Advance fee fraud is a type of financial scam where the victim is tricked into paying an upfront fee with the false promise of receiving a significant reward or benefit later. These scams often involve the use of deception, manipulation, and false guarantees to convince the victim to part with their money. There are numerous types of advance fee fraud schemes, including lottery and sweepstakes scams, inheritance scams, loan scams, employment scams, romance scams, and business opportunity scams. Each of these scams targets a different group of victims and employs unique tactics to defraud them. Advance fee fraud has a significant impact on individuals and businesses, causing financial losses, emotional distress, and in some cases, bankruptcy. In addition to the direct financial losses suffered by victims, advance fee fraud schemes also contribute to a climate of mistrust and insecurity in the marketplace. One of the hallmarks of advance fee fraud schemes is the use of false promises and guarantees to entice the victim. Scammers often make grandiose claims about the potential rewards or benefits that the victim will receive, which are typically far beyond what is realistically possible. Advance fee fraud schemes invariably involve a request for an upfront payment from the victim. This payment may be described as a processing fee, a tax, a security deposit, or another seemingly legitimate expense. The scammer will often insist that the payment is necessary for the victim to receive the promised reward or benefit. Scammers often use high-pressure tactics to persuade victims to make the upfront payment quickly. They may create a sense of urgency by claiming that the opportunity will expire soon or that there are other interested parties waiting to take advantage of the offer. In many cases, advance fee fraud schemes involve the use of fake or forged documents to lend an air of legitimacy to the scam. These documents may include official-looking letters, emails, or certificates that appear to be from reputable sources. In these scams, the victim is informed that they have won a large sum of money in a lottery or sweepstakes. The scammer then requests an upfront payment to cover taxes, fees, or other expenses before the winnings can be released. Inheritance scams involve the victim being informed that they are the beneficiary of a large inheritance from a distant relative. The scammer then requests an upfront payment to cover legal fees, taxes, or other expenses related to the inheritance. Loan scams target individuals and businesses in need of financing. The scammer may pose as a lender offering loans at attractive rates, but they will require an upfront payment as a sign of commitment or to cover fees before the loan can be disbursed. Employment scams prey on job seekers by offering high-paying jobs or work-from-home opportunities. The scammer may request an upfront payment for training materials, equipment, or other expenses before the victim can begin working. Romance scams involve the scammer forming a romantic relationship with the victim, often through online dating platforms. The scammer may then request money for various reasons, such as medical emergencies or travel expenses, with the promise of repayment or an in-person meeting. Business opportunity scams target entrepreneurs and investors with the promise of lucrative returns on investment. The scammer may offer a chance to invest in a new product, service, or business venture, but they will require an upfront payment to secure the opportunity or cover initial costs. Scammers often initiate contact with potential victims through email, phone calls, or social media. They may use a variety of tactics to establish trust and create a sense of legitimacy, such as posing as representatives of well-known companies or government agencies. Once trust is established, the scammer presents the victim with the false opportunity or offer. This may involve a detailed description of the potential rewards or benefits, along with convincing reasons why the victim is uniquely qualified to participate. The scammer will then request an upfront payment from the victim, often using persuasive arguments and high-pressure tactics to encourage compliance. The payment may be requested through various means, such as wire transfers, money orders, or gift cards. In many cases, scammers will continue to request additional payments from the victim after the initial upfront payment has been made. These requests may be accompanied by further promises of rewards or benefits, or by claims that the additional payments are necessary to overcome unforeseen obstacles. Once the scammer has received the upfront payments, they will typically cut off all communication with the victim and disappear, leaving the victim with no recourse to recover their lost funds. There are several warning signs that may indicate an advance fee fraud scheme, including unsolicited contact from strangers, requests for upfront payments, high-pressure tactics, and promises of unrealistic rewards or benefits. To avoid falling victim to advance fee fraud, it is essential to conduct thorough research and verify the information provided by the scammer. This may include checking the legitimacy of the company or organization they claim to represent, and seeking independent advice from trusted sources. Individuals can protect themselves from advance fee fraud by avoiding high-risk situations and offers, such as those that seem too good to be true, require upfront payments, or involve unknown or unverifiable parties. Another critical aspect of avoiding advance fee fraud is protecting personal and financial information. This includes being cautious about sharing personal details with strangers and ensuring that financial transactions are conducted through secure and reputable channels. If an individual suspects that they have been targeted by an advance fee fraud scheme, it is important to report the incident to the appropriate authorities. This may include local law enforcement, consumer protection agencies, or financial regulators. Perpetrators of advance fee fraud can face severe legal consequences, including criminal charges, fines, and imprisonment. The specific penalties will depend on the jurisdiction and the nature of the fraud. Due to the global nature of many advance fee fraud schemes, international cooperation is essential in combating this type of crime. Law enforcement agencies around the world work together to share information, coordinate investigations, and bring perpetrators to justice. Public awareness campaigns and education efforts play a crucial role in preventing advance fee fraud. These initiatives aim to inform the public about the risks and warning signs of advance fee fraud and provide guidance on how to protect themselves from these scams. Vigilance is key to avoiding advance fee fraud and protecting one's finances. By being aware of the warning signs, conducting thorough research, and exercising caution in financial transactions, individuals can significantly reduce their risk of falling victim to these scams. Governments, law enforcement agencies, and consumer protection organizations continue to work together to combat advance fee fraud. These efforts include public awareness campaigns, international cooperation, and the development of new tools and technologies to detect and prevent fraud. Ultimately, individuals must take personal responsibility for protecting themselves against advance fee fraud and other types of financial scams. By staying informed, maintaining a healthy skepticism, and adopting safe financial practices, individuals can play an active role in safeguarding their financial well-being and supporting the broader fight against fraud.What Is Advance Fee Fraud?

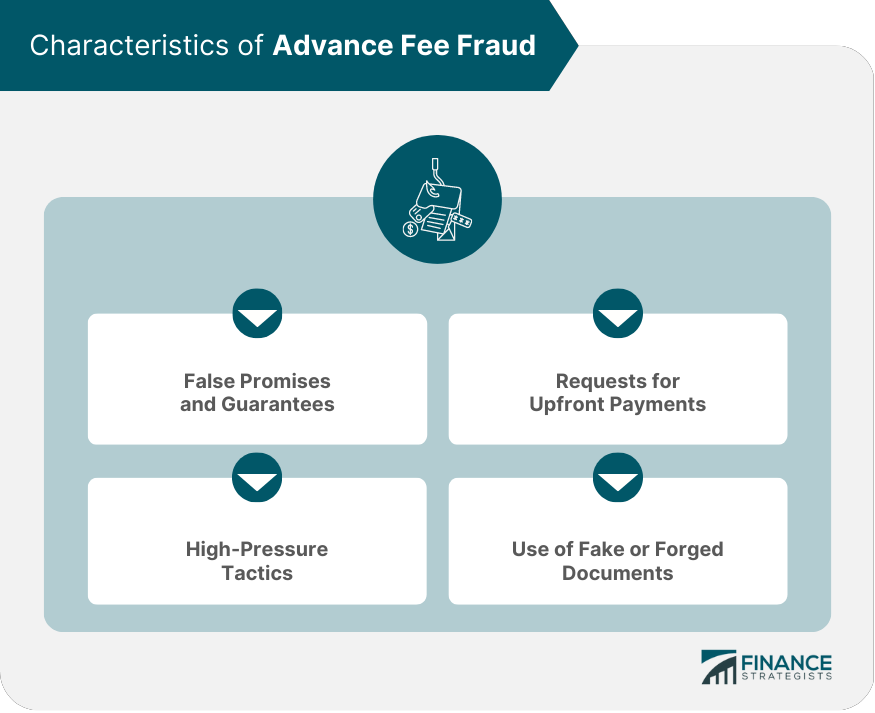

Characteristics of Advance Fee Fraud

False Promises and Guarantees

Requests for Upfront Payments

High-Pressure Tactics

Use of Fake or Forged Documents

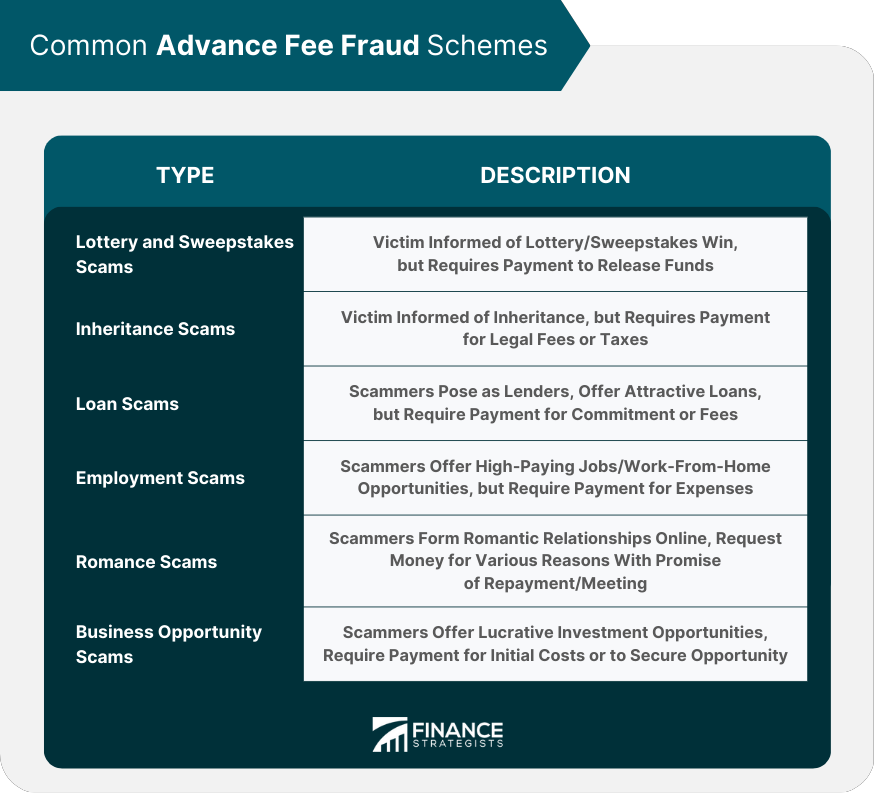

Common Advance Fee Fraud Schemes

Lottery and Sweepstakes Scams

Inheritance Scams

Loan Scams

Employment Scams

Romance Scams

Business Opportunity Scams

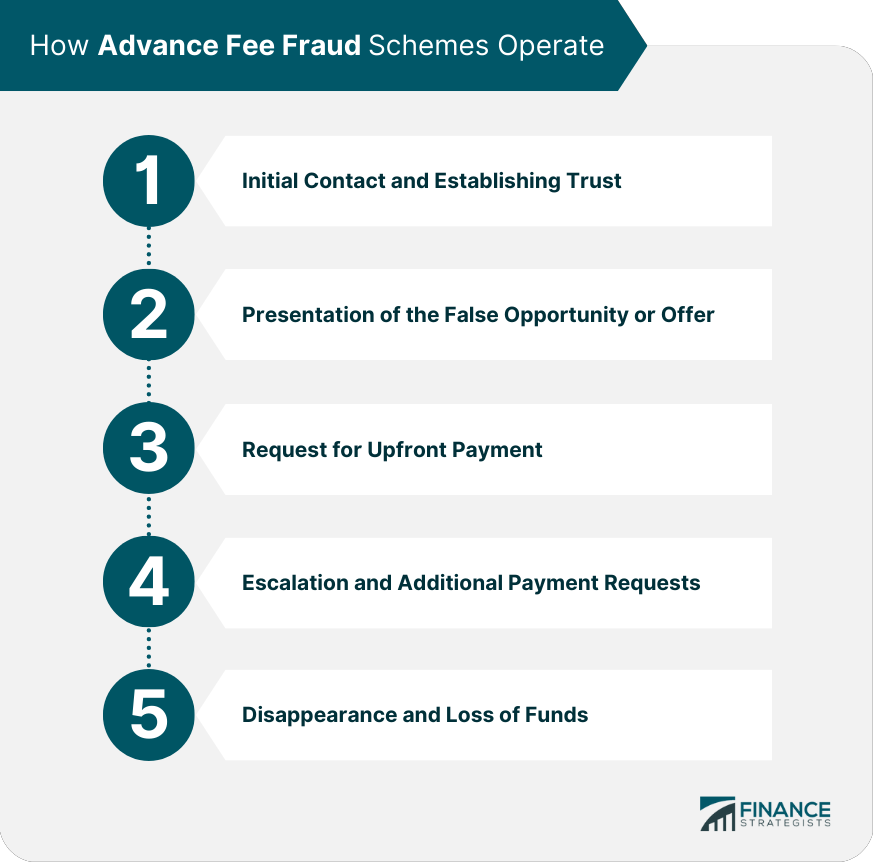

How Advance Fee Fraud Schemes Operate

Initial Contact and Establishing Trust

Presentation of the False Opportunity or Offer

Request for Upfront Payment

Escalation and Additional Payment Requests

Disappearance and Loss of Funds

Identifying and Avoiding Advance Fee Fraud

Warning Signs of Advance Fee Fraud

Conducting Research and Verifying Information

Avoiding High-Risk Situations and Offers

Protecting Personal and Financial Information

Reporting Suspected Fraud

Legal Consequences and Law Enforcement Efforts

Consequences for Perpetrators of Advance Fee Fraud

International Cooperation in Combating Advance Fee Fraud

Public Awareness Campaigns and Education Efforts

Conclusion

Advance Fee Fraud FAQs

Advance fee fraud is a type of scam in which the perpetrator promises a large sum of money in exchange for a small upfront payment or fee. However, once the victim pays the fee, the promised money never materializes.

Advance fee fraud typically involves the perpetrator contacting the victim through email, phone, or social media, posing as a wealthy individual or representative of a reputable company or organization. The perpetrator then entices the victim with the promise of a large sum of money, but requests an upfront payment or fee to cover administrative or legal costs. Once the victim pays the fee, the perpetrator disappears and the promised money is never delivered.

Common examples of advance fee fraud include lottery or sweepstakes scams, inheritance scams, and business opportunity scams.

To avoid falling victim to advance fee fraud, one should be skeptical of unsolicited offers of money or business opportunities, carefully review all correspondence and agreements, research the legitimacy of the company or organization, and never send money or personal information to anyone without verifying their identity.

If one suspects they have been a victim of advance fee fraud, they should immediately contact their bank or financial institution to stop any further payments, report the fraud to law enforcement agencies, and seek assistance from a reputable consumer protection agency or financial professional.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.