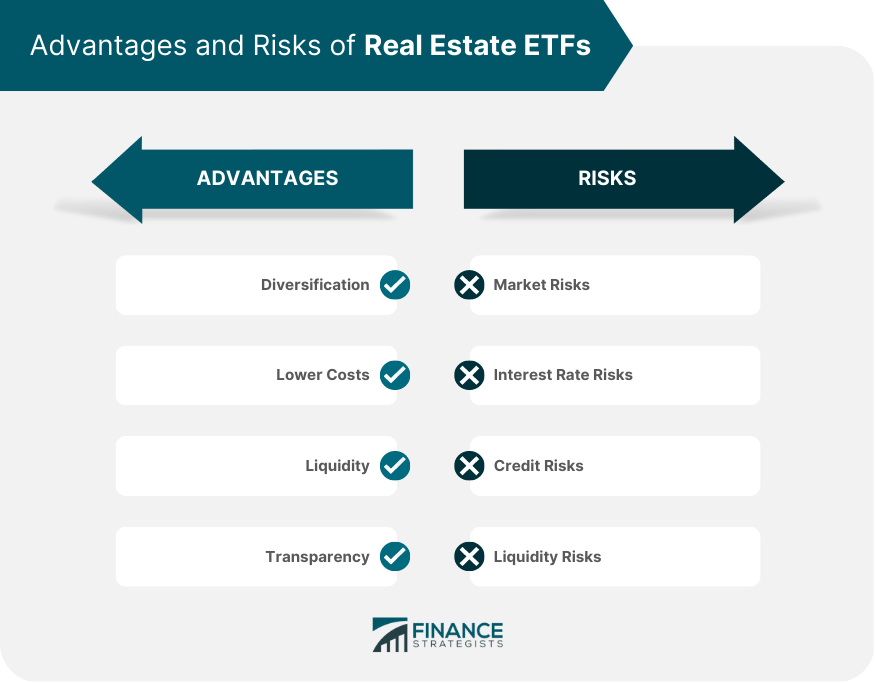

Advantages of Real Estate ETFs

Diversification

Lower Costs

Liquidity

Transparency

Risks of Real Estate ETFs

Market Risks

Interest Rate Risks

Credit Risks

Liquidity Risks

Factors to Consider When Choosing Real Estate ETFs

Asset Allocation

Expense Ratio

Liquidity

Performance History

Management Team

Conclusion

Real Estate ETFs FAQs

A Real Estate ETF is an exchange-traded fund that invests primarily in real estate-related assets such as property management firms, REITs, or real estate developers.

There are three main types of Real Estate ETFs: Equity REITs, Mortgage REITs, and Hybrid REITs.

Real Estate ETFs offer diversification, liquidity, and the potential for income through dividend payments. They also have lower expense ratios compared to traditional real estate investments.

Real Estate ETFs are subject to market volatility and can experience price fluctuations. They may also be affected by changes in interest rates or economic downturns.

Investors can buy Real Estate ETFs through a brokerage account, such as a traditional or online broker, and trade them like any other stock on an exchange. It's important to research and compare ETFs to find the best fit for your investment strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.