Investment advisory is a type of financial service that provides professional advice and guidance to individuals and organizations regarding their investments. Investment advisors are licensed professionals who offer personalized investment advice to their clients based on their financial goals, risk tolerance, and investment preferences. They help clients make informed investment decisions by providing expert knowledge of the financial markets and investment products. Additionally, they offer advice to clients on buying and selling securities for a fee. They can either work directly with their clients to provide investment advice or publish advisory reports and publications on specific securities. The Investment Advisers Act of 1940 outlines the responsibilities and duties of investment advisors, with three guidelines for defining who or what is an investment advisor. These guidelines cover the type of advice offered, payment for advisory services, and the source of income. Anyone providing advice or making recommendations on securities falls under the advisor classification, including financial planners, investment consultants, money managers, asset managers, hedge fund general partners, and others. Individuals or firms that specialize in providing investment advice to clients can provide investment advisory services. Investment advisors may work for a variety of financial institutions, such as banks, insurance companies, or investment firms. Some advisors work as independent financial consultants or run their own advisory firms. To become an investment advisor, individuals must meet certain qualifications and adhere to specific regulations. In the United States, investment advisors must register with the Securities and Exchange Commission (SEC) or state regulatory agencies. Advisors who manage less than $100 million in assets are typically regulated by state agencies, while those who manage more than $100 million are regulated by the SEC. Investment advisors must also meet certain educational and professional requirements. For example, they may need to hold a degree in finance or a related field, obtain a professional designation such as a Certified Financial Planner (CFP), or pass certain licensing exams. Additionally, investment advisors must adhere to fiduciary standards, which require them to act in the best interests of their clients and avoid conflicts of interest. Investment advisory services can be beneficial in several situations, including: If you are new to investing or do not have a good understanding of the financial markets, an investment advisor can help you navigate the complex investment landscape and provide you with the knowledge and guidance you need to make informed investment decisions. An investment advisor can also help you understand the risks and benefits of complex investment strategies, such as alternative investments or private equity. If you need help creating a comprehensive financial plan that includes investment advice, retirement planning, estate planning, and tax planning, an investment advisor can provide you with a holistic approach to managing your finances. The advisor can help you analyze your current financial situation, identify your goals, and develop a customized investment strategy tailored to your needs. If you need help creating a comprehensive financial plan that includes investment advice, retirement planning, estate planning, and tax planning, an investment advisor can provide you with a holistic approach to managing your finances. Managing large sums of money can be daunting, especially if you are unfamiliar with the investment landscape. An investment advisor can help you have effective wealth management by creating a customized investment portfolio that aligns with your financial goals and risk tolerance. They can also help you diversify your portfolio across different asset classes, such as stocks, bonds, and real estate, to reduce investment risk. Investment advisory firms are required to adhere to a fiduciary duty to act in the best interests of their clients. This means that their fee structures should align with the financial goals of their clients and should not be influenced by commissions or other incentives. The way investment advisory firms charge fees can vary but typically includes a flat investment management fee, a percentage of assets under management, an hourly fee, or a combination of flat and annual management or retainer fees. The fee structure of investment advisory firms ensures that clients are only charged for the services they need and receive instead of paying commissions on specific securities. This also means that clients have a clearer understanding of the fees they are paying and can make informed decisions about their investments. The average fee charged by registered investment advisors is similar to the average cost of financial advisors ranging from 1% to 2% of managed assets. Choosing an investment advisor or firm is a crucial decision that can affect your financial future. Here are some tips to help you make an informed decision: When an investment professional is designated as a fiduciary, it means that they have a legal obligation to act in the best interests of their clients. This fiduciary duty requires investment professionals to prioritize the needs, goals, and objectives of their clients above their own. In other words, they must always act in good faith and with the highest level of loyalty towards their clients. This is important because it helps ensure that the investment advisor does not engage in any unethical or fraudulent activities that could negatively impact the financial well-being of the client. When individuals work with a fiduciary investment advisor, they can trust that the advisor is putting their interests first and making decisions that are in their best interests. When searching for an investment advisor or firm, it is important to consider their experience level and their credentials. A financial advisor with extensive experience in the field may better understand market trends, investment strategies, and the financial landscape. This can translate into a better ability to make sound investment decisions and solid financial plans for their clients. In addition to experience, individuals should also look for the type of advisor with relevant professional designations or credentials. These credentials, such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), and Chartered Financial Consultant (ChFC), demonstrate a high level of knowledge and expertise in the field of finance and financial planning. It is essential to note that not all professional designations are created equal, and some may be more rigorous and comprehensive than others. Therefore, it is essential to research the various designations to understand the qualifications and expertise required to obtain them. When searching for an investment advisor, it is essential to consider their investment philosophy, which refers to their approach to investing and how they make investment decisions. Every investment advisor has a unique investment philosophy, which may or may not align with the investment goals and risk tolerance of a certain individual. Individuals should ensure that the investment philosophy of an investment advisor aligns with their long-term financial goals, risk tolerance, and investment timeline. For instance, some investment advisors prioritize aggressive investment strategies that seek high returns but come with a higher level of risk. Other investment advisors may adopt a more conservative investment approach that focuses on preserving capital and steady growth over time. Advisors should communicate effectively and regularly with their clients to keep them informed about the performance of their investments and any changes to their investment strategy. Effective communication between advisor and their clients is crucial in establishing a relationship based on trust and transparency. By keeping the lines of communication open, individuals can feel confident that their advisor is working in their best interests and providing them with the information they need to make informed investment decisions. Individuals should look for an advisor who is accessible, responsive and communicates in a way that is easy to understand. The advisor should be willing to take the time to explain complex investment concepts and answer any questions the individual may have. Checking the history can help individuals ensure that the advisor or firm they are considering has a clean record and can be trusted to act in the best interest of their clients. The Financial Industry Regulatory Authority (FINRA) BrokerCheck and the SEC’s Investment Advisor Public Disclosure (IAPD) databases are two online resources individuals can use to check the disciplinary history of an advisor. These databases provide information on advisors and firms subject to disciplinary actions or complaints. Asking for references from the advisor is also a smart move. These references can provide insight into the track record of the advisor with other clients and what to expect from working with them. Talking to references can help individuals learn about the communication style and investment philosophy of an advisor, and how they handle different situations, such as market fluctuations or changing life circumstances. References can provide an objective opinion on the performance of an advisor and how well they were able to help the client achieve their financial goals. Individuals should compare the fees charged by different investment advisors to find a fee structure that aligns with their budget and investment goals. Understanding how the fees are calculated is also crucial in determining whether they are worth the value provided by the advisor. Fees charged by investment advisors may include various types of charges, such as management fees, trading fees, and administrative fees. It is essential to understand the breakdown of these fees and whether they are charged as a percentage of assets under management, a flat fee, or a combination of both. Investment advisory services provide professional advice and guidance to individuals and organizations regarding their investments. Investment advisors are licensed professionals who offer personalized investment advice to their clients based on their financial goals, risk tolerance, and investment preferences. They help clients make informed investment decisions by providing expert knowledge of the financial markets and investment products. The corresponding fees are structured to align with the financial goals of the client, and investment advisory firms are required to adhere to a fiduciary duty to act in the best interests of their clients. To choose an investment advisor or firm, it is important to understand fiduciary duty, look for experience and credentials, and ask about the investment philosophy and strategies. When managing your finances, an investment advisor or a wealth management professional can offer a broad and thorough perspective. Seeking their guidance may help you better understand your financial situation and explore options for improving it.What Is Investment Advisory?

Have a financial question? Click here.Who Provides Investment Advisory Services?

When Do You Need Investment Advisory Services?

Lack of Investment Knowledge

Complex Investment Strategies

Require Comprehensive Financial Planning

Manage Large Sums of Money

Investment Advisory Fees

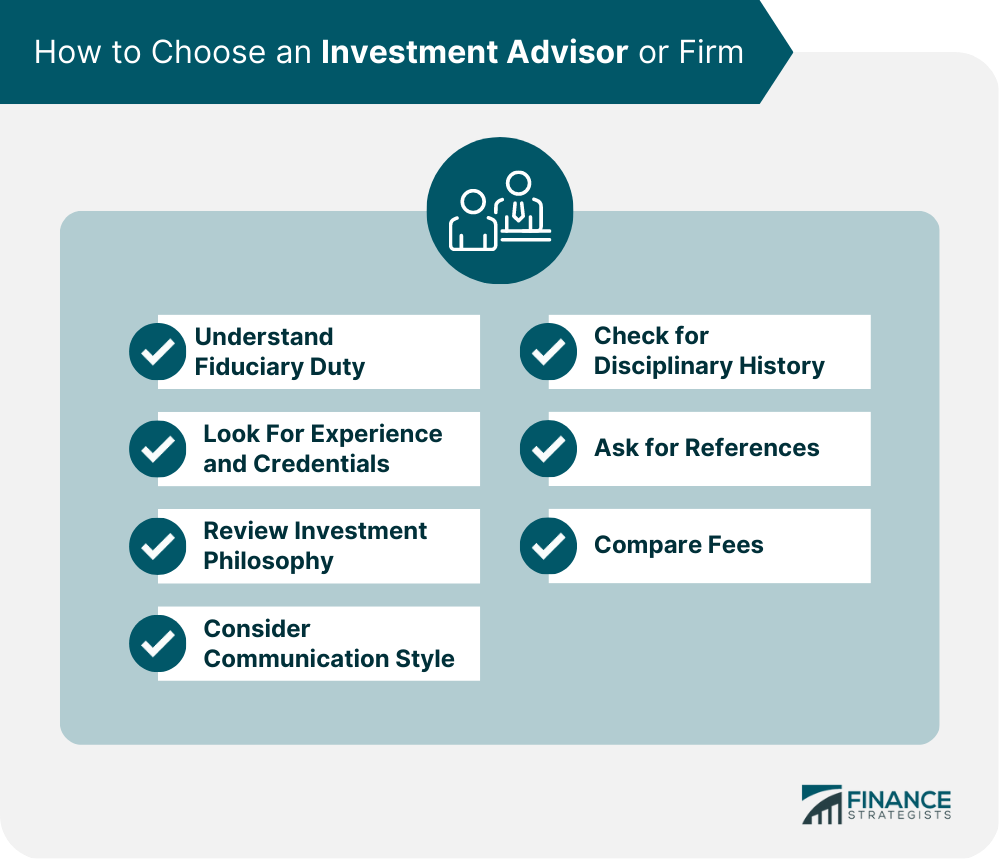

How to Choose an Investment Advisor or Firm

Understand Fiduciary Duty

Look For Experience and Credentials

Review Investment Philosophy

Consider Communication Style

Check for Disciplinary History

Ask for References

Compare Fees

Final Thoughts

Investment Advisory FAQs

Investment advisory is a financial service that provides advice and recommendations to clients regarding investment decisions. Investment advisors are professionals who are knowledgeable about the financial markets and can offer customized guidance based on the individual goals, risk tolerance, and financial situation of their clients.

Investment advisory differs from other financial services, such as brokerage and financial planning, in that it focuses solely on providing investment advice and recommendations. While brokers typically execute trades on behalf of their clients and financial planners offer a broader range of financial planning services, investment advisors primarily focus on providing investment guidance.

If you already have a financial adviser or a broker, you may still benefit from the services of an investment advisor. Investment advisors specialize in investment management and can provide customized advice and guidance on investment decisions. Depending on your financial situation and investment goals, consult with an investment advisor in addition to your other financial professionals.

When selecting an investment advisor, you should look for a professional who is registered with the Securities and Exchange Commission (SEC) or the state in which they operate. You should also look for an advisor who has experience in investment management and a track record of success. Other important considerations may include their investment philosophy, fee structure, and communication style.

The fees charged by investment advisors can vary depending on the experience of the advisor, the services provided, and the size of the portfolio of client. Many investment advisors charge a percentage of assets under management, typically ranging from 1% to 2% per year. Some advisors may also charge hourly or flat investment management fees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.