Real return is the profit or loss on an investment after accounting for inflation. It represents the actual purchasing power gained or lost over time as a result of investing. In this article, we will discuss the importance of understanding real return for investors and how it affects investment decision-making. Understanding real return is crucial for investors as it provides a more accurate picture of an investment's performance. It helps investors evaluate the true worth of their investments, considering the erosion of purchasing power due to inflation. By considering real return, investors can make better-informed decisions and create investment strategies that protect their wealth from inflation. Nominal return refers to the percentage increase or decrease in the value of an investment without considering inflation. It is the most straightforward way to measure investment performance but may not accurately represent the actual gains or losses experienced by the investor. To understand the true value of an investment, it is essential to consider the impact of inflation on the nominal return. Inflation is the rate at which the general level of prices for goods and services increases over time, eroding purchasing power. When calculating real return, it is crucial to account for the impact of inflation on investment returns. Inflation can significantly affect the true value of an investment, making it essential to factor it into any performance analysis. The real return formula is used to calculate the actual return on an investment after accounting for inflation. It is calculated as follows: By using this formula, investors can determine the true performance of their investments, considering the impact of inflation. The inflation rate is the primary factor affecting real return. High inflation can erode the purchasing power of investment returns, making it essential to consider when evaluating an investment's performance. Investors should monitor inflation trends and incorporate them into their investment decisions to ensure their portfolios maintain their real value over time. Taxes can also impact real return, as they may reduce the actual amount of return an investor receives. Different investments are subject to varying tax rates, which should be considered when evaluating the real return of an investment. By considering the tax implications of their investments, investors can optimize their after-tax real return and better protect their wealth. Fees associated with investing, such as management fees, trading fees, and advisory fees, can reduce the real return of an investment. Investors should carefully consider the fees associated with their investments and select low-cost options where possible to maximize their real return. Understanding and minimizing investment fees can help investors achieve better overall performance and protect their purchasing power. Market volatility can influence real return, as fluctuations in the market can impact investment performance. While market volatility cannot be controlled, investors can manage their exposure to risk by diversifying their portfolios and adjusting their investment strategies based on their risk tolerance and investment horizon. By managing risk and understanding the impact of market volatility on real return, investors can make better-informed decisions and protect their wealth. Calculating real return provides a more accurate understanding of investment performance by accounting for the impact of inflation. This allows investors to better evaluate the true value of their investments and make more informed decisions. Considering real return ensures that investors are not misled by nominal returns, which may overstate the actual gains or losses experienced by the investor. Real return is essential for effective financial planning, as it helps investors align their investment strategies with their financial goals. By considering the impact of inflation on investment returns, investors can create portfolios that protect their purchasing power and achieve their long-term objectives. Incorporating real return into financial planning enables investors to create more realistic and attainable financial goals, ultimately leading to better overall financial outcomes. Focusing on real return helps investors protect their wealth against the eroding effects of inflation. By seeking investments that offer positive real returns, investors can maintain their purchasing power and grow their wealth over time. Understanding and prioritizing real return ensures that investors can maintain their standard of living and meet their financial goals, even in the face of inflation. Calculating real return can be more complex than calculating nominal return, as it requires incorporating inflation data. This may deter some investors from using real return as a performance metric. However, the added complexity is necessary for obtaining a more accurate understanding of an investment's performance and should not be overlooked. The future inflation rate is uncertain, making it challenging to accurately predict the real return of an investment. This uncertainty can make it difficult for investors to assess the true value of their investments and make informed decisions. Despite this challenge, it is crucial to consider the potential impact of inflation when evaluating investment performance and making investment decisions. Market volatility can significantly impact real return, making it difficult for investors to accurately assess their investments' performance. While investors cannot control market volatility, they can manage their exposure to risk and create diversified portfolios to mitigate its impact. Understanding the potential impact of market volatility on real return is essential for making informed investment decisions and managing risk effectively. The primary difference between real return and nominal return is the consideration of inflation. Nominal return represents the percentage increase or decrease in an investment's value without considering inflation, while real return accounts for the impact of inflation on investment returns. Understanding the distinction between real and nominal return is crucial for accurately assessing an investment's performance and making informed investment decisions. Inflation can significantly erode the purchasing power of investment returns, making it essential to consider when evaluating an investment's performance. By accounting for inflation, real return provides a more accurate representation of an investment's true value and helps investors make better-informed decisions. Focusing on real return ensures that investors protect their wealth from the eroding effects of inflation and achieve their financial goals. Stocks are a common investment that can provide real returns by generating capital gains and dividend income. While stock prices can fluctuate due to market volatility, they have historically outpaced inflation over the long term, making them an attractive option for investors seeking real returns. Understanding the real return of stocks is essential for evaluating their performance and making informed investment decisions. Bonds can also generate real returns, primarily through interest income. However, the real return on bonds can be influenced by factors such as interest rate changes and credit risk. Investors should consider these factors when evaluating the real return potential of bonds in their portfolios. Considering the real return of bonds helps investors assess their true performance and manage their investment risk effectively. Real estate is another investment option that can provide real returns through appreciation and rental income. Like stocks and bonds, the real return on real estate investments can be influenced by various factors, such as market conditions, location, and property management. Evaluating the real return potential of real estate investments is crucial for making informed decisions and creating a well-diversified portfolio that protects against inflation. Real return is a vital metric for investors, as it provides a more accurate understanding of an investment's performance by accounting for inflation. Factors such as inflation rate, taxes, investment fees, and market volatility can impact real return, making it essential to consider when making investment decisions. By understanding the advantages and disadvantages of real return and comparing it to nominal return, investors can make better-informed decisions and protect their wealth from inflation. Monitoring real return is crucial for effective financial planning and ensuring that investment strategies align with financial goals. Regularly evaluating real return helps investors maintain their purchasing power, grow their wealth, and achieve their long-term objectives. By incorporating real return into their investment decision-making process, investors can optimize their overall performance and protect their wealth from the eroding effects of inflation.Definition of Real Return

Calculating Real Return

Nominal Return

Inflation

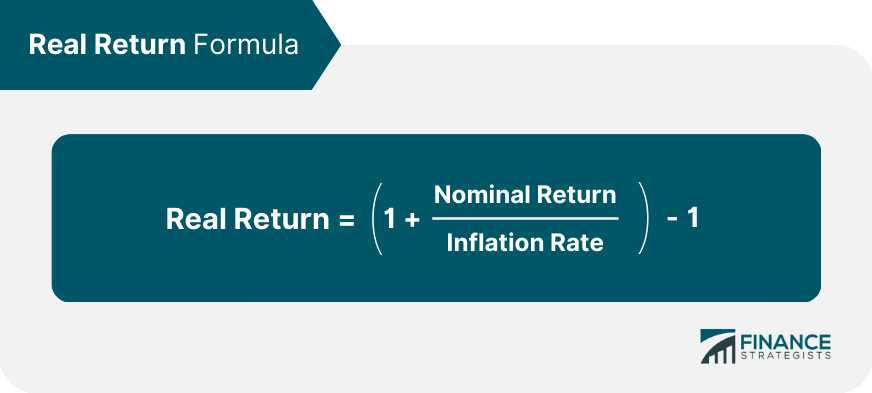

Real Return Formula

Factors Affecting Real Return

Inflation Rate

Taxes

Investment Fees

Market Volatility

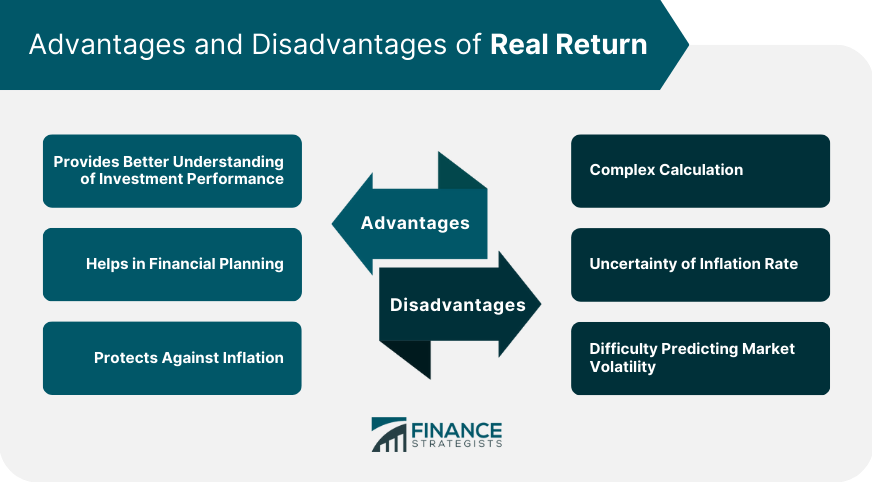

Advantages of Real Return

Provides Better Understanding of Investment Performance

Helps in Financial Planning

Protects Against Inflation

Disadvantages of Real Return

Complex Calculation

Uncertainty of Inflation Rate

Difficult to Predict Market Volatility

Real Return vs. Nominal Return

Differences Between Real and Nominal Return

Importance of Considering Inflation

Examples of Real Return

Stocks

Bonds

Real Estate

Conclusion

Real Return FAQs

Real Return is the actual return on an investment, after taking inflation into account.

Real Return is calculated by subtracting inflation from the nominal return of an investment.

Inflation rate, taxes, investment fees, and market volatility can all affect Real Return.

Real Return provides a better understanding of investment performance, helps in financial planning, and protects against inflation.

Real Return involves complex calculations, uncertainty of inflation rate, and difficulty predicting market volatility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.