Emerging market investing refers to the process of allocating capital to countries or regions with developing economies and financial markets. These markets often exhibit rapid economic growth, expanding middle classes, and increasing integration with global markets. Emerging markets are characterized by factors such as lower per capita income, higher economic growth potential, and less mature financial markets compared to developed markets. They also tend to have more volatile political and economic environments and higher currency risks. Investing in emerging markets offers the potential for higher returns, diversification, and exposure to new growth opportunities. However, it also carries risks such as political and economic instability, currency fluctuations, and market volatility. Investing in stocks of publicly traded companies from emerging markets offers investors the opportunity to participate in the growth of these economies. These stocks can be bought and sold on local stock exchanges or through American Depositary Receipts (ADRs) listed on U.S. exchanges. Index funds and ETFs provide investors with diversified exposure to a basket of emerging market stocks. These funds track the performance of an underlying index, such as the MSCI Emerging Markets Index, and offer a cost-effective way to invest in emerging markets. Sovereign debt refers to bonds issued by emerging market governments. Investing in sovereign debt provides investors with exposure to the credit risk of these governments and their ability to service their debt obligations. Corporate debt consists of bonds issued by companies in emerging markets. Investing in corporate debt allows investors to participate in the growth of these companies while potentially earning higher yields compared to developed market corporate bonds. Private equity investments in emerging markets involve investing in privately held companies or acquiring stakes in publicly traded companies with the aim of generating high returns through capital appreciation and income generation. Investing in real estate in emerging markets offers the potential for capital appreciation and income generation, driven by factors such as urbanization, population growth, and increasing disposable incomes. Infrastructure investments in emerging markets involve financing projects such as transportation, energy, and telecommunications, which can generate long-term, stable cash flows. Economic growth is a key driver of investment returns in emerging markets. Investors should consider factors such as GDP growth, industrial production, and consumer spending when evaluating investment opportunities. Political stability can significantly impact investment returns in emerging markets. Investors should assess factors such as government stability, policy continuity, and geopolitical risks when making investment decisions. Currency fluctuations can affect investment returns in emerging markets. Investors should consider the potential impact of currency movements on their investments and employ strategies to manage currency risk. The regulatory environment in emerging markets can be less transparent and more complex than in developed markets. Investors should understand the legal and regulatory frameworks governing their investments and assess potential risks related to regulatory changes. Market liquidity can be limited in emerging markets, making it more difficult to buy and sell investments. Investors should consider the liquidity of their investments and be prepared for potential periods of illiquidity. Investing in emerging markets can help diversify a portfolio, as these markets often exhibit different risk-return characteristics than developed markets. This diversification can help reduce portfolio volatility and enhance overall returns. Emerging markets often offer higher potential returns compared to developed markets, driven by factors such as rapid economic growth, expanding middle classes, and increasing integration with global markets. However, these higher potential returns come with greater risks, which investors should carefully consider before investing. Emerging market investing provides exposure to new growth opportunities not available in developed markets, such as innovative industries, untapped consumer markets, and infrastructure development. Investing in emerging markets allows investors to capitalize on favorable demographic trends, such as younger populations, growing labor forces, and increasing urbanization, which can drive economic growth and investment returns over the long term. Emerging markets are often characterized by political and economic instability, which can create risks for investors. Events such as regime changes, social unrest, and economic crises can negatively impact investment returns. Currency fluctuations can have a significant impact on investment returns in emerging markets. Investors should be prepared for potential currency risks and consider strategies to manage these risks, such as currency hedging or investing in local currency bonds. Emerging markets can be more volatile than developed markets, which can lead to larger fluctuations in investment returns. Investors should be prepared for periods of heightened volatility and consider implementing risk management strategies to protect their investments. Emerging markets may have limited transparency and disclosure compared to developed markets, making it more difficult for investors to obtain accurate and timely information about their investments. This lack of transparency can create additional risks for investors. Investing in emerging markets can expose investors to legal and regulatory uncertainties, which can negatively impact investment returns. Investors should carefully consider the legal and regulatory environment of their investments and be prepared for potential changes that could affect their investment outcomes. Diversifying investments across multiple emerging markets can help reduce the risks associated with investing in a single country or region. Diversification can be achieved through investments in stocks, bonds, or alternative assets, as well as through the use of index funds or ETFs. Investors should consider whether to employ an active or passive management approach when investing in emerging markets. Active management may offer the potential for higher returns and better risk management, while passive management can provide cost-effective exposure to a broad range of emerging market investments. Investing in emerging markets can be complex, and many investors may benefit from the expertise of professional investment managers or advisors. These professionals can help investors navigate the unique risks and opportunities of emerging market investing. Emerging market investments are best suited for long-term investors who can withstand periods of market volatility and currency fluctuations. A long-term investment horizon can increase the likelihood of achieving positive investment returns. Effective risk management is crucial when investing in emerging markets. Investors should consider strategies such as diversification, currency hedging, and the use of stop-loss orders to manage the risks associated with emerging market investing. Emerging market investing is an important component of a well-diversified global portfolio, offering the potential for higher returns, diversification, and exposure to new growth opportunities. While emerging market investing offers many opportunities, it also carries significant risks. Investors should carefully weigh the potential benefits and risks before investing in emerging markets and implement appropriate strategies to manage these risks. Emerging markets are dynamic and ever-changing. Investors should continuously monitor their investments and adapt their strategies to changing market conditions to maximize their chances of success in emerging market investing.What Is Emerging Market Investing?

Types of Emerging Market Investments

Stocks

Publicly Traded Companies

Index Funds and Exchange-Traded Funds (ETFs)

Bonds

Sovereign Debt

Corporate Debt

Alternative Investments

Private Equity

Real Estate

Infrastructure

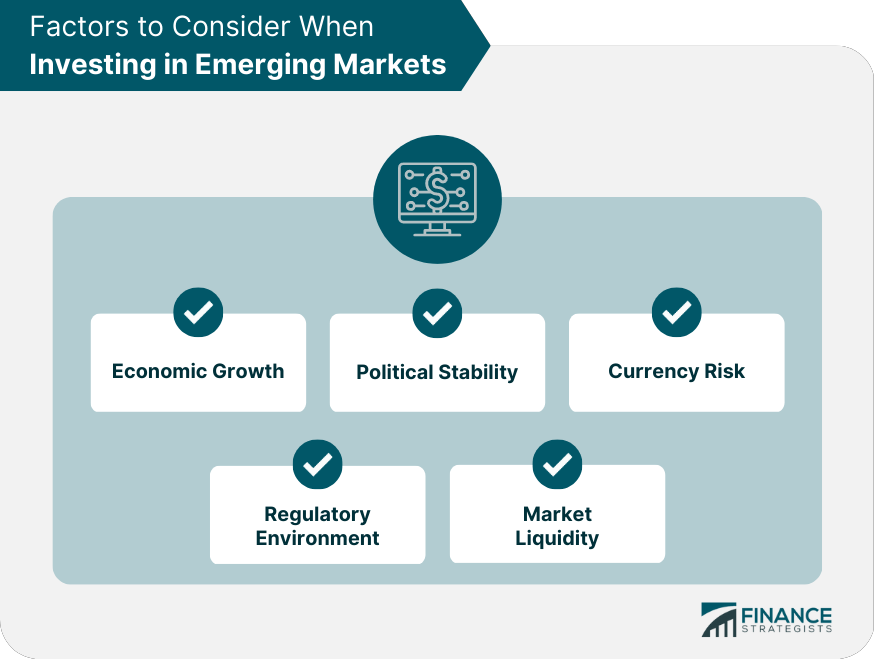

Factors to Consider When Investing in Emerging Markets

Economic Growth

Political Stability

Currency Risk

Regulatory Environment

Market Liquidity

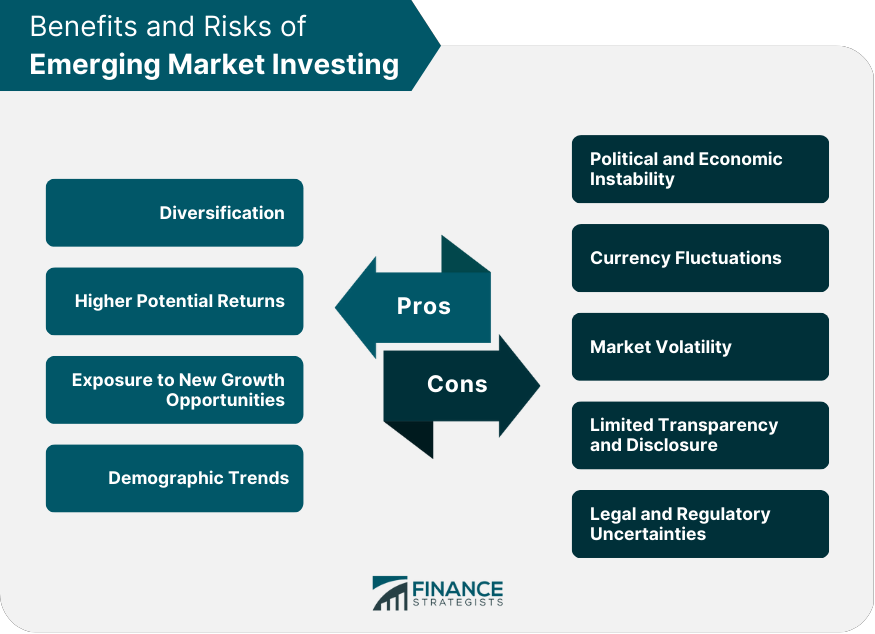

Benefits of Emerging Market Investing

Diversification

Higher Potential Returns

Exposure to New Growth Opportunities

Demographic Trends

Risks and Challenges of Emerging Market Investing

Political and Economic Instability

Currency Fluctuations

Market Volatility

Limited Transparency and Disclosure

Legal and Regulatory Uncertainties

Strategies for Successful Emerging Market Investing

Portfolio Diversification

Active vs Passive Management

Use of Professional Expertise

Long-Term Investment Horizon

Risk Management

Conclusion

Emerging Market Investing FAQs

Emerging market investing refers to investing in companies or assets located in developing countries that are experiencing rapid economic growth and industrialization. These markets are often characterized by higher levels of risk, volatility, and potential reward than developed markets.

Emerging market investing can provide diversification benefits, higher returns, and exposure to economies with strong growth potential. These markets often have lower valuations and higher growth rates than developed markets, providing opportunities for investors to generate alpha.

Some risks of emerging market investing include political instability, currency fluctuations, less-developed financial markets, and regulatory risks. These risks can result in higher volatility and lower liquidity than developed markets.

There are various strategies for investing in emerging markets, including direct investment in individual stocks or bonds, investing in mutual funds or exchange-traded funds (ETFs) that specialize in emerging markets, or investing in funds managed by emerging market asset managers.

To evaluate whether to invest in emerging markets, an investor should consider their risk tolerance, investment objectives, and time horizon. They should also analyze the economic and political conditions of the countries they are considering investing in, and the performance of the specific companies or assets they are considering investing in. Additionally, consulting with a financial advisor can provide valuable guidance on investing in emerging markets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.