Personal Rate of Return (PRR) is a measure of an individual investor's investment performance, expressed as a percentage. It reflects the return on an investment portfolio over a specified period, accounting for factors such as contributions, withdrawals, and investment gains or losses. Calculating PRR is crucial for investors to evaluate their investment performance, make informed decisions, and optimize their portfolios based on their financial goals and risk tolerance. PRR is influenced by various factors, including investment performance, risk tolerance, asset allocation, investment horizon, and fees and expenses. TWR is a method used to calculate PRR that measures the performance of an investment portfolio while eliminating the impact of cash flows, such as deposits and withdrawals. This method is useful for comparing investment performance against benchmarks or other investors. IRR is another method used to calculate PRR, which accounts for the timing and magnitude of cash flows. IRR is more suitable for investors who make frequent contributions or withdrawals, as it provides a more accurate reflection of their individual investment performance. The main difference between TWR and IRR lies in their treatment of cash flows. While TWR eliminates the impact of cash flows, IRR accounts for them, making it a more personalized measure of investment performance. Investors should choose the method that best aligns with their investment habits and goals. TWR is suitable for comparing investment performance, while IRR is more appropriate for evaluating personal investment decisions and strategies. The investment performance is one of the primary factors that can influence the PRR. It represents the gain or loss of an investment over a specific period, which is typically measured in terms of percentage returns. An investor can achieve a positive PRR if the investment's returns are higher than the initial investment amount. Risk tolerance is the level of risk that an investor is willing to take when making investment decisions. Investors who are comfortable with higher levels of risk may be more likely to invest in stocks or other high-risk assets, which can potentially lead to higher returns. On the other hand, investors who prefer lower risk may invest in more conservative assets, such as bonds or cash, which may result in lower returns but also offer a more stable investment. Asset allocation refers to the way that an investor distributes their portfolio across different asset classes, such as stocks, bonds, and cash. A well-diversified portfolio that includes a mix of asset classes can help mitigate risk and potentially lead to more consistent returns. However, if an investor has too much money invested in one particular asset class and that asset class experiences a downturn, it could negatively impact the investor's PRR. The investment horizon refers to the length of time that an investor intends to hold an investment. Typically, a longer investment horizon allows for more potential growth and can help offset any short-term market volatility. For instance, an investor who is saving for retirement and has a longer time horizon may be able to tolerate more market risk and volatility in pursuit of potentially higher returns. Fees and expenses associated with investing can significantly impact an investor's PRR. These costs can include management fees, transaction fees, and other expenses associated with buying, selling, and managing investments. Over time, these fees can add up and eat into an investor's returns, potentially lowering their PRR. Therefore, it is important to choose investment options with lower fees and expenses when possible. Diversifying investments across different asset classes, such as stocks, bonds, and real estate, can help reduce risk and increase potential returns. This strategy ensures that a single bad investment doesn't negatively affect the overall portfolio. Regularly reviewing and rebalancing the investment portfolio can help maintain the desired asset allocation and risk level. This process involves selling some of the overperforming assets and investing the proceeds into underperforming assets. High fees and expenses can significantly eat into investment returns. To improve personal rate of return, it is essential to compare and choose investment options with lower fees and expenses. Personal rate of return can be improved by adjusting the investment portfolio's risk level and investment horizon. Higher risk investments can provide higher returns, but they come with higher volatility and risk of loss. The investment horizon also plays a crucial role in determining personal rate of return, as long-term investments may provide better returns than short-term investments. Personal rate of return allows investors to assess the performance of their investment portfolio over a specific period. By tracking personal rate of return, investors can determine whether their investments are generating returns in line with their expectations and goals. Personal rate of return analysis can highlight areas of the portfolio that are underperforming. This can help investors make necessary adjustments to improve their investment returns. Personal rate of return analysis provides investors with the information they need to make informed investment decisions. For example, if a particular investment has consistently generated low returns, an investor may decide to sell that investment and seek out alternative options. By tracking personal rate of return, investors can evaluate the effectiveness of the financial advice they receive. If an investor's personal rate of return is consistently below average, it may be an indication that the financial advice they are receiving is not effective. PRR only reflects the return on an individual's investments and does not consider external factors such as changes in the market, inflation, or economic conditions. Comparing PRR with a relevant benchmark can be challenging, as the benchmark may not accurately reflect the individual's investment goals, risk tolerance, or asset allocation. Taxes can have a significant impact on an individual's investment returns, but calculating the tax implications of investments can be complex and may vary depending on the individual's tax situation.. PRR can be challenging to calculate for complex investments such as alternative investments, real estate, and private equity, which may have unique valuation methods and reporting requirements. Understanding and tracking PRR is essential for investors looking to optimize their investment performance and make informed decisions that align with their financial goals and risk tolerance. Regularly monitoring PRR can help investors identify areas for improvement, evaluate the effectiveness of their investment strategies, and adjust their portfolios as needed. By utilizing PRR as a tool for evaluating and adjusting their investment strategies, investors can improve their financial well-being and work towards achieving their financial goals.What Is Personal Rate of Return?

How to Calculate Personal Rate of Return

Time-Weighted Return (TWR)

Internal Rate of Return (IRR)

Differences Between TWR and IRR

Choosing the Appropriate Method for Calculating PRR

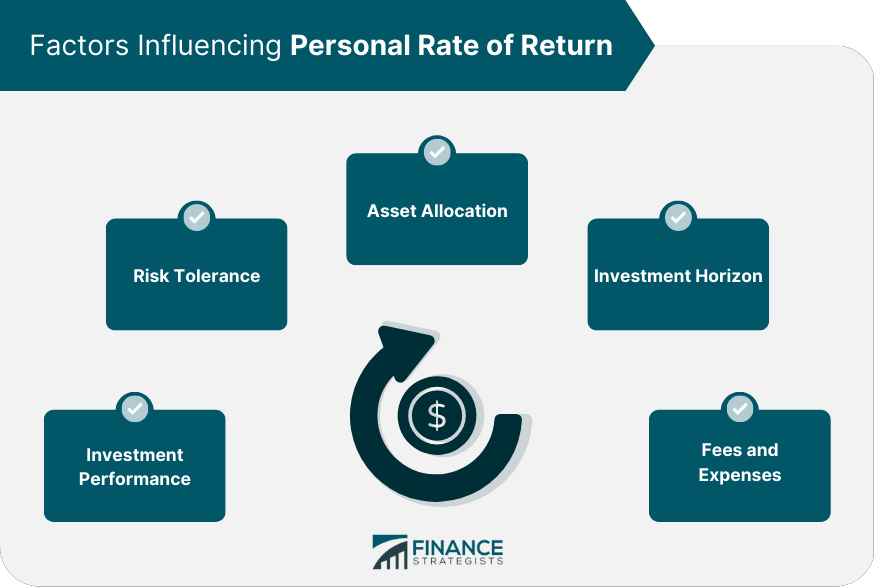

Factors Influencing Personal Rate of Return

Investment Performance

Risk Tolerance

Asset Allocation

Investment Horizon

Fees and Expenses

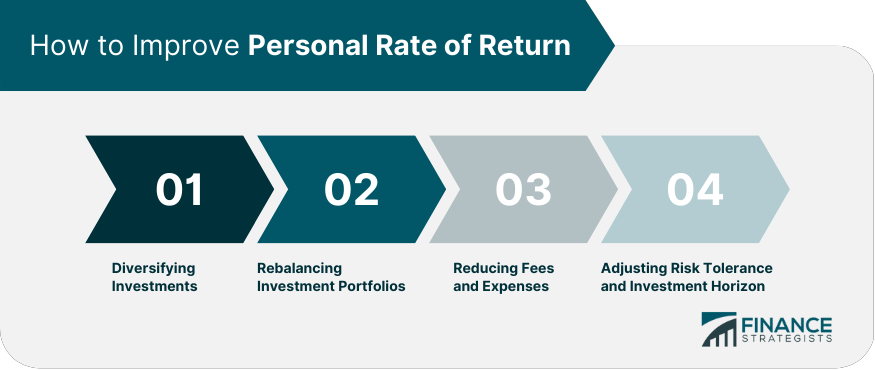

How to Improve Personal Rate of Return

Diversifying Investments

Rebalancing Investment Portfolios

Reducing Fees and Expenses

Adjusting Risk Tolerance and Investment Horizon

Benefits of Tracking Personal Rate of Return

Evaluating Investment Performance

Identifying Areas for Improvement

Making Informed Investment Decisions

Assessing the Effectiveness of Financial Advice

Limitations and Challenges of Personal Rate of Return

Not Accounting for External Factors

Comparing PRR With Benchmarks

The Impact of Taxes on PRR

Difficulty in Calculating PRR for Complex Investments

Conclusion

Personal Rate of Return FAQs

A personal rate of return in insurance refers to the percentage of investment earnings or losses that a policyholder experiences over a specific period, usually a year. This metric is used to measure the performance of an insurance policy's investments.

To calculate personal rate of return in insurance, you need to subtract the policy's initial investment balance from its ending balance, add any additional deposits or withdrawals, and then divide the result by the initial investment balance. The result is expressed as a percentage.

Several factors can affect your personal rate of return in insurance, including the performance of the policy's underlying investments, any fees or charges deducted from your account, and the length of time you have held the policy.

Yes, you can improve your personal rate of return in insurance by choosing policies with low fees and charges, investing in a diversified portfolio of investments, and holding your policy for a long period of time.

Reviewing your personal rate of return in insurance can help you determine whether your policy's investments are performing well and whether you need to make any adjustments to your investment strategy. It can also help you identify any fees or charges that may be eating into your investment returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.