Investment research and analysis are essential components of the finance industry. Two main types of analysts, buy-side and sell-side, work to provide investment recommendations and insights to investors. The primary difference between the two is their clients. Buy-side analysts work for institutional investors such as mutual funds, pension funds, and hedge funds, while sell-side analysts work for investment banks and brokerage firms and provide investment recommendations to individual investors. Buy-side analysts work for institutional investors such as mutual funds, pension funds, and hedge funds. Their primary goal is to provide investment recommendations to their clients to help them achieve their financial goals. These analysts typically identify undervalued securities to add to their client's portfolios. The job responsibilities of a buy-side analyst involve conducting extensive research to identify investment opportunities. They examine companies and analyze their financial statements to determine their valuation and growth potential. Buy-side analysts also evaluate market trends and economic indicators to help predict the performance of different asset classes. Examples of buy-side firms include Fidelity Investments, BlackRock, and The Vanguard Group. These firms manage large pools of assets for institutional clients and individual investors. These firms have a long-term investment horizon, and their goal is to generate returns for their clients by investing in undervalued securities. Sell-side analysts work for investment banks and brokerage firms. Their primary goal is to provide recommendations to their clients to help them make informed investment decisions. They usually focus on evaluating companies and industries to identify investment opportunities for their clients. Sell-side analysts’ responsibilities involve analyzing companies and industries to identify investment opportunities for their clients. They produce research reports that provide investment recommendations based on their analysis. Sell-side analysts also meet with company management teams to gather information and insights into their business operations. JPMorgan Chase, Goldman Sachs, and Morgan Stanley are examples of sell-side firms. These companies offer investment banking, sales, and trading services to institutional and individual clients. Sell-side analysts provide research reports to their clients to help them make informed investment decisions. Buy-side and sell-side analysts have contrasting research focus, client bases, compensation, work-life balance, and career paths. Buy-side analysts typically classify undervalued securities to add to their client's portfolios. They analyze companies and industries to identify investment opportunities to generate long-term returns for their clients. Sell-side analysts, on the other hand, scrutinize companies and industries. They produce research reports that provide investment guidance based on their analysis of the companies they cover. Buy-side analysts work for mutual funds, pension funds, and hedge funds. Their clients are institutional investors who have a long-term investment horizon and are focused on generating returns for their client's portfolios. Sell-side analysts work for investment banks and brokerage firms. Their clients are typically individual investors who have a shorter investment horizon and are looking for investment opportunities that will generate short-term returns. The compensation structure for buy-side and sell-side analysts is also different. Buy-side analysts typically receive a salary and a bonus based on the performance of the funds they manage. Sell-side analysts are compensated based on the revenue generated by the firm they work for. Buy-side analysts typically work fewer hours than sell-side analysts since their focus is on long-term investments. Sell-side analysts may work longer hours, including evenings and weekends, to provide timely research to their clients. Buy-side analysts may eventually move up to portfolio management roles or executive positions within the firms they work for. Sell-side analysts may become research directors or investment bankers. Buy-side and sell-side analysts are two different types of financial analysts that work in the investment industry. The following are the pros and cons of buy-side analysts: Work directly for investment firms, hedge funds, or other institutional investors, so they have a closer relationship with clients and can provide more personalized advice Focus on long-term investment strategies and the potential of a company's growth rather than short-term gains, which can lead to higher returns for clients Have access to proprietary information and data that is not publicly available, which can give them an edge in making investment decisions Have a broader perspective on the market as they cover a range of industries and companies, which can provide a more diversified investment portfolio Generally, have more stable and predictable work hours compared to sell-side analysts May have less access to management teams and industry experts, which can limit the depth of their research May have less exposure to the market as they primarily focus on managing client portfolios rather than trading securities May have limited career advancement opportunities as they are usually part of a larger investment firm or institution The following are the pros and cons of sell-side analysts: Work directly for investment banks or brokerage firms, so they have direct access to clients who are looking to buy or sell securities, which can provide more immediate feedback on their analysis Have more frequent interaction with management teams and industry experts, which can provide more in-depth insights and a better understanding of company operations Have access to a wider range of resources and research tools, which can allow them to produce more detailed reports May have more opportunities for career advancement as they can eventually move up to higher positions in the investment bank or brokerage firm May be more focused on short-term gains rather than long-term investment strategies, which can lead to higher volatility and lower returns for clients May be subject to conflicts of interest as they work for a firm that may have a vested interest in promoting certain securities or investment strategies May have more unpredictable and stressful work hours due to the fast-paced nature of the industry Overall, the choice between buy-side and sell-side analyst roles will depend on an individual's career goals, personal preferences, and work style. When choosing between buy-side and sell-side analysis, there are several factors to consider. One of the main considerations is the type of client you want to work for. If you prefer working with institutional clients and have a long-term investment horizon, then the buy-side analysis may be a better fit for you. If you prefer working with individual clients and have a shorter investment horizon, then the sell-side analysis may be a better fit. Another factor to consider is your skill set. Buy-side analysts typically have strong analytical skills and are excellent at identifying undervalued securities. Sell-side analysts, on the other hand, need strong communication skills to convey their recommendations effectively. Understanding the differences between buy-side and sell-side analysts is crucial for anyone interested in pursuing a career in finance or investing. Buy-side analysts focus on providing investment recommendations to institutional clients with a long-term investment horizon, while sell-side analysts provide investment recommendations to individual investors with a shorter investment horizon. When choosing between buy-side and sell-side analysis, factors to consider include the type of client you want to work for, your skill set, and the differences in compensation, research focus, and work-life balance associated with each. Consult a financial advisor or wealth management professional for additional information on buy-side and sell-side analysts. Their personal experience and expertise can guide you in choosing between the two.Buy-Side vs Sell-Side Analysts: Overview

Buy-Side Analysts

Sell-Side Analysts

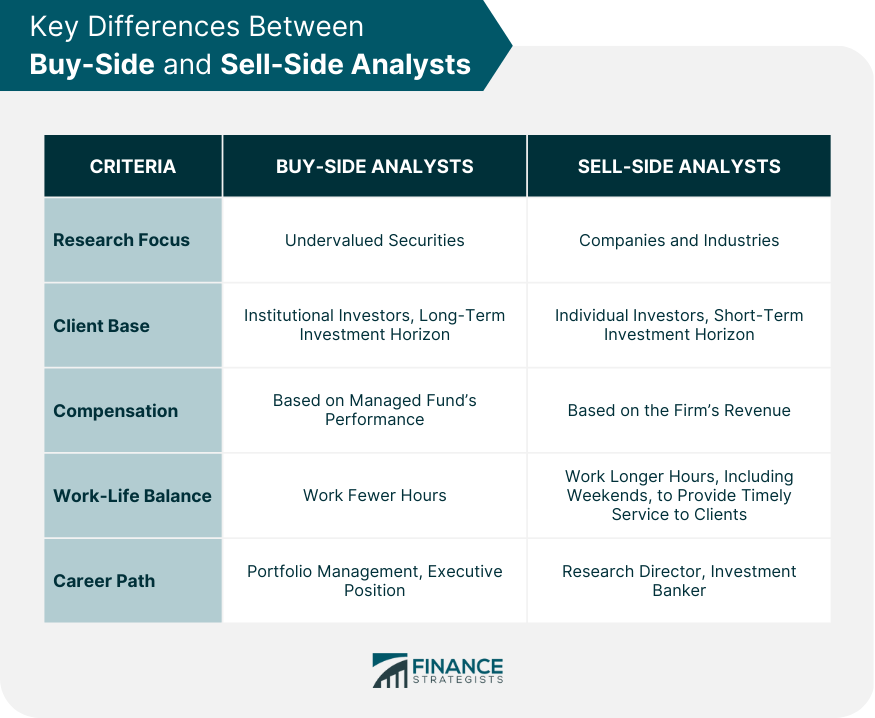

Key Differences Between Buy-Side and Sell-Side Analysts

Research Focus

Client Base

Compensation

Work-Life Balance

Career Paths

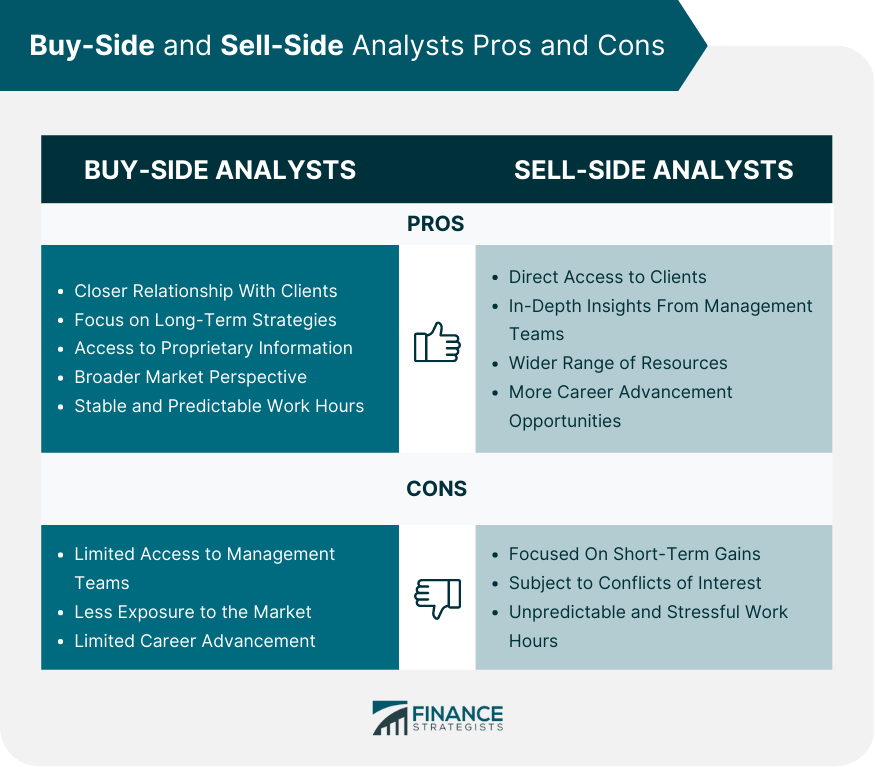

Buy-Side and Sell-Side Analysts' Pros and Cons

Buy-Side Analysts

Buy-Side Analysts Pros

Buy-Side Analysts Cons

Sell-Side Analysts

Sell-Side Analysts Pros

Sell-Side Analysts Cons

Which One Is Right for You?

The Bottom Line

Buy-Side vs Sell-Side Analysts FAQs

The main difference between buy-side and sell-side analysts is their clients. Buy-side analysts work for institutional investors such as mutual funds, pension funds, and hedge funds, while sell-side analysts work for investment banks and brokerage firms and provide investment recommendations to individual investors.

The job responsibilities of buy-side analysts involve conducting extensive research to identify investment opportunities. They analyze companies and their financial statements to determine their valuation and growth potential. Buy-side analysts also evaluate market trends and economic indicators to help predict the performance of different asset classes.

The job responsibilities of sell-side analysts involve analyzing companies and industries to identify investment opportunities for their clients. They produce research reports that provide investment recommendations based on their analysis. Sell-side analysts also meet with company management teams to gather information and insights into their business operations.

Buy-side analysts typically work for institutional investors such as mutual funds, pension funds, and hedge funds.

Sell-side analysts typically work for investment banks and brokerage firms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.