Long-short equity investing is a popular strategy involving taking long positions in some stocks and short positions in others. The primary goal of this strategy is to generate returns regardless of whether the overall market is going up or down. Long-short equity investing is often used by hedge funds and institutional investors but can also be employed by individual investors willing to take on a higher level of risk. There are several components in long-short equity investing, including the following: Long positions are a critical component of the long-short equity investing strategy. A long position involves buying stocks with the expectation that their value will increase. When investors take a long position, they expect the stock price to increase, allowing them to sell the stock at a higher price than they initially purchased. One example of a long position is when an investor buys an undervalued stock or has good growth potential. The investor believes that the stock price will increase in the future, and they will sell the stock at a profit. Another example of a long position is when an investor buys a stock that pays dividends. The investor expects to receive regular dividend payments, which can provide additional income and contribute to the overall returns. Short positions are another crucial component of the long-short equity investing strategy. A short position involves borrowing stocks and selling them in the hope that their value will decrease and then buying them back at a lower price to make a profit. Short positions allow investors to profit from declining stock prices. One example of a short position is when an investor short-sells a stock that is overvalued or has poor growth potential. The investor expects the stock price to decrease, allowing them to buy the stock back at a lower price and make a profit. Another example of a short position is when an investor short sells stock of a company in a declining industry. The investor expects the stock price to decrease as the industry declines, allowing them to buy the stock back at a lower price. In long-short equity investing, an investor takes a long position in stocks that are expected to perform well and a short position in stocks that are expected to underperform. The investor expects the stocks they are long in to increase in value, allowing them to sell the stock at a profit. At the same time, the investor expects the stocks they are short on to decrease in value, allowing them to repurchase the stock at a lower price and make a profit. There are several advantages and disadvantages involved in long-short equity investing. One of the main advantages of long-short equity investing is that it allows investors to generate returns regardless of whether the overall market is going up or down. This strategy can also hedge against market volatility, as short positions can help offset losses from long positions. Additionally, long-short equity investing can offer diversification benefits by allowing investors to invest in different sectors and industries. One of the main disadvantages of long-short equity investing is that it can be a complex and risky investment strategy. The use of leverage and short selling can magnify losses, potentially leading to significant losses for investors. Additionally, implementing long-short equity investing can be challenging, requiring significant research and analysis to identify the right stocks to invest in. Long-short equity investing can be implemented using various strategies, including fundamental analysis, technical analysis, and quantitative analysis. Fundamental analysis involves analyzing a company's financial statements, management, and industry trends to determine its intrinsic value. Investors using fundamental analysis will typically invest in stocks that are undervalued or have good growth potential and short stocks that are overvalued or have poor growth potential. Technical analysis involves analyzing past market data to identify patterns and trends. Investors using technical analysis will typically use charts and other tools to identify buy and sell signals and make investment decisions based on these signals. Quantitative analysis involves using mathematical models and statistical methods to identify investment opportunities. Before engaging in long-short equity investing, investors need to consider several factors to manage risk and ensure that they can achieve their investment goals. One critical factor to consider before engaging in long-short equity investing is risk management. Investors need to understand the risks associated with the investment strategy and develop a plan to manage these risks. Risk management can involve diversifying investments, setting stop-loss orders, and monitoring portfolio performance regularly. Another important factor to consider before engaging in long-short equity investing is market conditions. Market conditions can impact the success of long-short equity investing, and investors need to understand how to adjust their investment strategy to changing market conditions. For example, in a bull market, long positions may be more successful, while in a bear market, short positions may be more successful. Performance metrics are another critical factor to consider before engaging in long-short equity investing. Investors need to develop metrics to measure portfolio performance, such as return on investment, volatility, and correlation with the overall market. These metrics can help investors assess the effectiveness of their investment strategy and make necessary adjustments to optimize returns. Investors using quantitative analysis will typically use algorithms to identify buy and sell signals and make investment decisions based on these signals. Investors implementing long-short equity investing must choose the right brokerage, build a long-short equity portfolio, and regularly monitor and adjust the portfolio. One critical component of implementing long-short equity investing is choosing the right brokerage. When selecting a brokerage, investors need to consider factors such as trading fees, research tools, and margin requirements. Investors implementing long-short equity investing must build a portfolio that aligns with their investment goals and risk tolerance. A well-diversified portfolio should include stocks from different sectors and industries and a mix of long and short positions. Investors implementing long-short equity investing must monitor their portfolios regularly and make adjustments to optimize returns. This can involve adjusting long and short positions based on changing market conditions, managing risk, and optimizing performance metrics. Long-short equity investing is a complex and potentially lucrative investment strategy that can provide diversification benefits and a hedge against market volatility. However, it is a high-risk investment strategy that requires careful implementation and ongoing monitoring to optimize returns and minimize risks. Before engaging in long-short equity investing, it is crucial to consider factors such as risk management, market conditions, and performance metrics. By choosing the right brokerage, building a diversified long-short equity portfolio, and monitoring and adjusting the portfolio regularly, investors can optimize their returns and minimize risks. To ensure that your long-short equity investment strategy is implemented correctly, it is recommended that you seek the services of a wealth management professional. A wealth manager can provide valuable guidance and expertise in developing an investment strategy that aligns with your goals and risk tolerance.Definition of Long-Short Equity Investing

Components of Long-Short Equity Investing

Long Positions

Short Positions

How Long-Short Equity Investing Works

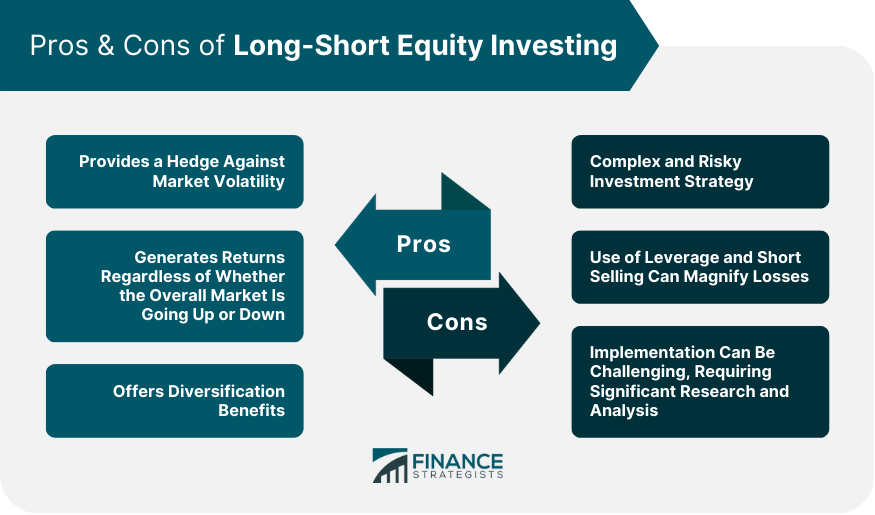

Pros & Cons of Long-Short Equity Investing

Pros of Long-Short Equity Investing

Cons of Long-Short Equity Investing

Long-Short Equity Investing Strategies

Fundamental Analysis

Technical Analysis

Quantitative Analysis

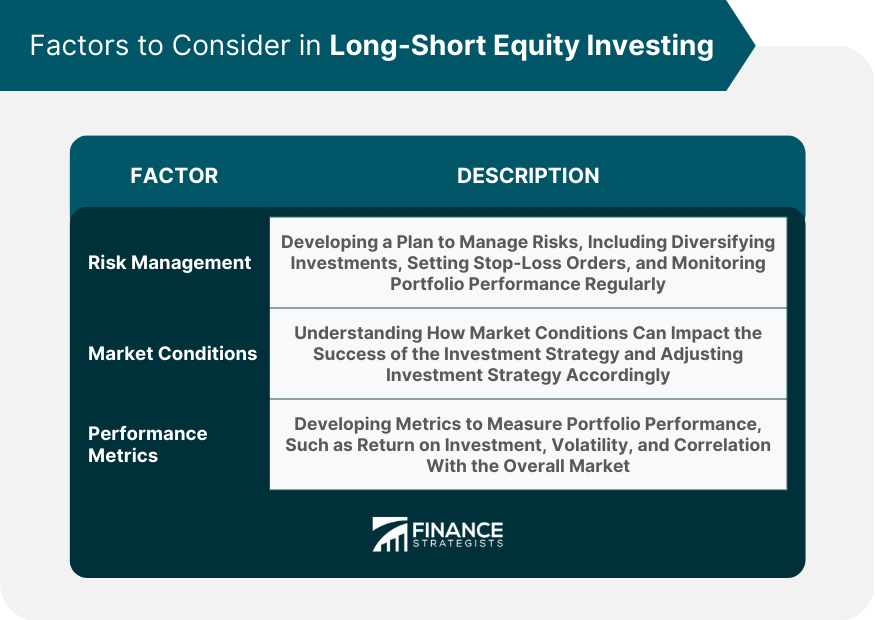

Factors to Consider in Long-Short Equity Investing

Risk Management

Market Conditions

Performance Metrics

Long-Short Equity Investing Implementation

Choosing the Right Brokerage

Building a Long-Short Equity Portfolio

Monitoring and Adjusting the Portfolio

Final Thoughts

Long-Short Equity Investing FAQs

Long-short equity investing is a strategy that involves taking long positions in some stocks and short positions in others, with the primary goal of generating returns regardless of whether the overall market is going up or down.

Yes, long-short equity investing is a high-risk investment strategy that requires careful implementation and ongoing monitoring to optimize returns and minimize risks. The use of leverage and short selling can magnify losses, potentially leading to significant losses for investors.

Investors can manage the risks associated with long-short equity investing by diversifying their investments, setting stop-loss orders, and monitoring portfolio performance regularly.

Before engaging in long-short equity investing, investors must consider risk management, market conditions, and performance metrics.

It is recommended to seek the services of a wealth management professional when engaging in long-short equity investing to ensure that your investment strategy is implemented correctly. A wealth manager can provide valuable guidance and expertise in developing an investment strategy that aligns with your goals and risk tolerance, helping you achieve your financial objectives and build a more secure financial future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.