The nominal return is the total percentage gain or loss on an investment before adjusting for inflation. It represents the actual change in the value of an asset over a specific period. The components of nominal return include the appreciation or depreciation in the value of the investment and any income generated from it, such as dividends or interest. This return is an important metric for investors to understand their investments' performance. Nominal return helps investors gauge the profitability of their investments. It also serves as a useful tool for comparing the performance of various investment options. However, it's essential to consider the impact of inflation on these returns. Nominal return is a financial term that refers to the rate of return on an investment before adjusting for inflation. It is important because it gives investors an idea of the total amount of money earned or lost on an investment, without taking into account the impact of inflation. Nominal return is often used to compare the performance of different investment options, but it should not be the only factor considered when making investment decisions. Investors should also consider the real return, which is the nominal return adjusted for inflation. This is because inflation erodes the purchasing power of money over time, and investments that have a higher nominal return may still result in a lower real return if the rate of inflation is high. Therefore, it is important to take both nominal return and inflation into account when evaluating investment options and making investment decisions. The formula for nominal return is straightforward: This formula calculates the total return on investment, including capital gains and income generated during the investment period. Consider an investor who purchased a stock for $1,000 and sold it for $1,200 after one year. During the investment period, the stock paid $50 in dividends. The nominal return would be calculated as ($1,200 - $1,000 + $50) / $1,000 = 0.25 or 25%. Below are some details regarding the relationship between nominal return and real return. Nominal return represents the actual change in the value of an investment, while real return adjusts for the effects of inflation. Real return provides a more accurate picture of an investment's performance, as it accounts for the purchasing power of money over time. To calculate real return, the inflation rate must be subtracted from the nominal return. This adjustment is essential to accurately assess the true value of an investment and make better-informed decisions about future investments. Below are the factors that affect nominal return: Interest rates can significantly impact nominal returns, as they influence the cost of borrowing and the return on savings. High-interest rates can lead to lower returns on investments, while low-interest rates can result in higher returns. Inflation rates directly affect nominal returns by eroding the purchasing power of money. Higher inflation rates can result in lower real returns, even if the nominal return appears to be positive. Market volatility can lead to fluctuations in nominal returns, as asset prices experience rapid changes. Investors must consider the inherent risks associated with market volatility when evaluating the performance of their investments. Economic conditions, such as GDP growth, employment levels, and consumer confidence, can influence nominal returns. A strong economy generally supports higher returns on investments, while a weak economy can lead to lower returns. There are several applications of Nominal Return, including the following: Nominal return plays a crucial role in investment decision-making by providing a basis for comparing the performance of various investment options. Investors can use this metric to allocate their resources more effectively. Nominal return is a key metric for evaluating the performance of individual investments, as well as entire portfolios. By comparing nominal returns, investors can identify which assets are performing well and which may need to be reevaluated. Nominal return can be used for benchmarking purposes, allowing investors to compare their investment performance against a standard, such as a market index. This comparison can help identify areas for improvement in an investment strategy. Nominal return is an essential component of financial planning, as it helps investors determine the potential returns on their investments and make informed decisions about how to allocate their resources. There are certain limitations to nominal return, such as: Inflation can distort nominal return figures, making them appear more favorable than they truly are. To gain an accurate understanding of an investment's performance, investors must consider real returns that account for the impact of inflation on purchasing power. Nominal return does not consider currency risk, which can affect the actual return for investors dealing with foreign investments. Fluctuations in exchange rates can lead to differences in the value of returns when converted to an investor's home currency. Nominal return, as a standalone metric, does not account for diversification in an investment portfolio. Investors must consider the benefits of diversification, which can help mitigate risks and improve overall portfolio performance. In conclusion, nominal return is an essential metric for investors to understand the performance of their investments. However, it is crucial to account for factors such as inflation, currency risk, and diversification when making investment decisions. Nominal return is an important tool in finance for evaluating investment performance, making informed decisions, and planning for the future. By understanding the limitations of nominal return and considering real return, investors can make better-informed decisions and optimize their investment strategies. While nominal return is useful for comparing investment options and evaluating performance, it is crucial to consider its limitations, such as the impact of inflation, currency risk, and diversification. By incorporating these factors into their decision-making process, investors can more accurately assess their investments and achieve their financial goals.Definition of Nominal Return

Importance of Nominal Return

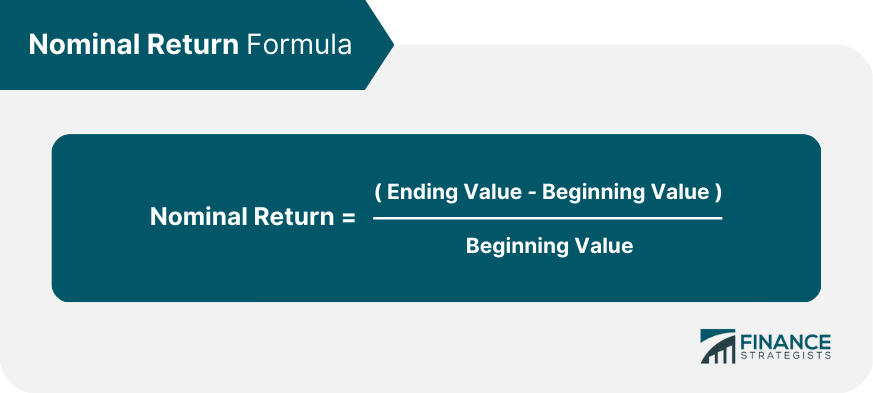

Calculation of Nominal Return

Formula for Nominal Return

Example of Nominal Return Calculation

Relationship Between Nominal Return and Real Return

Differences Between Nominal and Real Returns

Inflation Adjustment

Factors Affecting Nominal Return

Interest Rates

Inflation Rates

Market Volatility

Economic Conditions

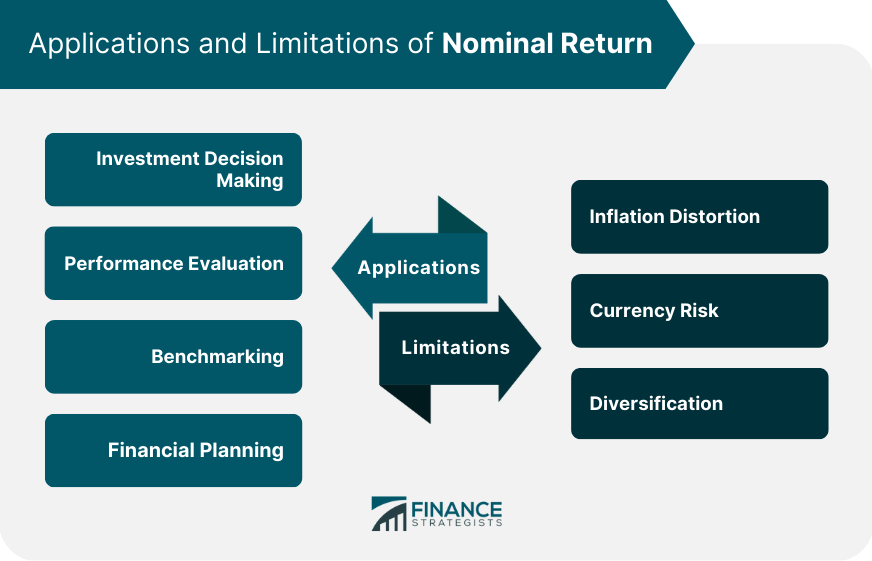

Applications of Nominal Return

Investment Decision Making

Performance Evaluation

Benchmarking

Financial Planning

Limitations of Nominal Return

Inflation Distortion

Currency Risk

Diversification

Conclusion

Nominal Return FAQs

Nominal return is the percentage increase or decrease of an investment without adjusting for inflation.

Nominal return is calculated by subtracting the initial investment from the final value, dividing by the initial investment, and then multiplying by 100.

Nominal return is the actual percentage gain or loss of an investment, while real return factors in the effects of inflation.

Factors that can affect nominal return include interest rates, economic growth, inflation, and market volatility.

Nominal return is important in investing because it helps investors understand the actual percentage gain or loss of their investments without factoring in inflation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.