Arbitrage is the process of simultaneously buying and selling the same asset or security in different markets to take advantage of price discrepancies. It is a key component of financial markets, as it helps ensure that prices remain efficient and fair. In the world of finance, arbitrage is a commonly used strategy to capitalize on price differences. Traders and investors exploit these differences to generate risk-free profits while maintaining a neutral market position. Arbitrage strategies serve a crucial role in maintaining efficient markets. They help to ensure that asset prices accurately reflect their true value, thereby minimizing the potential for market manipulation or distortion. Moreover, arbitrage strategies contribute to market liquidity and price stability. By taking advantage of price discrepancies, arbitrageurs create a more balanced and stable market environment, which is beneficial for all market participants. Spatial arbitrage involves exploiting price differences in different locations or markets. This can include geographic price differences and currency arbitrage, where traders capitalize on exchange rate discrepancies. Geographic price differences can arise due to various factors, such as transportation costs, taxes, and regional supply and demand imbalances. Currency arbitrage, on the other hand, involves trading currencies with the aim of profiting from exchange rate differences between different currency pairs. Temporal arbitrage focuses on exploiting price differences that exist at different points in time. This can include time-specific price differences, as well as seasonal and cyclical arbitrage strategies. Time-specific price differences may result from short-term market inefficiencies or temporary supply and demand imbalances. Seasonal and cyclical arbitrage strategies involve capitalizing on predictable price patterns that occur due to seasonal factors or economic cycles. Statistical arbitrage employs mathematical models and statistical techniques to identify and exploit price discrepancies. Pairs trading and mean reversion strategies are two common types of statistical arbitrage. Pairs trading involves identifying and trading two highly correlated assets, with the expectation that their price relationship will revert to its historical average. Mean reversion strategies focus on identifying assets that have deviated significantly from their historical average price, with the expectation that they will eventually revert to that average. Risk arbitrage, also known as event-driven arbitrage, involves taking advantage of price discrepancies resulting from specific events, such as mergers or acquisitions. Merger arbitrage and convertible bond arbitrage are two examples of risk arbitrage strategies. Merger arbitrage involves trading the stocks of companies involved in a merger or acquisition, with the aim of profiting from the price discrepancy between the target company's stock price and the acquisition price. Convertible bond arbitrage involves trading convertible bonds and their underlying equities to profit from pricing inefficiencies. Understanding the concepts of market efficiency and inefficiency is crucial for successful arbitrage trading. Market efficiency refers to the degree to which asset prices reflect all available information, while market inefficiency occurs when prices do not accurately reflect this information. Arbitrage strategies capitalize on market inefficiencies by identifying and exploiting price discrepancies. As arbitrageurs trade on these discrepancies, they help bring prices closer to their true value, thereby contributing to market efficiency. The ability to identify arbitrage opportunities is essential for successful trading. This involves closely monitoring market data, conducting thorough research, and staying informed about relevant news and events. Successful arbitrageurs develop a keen sense of market dynamics and trends, enabling them to quickly spot and capitalize on price discrepancies. This often requires a combination of technical and fundamental analysis, as well as the ability to process and interpret large volumes of data. Risk management is a critical aspect of successful arbitrage strategies. Despite the common perception that arbitrage is a risk-free endeavor, there are still potential risks associated with these strategies, such as execution risk, liquidity risk, and counterparty risk. To minimize these risks, arbitrageurs must implement sound risk management practices, including setting stop-loss orders, diversifying their portfolio, and maintaining a disciplined approach to trading. Proper risk management can help protect profits and limit losses in the event of adverse market conditions. Efficient execution and timing are vital components of successful arbitrage strategies. In many cases, price discrepancies are short-lived, making it crucial for arbitrageurs to act quickly and decisively. The use of advanced trading tools, such as algorithmic and high-frequency trading systems, can help improve execution speed and accuracy. Additionally, a deep understanding of market structure and dynamics can assist arbitrageurs in optimizing their trade timing and maximizing profits. As arbitrage strategies have evolved and become more sophisticated, the regulatory framework governing them has also needed to adapt. Regulators play a vital role in maintaining market integrity, ensuring that arbitrage strategies are conducted legally and ethically. Compliance with relevant regulations, such as those related to market manipulation and insider trading, is essential for arbitrageurs. A strong understanding of the regulatory environment can help traders navigate potential legal and ethical pitfalls and protect their reputations and profits. Market manipulation and insider trading are two illegal practices that can have serious consequences for those involved in arbitrage strategies. Market manipulation involves the deliberate distortion of asset prices to generate profits, while insider trading involves trading on non-public information. Arbitrageurs must be vigilant in ensuring that their strategies do not involve these illegal practices. Failure to adhere to legal and ethical standards can result in severe penalties, including fines, sanctions, and reputational damage. Beyond legal and ethical considerations, arbitrage strategies can also have social and environmental impacts. For example, high-frequency trading has been criticized for contributing to market volatility and systemic risk. Arbitrageurs should be mindful of the potential social and environmental consequences of their strategies and take steps to minimize any negative effects. This can involve incorporating sustainable and responsible investing principles into their trading practices and considering the broader implications of their actions on market stability and the environment. The future of arbitrage strategies will be influenced by the ongoing evolution of market structure. Factors such as increased market fragmentation, the growth of electronic trading platforms, and the rise of alternative trading venues will continue to shape the landscape of arbitrage opportunities. As market structure evolves, arbitrageurs will need to adapt their strategies and techniques to remain competitive. This may involve embracing new technologies, exploring novel asset classes, and continually refining their approach to identifying and exploiting price discrepancies. Innovations in technology, data analysis, and financial products will continue to drive the development of new and more sophisticated arbitrage strategies. At the same time, these innovations may also present challenges, such as increased competition, heightened regulatory scrutiny, and the need for more advanced skill sets. To stay ahead in this rapidly changing environment, arbitrageurs must be prepared to invest in their knowledge and expertise continually. This may involve staying abreast of industry trends, refining their trading algorithms, and cultivating a deep understanding of the markets in which they operate. As arbitrage strategies continue to evolve, their role in maintaining global financial stability will remain an important consideration. By promoting market efficiency and contributing to price discovery, arbitrageurs play a vital role in fostering a healthy and stable financial system. However, some critics argue that certain arbitrage strategies, such as high-frequency trading, can exacerbate market volatility and create systemic risks. As a result, the ongoing debate surrounding the benefits and potential drawbacks of arbitrage strategies is likely to persist, shaping the future development of these trading techniques.Overview of Arbitrage Strategies

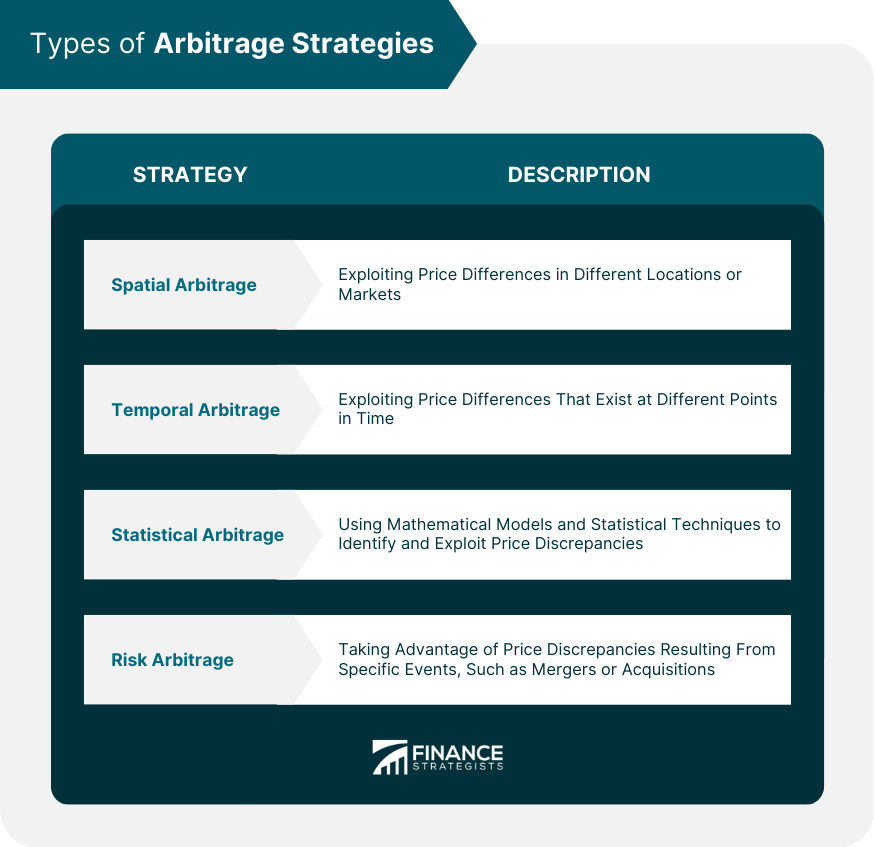

Types of Arbitrage Strategies

Spatial Arbitrage

Temporal Arbitrage

Statistical Arbitrage

Risk Arbitrage

Key Components of Successful Arbitrage Strategies

Market Efficiency and Inefficiency

Opportunity Identification

Risk Management

Execution and Timing

Legal and Ethical Considerations in Arbitrage

Regulatory Framework

Market Manipulation and Insider Trading

Social and Environmental Impacts

Final Thoughts

Arbitrage Strategies FAQs

Arbitrage strategy is a trading method that involves taking advantage of price differences in two or more markets to earn profit with minimal risk.

The types of arbitrage strategies include spatial, statistical, temporal, and inter-exchange arbitrage.

The components of arbitrage strategies include identifying price discrepancies, executing trades quickly, and managing risk through hedging.

Yes, there are regulations on arbitrage strategies, such as SEC Rule 10b-18, which sets guidelines for market manipulation, and anti-money laundering regulations.

You can learn more about arbitrage strategies by researching online, reading books on trading and finance, or consulting with a financial advisor or professional trader.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.