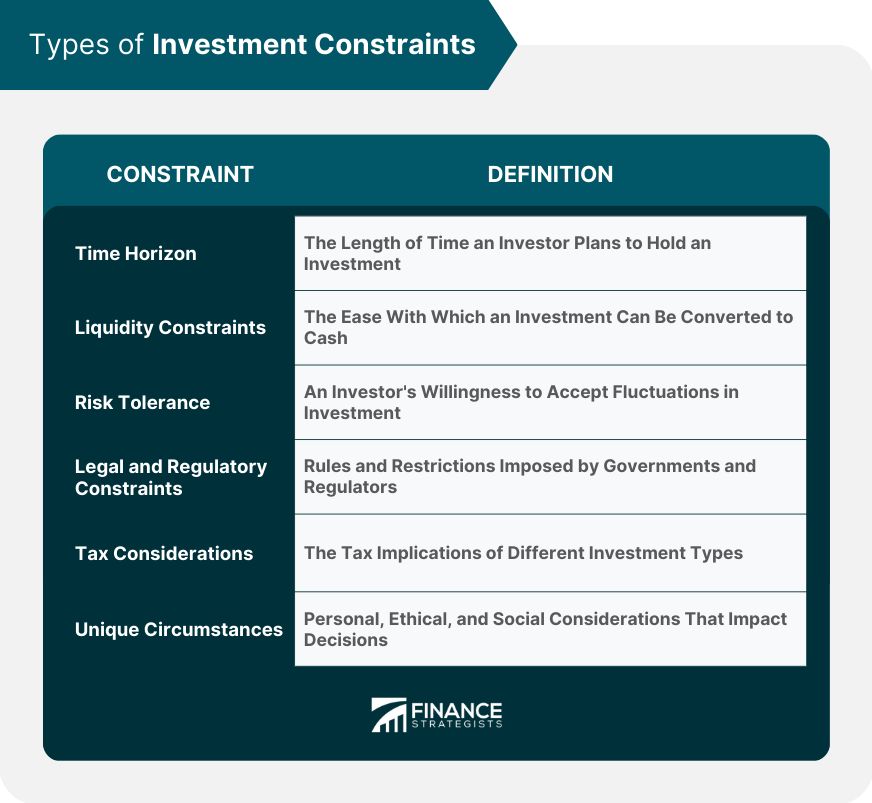

Investment constraints are restrictions or limitations that investors face when building and managing their investment portfolios. They can be both internal, relating to the investor's personal situation, and external, relating to market or regulatory conditions. Investment constraints play a significant role in shaping an investor's investment strategy. By considering these constraints, investors can make more informed decisions and better manage their investment risk. Understanding investment constraints is essential to create a tailored investment strategy. By considering these constraints, investors can optimize their portfolio to meet their financial objectives while minimizing risk exposure. Awareness of investment constraints allows investors to better navigate market conditions and make well-informed decisions. This knowledge can lead to improved investment performance and help investors achieve their long-term financial goals. The time horizon is the length of time an investor plans to hold an investment before needing to access the funds. It is an essential consideration when making investment decisions, as it impacts the types of investments and the level of risk an investor is willing to take. Short-term investments are designed to generate returns within a few months or years. These investments often carry higher risks but can provide substantial returns in a short period. Long-term investments, on the other hand, are held for several years or even decades. These investments tend to have lower risk levels and provide steady returns over time. Liquidity refers to the ease with which an investment can be converted to cash without significantly impacting its price. Investors should consider their liquidity needs when making investment decisions. Market liquidity refers to the ability of an investor to buy or sell an asset in the market without causing a significant price change. Investments with high market liquidity, such as stocks or bonds, can be easily converted to cash when needed. Investor liquidity, on the other hand, relates to the investor's ability to access their funds when needed. If an investor requires immediate access to their investment, they should prioritize more liquid assets. Risk tolerance is an investor's willingness to accept fluctuations in investment value. It is a crucial factor in determining the appropriate investment strategy and portfolio composition. Conservative investors have a low tolerance for risk and prefer investments with stable returns and low volatility. They often invest in government bonds, blue-chip stocks, and other low-risk assets. Aggressive investors have a high tolerance for risk and are willing to accept significant fluctuations in investment value. These investors typically pursue higher returns and invest in riskier assets, such as growth stocks, options, and commodities. Legal and regulatory constraints are rules and restrictions imposed by governments and regulatory authorities that can impact investment decisions. Investors must be aware of these constraints when constructing and managing their portfolios. Securities laws regulate the issuance, trading, and reporting of securities in the market. These laws are designed to protect investors and ensure fair and transparent markets. Investment regulations, such as restrictions on certain investment types or limits on leverage, can also impact an investor's ability to execute their investment strategy. Compliance with these regulations is crucial to avoid potential legal and financial consequences. Tax implications play a critical role in shaping an investor's investment strategy. Different investments have varying tax treatments, and investors should consider the tax consequences when selecting investments. Tax-deferred investments, such as retirement accounts or annuities, allow investors to defer taxes on gains until they withdraw the funds. This deferral can provide significant tax advantages and help boost long-term returns. Taxable investments, on the other hand, require investors to pay taxes on their gains in the year they are realized. These investments may have lower after-tax returns, but they offer more flexibility and access to funds when needed. Every investor has unique circumstances that can impact their investment decisions. These factors may include ethical or social considerations, as well as personal preferences. Ethical and social considerations involve investing in companies or industries that align with an investor's values. Some investors may choose to avoid certain industries or prioritize investments in companies with strong environmental, social, and governance (ESG) practices. Personal preferences can also shape an investor's investment strategy. For example, an investor may have a strong affinity for a particular industry or company, which influences their investment decisions. Diversification is a strategy that involves spreading investments across various asset classes, sectors, and regions to reduce risk. This approach can help investors manage their investment constraints more effectively. Asset allocation is the process of dividing a portfolio among different asset classes, such as stocks, bonds, and cash. By allocating assets strategically, investors can balance risk and return while considering their unique constraints. Investment styles, such as growth or value investing, can also play a role in diversification. By incorporating multiple investment styles into a portfolio, investors can further manage risk and potentially enhance returns. Portfolio rebalancing is a strategy that involves adjusting the weightings of assets in a portfolio to maintain a desired level of risk and return. This process can help investors manage their investment constraints over time. Periodic rebalancing involves reviewing and adjusting a portfolio at regular intervals, such as annually or quarterly. This approach allows investors to realign their portfolios with their investment objectives and constraints as market conditions change. Threshold rebalancing involves adjusting a portfolio when an asset's weighting deviates significantly from its target allocation. By rebalancing when thresholds are reached, investors can maintain a more consistent risk profile and better manage their investment constraints. Financial advisors play a critical role in helping clients identify and understand their investment constraints. By asking relevant questions and gathering information, advisors can gain insights into their clients' unique circumstances and constraints. Once a financial advisor has identified a client's constraints, they can create a customized investment strategy that addresses these limitations. This tailored approach allows clients to achieve their financial goals while managing risk effectively. A financial advisor's role doesn't end with creating an investment strategy. They must also monitor the client's portfolio and make adjustments as needed to ensure it continues to align with the client's constraints and objectives over time. Investment constraints are a critical consideration for investors when building and managing their investment portfolios. These constraints can be both internal and external and can significantly impact an investor's investment strategy. Understanding investment constraints is essential for creating a tailored investment strategy that meets an investor's financial objectives while minimizing risk exposure. Investment constraints can be categorized into different types, including time horizon, liquidity constraints, risk tolerance, legal and regulatory constraints, tax considerations, and unique circumstances. Each of these constraints requires a different approach to investment management to ensure optimal portfolio performance. Investors can adopt various strategies to manage their investment constraints, such as diversification and portfolio rebalancing. These strategies can help investors balance risk and return while considering their unique constraints. Financial advisors play a critical role in helping clients identify and address their investment constraints. By creating a customized investment strategy and continuously monitoring and adjusting it, financial advisors can help investors achieve their financial goals while managing risk effectively. In summary, investors must be aware of their investment constraints and seek expert advice to optimize their portfolio and achieve their long-term financial goals.Definition of Investment Constraints

Types of Investment Constraints

Time Horizon

Liquidity Constraints

Risk Tolerance

Legal and Regulatory Constraints

Tax Considerations

Unique Circumstances

Strategies for Managing Investment Constraints

Diversification

Portfolio Rebalancing

Role of Financial Advisors in Addressing Investment Constraints

Conclusion

Investment Constraints FAQs

Investment constraints are important because they help investors make informed decisions that align with their goals, risk tolerance, and financial situation.

There are several types of investment constraints, including liquidity, time horizon, tax considerations, regulatory requirements, and ethical considerations.

To develop an investment strategy that considers constraints, you need to identify and prioritize your investment goals, assess your risk tolerance, and determine the constraints that apply to your investment decisions.

Yes, investment constraints can be modified or removed over time as your financial situation changes or as new investment opportunities become available. However, it is important to consider the potential impact of these changes on your overall investment strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.