Real assets are tangible assets that have intrinsic value and are used for productive purposes. Real assets include land, property, infrastructure, natural resources, and collectibles. Real assets are an important component of investment portfolios because they offer potential for capital appreciation, steady cash flow, portfolio diversification, and inflation hedging. Real assets also have a low correlation to traditional financial assets, which can reduce overall portfolio risk. Land and property are real assets that include residential and commercial real estate. Land and property provide a tangible asset with a long lifespan and the potential for capital appreciation and steady cash flow from rental income. Infrastructure is a real asset that includes transportation systems, utilities, and public works projects. Infrastructure provides a tangible asset with a long lifespan and the potential for steady cash flow from user fees or government contracts. Natural resources are real assets that include energy, minerals, and timberland. Natural resources provide a tangible asset with the potential for capital appreciation and steady cash flow from resource extraction. Collectibles are real assets that include art, antiques, and other items that have value beyond their functional use. Collectibles provide a tangible asset with the potential for capital appreciation and are often used as a hedge against inflation. Real assets are physical and have a discernible existence, such as real estate or precious metals. They can be stored, maintained, and insured, making them a valuable asset for investors seeking tangible holdings. Real assets are designed to endure for long periods, providing a steady stream of income and appreciation over time. Assets like farmland or timberland may increase in value over the course of several decades or even centuries. Real assets are geographically fixed and their value can be affected by local economic and environmental factors. For example, a beachfront property may appreciate in value if the area becomes more popular, while a mining operation could suffer if the nearby natural resources run out. Real assets are often associated with high transaction costs, including legal fees, appraisal fees, and maintenance costs. These expenses can make it more difficult for individual investors to enter the market, but can also create barriers to entry that protect investors from competition. Real assets, particularly those that are tied to commodities or natural resources, can serve as a hedge against inflation. This is because the prices of these assets tend to increase along with the general level of prices in the economy. Many real assets, such as rental properties or infrastructure investments, generate steady cash flow in the form of rent or other payments. This can provide a reliable source of income for investors seeking regular returns. Real assets can provide diversification benefits to investors by providing exposure to a wide range of asset classes that are not typically correlated with traditional financial assets such as stocks and bonds. Real assets have the potential to appreciate in value over time, particularly those that are scarce or in high demand. As a result, they can provide significant capital gains to investors who are able to hold them for the long term. Real assets are subject to market fluctuations and can experience significant price swings, particularly in response to changes in supply and demand or economic conditions. This can create volatility that may be difficult for some investors to stomach. Real assets are often illiquid, meaning that they cannot be easily bought or sold. This can create difficulties for investors who need to access their capital quickly, particularly in times of financial distress. Many real assets require significant capital investments upfront, which can make them inaccessible to smaller investors or those with limited capital. This can create a barrier to entry that can limit the pool of potential investors. Real assets often require ongoing maintenance and upkeep, which can be expensive and time-consuming. This can create additional costs for investors that may reduce the overall returns on their investment. Residential and commercial real estate provide a tangible asset with the potential for capital appreciation and steady cash flow from rental income. Energy and utility infrastructure provide a tangible asset with the potential for steady cash flow from user fees or government contracts. Precious metals and collectibles provide a tangible asset with the potential for capital appreciation and are often used as a hedge against inflation. Timberland and farmland provide a tangible asset with the potential for steady cash flow from resource extraction or agricultural production. Direct ownership of real assets involves purchasing and managing the asset directly, such as buying a rental property or investing in timberland or farmland. REITs are a popular way to invest in real estate without direct ownership. REITs are publicly traded companies that invest in real estate and generate income from rental properties, mortgages, or other real estate investments. Real assets mutual funds invest in a diversified portfolio of real assets, such as real estate, infrastructure, and natural resources. Real assets Exchange-Traded Funds are similar to real assets mutual funds but trade on an exchange like a stock, providing more flexibility for investors. Real assets are an important component of investment portfolios because they offer potential for capital appreciation, steady cash flow, portfolio diversification, and inflation hedging. However, real assets are subject to market volatility, limited liquidity, high initial investment, and costly maintenance. Investing in real assets requires careful consideration of the advantages and risks and the development of a sound investment strategy that aligns with individual investment goals and risk tolerance. Professional advice and due diligence are important to ensure successful real assets investments. Investing in real assets requires a significant amount of due diligence and expertise to navigate complex legal, financial, and operational issues. Professional advice from a financial advisor, lawyer, or other expert is essential to ensure that investments align with individual investment goals and risk tolerance.Definition of Real Assets

Types of Real Assets

Land and Property

Infrastructure

Natural Resources

Collectibles

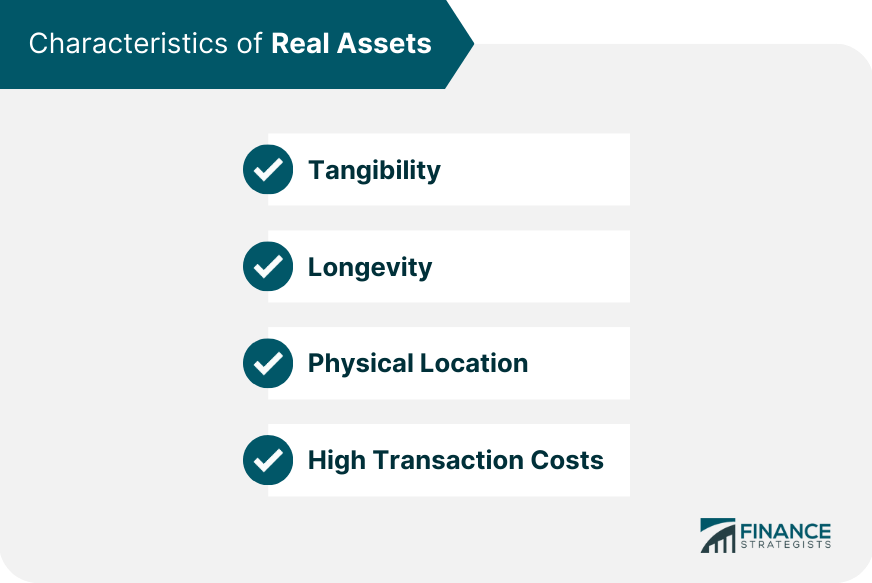

Characteristics of Real Assets

Tangibility

Longevity

Physical Location

High Transaction Costs

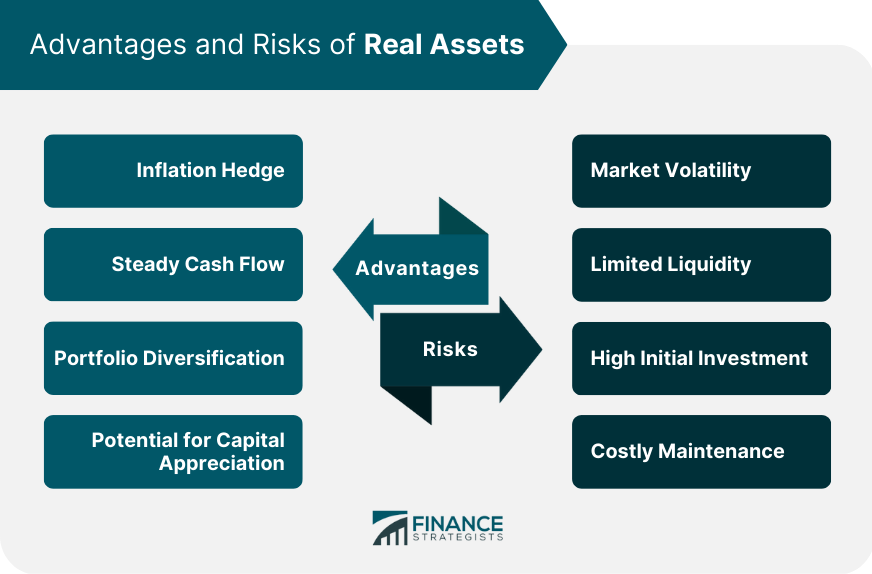

Advantages of Real Assets

Inflation Hedge

Steady Cash Flow

Portfolio Diversification

Potential for Capital Appreciation

Risks of Real Assets

Market Volatility

Limited Liquidity

High Initial Investment

Costly Maintenance

Examples of Real Assets Investment

Residential and Commercial Real Estate

Energy and Utility Infrastructure

Precious Metals and Collectibles

Timberland and Farmland

Real Assets Investment Strategies

Direct Ownership

Real Estate Investment

Real Assets Mutual Funds

Exchange-Traded Funds (ETFs)

Bottom Line

Real Assets FAQs

Real assets refer to tangible assets that have inherent value, such as land, property, infrastructure, and natural resources.

Real assets can provide inflation hedge, steady cash flow, portfolio diversification, and potential for capital appreciation.

The risks of investing in real assets include market volatility, limited liquidity, high initial investment, and costly maintenance.

Real assets investment can be in the form of direct ownership, real estate investment trusts (REITs), real assets mutual funds, and exchange-traded funds (ETFs).

You can start by doing research, seeking professional advice, and choosing a suitable investment strategy based on your goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.