Default Investment Alternatives (DIAs) are pre-selected investment options chosen by a retirement plan's sponsor or fiduciary. They serve as the default choice for plan participants who do not actively select their own investments within the plan. The purpose of DIAs is to simplify the investment decision-making process for plan participants and encourage long-term investing. DIAs play a crucial role in ensuring that participants' retirement savings are invested in a diversified and professionally managed portfolio, even if they do not actively engage in the investment process. DIAs are commonly used in employer-sponsored retirement plans, such as 401(k), 403(b), and 457 plans, where participants have the option to allocate their contributions among various investment choices. If participants do not make an active investment selection, their contributions are automatically directed into the plan's DIA. Target-Date Funds (TDFs) are mutual funds that automatically adjust their asset allocation over time, becoming more conservative as the investor approaches the target retirement date. They are designed to provide a diversified and age-appropriate investment solution for plan participants, making them a popular choice as a DIA. Balanced funds are mutual funds that invest in a mix of stocks, bonds, and other assets, maintaining a predetermined asset allocation. These funds provide a diversified investment option that aims to achieve long-term growth while managing risk, making them suitable as a DIA for retirement plans. Managed accounts are personalized investment portfolios managed by professional investment managers on behalf of plan participants. As a DIA, managed accounts can offer tailored asset allocation and investment strategies based on the participant's individual risk tolerance, time horizon, and financial goals. Diversification is an essential factor to consider when selecting a DIA, as it can help reduce overall portfolio risk and enhance long-term returns. A well-diversified DIA should include a mix of asset classes, such as stocks, bonds, and cash, and may also incorporate alternative investments. Risk tolerance and time horizon are critical considerations in selecting a suitable DIA. The chosen DIA should align with the plan's participants' risk tolerance and investment time horizon, providing an appropriate balance between growth potential and risk management. Fees and expenses are important factors to consider when selecting a DIA, as they can significantly impact long-term investment returns. Plan sponsors and fiduciaries should carefully evaluate the fees and expenses associated with potential DIAs and select cost-effective options that offer value to plan participants. Plan sponsors and fiduciaries are responsible for selecting a suitable Default Investment Alternative for their retirement plan participants. This involves evaluating various investment options, considering factors such as diversification, risk tolerance, time horizon, and fees to determine the most appropriate DIA for the plan. It is essential for plan sponsors and fiduciaries to regularly monitor and evaluate the performance of the selected DIA. This helps ensure that the investment option continues to meet the plan's objectives and remains aligned with the best interests of plan participants. Plan sponsors and fiduciaries should clearly communicate information about the DIA to plan participants. This includes providing educational materials, performance updates, and any changes to the DIA, ensuring that participants remain informed about their investment options. DIAs simplify the investment decision-making process for plan participants, offering a professionally managed investment option without requiring active engagement from the participant. DIAs benefit from professional management, which can help optimize investment returns and manage risk more effectively than individual investors might achieve on their own. DIAs encourages long-term investing, providing a suitable investment option for plan participants who may be less knowledgeable about investment strategies or who lack the time to actively manage their retirement portfolios. DIAs may not fully address the unique investment needs and preferences of individual plan participants, as they offer a one-size-fits-all solution. Some DIAs may not be the best investment option for certain plan participants, potentially leading to suboptimal investment outcomes. DIAs may have higher fees and expenses compared to other investment options, which can impact long-term investment returns. Personalizing retirement investment strategies involves assessing individual risk tolerance and financial goals to create a tailored investment plan that meets each participant's unique needs. Plan participants should regularly review and adjust their investment choices to ensure their portfolios remain aligned with their risk tolerance, financial goals, and market conditions. Seeking advice from financial professionals can help plan participants make informed decisions about their retirement investment strategies and better understand the potential risks and rewards associated with different investment options. Default Investment Alternatives play a crucial role in retirement plans, providing a simplified and professionally managed investment option for plan participants who do not actively select their own investments. It is essential for plan participants to understand the advantages and disadvantages of DIAs and to make informed decisions about their retirement investment strategies. Plan participants are encouraged to seek personalized investment advice to ensure their retirement portfolios are tailored to their individual risk tolerance, financial goals, and investment preferences. Partnering with professional wealth management services can help plan participants optimize their retirement investment strategies, navigate complex investment decisions, and achieve long-term financial success. Reach out to a trusted wealth management advisor today to enhance your retirement planning experience.What Is Default Investment Alternative?

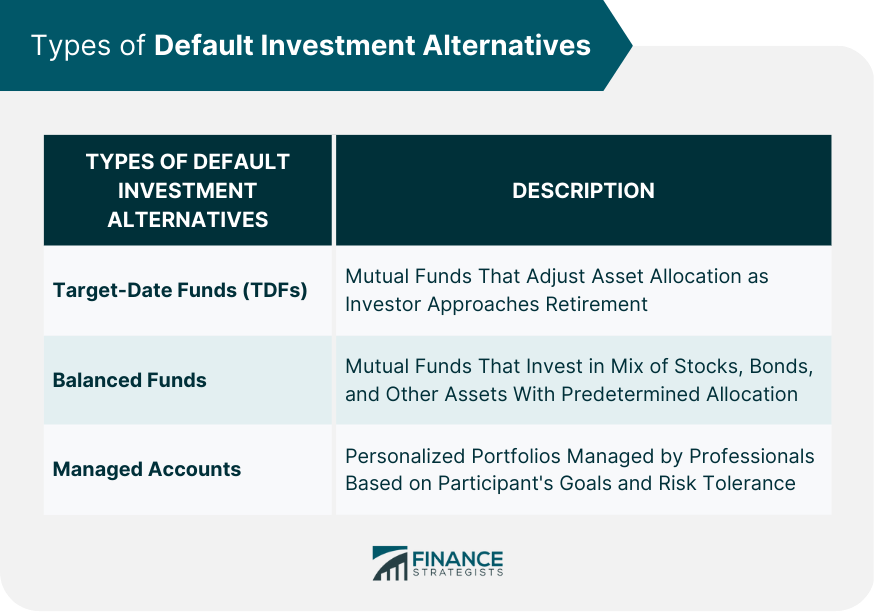

Types of Default Investment Alternatives

Target-Date Funds

Balanced Funds

Managed Accounts

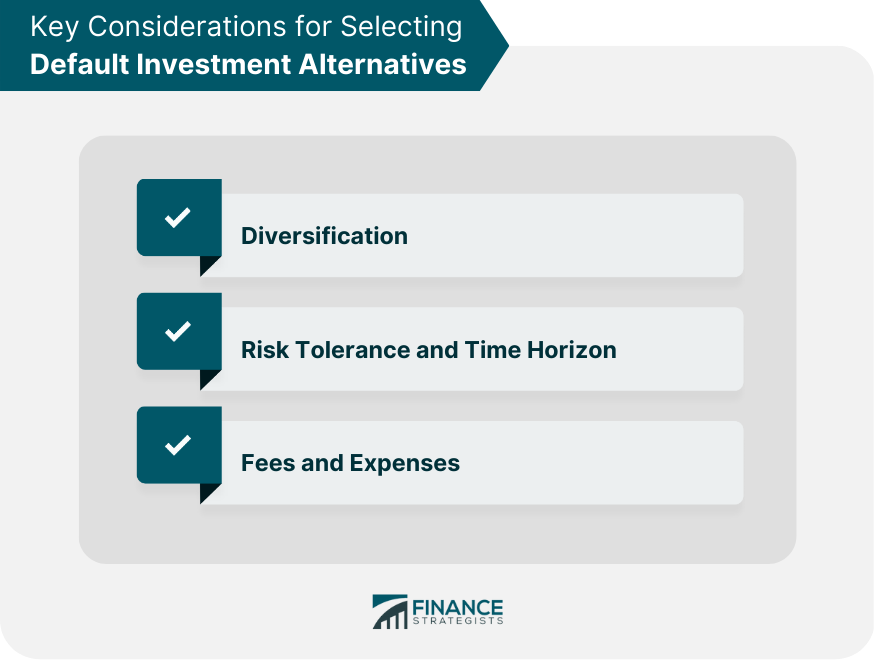

Key Considerations for Selecting Default Investment Alternatives

Diversification

Risk Tolerance and Time Horizon

Fees and Expenses

Role of Plan Sponsors and Fiduciaries

Choosing a Default Investment Alternative

Monitoring and Evaluating Investment Performance

Communicating with Plan Participants

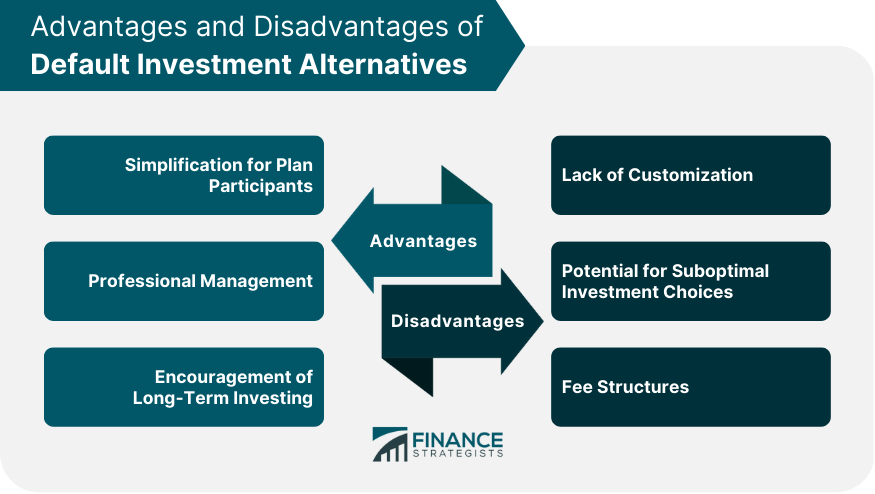

Advantages of Default Investment Alternatives

Simplification for Plan Participants

Professional Management

Encouragement of Long-Term Investing

Disadvantages of Default Investment Alternatives

Lack of Customization

Potential for Suboptimal Investment Choices

Fee Structures

Importance of Personalizing Retirement Investment Strategies

Assessing Individual Risk Tolerance and Goals

Regularly Reviewing and Adjusting Investment Choices

Consulting with Financial Professionals

Final Thoughts

Default Investment Alternative FAQs

A Default Investment Alternative (DIA) is a pre-selected investment option that serves as the default choice for plan participants who do not actively select their own investments within the plan.

The three types of Default Investment Alternatives are Target-Date Funds (TDFs), Balanced Funds, and Managed Accounts.

The key considerations when selecting a DIA include diversification, risk tolerance, and time horizon, and fees and expenses.

Plan sponsors and fiduciaries are responsible for selecting a suitable DIA for their retirement plan participants, monitoring and evaluating investment performance, and communicating with plan participants.

Advantages of DIAs include simplification for plan participants, professional management, and encouragement of long-term investing. Disadvantages include lack of customization, potential for suboptimal investment choices, and fee structures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.