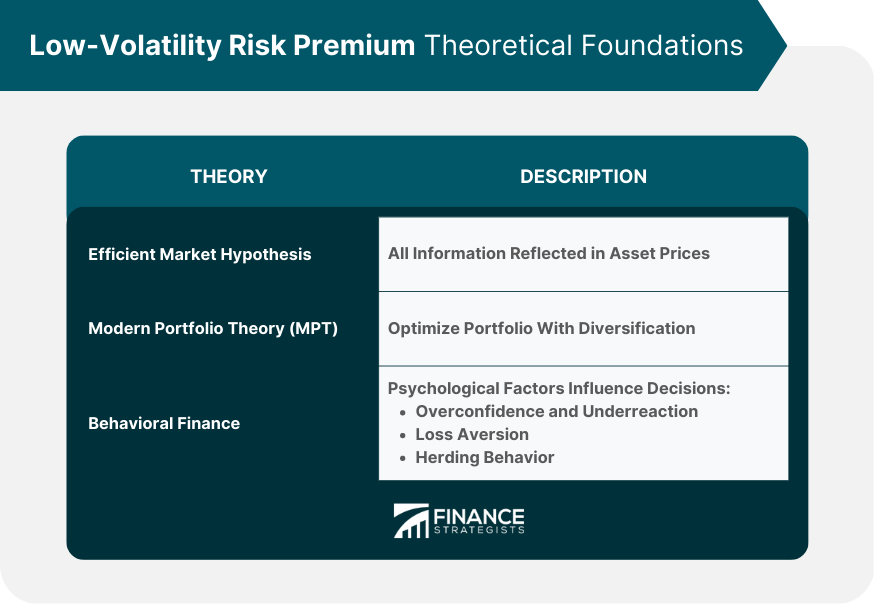

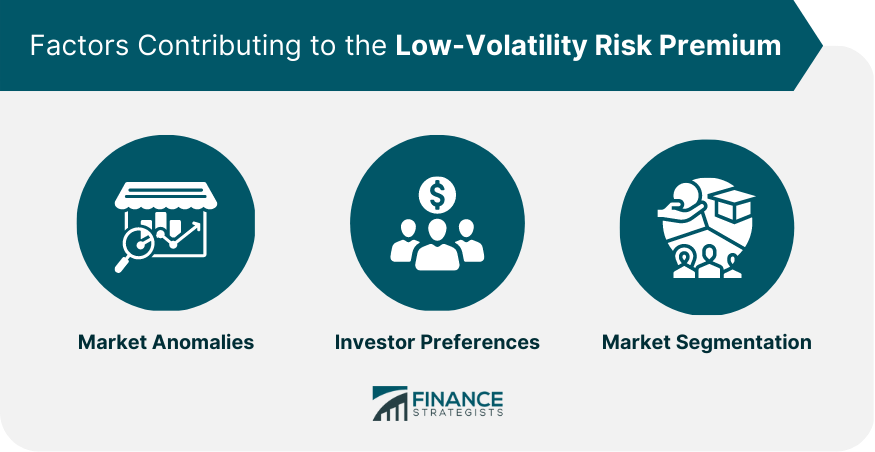

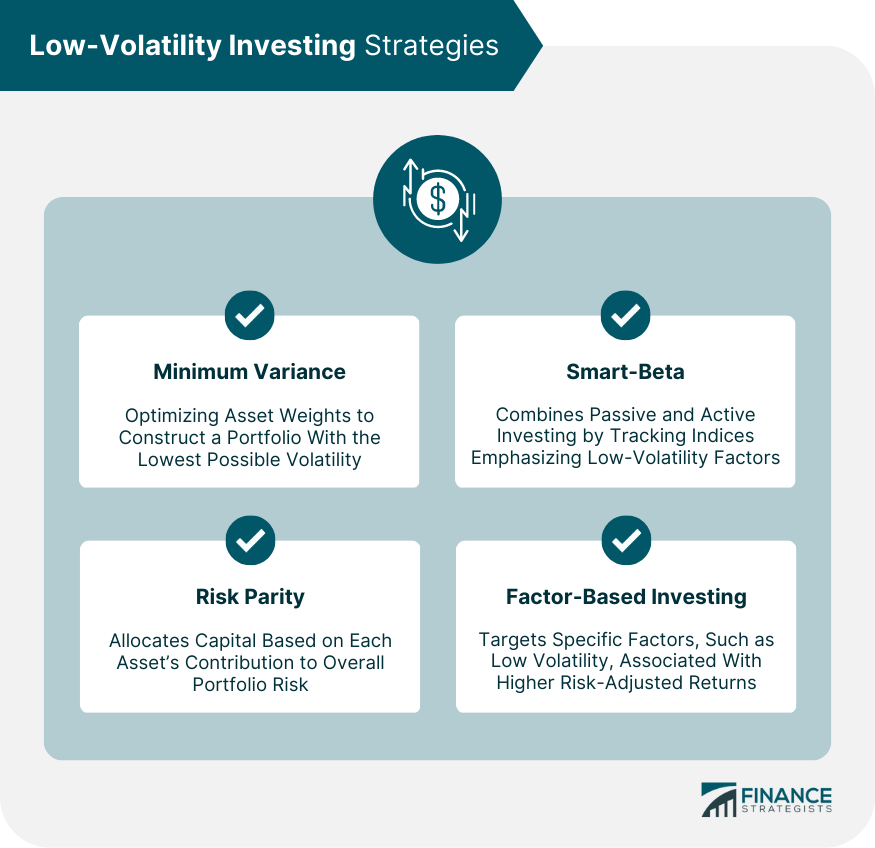

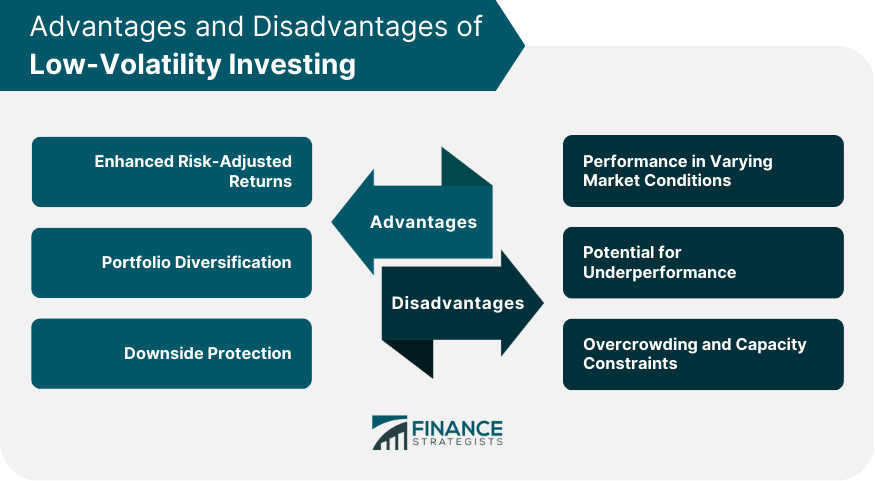

The low-volatility risk premium refers to the phenomenon where lower-risk assets generate higher risk-adjusted returns compared to their high-risk counterparts. This concept has become increasingly important in the world of investing as it challenges traditional finance theories and offers an alternative strategy for portfolio construction. The Efficient Market Hypothesis posits that all available information is reflected in asset prices, making it impossible to consistently achieve above-average returns without assuming a higher risk. The low-volatility risk premium, however, contradicts this theory by demonstrating that lower-risk investments can outperform higher-risk ones on a risk-adjusted basis. Modern Portfolio Theory provides a framework for optimizing a portfolio by combining assets with varying risk and return characteristics. MPT emphasizes the importance of diversification and focuses on the relationship between risk and return. While MPT acknowledges that higher risk should lead to higher returns, the low-volatility risk premium challenges this notion and shows that this relationship may not always hold true. Behavioral finance provides insights into the psychological factors that influence investors' decision-making processes. Some key concepts in behavioral finance that help explain the low-volatility risk premium include: Investors may be overconfident in their ability to predict market movements and may underestimate the risks associated with high-volatility assets, leading to their underperformance. Loss aversion refers to the tendency of investors to avoid realizing losses and to be more sensitive to potential losses than gains. This behavior can contribute to a preference for low-volatility assets, which may offer greater downside protection. Investors may exhibit herding behavior by following the actions of others, regardless of their own information or beliefs. This can result in the overvaluation of high-volatility assets and undervaluation of low-volatility ones, leading to a low-volatility risk premium. Numerous academic studies and historical analyses have documented the outperformance of low-volatility portfolios compared to their higher-risk counterparts. This outperformance has been observed across various market segments, regions, and time periods. Several factors have been proposed to explain the existence of the low-volatility risk premium, including: Market anomalies, or deviations from the expected relationship between risk and return, may contribute to the low-volatility risk premium. These anomalies can arise from behavioral biases, market inefficiencies, or other factors that cause asset prices to deviate from their fundamental values. Investor preferences for high-volatility assets, driven by factors such as overconfidence or the pursuit of "lottery-like" returns, can lead to the undervaluation of low-volatility assets and the subsequent low-volatility risk premium. Market segmentation, or the division of the market into subsegments with differing characteristics and investor bases, can result in the mispricing of assets and the emergence of a low-volatility risk premium. The low-volatility risk premium has been documented across various regions and markets, suggesting that it is a pervasive phenomenon. Comparisons to high-volatility strategies have also demonstrated the relative merits of low-volatility investing. Minimum variance portfolios aim to construct a portfolio with the lowest possible volatility by optimizing asset weights based on their historical or forecasted volatilities and correlations. This strategy seeks to benefit from the low-volatility risk premium by minimizing overall portfolio risk. Risk parity portfolios allocate capital to assets based on their contribution to overall portfolio risk, rather than their expected returns. This approach ensures that each asset contributes equally to portfolio risk, resulting in a more balanced and potentially less volatile portfolio. Smart-beta strategies combine elements of passive and active investing by tracking indices that emphasize specific factors, such as low volatility. These strategies aim to capture the low-volatility risk premium by providing exposure to a basket of low-volatility stocks while maintaining a systematic and rules-based approach. Factor-based investing involves targeting specific factors, such as low volatility, that have historically been associated with higher risk-adjusted returns. By overweighting low-volatility stocks in a portfolio, investors can seek to benefit from the low-volatility risk premium. Selecting stocks for a low-volatility portfolio typically involves identifying stocks with low historical or forecasted volatilities, low beta values, or other measures of risk. Various quantitative and qualitative factors, such as financial ratios, industry characteristics, and macroeconomic trends, can also be considered. Diversification is a key component of low-volatility portfolio construction, as it helps reduce idiosyncratic risk and improve risk-adjusted returns. Investors should consider diversifying across different sectors, industries, countries, and asset classes to mitigate the impact of individual stock or market events. Regular rebalancing is essential to maintain the desired risk profile of a low-volatility portfolio. Investors should establish a rebalancing frequency and methodology that aligns with their investment objectives and risk tolerance while minimizing transaction costs and taxes. Risk management plays a crucial role in low-volatility investing, as it helps ensure that portfolio risk remains within acceptable bounds. Investors should monitor and manage various risk factors, such as liquidity risk, concentration risk, and currency risk, to protect against potential losses. Evaluating the performance of low-volatility portfolios requires the use of risk-adjusted return metrics, such as the Sharpe ratio, Sortino ratio, and Information ratio. These metrics help investors assess the relationship between risk and return and compare the performance of different portfolios and investment strategies. Comparing the performance of a low-volatility portfolio to relevant benchmarks, such as broad market indices or other low-volatility strategies, can help investors determine the effectiveness of their investment approach and identify areas for improvement. Attribution analysis involves decomposing portfolio returns into various components to understand the sources of performance. This analysis can help investors identify the specific factors or investment decisions that contributed to the portfolio's performance and refine their investment strategy. Low-volatility investing offers several potential benefits, including: 1. Enhanced Risk-Adjusted Returns: By targeting low-volatility stocks, investors can potentially achieve higher risk-adjusted returns compared to traditional market capitalization-weighted portfolios. 2. Portfolio Diversification: Incorporating low-volatility strategies into a broader investment portfolio can help improve diversification and reduce overall portfolio risk. Despite its appealing characteristics, low-volatility investing also comes with certain limitations and risks, including: 1. Performance in Varying Market Conditions: Low-volatility strategies may underperform during strong bull markets, as high-volatility stocks may experience greater price appreciation in such conditions. 2. Potential for Underperformance: Although low-volatility strategies have historically exhibited higher risk-adjusted returns, there is no guarantee that this trend will continue in the future. Market conditions, investor behavior, and other factors can influence the performance of low-volatility portfolios. 3. Overcrowding and Capacity Constraints: As more investors become aware of the low-volatility risk premium and allocate capital to low-volatility strategies, the potential for overcrowding and capacity constraints increases. This could result in reduced future returns, increased correlations among low-volatility stocks, and diminished diversification benefits. The low-volatility risk premium represents a compelling opportunity for investors seeking to enhance risk-adjusted returns and improve portfolio diversification. Definition of Low-Volatility Risk Premium

Low-Volatility Risk Premium Theoretical Foundations

Efficient Market Hypothesis (EMH)

Modern Portfolio Theory (MPT)

Behavioral Finance

Overconfidence and Underreaction

Loss Aversion

Herding Behavior

Low-Volatility Risk Premium Empirical Evidence

Historical Performance of Low-Volatility Portfolios

Factors Contributing to the Low-Volatility Risk Premium

Market Anomalies

Investor Preferences

Market Segmentation

Global Perspective

Low-Volatility Investing Strategies

Minimum Variance Portfolios

Risk Parity Portfolios

Smart-Beta Strategies

Factor-Based Investing

Low-Volatility Risk Premium Portfolio Construction

Stock Selection Criteria

Diversification

Rebalancing Considerations

Risk Management

Low-Volatility Risk Premium Performance Evaluation

Risk-Adjusted Return Metrics

Benchmark Comparisons

Attribution Analysis

Low-Volatility Risk Premium Practical Applications and Limitations

Benefits of Low-Volatility Investing

3. Downside Protection: Low-volatility stocks may exhibit lower drawdowns during market downturns, providing investors with greater downside protection and potentially smoother investment returns.Limitations and Risks

Conclusion

By understanding the theoretical foundations, empirical evidence, investing strategies, and practical applications and limitations of the low-volatility risk premium, investors can make more informed decisions and better manage their portfolios.

As the investment landscape evolves, it is crucial for investors and portfolio managers to stay abreast of the latest research and trends related to the low-volatility risk premium and other alternative investment strategies.

Low-Volatility Risk Premium FAQs

The low-volatility risk premium refers to the observed phenomenon where lower-risk assets, typically characterized by low volatility, generate higher risk-adjusted returns compared to their high-risk counterparts. This concept challenges traditional finance theories and offers an alternative approach to investing.

Behavioral finance helps explain the low-volatility risk premium by examining the psychological factors that influence investors' decision-making processes. Key concepts in behavioral finance that contribute to the low-volatility risk premium include overconfidence, underreaction, loss aversion, and herding behavior, which can lead to the undervaluation of low-volatility assets and subsequent outperformance.

Several low-volatility investing strategies aim to capture the low-volatility risk premium, including minimum variance portfolios, risk parity portfolios, smart-beta strategies, and factor-based investing. These strategies seek to construct portfolios that emphasize low-volatility stocks or assets, which have historically exhibited higher risk-adjusted returns.

The benefits of investing based on the low-volatility risk premium include enhanced risk-adjusted returns, improved portfolio diversification, and better downside protection. However, there are also limitations and risks, such as potential underperformance during strong bull markets, the uncertainty of future returns, and the potential for overcrowding and capacity constraints.

Investors can evaluate the performance of a portfolio targeting the low-volatility risk premium using risk-adjusted return metrics such as the Sharpe ratio, Sortino ratio, and Information ratio. Additionally, comparing the portfolio's performance to relevant benchmarks and conducting attribution analysis can help investors assess the effectiveness of their investment approach and identify areas for improvement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.