A stable value fund is a type of investment fund that is designed to provide investors with a stable and predictable return on their investment while minimizing risk. It is typically composed of fixed income securities such as bonds, mortgages, and other low-risk investments. The importance of stable value funds lies in their ability to offer investors a relatively safe and stable investment option, with little risk to their principal. This is particularly important for investors who are nearing retirement or who have a low tolerance for risk. Stable value funds also offer a predictable stream of income, which can be used to fund ongoing expenses or to reinvest in other investments. The primary characteristic of a stable value fund is that it is composed of fixed income investments such as bonds, mortgage, and other low-risk securities. These investments are chosen for their ability to provide a steady and predictable stream of income, with little risk of loss to principal. Another characteristic of stable value funds is that they are designed to have low volatility. This means that the value of the fund does not fluctuate significantly, even in times of market turbulence or economic uncertainty. Finally, stable value funds are designed to preserve capital. This means that they are focused on protecting the principal investment and minimizing the risk of loss. This is achieved through a combination of low-risk investments and other strategies designed to minimize risk. The primary benefit of stable value funds is that they are designed to preserve capital. This means that investors can feel confident that their principal investment will be protected, even in times of market turbulence or economic uncertainty. Another benefit of stable value funds is that they offer stable returns. This means that investors can expect a predictable stream of income from their investment, which can be used to fund ongoing expenses or to reinvest in other investments. Finally, stable value funds are considered to be a low-risk investment option. This is because they are designed to minimize risk to the principal investment, while still offering a reasonable rate of return. One of the main drawbacks of stable value funds is their limited upside potential. Stable value funds are composed primarily of fixed income investments, such as bonds and money market securities. While these types of investments are generally considered to be relatively safe, they also tend to have lower returns than other types of investments, such as stocks. This means that investors who invest primarily in stable value funds may miss out on potential gains that could be realized by investing in other types of investments with higher returns. Another potential drawback of stable value funds is the possibility of credit risk. Stable value funds typically invest in bonds and other fixed income securities that are considered to be relatively safe. However, there is still a risk that the issuer of these securities may default on their debt obligations, which could result in a loss of principal for the investor. Additionally, stable value funds may invest in securities that are rated lower than investment-grade, which can increase the risk of default. Finally, stable value funds may also have restrictions on withdrawals that can limit an investor's ability to access their funds. Many stable value funds have restrictions on how often investors can withdraw their money, and some may even require a waiting period before withdrawals are permitted. Additionally, some stable value funds may charge penalties or fees for early withdrawals, which can further limit an investor's ability to access their funds. One important factor to consider before investing in a stable value fund is the fees and expenses associated with the fund. These may include management fees, administrative fees, and other costs. It is important to understand these costs and how they may impact the overall return on investment. Another important factor to consider is the investor's overall investment objectives. Finally, it is important to consider the credit risk associated with stable value funds. While these funds are designed to minimize risk to the principal investment, there is still some risk involved, particularly if the investments are not properly diversified or if the credit quality of the underlying investments deteriorates. It is important to carefully research the credit quality of the investments within the fund and to consider the potential impact of credit risk on the overall return on investment. Stable value funds are a type of investment fund that are designed to provide investors with a relatively safe and predictable investment option. They are composed of fixed income investments, have low volatility, and are focused on preserving capital. While stable value funds offer many benefits, including capital preservation, stable returns, and low risk, they also have some drawbacks to consider. Investors should carefully consider their investment objectives, the fees and expenses associated with the fund, and the credit risk of the underlying investments before investing in a stable value fund. Overall, stable value funds can be a useful investment option for investors who are looking for a relatively safe and predictable investment option, particularly those who are nearing retirement or who have a low tolerance for risk.Definition of Stable Value Fund

Characteristics of Stable Value Fund

Fixed Income Investments

Low Volatility

Preservation of Capital

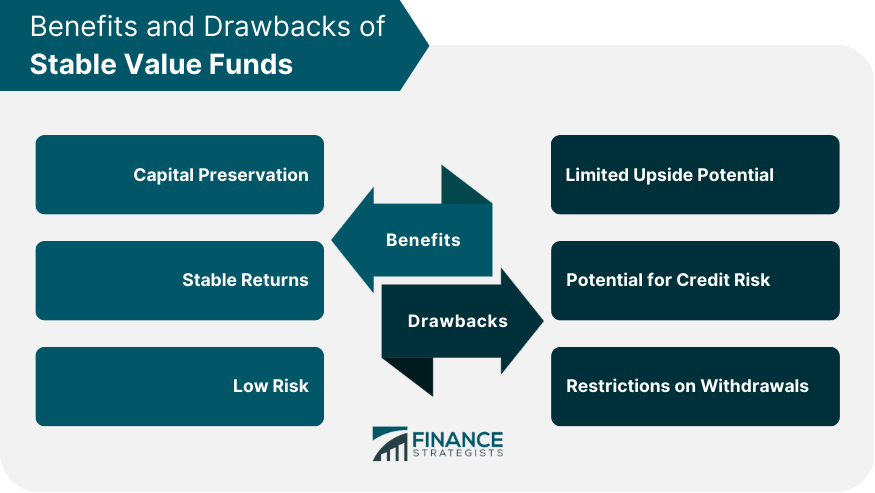

Benefits of Stable Value Fund

Capital Preservation

Stable Returns

Low Risk

Drawbacks of Stable Value Fund

Limited Upside Potential

Potential for Credit Risk

Restrictions on Withdrawals

Factors to Consider Before Investing in Stable Value Fund

Fees and Expenses

Investment Objectives

Stable value funds may be a good option for investors who are looking for a relatively safe and predictable investment option, but may not be suitable for investors who are looking for higher rates of return or who have a higher tolerance for risk.Credit Risk

Conclusion

Stable Value Fund FAQs

A Stable Value Fund is a low-risk investment vehicle that is designed to provide stable returns to investors while preserving capital.

A Stable Value Fund invests in a portfolio of high-quality, fixed-income securities that are selected to provide a stable return. The fund may also use insurance or other guarantees to further reduce risk.

Stable Value Funds offer low-risk investment options with stable returns, making them an attractive option for risk-averse investors looking for predictable income. They also offer diversification benefits and can help to protect against inflation.

Stable Value Funds typically have lower returns compared to other investments like stocks or high-yield bonds. Additionally, they may have restrictions on when investors can withdraw their money.

Stable Value Funds are ideal for investors who want to preserve capital while generating predictable returns. They may be a good fit for retirees, those nearing retirement, or investors who are risk-averse and want to limit their exposure to market volatility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.