Infrastructure risk premium refers to the extra return an investor expects for investing in infrastructure assets compared to other, less risky assets. It compensates for the specific risks associated with these types of investments, such as political, regulatory, and construction risks. The importance of infrastructure risk premium lies in its influence on investment decisions. Investors need to understand the risk-return trade-offs when allocating capital to infrastructure projects, ensuring that the potential rewards justify the risks involved. Several factors contribute to the infrastructure risk premium, each presenting unique challenges and uncertainties to investors. Understanding these factors can help investors make more informed decisions and better assess the risks and potential rewards of infrastructure investments. Political risk is a significant factor contributing to the infrastructure risk premium. It refers to the risk of changes in government policies or instability that may affect the investment's profitability. Political risk can arise due to social unrest, war, or nationalization of assets. Regulatory risk is another factor contributing to the infrastructure risk premium. It refers to the risk of changes in laws, regulations, or policies that may impact the investment's profitability. Regulatory risk can arise due to changes in environmental or safety regulations, licensing requirements, or tariff structures. Construction risk refers to the risks associated with the construction of infrastructure assets, such as cost overruns, delays, or quality issues. Construction risk is a crucial factor contributing to the infrastructure risk premium as it can significantly impact the project's financial performance and overall profitability. Operational risk refers to the risks associated with the operation and maintenance of infrastructure assets, such as equipment failure, accidents, or supply chain disruptions. Operational risk is another factor contributing to the infrastructure risk premium as it can impact the asset's revenue streams and overall financial performance. Financial risk refers to the risks associated with financing infrastructure assets, such as interest rate risk, currency risk, or liquidity risk. Financial risk is a critical factor contributing to the infrastructure risk premium as it can impact the project's cost of capital and overall profitability. Environmental risk refers to the risks associated with the environmental impact of infrastructure assets, such as air pollution, water pollution, or greenhouse gas emissions. Environmental risk is another factor contributing to the infrastructure risk premium as it can lead to additional costs, legal liabilities, or reputational damage. Technological risk refers to the risks associated with the use of technology in infrastructure assets, such as cybersecurity risks or obsolescence. Technological risk is a crucial factor contributing to the infrastructure risk premium as it can impact the asset's safety, security, or reliability. There are various methods for measuring infrastructure risk premium, both quantitative and qualitative. Historical data analysis involves examining historical performance data of infrastructure assets to estimate future performance. Monte Carlo simulations involve generating random variables and running simulations to estimate the likelihood of different outcomes. Expert opinions involve seeking input from industry experts to identify potential risks and estimate the likelihood and impact of those risks. Risk rating systems involve assigning scores to different risk factors based on their perceived likelihood and impact. Infrastructure risk premium plays a significant role in asset pricing, as it affects the expected return on infrastructure investments. Traditional asset pricing models like the Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT) provide a foundation for understanding the relationship between risk and return. CAPM, for example, suggests that an asset's expected return is determined by its sensitivity to market risk and the risk-free rate. However, the model may not fully capture the unique risks associated with infrastructure investments, necessitating adjustments or alternative models. The Infrastructure Asset Pricing Model (IAPM) is one such alternative, which considers infrastructure-specific risk factors in addition to the traditional market risk factors. This model can help investors better estimate the required return on infrastructure assets by accounting for the infrastructure risk premium. In the context of portfolio management, infrastructure risk premium plays a crucial role in determining asset allocation and diversification strategies. Investors must weigh the potential benefits and risks of including infrastructure assets in their portfolios. A well-diversified portfolio can help reduce the overall risk, as the performance of different assets may not be perfectly correlated. Including infrastructure assets in a portfolio can offer diversification benefits, as these investments may exhibit different risk-return characteristics than traditional assets like stocks and bonds. However, it's essential to understand the infrastructure risk premium when determining the optimal allocation of capital to infrastructure investments. A thorough assessment of the risk-return trade-offs can help investors make informed decisions on how much capital to allocate to infrastructure projects, while balancing the potential rewards against the associated risks. Effective mitigation and management of infrastructure risk premium can lead to more attractive investment opportunities and better risk-adjusted returns for investors. Several strategies and tools can be employed to manage and reduce the risk premium associated with infrastructure investments. Public-private partnerships (PPPs) are one approach to mitigating infrastructure risk premium. By sharing the risks and rewards of infrastructure projects between public and private entities, PPPs can help distribute the risks more evenly and potentially reduce the risk premium required by investors. Risk sharing mechanisms, such as guarantees or revenue-sharing agreements, can also help mitigate the infrastructure risk premium. These mechanisms can provide investors with a degree of protection against specific risks, making infrastructure investments more attractive and potentially reducing the required risk premium. Insurance and hedging instruments are another way to manage infrastructure risk premium. Investors can use these tools to transfer specific risks, such as construction or operational risks, to third parties. By reducing the overall risk exposure, investors may be more willing to accept a lower risk premium on infrastructure investments. Finally, due diligence and monitoring play a crucial role in managing the infrastructure risk premium. Conducting thorough due diligence before investing and continuously monitoring infrastructure projects can help investors identify and address potential risks early, reducing the likelihood of negative outcomes and potentially lowering the risk premium. Understanding and properly assessing the infrastructure risk premium is essential for investors and policymakers alike. It helps investors make informed decisions about allocating capital to infrastructure projects and managing their portfolios, while policymakers can use this understanding to design policies and frameworks that attract investment and promote sustainable infrastructure development. By effectively managing and mitigating the infrastructure risk premium, investors can unlock the potential of infrastructure investments and contribute to long-term economic growth and prosperity.Definition of Infrastructure Risk Premium

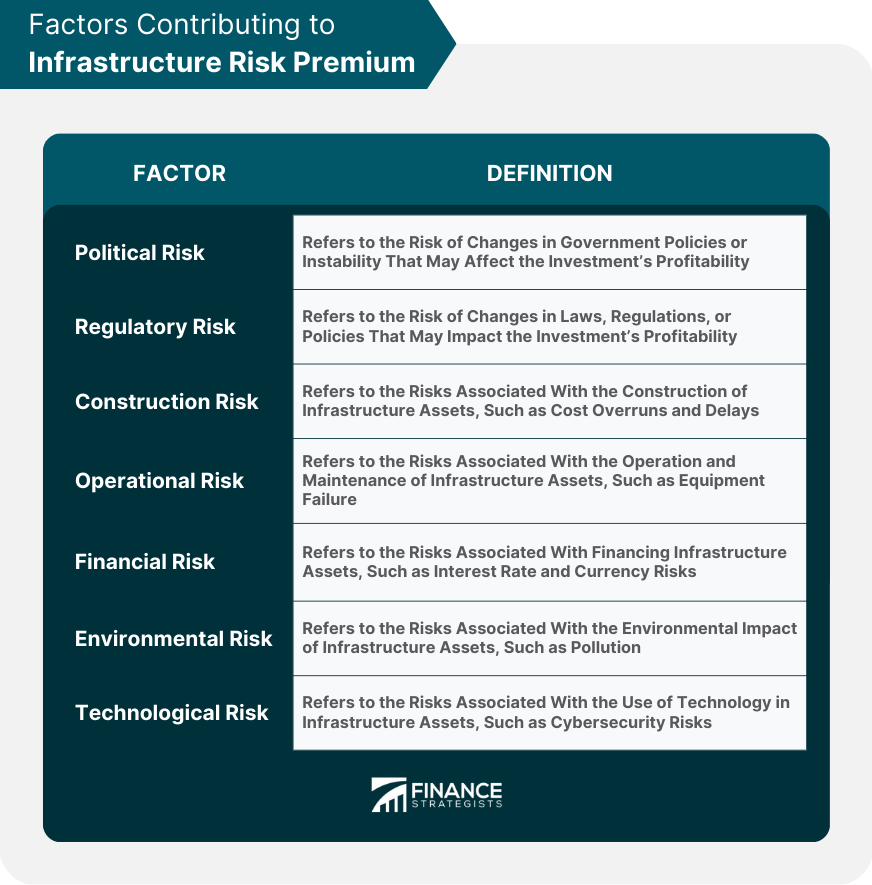

Factors Contributing to Infrastructure Risk Premium

Political Risk

Regulatory Risk

Construction Risk

Operational Risk

Financial Risk

Environmental Risk

Technological Risk

Measuring Infrastructure Risk Premium

Historical Data Analysis

Monte Carlo Simulations

Expert Opinions

Risk Rating Systems

The Impact of Infrastructure Risk Premium on Asset Pricing

Infrastructure Risk Premium in Portfolio Management

Mitigation and Management of Infrastructure Risk Premium

Conclusion

Infrastructure Risk Premium FAQs

Infrastructure risk premium is the additional return required by investors to compensate for the risk of investing in infrastructure assets.

The infrastructure risk premium is influenced by factors such as political stability, regulatory environment, project complexity, and the level of competition in the market.

The infrastructure risk premium is measured by calculating the difference between the expected return on a risk-free investment and the expected return on an infrastructure investment.

The infrastructure risk premium is crucial in determining the appropriate return on investment for infrastructure assets and in evaluating the risks associated with infrastructure investments.

No, the infrastructure risk premium varies depending on the type of asset, such as transportation, energy, or water infrastructure, as well as the country and region where the investment is made.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.