A PBC is legally required to pursue one or more social or environmental purposes in addition to generating profit for its shareholders. PBCs are businesses that prioritize a social mission alongside profits and are recognized by the government as being in the public interest. A PBC structure enables businesses to concentrate on generating profits while contributing to society's benefits. They are profit-making enterprises with a social objective that has been acknowledged by the government as being in the public's interest rather than solely driven by profit. A public benefit corporation is required to report to its shareholders every two years on how it is progressing towards its social objective and promoting the interests of stakeholders. Numerous startups have expressed enthusiasm for this framework since it allows businesses to focus on generating profits and contributes to the well-being of the community and individuals. PBCs are a recent development designed to address the issue of shareholder primacy in corporate decision-making. The PBC model allows companies to pursue societal or stakeholder interests alongside financial gain, explicitly rejecting the notion that profits should be the sole purpose of a corporation. B Lab, a private organization, played a crucial role in the establishment of benefit corporation statutes. They drafted a model statute and urged state legislatures to adopt it. Maryland became the first state to do so in 2010, and today, there are over 3,000 PBCs in the US. Although the precise scope and obligations of PBCs vary depending on the applicable statute, they all aim to create a new type of entity that can balance economic profit with social and environmental impact. The PBC business form is gaining momentum and has seen a doubling of the number of PBCs formed in the last year, with over 4,000 companies now using this model. This growth is a testament to the increasing demand for businesses to prioritize social and environmental concerns alongside financial goals. PBCs have also begun to attract significant investment from venture capital and other funds, demonstrating the growing acceptance of this model in the financial world. Lemonade made headlines by becoming 2020's best IPO debut with more than 140% gain. The purpose of a PBC is to enable companies to pursue social or environmental objectives alongside financial goals. PBCs are unique because they prioritize a public benefit purpose in addition to generating profits for shareholders. Here are some of the key purposes of a PBC: PBCs prioritize a public benefit purpose designed to have a positive social or environmental impact. This can include a wide range of objectives, such as reducing carbon emissions, promoting renewable energy, or increasing access to healthcare or education. The public benefit purpose is legally required to be a core part of the company's mission, and the company must report annually on its progress toward achieving this purpose. While PBCs prioritize social and environmental impact, they also aim to generate profits for shareholders. They must balance their social and environmental objectives with the financial interests of their shareholders. This can be challenging, but it is necessary for the company's long-term sustainability. PBCs are designed to consider the interests of all stakeholders, not just the shareholders. This includes employees, customers, suppliers, and the communities in which the company operates. They are legally required to identify the stakeholders they seek to benefit from and explain how they will promote their interests. Public benefit corporations offer several benefits to both companies and society as a whole. Here are some of the key benefits of PBCs: PBCs are legally required to pursue one or more social or environmental purposes in addition to generating profits for shareholders. This legal recognition ensures that companies prioritize social and environmental goals alongside financial goals. PBCs can tap into a growing market of socially conscious consumers and investors who prioritize companies that prioritize social and environmental goals. This can lead to increased brand loyalty, market share, and customer acquisition. PBCs have legal protections that shield directors and officers from liability when pursuing the company's social or environmental goals, even if doing so may not maximize shareholder value. This can reduce regulatory and legal risks associated with pursuing social and environmental goals. PBCs are often seen as more socially responsible and environmentally conscious than traditional corporations, which can improve a company's reputation and brand image. This can lead to increased customer loyalty, employee engagement, and investor interest. By prioritizing social and environmental goals alongside financial goals, PBCs can encourage innovation and creativity in pursuing these goals. This can lead to new products, services, and business models that benefit society as a whole. PBCs can have a diverse ownership structure, including for-profit and non-profit investors. This can provide flexibility in raising capital and attracting investors who are aligned with the company's social and environmental goals. Overall, PBCs offer several benefits to companies seeking to balance financial goals with social and environmental objectives. As more companies adopt this model, it is likely that the trend toward socially responsible and environmentally conscious business practices will continue to grow. While public benefit corporations offer several benefits, some risks and challenges are associated with this business model. Here are some of the key risks and challenges of PBCs: PBCs are legally required to pursue a public benefit purpose in addition to generating profits for shareholders. However, there may be conflicts between the public benefit purpose and the financial interests of the shareholders. This can lead to tension and difficult decisions for directors and management. PBCs are required to adopt a third-party standard to measure their social and environmental performance, such as the B Impact Assessment developed by B Lab. However, a limited number of third-party standards are available, which can make it difficult for companies to find one that fits their specific needs. While PBCs must report on their social and environmental performance, it can be challenging to accurately measure and report on this impact. This can make it difficult for stakeholders to evaluate a company's performance and for PBCs to demonstrate their impact. While PBCs are gaining acceptance in the financial world, some investors may still be skeptical of this business model. This can make it difficult for PBCs to raise capital and attract investors. PBCs must comply with additional administrative and legal requirements, such as annual benefit reports, benefit director appointments, and third-party performance assessments. These additional requirements can increase administrative and legal costs for PBCs. PBCs are regulated at the state level, and the legal requirements and obligations of PBCs can vary by state. This lack of consistency in the legal framework can make it difficult for PBCs to operate across state lines. PBCs face several risks and challenges that companies must carefully consider before adopting this business model. While PBCs offer several benefits, companies must weigh these against the potential risks and challenges to determine if this model is the right fit for their specific needs and goals. Public benefit corporations are one of several business structures available to companies. Each structure has its own benefits and drawbacks, and companies must carefully consider which structure is best for their specific needs and goals. Here is a comparison of PBCs to some of the other commonly used business structures: Traditional corporations are the most common business structure, and they prioritize maximizing profits for shareholders above all else. While traditional corporations can pursue social or environmental objectives, these objectives are often seen as secondary to financial goals. In contrast, PBCs prioritize a public benefit purpose in addition to generating profits for shareholders. This legal requirement ensures that PBCs prioritize social and environmental objectives alongside financial goals. LLCs are flexible business structures that combine the liability protection of a corporation with the tax benefits of a partnership. Like traditional corporations, LLCs prioritize financial goals over social and environmental objectives. While LLCs can pursue social or environmental goals, they are not legally required to do so. In contrast, PBCs are legally required to prioritize a public benefit purpose alongside financial goals. B Corporations are similar to PBCs in that they are legally required to pursue a public benefit purpose alongside financial goals. However, B Corporations are not a separate business structure like PBCs. Instead, they are a certification that companies can obtain to demonstrate their commitment to social and environmental objectives. B Corporations can be structured as traditional corporations or LLCs but must meet certain social and environmental performance standards. Non-profit corporations are a type of corporation that is organized for charitable, educational, or religious purposes. Unlike PBCs, non-profit corporations cannot distribute profits to shareholders. Instead, any profits must be reinvested in the organization's mission. While non-profit corporations prioritize social and environmental objectives, they are not structured to generate profits for shareholders. PBCs offer a unique business structure that enables companies to prioritize social and environmental objectives alongside financial goals. While PBCs are not the only option available, they offer a legally recognized framework that ensures companies are committed to pursuing a public benefit purpose. A public benefit corporation is a relatively new business structure designed to address the issue of shareholder primacy in corporate decision-making. PBCs prioritize a public benefit purpose in addition to generating profits for shareholders and are legally required to pursue one or more social or environmental purposes. They offer several benefits, such as legal recognition of social and environmental purposes, access to a growing market of socially conscious consumers and investors, and improved reputation and brand image. However, they also face several risks and challenges, such as potential conflicts between public benefit purpose and shareholder interests, limited availability of third-party standards, and difficulty in measuring and reporting social and environmental impact. PBCs are one of several business structures available to companies, and each structure has its own benefits and drawbacks. As the trend towards socially responsible and environmentally conscious business practices continues to grow, seeking the guidance of a financial advisor may help companies make informed decisions about adopting a PBC or other business structure.What Is a Public Benefit Corporation (PBC)?

Background of Public Benefit Corporation (PBC)

Purpose of Public Benefit Corporation (PBC)

Social and Environmental Impact

Shareholder Value

Stakeholder Interests

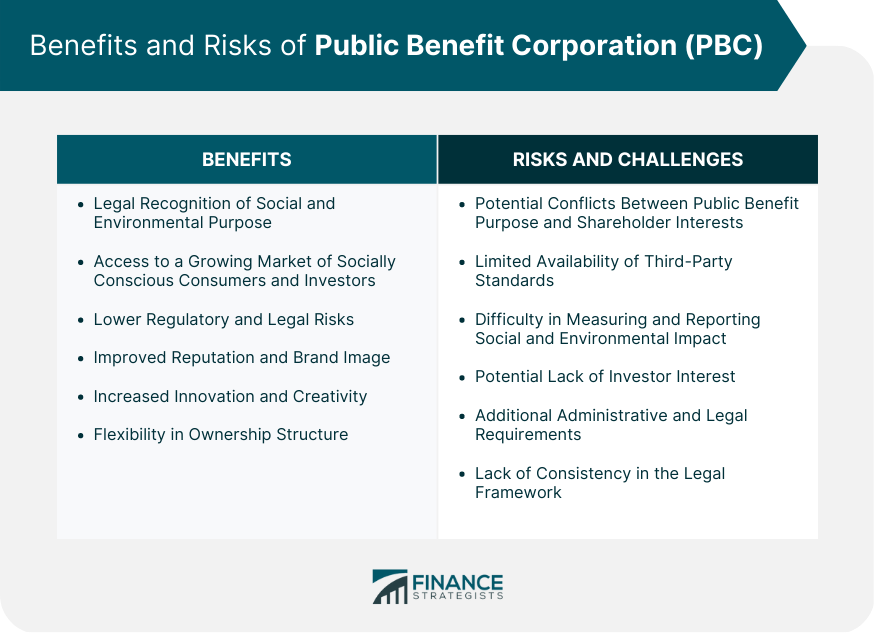

Benefits of Public Benefit Corporation (PBC)

Legal Recognition of Social and Environmental Purpose

Access to a Growing Market of Socially Conscious Consumers and Investors

Lower Regulatory and Legal Risks

Improved Reputation and Brand Image

Increased Innovation and Creativity

Flexibility in Ownership Structure

Risks and Challenges of Public Benefit Corporation (PBC)

Potential Conflicts Between Public Benefit Purpose and Shareholder Interests

Limited Availability of Third-Party Standards

Difficulty in Measuring and Reporting Social and Environmental Impact

Potential Lack of Investor Interest

Additional Administrative and Legal Requirements

Lack of Consistency in the Legal Framework

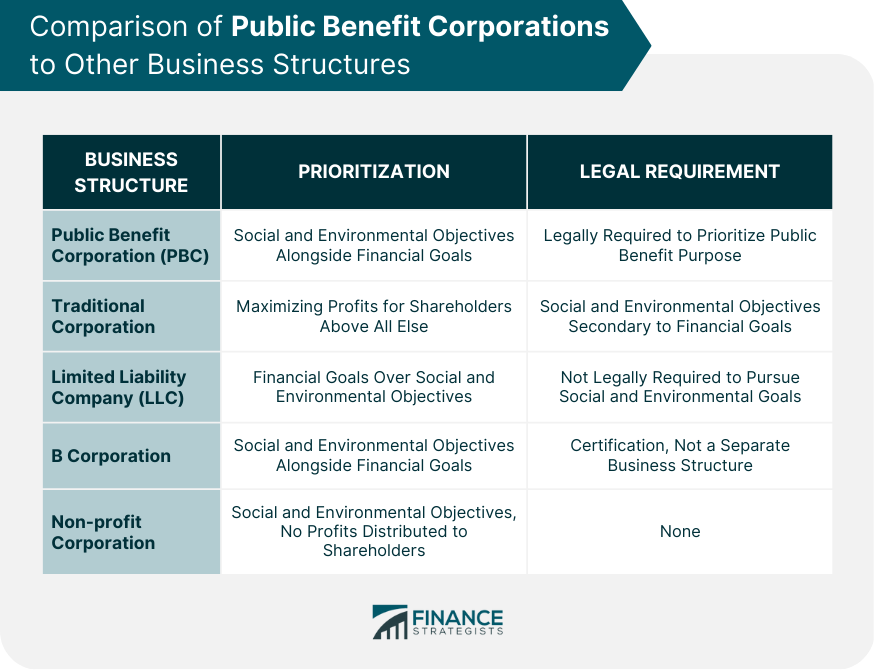

Comparison of Public Benefit Corporations to Other Business Structures

Traditional Corporation

Limited Liability Company (LLC)

B Corporation

Non-profit Corporation

Final Thoughts

Public Benefit Corporation (PBC) FAQs

A PBC is a type of for-profit business that is legally required to pursue one or more social or environmental purposes and generate profits for its shareholders.

The purpose of a PBC is to enable companies to prioritize social and environmental objectives alongside financial goals. PBCs are unique because they prioritize a public benefit purpose in addition to generating profits for shareholders.

Some benefits of forming a PBC include legal recognition of social and environmental purpose, access to a growing market of socially conscious consumers and investors, lower regulatory and legal risks, improved reputation and brand image, and increased innovation and creativity.

Some risks and challenges of forming a PBC include potential conflicts between public benefit purpose and shareholder interests, limited availability of third-party standards, difficulty in measuring and reporting social and environmental impact, potential lack of investor interest, additional administrative and legal requirements, and lack of consistency in the legal framework.

PBCs are one of several business structures available to companies. Each structure has its own benefits and drawbacks, and companies must carefully consider which structure is best for their specific needs and goals. Compared to traditional corporations, LLCs, B Corporations, and non-profit corporations, PBCs offer a unique legal framework that ensures companies are committed to pursuing a public benefit purpose alongside financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.