Portfolio management involves the selection of various investments, such as stocks, bonds, and other securities, that fit within an investor's overall investment strategy. These investments are chosen with the aim of achieving specific investment goals, which may vary between investors. One common goal for investors is to generate income from their portfolios. Portfolio income strategies are investment techniques that are designed to provide a steady stream of income to investors while managing risk. These strategies can be particularly attractive to investors who rely on their investments to generate regular income, such as retirees or individuals with fixed expenses. Income-generating investments are those that provide a regular stream of income to investors. These investments can include bonds, dividend-paying stocks, real estate, and other assets that generate cash flow. Investors can choose to invest in a single asset class or a mix of different income-generating investments to diversify their portfolio and manage risk. Several factors should be considered when selecting income-generating investments, including the current economic and market conditions, the creditworthiness of the issuer, the yield and duration of the investment, and the investor's risk tolerance and investment goals. While generating income is an essential goal for many investors, it is important to balance income generation with risk management. High-yielding investments may come with higher risk, and investors must evaluate the tradeoff between risk and return. It is essential to diversify income-generating investments across different asset classes to reduce risk and increase the chances of achieving optimal returns. Dividend investing is a strategy in which investors focus on investing in stocks that pay dividends. Dividends are a portion of a company's profits paid to shareholders as a cash payment or additional shares of stock. Dividend-paying stocks can provide a regular stream of income to investors and may offer lower volatility compared to growth stocks. Fixed income investing involves investing in debt securities that pay a fixed rate of interest, such as bonds or Treasury securities. Fixed-income investments provide a steady stream of income to investors and can provide stability to a portfolio. However, fixed-income investments come with interest rate risk, and investors must evaluate the impact of changing interest rates on their portfolios. Real estate investing involves investing in properties, such as rental properties, to generate income. Real estate investments can provide a regular stream of income to investors and offer diversification benefits compared to traditional investments. However, real estate investments come with liquidity and market risk, and investors must evaluate the impact of these risks on their portfolios. Investors must evaluate portfolio income strategies based on the risk and return characteristics of the investments. While high-yielding investments may provide a higher return, they come with higher risk, and investors must evaluate the tradeoff between risk and return. The evaluation of portfolio income strategies should be based on the investor's investment goals, risk tolerance, and time horizon. Investors must evaluate portfolio income strategies based on their investment goals and risk tolerance. The evaluation should consider factors such as the investor's need for income, the length of time the investor can hold the investment, and the investor's tolerance for market volatility. The evaluation should also consider the impact of changing market conditions on the portfolio's income stream. Investors must regularly rebalance their portfolio income strategies to ensure that they align with their investment goals and risk tolerance. Rebalancing involves adjusting the portfolio's allocation to different asset classes to maintain the desired balance between income generation and risk management. Investors must establish clear investment objectives and select income-generating investments that align with their investment goals and risk tolerance. The selection process should consider factors such as the current market and economic conditions, the creditworthiness of the issuer, the yield and duration of the investment, and the investor's tolerance for market volatility. Diversification is an essential component of portfolio income strategies as it helps to reduce risk and increase the chances of achieving optimal returns. Investors should consider diversifying their income-generating investments across different asset classes, such as stocks, bonds, and real estate, to minimize risk and increase the chances of achieving a steady stream of income. Investors must create a comprehensive income strategy that outlines their investment goals, risk tolerance, and the mix of income-generating investments in their portfolio. The income strategy should be regularly reviewed and updated to ensure that it aligns with the investor's investment goals and risk tolerance. Portfolio income strategies are subject to market risk and fluctuations, which can impact the portfolio's income stream. The market risk can be attributed to factors such as changes in interest rates, inflation, and economic conditions. Investors must evaluate the impact of these risks on their portfolios and adjust their income strategies accordingly. Economic and political risks can impact the performance of income-generating investments. Factors such as changes in government policies, geopolitical tensions, and natural disasters can impact the economy and financial markets, affecting the portfolio's income stream. Interest rate risk is a significant risk for fixed-income investments. Changes in interest rates can impact the value of fixed-income investments, and investors must evaluate the impact of changing interest rates on their portfolio's income stream. Portfolio income strategies play a crucial role in investment decision-making as they enable investors to achieve their investment goals while managing risk. The selection of income-generating investments should be based on the investor's investment goals, risk tolerance, and current market and economic conditions. Portfolio income strategies are closely linked to asset allocation, as the allocation of investments across different asset classes determines the portfolio's income stream and risk. Investors must evaluate the impact of asset allocation on their portfolio's income stream and adjust their income strategies accordingly. Portfolio income strategies should be incorporated into risk assessments to evaluate the portfolio's exposure to risk and the impact of changing market and economic conditions on the portfolio's income stream. By incorporating portfolio income strategies into risk assessments, investors can make informed decisions about the composition of their portfolios and the level of risk they are willing to take. Portfolio income strategies are investment techniques that provide a steady stream of income to investors while managing risk. Income-generating investments can include bonds, dividend-paying stocks, real estate, and other assets that generate cash flow. When selecting income-generating investments, investors should consider factors such as current economic and market conditions, the creditworthiness of the issuer, the yield and duration of the investment, and their risk tolerance and investment goals. Portfolio income strategies include dividend investing, fixed income investing, and real estate investing. Investors must evaluate these strategies based on their risk and return characteristics, investment goals, and risk tolerance. Additionally, investors must regularly review and update their income strategies to ensure that they align with their investment goals and risk tolerance.Portfolio Income Strategies Overview

Understanding Portfolio Income Strategies

Types of Income-Generating Investments

Factors to Consider When Selecting Income-Generating Investments

Balancing Income Generation and Risk Management

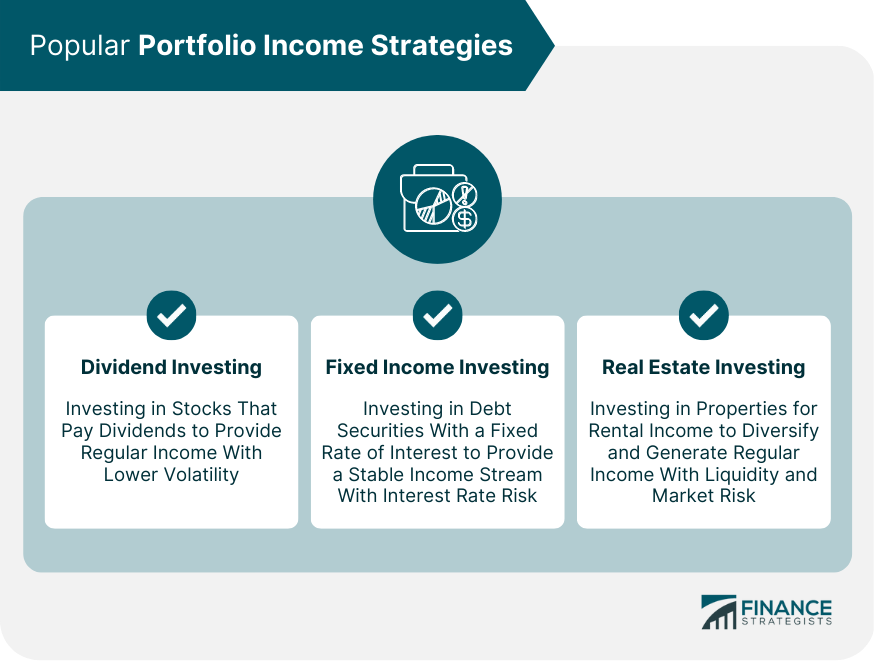

Popular Portfolio Income Strategies

Dividend Investing

Fixed Income Investing

Real Estate Investing

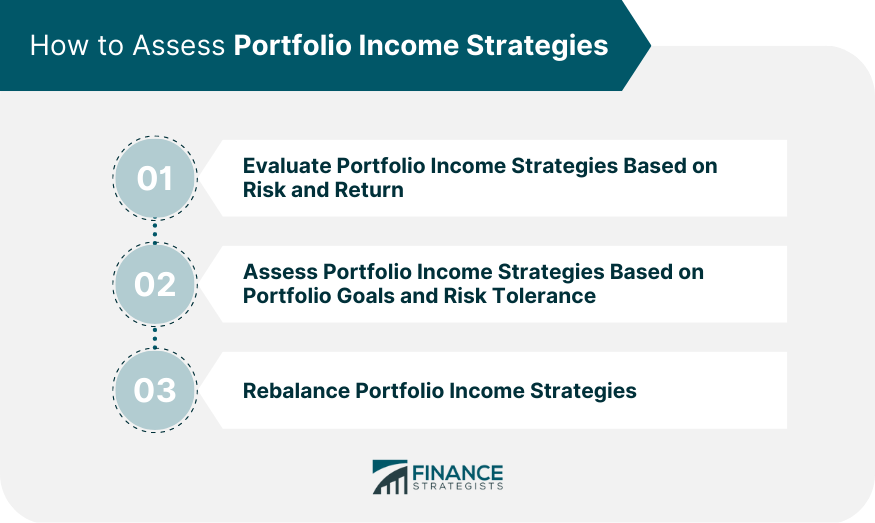

Assessing Portfolio Income Strategies

Evaluating Portfolio Income Strategies Based on Risk and Return

Assessing Portfolio Income Strategies Based on Portfolio Goals and Risk Tolerance

Rebalancing Portfolio Income Strategies

Implementing Portfolio Income Strategies

Establishing Investment Objectives and Selecting Income-Generating Investments

Diversifying Income-Generating Investments

Creating a Comprehensive Income Strategy for a Portfolio

Limitations and Challenges of Portfolio Income Strategies

Market Risk and Fluctuations

Economic and Political Risk

Interest Rate Risk

Portfolio Income Strategies and Investment Decision-making

Role of Portfolio Income Strategies in Investment Decision-making

Portfolio Income Strategies and Asset Allocation

Incorporating Portfolio Income Strategies in Risk Assessments

Conclusion

Portfolio Income Strategies FAQs

Portfolio income strategies are investment techniques designed to provide a steady stream of income to investors while managing risk. These strategies involve investing in income-generating assets, such as dividend-paying stocks, fixed-income securities, and real estate, to generate regular income for investors.

You can assess the effectiveness of your portfolio income strategies by evaluating them based on risk and return, portfolio goals and risk tolerance, and by regularly rebalancing your portfolio to ensure it aligns with your investment goals. It is important to regularly review and update your income strategy to ensure it remains relevant to your investment objectives.

Portfolio income strategies are subject to market risk and fluctuations, economic and political risks, and interest rate risk. Investors must evaluate the impact of these risks on their portfolio's income stream and adjust their income strategies accordingly.

To implement portfolio income strategies, you must establish clear investment objectives, select income-generating investments that align with your investment goals and risk tolerance, and diversify your income-generating investments across different asset classes to reduce risk. It is essential to create a comprehensive income strategy for your portfolio that outlines your investment goals and the mix of income-generating investments in your portfolio.

Portfolio income strategies play a crucial role in investment decision-making as they enable investors to achieve their investment goals while managing risk. The selection of income-generating investments should be based on the investor's investment goals, risk tolerance, and the current market and economic conditions. By incorporating portfolio income strategies into risk assessments, investors can make informed decisions about the composition of their portfolios and the level of risk they are willing to take.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.