Herding behavior refers to the tendency of investors or traders to follow the actions of their peers, rather than making independent decisions based on their own analysis and information. In other words, investors tend to buy or sell assets simply because others are doing so, rather than because of any fundamental analysis or market research. This can lead to the formation of market bubbles or crashes, as the herd mentality can cause prices to rise or fall rapidly and unpredictably. Herding behavior is often driven by emotions such as fear, greed, and panic, and can be exacerbated by the availability of real-time information and social media, which can amplify the actions of the herd. Herding behavior can be seen in a variety of financial markets, including stocks, bonds, and commodities. It is important for investors to be aware of this behavior and to avoid making decisions based solely on the actions of others. Instead, investors should focus on their own analysis and risk tolerance when making investment decisions. The wealth-management and investment-management industries are responsible for managing the financial assets of individuals, institutions, and corporations. These industries play a crucial role in allocating capital, providing investment advice, and managing risk on behalf of clients. As such, understanding the impact of herding behavior in these industries is essential for both investors and financial professionals. Understanding herding behavior is vital because it can lead to suboptimal investment decisions, market inefficiencies, and financial instability. By recognizing the causes and consequences of herding behavior, investors, wealth managers, and investment managers can develop strategies to mitigate its effects and make more informed decisions. An informational cascade occurs when individuals rely on the decisions or opinions of others, rather than their own information, leading to a snowball effect of actions or beliefs. For example, if investors observe others buying a particular stock, they may assume that those investors have more information and follow suit, regardless of their own analysis. Informational cascades can lead to herding behavior and create market inefficiencies by causing investors to make decisions based on the actions of others rather than their own independent analysis. This can result in overvalued or undervalued assets and increased market volatility. Peer pressure and conformity can cause investors to adopt the investment strategies or decisions of their peers, even when they disagree with those choices. This desire to conform can be driven by a fear of being perceived as deviant or a desire to maintain social standing. Reputation and career concerns can also drive herding behavior, particularly among professional money managers. These individuals may be more likely to follow the crowd to protect their careers or maintain their reputation, as being wrong in a group is often perceived as less risky than being wrong alone. The availability heuristic is a cognitive bias that causes individuals to rely on readily available information rather than seeking out all relevant data. This can lead to herding behavior, as investors may base decisions on recent news or the actions of others, rather than conducting thorough analysis. Confirmation bias occurs when individuals selectively search for, interpret, and remember information that confirms their pre-existing beliefs. This can contribute to herding behavior, as investors may be more likely to follow the crowd if it aligns with their existing opinions. Overconfidence can lead to herding behavior, as investors who overestimate their abilities may be more likely to follow the crowd, believing that they can identify trends and predict market movements. Several empirical studies have provided evidence of herding behavior in the wealth-management and investment-management industries. These studies have found that mutual funds, pension funds, and other institutional investors often exhibit herding behavior, particularly during periods of market uncertainty or volatility. Herding behavior has been implicated in the formation of market bubbles and crashes, such as the dot-com bubble in the late 1990s and the global financial crisis of 2008. These events were characterized by excessive optimism, speculation, and a widespread abandonment of fundamental analysis in favor of following the crowd. Copycat investing, or the practice of mimicking the investment strategies of successful investors, can also contribute to herding behavior. Investment consultants and financial advisors may unknowingly perpetuate herding by recommending similar investments to their clients, leading to a concentration of capital in certain assets. Herding behavior can reduce market efficiency and hinder the price discovery process by causing asset prices to diverge from their fundamental values. When investors follow the crowd rather than conducting independent analysis, mispriced assets may persist for longer periods, leading to market distortions. As mentioned earlier, herding behavior can contribute to the formation of asset bubbles, wherein the prices of certain assets become significantly overvalued. When these bubbles eventually burst, they can result in substantial losses for investors and create ripple effects throughout the financial system. Herding behavior can increase systemic risk and threaten financial stability by causing investors to concentrate their holdings in particular assets or sectors. This concentration of risk can exacerbate market downturns and lead to widespread financial contagion in the event of a crisis. Diversification is a key strategy for mitigating the effects of herding behavior. By spreading investments across a wide range of assets and sectors, investors can reduce their exposure to the risks associated with following the crowd. Contrarian investing involves taking positions that are opposite to the prevailing market sentiment or the actions of the majority of investors. By adopting a contrarian approach, investors can potentially capitalize on mispriced assets created by herding behavior. Understanding the psychological and behavioral factors that contribute to herding behavior is essential for mitigating its effects. Investor education and the study of behavioral finance can help investors recognize and overcome the cognitive biases that drive herding behavior. An effective regulatory framework and strong corporate governance can help mitigate the risks associated with herding behavior by promoting transparency, accountability, and the adoption of sound risk management practices. The dot-com bubble of the late 1990s was characterized by widespread herding behavior, as investors poured money into technology stocks with little regard for their fundamental value. When the bubble burst, many investors experienced significant losses, and the broader market was adversely affected. The global financial crisis of 2008 was another example of herding behavior, as investors and financial institutions engaged in excessive risk-taking and speculation in the housing market. The subsequent collapse of the market led to a severe economic downturn and highlighted the dangers of following the crowd. The growing popularity of passive investing, which involves investing in broad market indices through vehicles like exchange-traded funds (ETFs), has raised concerns about potential herding behavior. Some argue that the rise of passive investing could lead to a concentration of capital in certain assets, exacerbating market volatility and systemic risk. Herding behavior is a pervasive phenomenon in the wealth-management and investment-management industries, driven by factors such as informational cascades, social influences, and cognitive biases. This behavior can have significant consequences for financial markets, including reduced efficiency, asset mispricing, and increased systemic risk. Recognizing and addressing herding behavior is crucial for investors, wealth managers, and investment managers, as it can help them make more informed decisions and mitigate the risks associated with following the crowd. By understanding the causes and consequences of herding behavior, financial professionals can develop strategies to counteract its effects, such as diversification, contrarian investing, and investor education. Further research is needed to better understand the dynamics of herding behavior and its impact on financial markets. This research can help inform the development of policies, regulations, and investment strategies that mitigate the risks associated with herding behavior. Additionally, financial professionals must remain vigilant in monitoring market trends and investor sentiment to identify potential instances of herding and take appropriate action to protect their clients and the broader financial system.Definition of Herding Behavior

Overview of Wealth-Management and Investment-Management Industries

Importance of Understanding Herding Behavior in These Industries

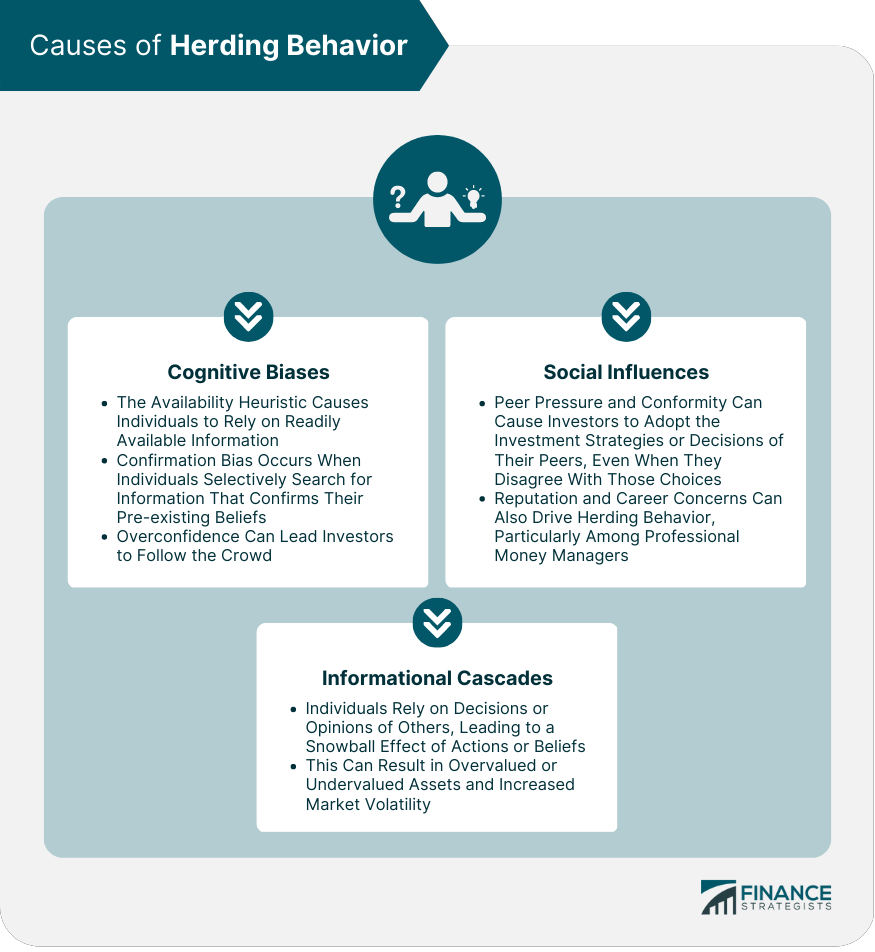

Causes of Herding Behavior

Informational Cascades

Social Influences

Peer Pressure and Conformity

Reputation and Career Concerns

Cognitive Biases

Availability Heuristic

Confirmation Bias

Overconfidence

Evidence of Herding Behavior in Wealth Management

Empirical Studies and Findings

Market Bubbles and Crashes

Copycat Investing and the Role of Investment Consultants

Impact of Herding Behavior on Financial Markets

Market Efficiency and Price Discovery

Asset Mispricing and Bubbles

Systemic Risk and Financial Stability

Strategies to Mitigate Herding Behavior

Diversification

Contrarian Investing

Behavioral Finance and Investor Education

Improved Regulatory Framework and Corporate Governance

Case Studies

Herding During the Dot-Com Bubble

The Global Financial Crisis of 2008

The Rise of Passive Investing and Its Potential Effects

Conclusion

Summary of Key Findings

The Importance of Recognizing and Addressing Herding Behavior

Future Research and Industry Implications

Herding Behavior FAQs

Herding behavior in wealth management is a phenomenon in which investors follow the investment decisions of their peers or other market participants, rather than making independent decisions based on their own analysis.

Herding behavior in wealth management can occur due to several reasons, such as information asymmetry, cognitive biases, fear of missing out (FOMO), and the desire to conform with others in the market.

Herding behavior in wealth management can lead to market inefficiencies, increased volatility, and reduced diversification. It can also result in suboptimal investment decisions, as investors may ignore fundamental analysis in favor of following the crowd.

To avoid herding behavior in wealth management, investors should focus on fundamental analysis and long-term investment objectives, rather than short-term market movements. Diversification, disciplined portfolio rebalancing, and a contrarian investment approach can also help reduce the impact of herding behavior.

Herding behavior in wealth management can sometimes be beneficial, such as in situations where market participants have limited information and following the crowd can reduce the risk of making a bad investment decision. However, excessive herding behavior can be harmful and lead to market bubbles or crashes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.