Target-risk funds are a type of mutual fund or exchange-traded fund (ETF) that invests in a diversified portfolio of assets with a specific risk profile. The fund's objective is to maintain a specific level of risk while providing returns consistent with that risk level. Target-risk funds are designed for investors who have a particular level of risk tolerance and want a diversified portfolio that aligns with their investment goals. Target-risk funds work by allocating the portfolio across various asset classes based on the investor's chosen level of risk. The asset classes could include stocks, bonds, real estate, commodities, and alternative investments. The fund manager will then adjust the asset allocation periodically to maintain the target risk level. For example, if the stock market is performing well, the fund manager may reduce the allocation to stocks and increase the allocation to bonds to maintain the target risk level. There are numerous target-risk funds available in the market today, with different risk profiles and investment objectives. One of the most popular target-risk funds is the Vanguard Target Retirement Funds, which are designed for investors who want a diversified portfolio based on their expected retirement date. Another example is the iShares Core Aggressive Allocation ETF, which is designed for investors who want a portfolio with a higher risk profile. Target-risk funds can be divided into three main types based on their risk profile: conservative, moderate, and aggressive. Conservative target-risk funds are designed for investors who have a low-risk tolerance and want to protect their capital. These funds typically have a higher allocation to bonds and cash and a lower allocation to stocks and other higher-risk assets. Conservative target-risk funds are suitable for investors who are close to retirement or need their capital for a specific goal. Moderate target-risk funds are designed for investors who have a moderate risk tolerance and want a balanced portfolio of stocks and bonds. These funds typically have an equal allocation to stocks and bonds and a smaller allocation to other asset classes. Moderate target-risk funds are suitable for investors who have a long-term investment horizon and want a balanced portfolio that can provide steady returns. Aggressive target-risk funds are designed for investors who have a high-risk tolerance and want to maximize their returns. These funds typically have a higher allocation to stocks and other higher-risk assets and a lower allocation to bonds and cash. Aggressive target-risk funds are suitable for investors who have a long-term investment horizon and are willing to take on higher risks to achieve higher returns. There are different benefits to investing in Target-Risk Funds. Target-risk funds provide investors with a diversified portfolio that can reduce the overall risk of their investment. By investing in different asset classes, investors can spread their risk and reduce their exposure to any single asset class. Target-risk funds automatically rebalance the portfolio to maintain the target risk level. This means that the fund manager will adjust the asset allocation periodically to ensure that the portfolio aligns with the investor's chosen level of risk. Target-risk funds are managed by experienced professionals who have the expertise and resources to allocate the portfolio across different asset classes to achieve the desired level of risk. Investing in Target-Risk Funds also comes with several drawbacks. Target-risk funds have a predetermined asset allocation that cannot be customized. This means that investors cannot choose specific assets or asset classes that they want to include or exclude from the portfolio. The fund manager has full control over the asset allocation, which can limit an investor's flexibility. Target-risk funds can have higher fees compared to other types of mutual funds or ETFs. The fees can include management fees, operating expenses, and transaction fees, which can reduce the overall returns of the investment. While target-risk funds aim to maintain a specific level of risk, there is no guarantee that the investment will achieve the desired returns. Market conditions can impact the performance of the portfolio, and investors may experience losses or lower returns than expected. Below are several strategies to maximize investments made in target-risk funds. Before investing in target-risk funds, it's essential to understand your risk tolerance. This means evaluating your financial situation, investment goals, and personal preferences to determine the appropriate level of risk for your investment. There are various target-risk funds available in the market with different investment objectives and risk profiles. It's crucial to research and compare the funds to find the one that aligns with your investment goals and risk tolerance. While target-risk funds are designed to maintain a specific level of risk, it's still essential to monitor the portfolio periodically to ensure that it aligns with your investment goals and risk tolerance. Target-risk funds can be an effective way for investors to achieve a diversified portfolio that aligns with their risk tolerance. These funds provide benefits such as diversification, automatic rebalancing, and professional management. However, they also have drawbacks such as limited flexibility, high fees, and no guarantees. It's essential to understand your risk tolerance, choose the right fund, and monitor your portfolio to ensure that it aligns with your investment goals. With careful consideration and research, target-risk funds can be an effective tool for achieving long-term investment goals.Definition of Target-Risk Funds

Types of Target-Risk Funds

Conservative Target-Risk Funds

Moderate Target-Risk Funds

Aggressive Target-Risk Funds

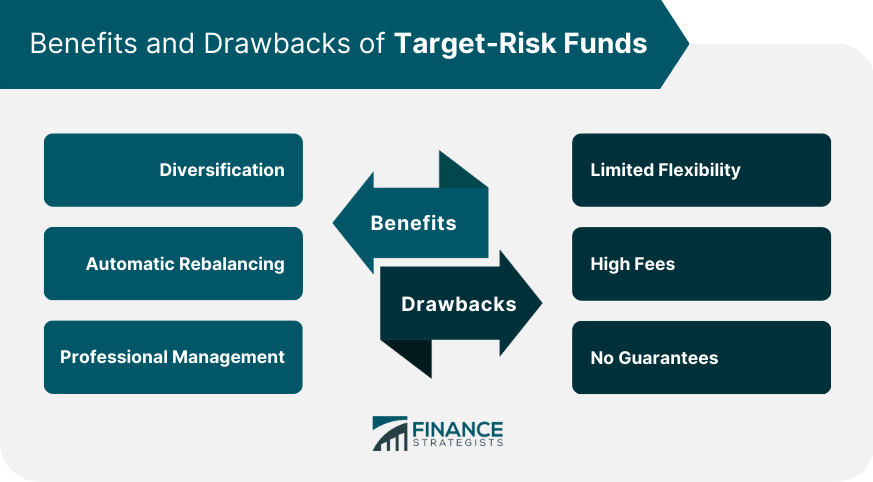

Benefits of Target-Risk Funds

Diversification

Automatic Rebalancing

Professional Management

Drawbacks of Target-Risk Funds

Limited Flexibility

High Fees

No Guarantees

Strategies for Investing in Target-Risk Funds

Understanding Your Risk Tolerance

Choosing the Right Fund

Monitoring Your Portfolio

If your investment goals or risk tolerance changes, you may need to adjust your portfolio accordingly.Final Thoughts

Target-Risk Fund FAQs

A target-risk fund is a type of mutual fund that is designed to achieve a specific level of risk. The fund's investment strategy is based on the investor's risk tolerance and the fund's objective.

There are three types of target-risk funds: conservative, moderate, and aggressive. Conservative funds aim for lower returns with less risk, moderate funds offer a balance between risk and return, while aggressive funds aim for higher returns with more risk.

Target-risk funds provide investors with a diversified portfolio, professional management, and ease of investment. They also provide a clear investment objective, making it easier for investors to plan their investments.

Target-risk funds may have higher fees and expenses than other types of mutual funds. Investors may also be limited in their investment choices and have less control over the fund's management.

A common strategy is to invest in a target-risk fund that aligns with your risk tolerance and investment objectives. Investors should regularly review their investments and make adjustments as needed to stay on track with their financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.