Investment fraud occurs when individuals or companies use deceptive practices to take advantage of investors and steal their money. To prevent investment fraud, it is essential to be aware of common scams and fraudulent activities. This includes researching the company or investment opportunity, reading reviews and news articles, and checking with the Securities and Exchange Commission (SEC) to ensure that the investment is registered and legitimate. Additionally, investors should be wary of unsolicited investment offers, high-pressure sales tactics, and promises of guaranteed returns. It is also essential to work with reputable financial advisors and brokers who are licensed and registered with the SEC or other regulatory bodies. By staying informed and vigilant, investors can protect themselves from investment fraud and make informed decisions about their finances. Understanding different types of investments, their risks and rewards, and various investment strategies can help investors make informed decisions and identify potential scams. Learn about stocks, bonds, mutual funds, real estate, and other investment vehicles to understand their benefits and risks. Become familiar with the risk-return trade-off and the concept of diversification to help mitigate risks. Understand different investment strategies, such as growth, value, and income investing, to determine which approach best aligns with your financial goals and risk tolerance. Before committing funds, perform due diligence on investment opportunities, financial advisors, and companies. Diversifying your investment portfolio can help spread risk and reduce the impact of a single fraudulent investment. Question and verify information about investment opportunities, especially if they seem too good to be true. Be vigilant when investing online, as the internet has become a breeding ground for fraudulent activities. Ensure that websites are secure and reputable before providing personal or financial information. Take your time when making investment decisions, and don't let anyone pressure you into making hasty choices without proper research and consideration. Regularly review your investment portfolio to ensure that it continues to align with your financial goals and to detect any irregularities or signs of fraud. Consult with trusted financial advisors, friends, or family members before making significant investment decisions to gain alternative perspectives and insights. Investment fraud prevention is essential for protecting investors and ensuring the integrity of the financial system. Investment fraud can cause significant financial losses and undermine confidence in the investment markets. It is crucial to prevent investment fraud to promote a fair and transparent investment environment that benefits investors, companies, and the economy as a whole. Investment fraud prevention is also important for maintaining investor trust and confidence. When investors feel that the investment markets are fair and transparent, they are more likely to invest in the market, which can help promote economic growth and prosperity. By preventing investment fraud, we can promote a healthy investment environment that benefits everyone involved. Finally, investment fraud prevention is essential for protecting vulnerable investors, such as senior citizens, who may be more susceptible to investment scams. By educating investors about the risks of investment fraud and providing resources to help prevent it, we can help protect vulnerable investors and ensure that everyone has access to a fair and transparent investment environment. Ponzi schemes are fraudulent investment operations where returns are paid to existing investors from funds contributed by new investors rather than from profit earned by the operation. Pyramid schemes are similar to Ponzi schemes but rely on the recruitment of new investors to generate returns for earlier investors. Participants are required to recruit new members in order to receive payments. In pump-and-dump schemes, fraudsters buy cheap stocks, inflate the stock price by spreading false or misleading information, and then sell their shares at a profit before the price falls. Insider trading occurs when individuals trade a company's securities based on non-public, material information, giving them an unfair advantage over other investors. Advance fee fraud involves convincing investors to pay upfront fees with the promise of high returns, which are never realized. Binary options fraud entails manipulating the outcome of binary options trades or refusing to pay out winnings to investors. High-Yield Investment Programs (HYIPs) are unregistered investment programs that promise unrealistically high returns, usually achieved by using new investor funds to pay off earlier investors. Affinity fraud targets specific groups, such as religious or ethnic communities, exploiting the trust and familiarity within these groups to promote fraudulent investments. Boiler room scams involve high-pressure sales tactics to sell overpriced or worthless securities to unsuspecting investors, often through unsolicited phone calls. Promises of high returns with little or no risk should be treated with skepticism, as investments typically involve a trade-off between risk and reward. Fraudsters often need to provide more accurate or specific information about investment opportunities, making it difficult for investors to assess the risks and potential returns accurately. Scammers may use high-pressure sales tactics to force investors to make hasty decisions without due diligence. Unsolicited offers, especially those received through email or social media, should be treated cautiously and researched thoroughly. Offshore investments can be more challenging to regulate and monitor, making them more susceptible to fraudulent activities. Investment strategies that are difficult to understand or lack transparency may be designed to hide fraudulent practices. Investments and financial advisors should be registered with appropriate regulatory authorities to ensure industry standards and regulations compliance. If you suspect or fall victim to investment fraud, report it to the appropriate authorities, such as local law enforcement, financial regulatory authorities, and consumer protection agencies. Reporting investment fraud can help recover lost funds, protect others from being defrauded, and hold perpetrators accountable. These agencies provide information, resources, and tools to help investors protect themselves from investment fraud: These organizations offer resources and support to investors and help raise awareness of investment fraud: Better Business Bureau (BBB) American Association of Retired Persons (AARP) These websites provide valuable information, tools, and alerts to help investors avoid and report investment fraud: Investor.gov Scam alerts and investor bulletins Investment fraud prevention is crucial to protect investors and maintain the integrity of the financial system. By being aware of common investment scams, researching and verifying investment opportunities, and working with reputable financial advisors, investors can reduce their risk of falling victim to fraudulent activities. It is also important to diversify investment portfolios, maintain a healthy skepticism, and avoid making hasty investment decisions. There are various types of investment fraud, including Ponzi schemes, pyramid schemes, pump and dump schemes, insider trading, and affinity fraud, among others. Warning signs of investment fraud include guaranteed high returns, limited information or documentation, pressure to invest quickly, and unsolicited investment offers, among others. If investors suspect or fall victim to investment fraud, they should report it to the appropriate authorities and seek legal assistance. Various resources are available to help investors protect themselves from investment fraud, including government and regulatory agencies, non-profit organizations, and online resources. By staying informed and vigilant, investors can make informed decisions and protect themselves from investment fraud.Overview of Investment Fraud Prevention

Finally, if you suspect that you have been the victim of investment fraud, it is essential to report it to the proper authorities and seek legal assistance. How to Prevent Investment Fraud

Educate Yourself on Investment Basics

Research and Verify

Diversify Investments

Maintain a Healthy Skepticism

Be Cautious With Online Investments

Avoid Pressure to Make Quick Decisions

Monitor Investments Regularly

Discuss Investment Opportunities With Trusted Advisors

Importance of Investment Fraud Prevention

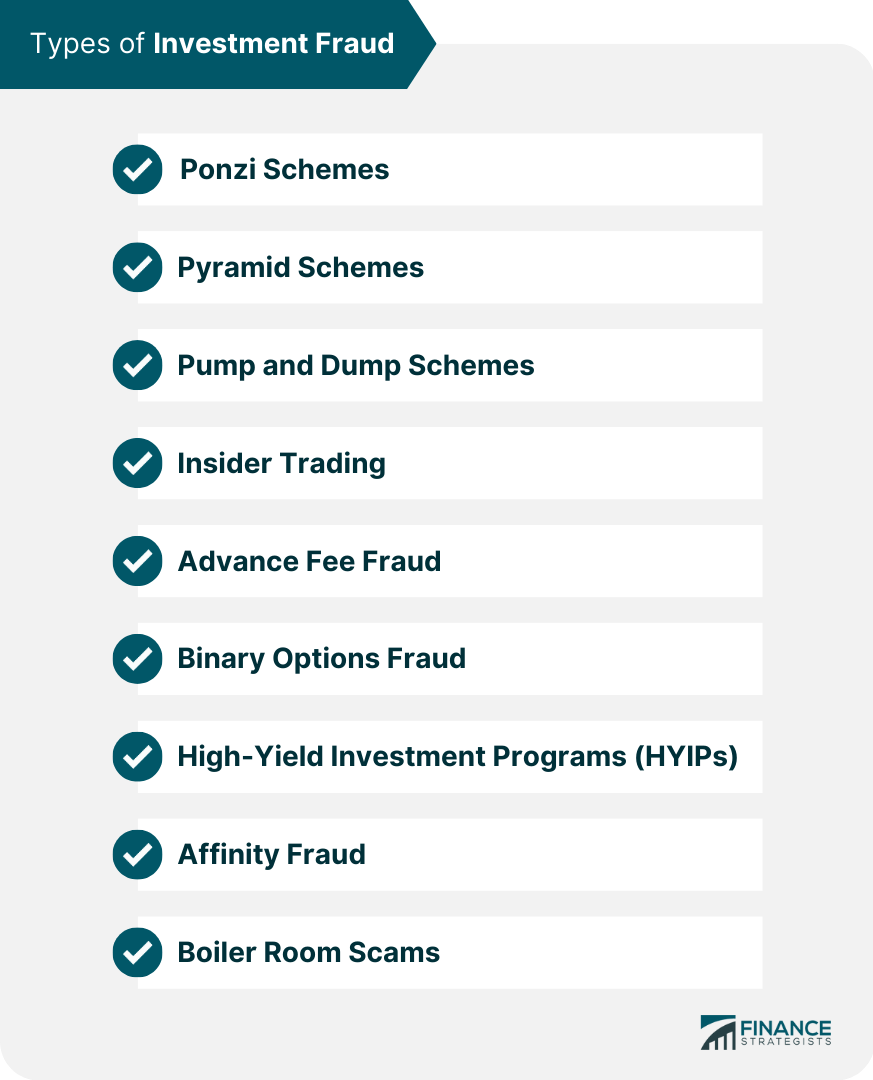

Types of Investment Fraud

Ponzi Schemes

Pyramid Schemes

Pump and Dump Schemes

Insider Trading

Advance Fee Fraud

Binary Options Fraud

High-Yield Investment Programs (HYIPs)

Affinity Fraud

Boiler Room Scams

Warning Signs of Investment Fraud

Guaranteed High Returns

Limited Information or Documentation

Pressure to Invest Quickly

Unsolicited Investment Offers

Offshore Investments

Complex or Vague Investment Strategies

Unregistered Investments or Advisors

Reporting Investment Fraud

Investment Fraud Prevention Resources

Government and Regulatory Agencies

Non-Profit Organizations

Online Resources

Conclusion

Investment Fraud Prevention FAQs

Investment fraud prevention is a set of strategies and practices designed to protect investors from being defrauded by fraudulent investment schemes.

Investment fraud prevention is crucial for protecting investors, maintaining investor trust and confidence, promoting a fair and transparent investment environment that benefits the economy, and preventing significant financial losses. By preventing investment fraud, we can also protect vulnerable investors, such as senior citizens, and ensure that everyone has access to a fair and transparent investment environment.

Investors can prevent investment fraud by educating themselves on investment basics, researching and verifying investment opportunities, maintaining healthy skepticism, diversifying investments, and regularly monitoring investments. They should also avoid pressure to make quick decisions and consult trusted advisors before making significant investment decisions.

Several government and regulatory agencies, non-profit organizations, and online resources offer information, tools, and alerts to help investors avoid and report investment fraud. These include the U.S. Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), North American Securities Administrators Association (NASAA), and Investor.gov, among others.

Companies can prevent investment fraud by implementing strong internal controls, conducting background checks on employees and third-party vendors, training employees on investment fraud prevention, and regularly reviewing and updating their policies and procedures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.