Trading strategies refer to a set of techniques and approaches used by traders to make informed decisions about buying, selling, or holding financial assets such as stocks, bonds, commodities, or currencies. These strategies aim to maximize profits and minimize risks by analyzing market trends, assessing financial statements, and using mathematical models and statistical methods. Trading strategies are an essential aspect of the investment process and are often customized to the investor's financial goals, risk tolerance, and time horizon. The primary purpose of different trading strategies is to help investors make informed investment decisions based on a systematic approach. Trading strategies provide investors with a framework to evaluate market conditions, identify investment opportunities, and execute trades accordingly. By using a trading strategy, investors can reduce the impact of emotions and biases on their investment decisions and rely on objective data and analysis. Moreover, trading strategies enable investors to manage their portfolio risk effectively, ensure diversification, and achieve consistent returns over time. There are different types of trading strategies that investors can use to achieve their financial goals. These strategies can be broadly classified into five categories: fundamental, technical, quantitative, options and forex trading. Fundamental trading strategies are based on the analysis of a company's financial and economic data. These strategies aim to identify undervalued or overvalued stocks and invest in them based on their intrinsic value. Technical trading strategies are based on the analysis of market data such as price movements, trading volume, and other indicators. These strategies aim to identify patterns and trends in the market and make investment decisions based on them. These trading strategies are based on mathematical and statistical models and algorithms. These strategies aim to identify patterns and signals in market data and make investment decisions based on them. In this investment strategy, the investor engages in buying and selling options contracts that grant them the right to buy or sell an underlying asset at a pre-decided price and time, but not an obligation to do so. Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in the global foreign exchange market. Forex trading is one of the most liquid markets in the world, with a daily turnover of over $7.5 trillion. There are four types of fundamental trading strategies: Value investing involves buying stocks that are undervalued based on their financial statements and other data. Value investors believe that the market is inefficient and that stocks can be mispriced for a variety of reasons. On the other hand, growth investing centers on investing in companies with high potential for growth and expansion. Growth investors look for companies with strong earnings growth and high revenue growth rates. This involves buying stocks that pay high dividends and provide a regular income stream. Income investors are often retirees or other individuals who are looking for a steady source of income from their investments. This strategy focuses on investing in companies with a history of consistently paying dividends to their shareholders. Dividend investors are looking for companies that have a solid track record of paying dividends, even during difficult economic times. Technical trading strategies involve analyzing market data, such as price movements and trading volume, to identify patterns and trends: The first strategy under this category involves investing in assets that are trending upward or downward based on their historical performance. Trend followers believe that trends tend to continue and that assets that are trending will continue to perform well in the future. Momentum trading involves investing in assets that have recently shown strong price movements, with the expectation that the trend will continue. Momentum traders believe that assets that have recently performed well are likely to continue to do so. This involves buying and holding stocks for a short period, typically a few days to a few weeks, to take advantage of short-term price fluctuations. Swing traders believe that stocks tend to swing up and down in the short term and that they can profit by buying at the bottom of the swing and selling at the top. This strategy involves buying and selling stocks within the same trading day, targeting to profit from small price movements. Day traders use technical analysis and other tools to identify short-term trading opportunities and make rapid trades to take advantage of them. The list below are the three types of quantitative trading: This involves using powerful computers and algorithms to buy and sell stocks at high speeds, aiming to profit from small price movements. High-frequency traders often hold their positions for only a few seconds or less. The strategy involves using pre-programmed instructions to execute trades automatically, based on specific market conditions or data. Algorithmic traders can use a variety of strategies, including mean reversion, trend following, and statistical arbitrage. This involves identifying and exploiting pricing discrepancies between related assets or markets, based on statistical analysis. Statistical arbitrage traders use mathematical models and statistical tools to identify relationships between different securities and profit from any resulting mispricings. The four types of options trading strategies are long call, short call, long put, and short put. The strategy involves buying a call option with the expectation that the price of the underlying asset will increase. If the price of the asset does increase, the investor can exercise the option and buy the asset at the strike price, then sell it at the higher market price to realize a profit. The short call strategy involves selling a call option with the expectation that the price of the underlying asset will decrease. If the price of the asset does decrease, the investor can keep the premium received for selling the option. This involves buying a put option with the expectation that the price of the underlying asset will decrease. If the price of the asset does decrease, the investor can exercise the option and sell the asset at the strike price, then buy it back at the lower market price to realize a profit. The short put strategy involves selling a put option with the expectation that the price of the underlying asset will increase. If the price of the asset does increase, the investor can keep the premium received for selling the option. Forex trading is the buying and selling currencies in the global foreign exchange market. The trend trading strategy involves identifying and following trends in currency pairs and taking positions based on them. Trend traders aim to profit from the continued movement of a currency pair in the same direction. Another strategy is range trading. This involves buying at the lower end and selling at the upper end of a trading range. Range traders aim to profit from the cyclical movements of a currency pair within a specific price range. This involves identifying and trading currency pairs that break out of a trading range. Breakout traders aim to profit from the sudden movement of a currency pair in one direction after a period of consolidation. The carry trade involves buying a currency with a higher interest rate and selling a currency with a lower interest rate to profit from the interest rate differential. Carry traders aim to profit from the difference in interest rates between two currencies, and they often hold their positions for an extended period. Choosing the right trading strategy is crucial for any investor looking to achieve their financial goals. The choice of strategy depends on several factors, including the investor's investment objectives, risk tolerance, and time horizon. For instance, a value investor might prefer fundamental trading strategies that focus on analyzing a company's financial statements to determine its intrinsic value. Conversely, a momentum trader might prefer technical trading strategies that identify patterns and trends in market data to make investment decisions. Investors should also consider the potential risks and rewards of each trading strategy before making a decision. Some trading strategies, such as high-frequency trading and statistical arbitrage, involve significant risks and require specialized knowledge and skills. On the other hand, options trading and dividend investing can offer lower risks and more predictable returns but may require a longer time horizon. Ultimately, investors should choose a trading strategy that aligns with their investment objectives, risk tolerance, and time horizon while also considering the potential risks and rewards of each strategy. Investors who are unsure of which trading strategy to choose or are looking for professional guidance may benefit from wealth management services. Seeking professional advice can also help investors avoid costly mistakes and make more informed investment decisions. Trading strategies are essential tools for investors seeking to achieve their financial goals and manage their investment risk effectively. There are several types of trading strategies, including fundamental, technical, quantitative, options, and forex trading strategies. Each trading strategy offers investors unique opportunities and challenges, and investors should carefully consider their investment objectives, risk tolerance, and time horizon when choosing a trading strategy. Furthermore, investors should seek professional advice and rely on objective data and analysis rather than emotions and biases when making investment decisions. Choosing the right trading strategy is crucial for any investor looking to achieve their financial goals. By choosing the right trading strategy, investors can maximize their returns and achieve long-term financial success while managing their investment risk effectively. It is crucial for investors to choose a trading strategy that aligns with their investment objectives.Definition of Trading Strategies

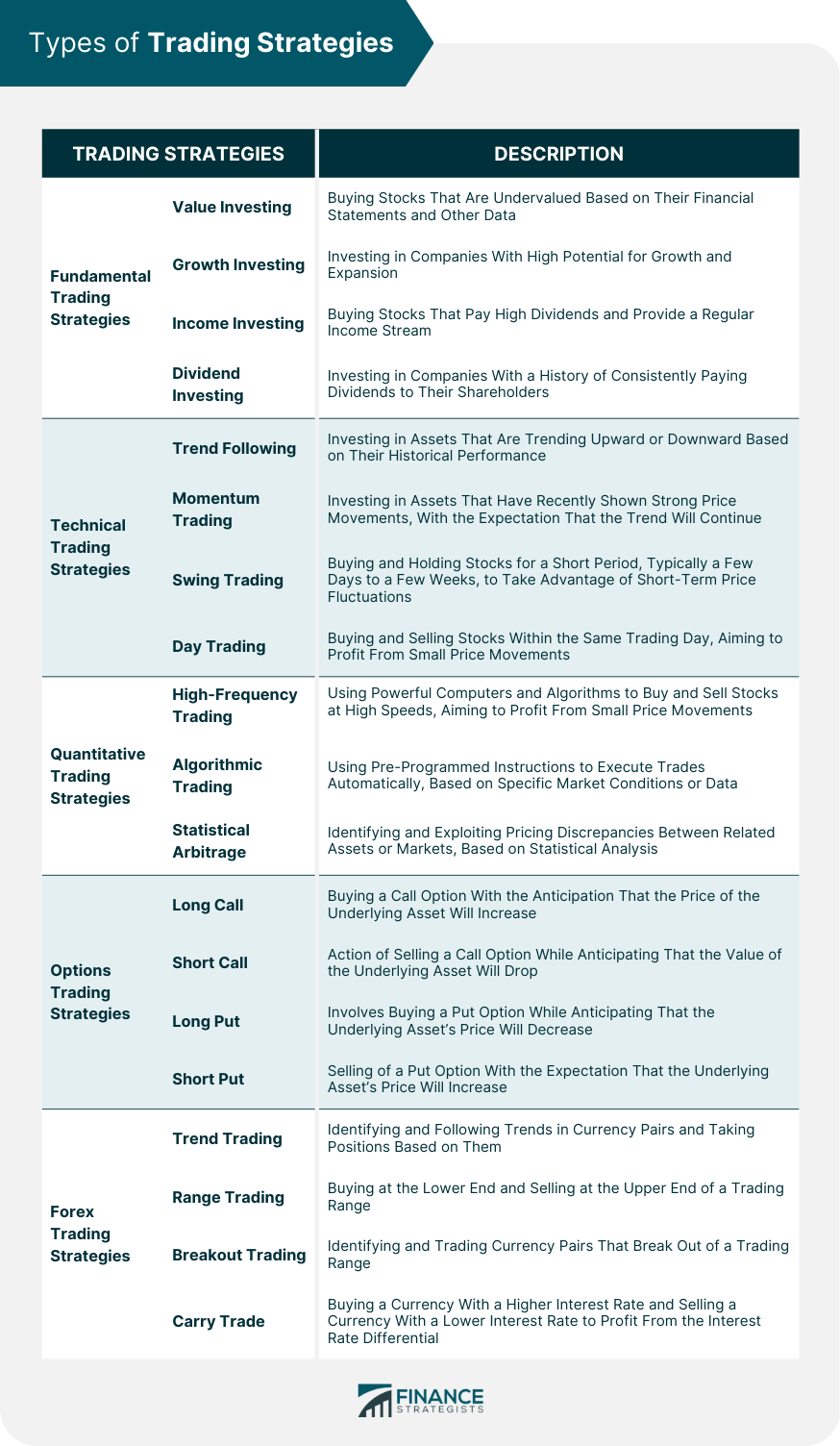

Types of Trading Strategies

Fundamental Trading Strategies

Technical Trading Strategies

Quantitative Trading Strategies

Options Trading

Forex Trading

Fundamental Trading Strategies

Value Investing

Growth Investing

Income Investing

Dividend Investing

Technical Trading Strategies

Trend Following

Momentum Trading

Swing Trading

Day Trading

Quantitative Trading Strategies

High-Frequency Trading

Algorithmic Trading

Statistical Arbitrage

Options Trading Strategies

Long Call

Short Call

Long Put

Short Put

Forex Trading Strategies

Trend Trading

Range Trading

Breakout Trading

Carry Trade

Which Trading Strategy Is for You?

Final Thoughts

Types of Trading Strategies FAQs

The different types of trading strategies include fundamental, technical, quantitative, options, and forex trading strategies.

Choosing the right trading strategy depends on several factors, including your investment objectives, risk tolerance, and time horizon. You should also consider the potential risks and rewards of each trading strategy before making a decision.

Fundamental trading strategies analyze a company's financial and economic data to determine its intrinsic value and invest based on that information, while technical trading strategies analyze market data, such as price movements and trading volume, to identify patterns and trends and make investment decisions based on them.

Wealth management professionals can help you develop a personalized investment plan based on your unique circumstances and investment objectives, and provide ongoing advice and support to help you achieve your financial goals. Seeking professional advice can also help you avoid costly mistakes and make more informed investment decisions.

No, trading strategies are not guaranteed to be successful. The stock market is inherently unpredictable, and there is always a risk of losing money, regardless of the trading strategy used. However, using a well-researched and tested trading strategy can help investors manage their risk and increase their chances of success over the long term. It is crucial to approach trading with a long-term perspective and not to make emotional decisions based on short-term market fluctuations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.