The value risk premium refers to the excess return that value stocks, or stocks perceived to be undervalued, tend to generate over growth stocks, or those with higher valuations. This concept is rooted in the idea that value stocks are priced below their intrinsic value, offering investors an opportunity to profit from the eventual market correction. In investment theory and practice, the value risk premium is important for investors looking to optimize their portfolios. It provides a rationale for the long-term outperformance of value stocks and influences the development of investment strategies aimed at capturing this excess return. Value investing is an investment approach that focuses on identifying undervalued stocks with strong fundamentals, which are expected to generate higher returns over time. The value risk premium is a central component of this approach, as it represents the potential reward for investors who successfully identify and invest in value stocks. From a behavioral finance standpoint, the value risk premium may arise due to cognitive biases and irrational decision-making among market participants. Investors might overreact to negative news or underestimate the potential of value stocks, causing them to be undervalued and providing an opportunity for value investors. The existence of the value risk premium also suggests that markets are not always efficient, and mispricing can persist for extended periods. This mispricing allows value investors to capitalize on the discrepancy between a stock's market price and its intrinsic value, eventually profiting when the market corrects the mispricing. Another explanation for the value risk premium is that it compensates investors for taking on the additional risk associated with value stocks. Since value stocks often have higher levels of financial distress or face greater uncertainty, investors may require a higher return to justify investing in these stocks. One factor contributing to the value risk premium is the risk of financial distress faced by value stocks. Companies with lower valuations may have a higher likelihood of bankruptcy or financial difficulties, causing investors to demand a higher return as compensation for this risk. Investor sentiment and market psychology can also play a significant role in driving the value risk premium. During periods of market pessimism, investors may become overly risk-averse and undervalue stocks with strong fundamentals, creating opportunities for value investors to exploit. Market liquidity, or the ease with which assets can be bought or sold without affecting their price, can also impact the value risk premium. Less liquid stocks may have a higher value risk premium because investors require additional compensation for the difficulty in buying or selling these assets. Economic and business cycles can influence the value risk premium, as value stocks may perform better during specific business cycle phases. For instance, value stocks may outperform during market recoveries or when economic growth is sluggish, contributing to the value risk premium. When constructing a portfolio, investors can consider the value risk premium by allocating a portion of their investments to value stocks or strategies that target undervalued assets. This allocation can potentially enhance the portfolio's risk-adjusted returns over time. Incorporating the value risk premium into portfolio construction can also provide diversification benefits. Since value and growth stocks may perform differently under various market conditions, a mix of both types of stocks can help mitigate risk and enhance long-term returns. Investors may enhance their expected returns without necessarily increasing their overall risk by considering the value risk premium when constructing portfolios. This is because value stocks, which typically have lower valuations and higher dividend yields, can offer more attractive risk-adjusted returns compared to growth stocks over the long term. One way to capture the value risk premium is through a value investing approach, which involves identifying and investing in undervalued stocks with strong fundamentals. By buying these stocks at a discount to their intrinsic value, investors can potentially profit as the market eventually recognizes their true worth. Factor-based investing is another strategy to capture the value risk premium. This approach involves targeting specific factors or characteristics, such as low price-to-earnings ratios or high dividend yields, that have historically been associated with higher returns. Investors can systematically gain exposure to the value risk premium by focusing on these factors. Smart-beta strategies, which combine the benefits of passive and active investing, can also be used to capture the value risk premium. These strategies typically use rules-based methodologies to select and weigh stocks based on specific value factors, offering a more cost-effective way to gain exposure to the value risk premium compared to traditional active management. Some critics argue that the value risk premium is a result of data mining, meaning that the observed outperformance of value stocks may be due to chance rather than a true underlying factor. However, the persistence of the value risk premium across various time periods and markets suggests that it is not solely a statistical artifact. Investing in undervalued stocks in pursuit of the value risk premium can expose investors to value traps, where a stock's low valuation is justified due to underlying issues with the company. Investors must carefully analyze a stock's fundamentals to differentiate between genuine value opportunities and value traps. Changing market dynamics, such as technological advancements and evolving investor preferences, may influence the value risk premium. As a result, investors should be aware that the value risk premium may not remain constant over time and should regularly reassess their investment strategies. Understanding the value risk premium is crucial for investors looking to optimize their portfolios and exploit market inefficiencies. By incorporating the value risk premium into their investment strategies, investors can potentially enhance their risk-adjusted returns over the long term. The value risk premium has significant implications for investment strategies. It provides a rationale for the long-term outperformance of value stocks and influences the development of various investment approaches, such as value investing, factor-based investing, and smart-beta strategies. Future research on the value risk premium should continue to explore its drivers, potential limitations, and the effectiveness of various investment strategies in capturing this premium. As market dynamics and investor behavior evolve, understanding the value risk premium's ongoing relevance will be crucial for investment success. Partnering with a professional wealth management service can be invaluable for investors seeking to capitalize on the value risk premium. What Is Value Risk Premium?

Origins of Value Risk Premium

Behavioral Finance Perspective

Market Inefficiencies and Mispricing

Risk-Based Explanation

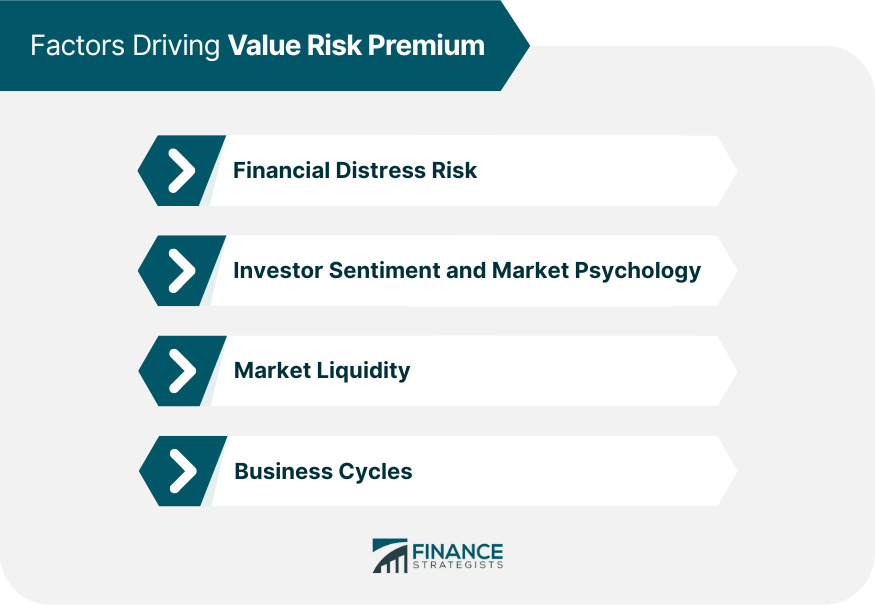

Factors Driving Value Risk Premium

Financial Distress Risk

Investor Sentiment and Market Psychology

Market Liquidity

Business Cycles

Value Risk Premium and Portfolio Construction

Incorporating Value Risk Premium Into Asset Allocation

Diversification Benefits

Impact on Expected Returns and Risk

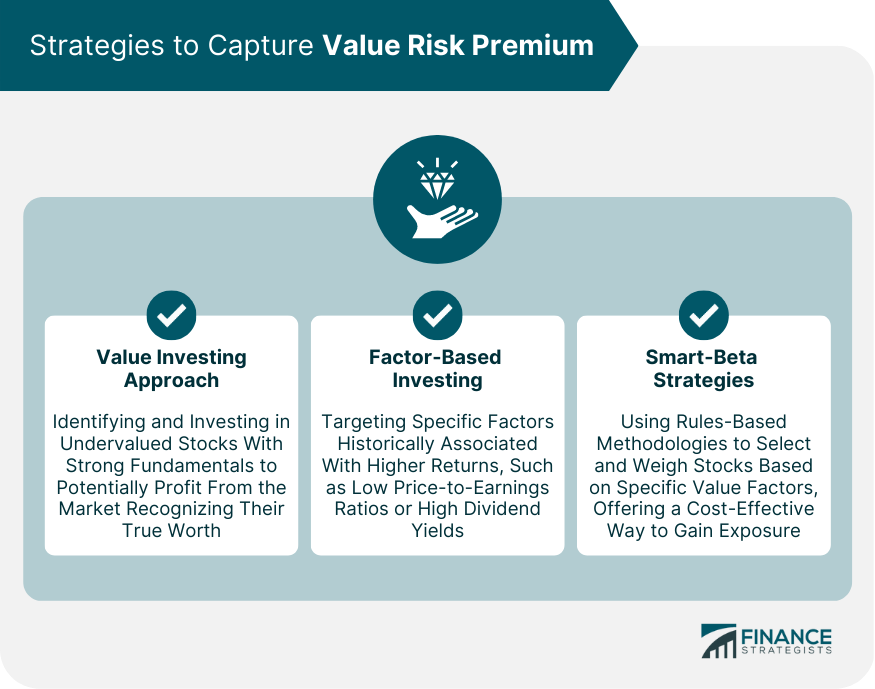

Strategies to Capture Value Risk Premium

Value Investing Approach

Factor-Based Investing

Smart-Beta Strategies

Criticisms and Limitations of Value Risk Premium

Data Mining Concerns

Value Trap Risks

Changing Market Dynamics

Final Thoughts

Value Risk Premium FAQs

The value risk premium refers to the excess return that value stocks, or stocks perceived to be undervalued, tend to generate over growth stocks, or those with higher valuations.

The value risk premium is important because it provides a rationale for the long-term outperformance of value stocks and influences the development of investment strategies aimed at capturing this excess return.

Investors can capture the value risk premium through various strategies, such as value investing, factor-based investing, and smart-beta strategies, which focus on identifying undervalued stocks or targeting specific value factors.

Factors driving the value risk premium include financial distress risk, investor sentiment and market psychology, market liquidity, and business cycles.

Criticisms and limitations of the value risk premium include data mining concerns, value trap risks, and changing market dynamics that may influence the premium's persistence and relevance over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.