When the goods purchased for selling purposes are sold to customers at a particular price are termed as sales. In simple words goods sold are called sales. Sales, in its simplest form, refers to the act of selling a product or service to a customer. The transfer of ownership is usually completed in exchange for money or an agreed-upon value. Sales is not only a basic economic activity but also an integral part of business operations. It encompasses all the processes involved in persuading and convincing a potential customer to purchase a product or service. The sphere of sales is complex and multifaceted, stretching far beyond the mere exchange of goods and services for money. It is a comprehensive process that starts from identifying the customer's needs, presenting the appropriate solution, and culminates in the customer making the decision to buy. Sales are of the following two types: Cash sales are transactions where the customer pays for goods or services at the time of purchase, typically using cash or digital payment methods. Cash sales can be seen in everyday purchases like buying groceries at a supermarket or purchasing a cup of coffee. In a business context, cash sales are beneficial as they improve cash flow and reduce the risk of bad debts. Cash sales also allow businesses to quickly reinvest in inventory, personnel, or other business needs, helping them remain agile and responsive to market changes. Credit sales, on the other hand, are transactions where the customer purchases goods or services on credit, promising to pay the seller at a later date. This type of sale is common in business-to-business (B2B) transactions and is often facilitated through invoices or purchase orders. While credit sales can pose a risk due to the potential of non-payment, they can also stimulate demand and sales by offering customers the flexibility to pay later. However, businesses must manage their credit policies carefully to balance the increased sales potential against the risk of bad debts. Below are additional types of sales: Direct sales refer to selling products or services directly to consumers without the intervention of intermediaries. This type of sale is typically conducted in a non-retail environment such as at home, at work, or other non-store locations. Direct sales can be made via online channels, telemarketing, direct mail, and face-to-face interaction. In the era of digitalization and e-commerce, direct sales have taken center stage due to their ability to offer personalized experiences. They allow businesses to build and maintain a direct relationship with their customers, gather valuable data, and receive immediate feedback. It also provides customers with direct access to products and the advantage of personalized service. Wholesale sales involve selling goods in large quantities to retailers or industrial, commercial, institutional, or professional business users. The primary purpose of wholesale selling is to enable these entities to resell the goods to end consumers. This method is highly prevalent in various industries, ranging from fashion and food to electronics and automobiles. Wholesale sales can provide a consistent and substantial stream of revenue, especially if businesses establish strong relationships with reliable retailers. Moreover, the cost per unit is generally lower in wholesale sales due to the volume of products sold, thereby allowing businesses to maximize their profitability. Retail sales represent the sale of goods to the end consumer for use or consumption, not for resale. This type of sale happens through various channels such as brick-and-mortar stores, online e-commerce websites, or through direct selling. Retail sales are the final step in the distribution of products, where the goods reach the hands of consumers. Retail sales provide the crucial link between manufacturers and consumers, offering businesses a means to distribute their products to a broader audience. In turn, it ensures consumers have access to a wide variety of products, making it an essential component of the global economy. Prospecting involves identifying potential customers who may be interested in a product or service. It is the first step in the sales process and often involves market research, networking, and cold outreach. This stage is critical as it sets the foundation for all future sales activities, ensuring that sales efforts are targeted effectively. While prospecting can be challenging due to the uncertainty involved, it is crucial for driving sales growth. A successful prospecting process leads to a robust sales pipeline, providing a steady stream of potential customers that can be converted into actual sales. Qualifying leads is the process of determining whether a prospective customer has the need, authority, and financial capacity to purchase a product or service. It involves asking the right questions to understand the prospect's circumstances and establish whether they are a good fit for the product or service on offer. By qualifying leads, salespeople can focus their efforts on the most promising prospects, thereby improving sales efficiency. It reduces time spent on less likely prospects and increases the probability of closing sales, contributing to revenue growth. Presenting and demonstrating involve explaining the features and benefits of a product or service to a potential customer. The goal is to show how the offering can solve the customer's problem or meet their needs. This stage often involves product demonstrations, sales presentations, or pitches. A compelling presentation or demonstration can significantly influence the prospect's purchasing decision. It allows the salesperson to showcase the value of the product or service, creating a strong impression in the prospect's mind and increasing the likelihood of a sale. Handling objections is a crucial part of the sales process where salespeople address the concerns or doubts raised by the potential customer. These objections could be related to price, product features, competition, or any other aspect that might hinder the sale. Overcoming objections requires excellent listening, problem-solving, and negotiation skills. By addressing the prospect's concerns effectively, salespeople can build trust, demonstrate the value of their offering, and steer the conversation towards closing the sale. Closing the sale is the point in the sales process where the customer agrees to purchase the product or service. This stage involves finalizing the details of the transaction, including price, delivery, and payment terms. The close is a critical juncture as it turns a prospect into a customer, generating revenue for the business. However, closing a sale is often challenging as it requires a delicate balance of persuasion and customer satisfaction. A successful close depends on understanding the customer's needs, presenting a compelling solution, and overcoming any final objections. The sales process does not end with closing the sale. The follow-up and customer relationship management stages involve maintaining communication with the customer after the sale. This could include providing after-sales service, addressing any issues or concerns, and seeking feedback. Maintaining a strong relationship with customers can lead to repeat business and customer loyalty, which are crucial for long-term sales success. Moreover, satisfied customers are more likely to recommend the business to others, leading to new sales opportunities. Revenue is the total amount of money a company generates by selling its goods and services. It is the most basic sales metric, often referred to as the "top line" on income statements. Revenue reflects the overall effectiveness of a company's sales and marketing efforts, making it a key indicator of business performance. However, revenue alone doesn't tell the entire story of a business's financial health. Other metrics, such as profit margin, growth rate, and customer acquisition cost, need to be considered to gain a comprehensive understanding of sales performance. Gross margin is a company's total sales revenue minus its Cost of Goods Sold (COGS), divided by the total sales revenue, expressed as a percentage. It measures the profitability of a company's core business operations before considering overhead costs, interest payments, and taxes. A higher gross margin indicates that a company can convert sales into profits more effectively, providing more money to cover operating expenses and generate net income. Hence, gross margin is an important metric to evaluate a company's efficiency and financial health. The sales growth rate is the percentage increase in sales over a specific period compared to the previous period. It shows how fast a company's sales revenue is growing and is an important indicator of market acceptance and the effectiveness of sales strategies. A high sales growth rate could indicate that a company is outperforming its competitors or that its products or services are in high demand. However, sales growth needs to be analyzed in conjunction with other metrics to ensure that it's leading to increased profitability and not just driven by factors such as price reductions. Customer Acquisition Cost (CAC) is the total cost of acquiring a new customer, including all marketing and sales expenses. It's a critical metric in sales as it shows how much a company spends to attract each new customer. A lower CAC implies that a company is efficiently acquiring customers and has a cost-effective marketing strategy. Conversely, a high CAC might indicate that a company's marketing efforts are not effective or too expensive. Businesses must strive to reduce their CAC while increasing the value they get from each customer. Customer Lifetime Value (CLTV) is the total net profit that a company makes from any given customer throughout their relationship. It factors in not just a single transaction but all future transactions that the customer might undertake. CLTV is a crucial sales metric as it helps businesses understand how much revenue they can expect from a customer over time. By comparing CLTV with CAC, businesses can assess the return on their marketing investments and determine whether they are maintaining profitable relationships with their customers. Target market segmentation is the process of dividing a broad market into distinct groups of customers with similar needs, characteristics, or behaviors. These segments can be defined based on various factors like demographics, geography, psychographics, and behavior. Effective market segmentation allows businesses to tailor their sales and marketing strategies to meet the specific needs of each segment. It leads to a more efficient use of resources, higher customer satisfaction, and improved sales performance. Pricing strategies are approaches used by businesses to price their products or services. These can range from cost-plus pricing (adding a markup to the cost of production) to value-based pricing (pricing based on the perceived value to the customer). Choosing the right pricing strategy is critical in sales as it directly affects demand, profitability, and market positioning. An effective pricing strategy should consider factors such as the cost of production, market conditions, competitive landscape, and customer perceptions. Sales channels are the paths that a product or service follows from the producer to the final consumer. They can include direct channels (like direct sales or e-commerce) or indirect channels (like retailers or distributors). The choice of sales channels has a significant impact on sales performance as it determines how easily and cost-effectively a company can reach its customers. Businesses need to choose their sales channels carefully, considering their product characteristics, target market, and overall business strategy. Sales promotion and advertising are key strategies used by businesses to boost their sales. Sales promotions include short-term tactics like discounts, coupons, and special offers designed to stimulate immediate sales. Advertising, on the other hand, is a long-term strategy aimed at building brand awareness and influencing purchasing decisions over time. Both sales promotion and advertising are essential tools in the sales strategy mix. They can enhance product visibility, stimulate demand, and differentiate a company's offerings from its competitors. Sales training and development involve equipping the sales team with the necessary skills and knowledge to perform effectively. This can include training on product knowledge, sales techniques, customer service, and relationship management. Investing in sales training and development can significantly improve sales performance. A well-trained sales team is better equipped to engage with customers, address their needs, and close sales. Moreover, ongoing development opportunities can boost team morale and retention. Historical analysis is a sales forecasting method that uses past sales data to predict future sales. It assumes that past patterns will continue into the future, making it a simple and commonly used forecasting approach. While historical analysis can provide a useful baseline, it may not accurately predict future sales in changing market conditions. Hence, it's often used in combination with other forecasting methods to increase accuracy. Market research involves gathering and analyzing information about the market, customers, and competitors to predict future sales. It can include methods like surveys, focus groups, and in-depth interviews. Market research can provide valuable insights into customer preferences, market trends, and competitive dynamics. However, it can be time-consuming and costly, and its accuracy depends on the quality of the data collected and analyzed. The expert opinion method involves seeking forecasts from experienced individuals within the industry, such as sales managers, executives, or industry analysts. These experts use their knowledge and intuition to predict future sales. While expert opinions can provide valuable insights, they are subjective and can be influenced by personal biases. Therefore, like other methods, expert opinions should be used in conjunction with other forecasting techniques to improve accuracy. The sales revenue forecast is an estimate of the revenue a company expects to generate from sales in a particular period. It's based on projected sales volume and unit prices and forms the basis of the sales budget. A well-prepared sales revenue forecast provides valuable guidance for business planning and decision-making. However, it's important to regularly review and update the forecast as market conditions change. The sales expenses forecast is an estimate of all costs associated with the company's sales activities. This can include salaries, commissions, travel expenses, advertising costs, and any other expenses related to sales efforts. Forecasting sales expenses accurately is crucial for budgeting and profitability analysis. It helps businesses plan their resources effectively and ensures they can support their sales activities while maintaining profitability. The sales budgeting process involves combining the sales revenue and expenses forecasts to create a comprehensive sales budget. The budget serves as a financial plan that outlines the company's sales expectations and how resources will be allocated to achieve these goals. Creating a robust sales budget requires careful planning and coordination across different parts of the business. It's a dynamic process that needs to be continuously monitored and adjusted to respond to changes in the business environment. It encompasses various transactions where products or services are sold by merchants or dealers. For instance: Cloth sold by a cloth merchant is known as "Sales" Cement sold by a cement dealer is known as "Sales" Cars sold by a car dealer is known as "Sales" Sales are the process of exchanging goods or services for monetary compensation. Understanding the definition, types, process, metrics, strategies, and budgeting of sales is crucial for business success. Sales can be cash sales or credit sales, each with its own benefits and considerations. The sales process involves prospecting, qualifying leads, presenting and demonstrating, handling objections, closing the sale, and follow-up. Key performance indicators such as revenue, gross margin, sales growth rate, customer acquisition cost, and customer lifetime value provide insights into sales effectiveness. Sales strategies include target market segmentation, pricing strategies, sales channels, promotion, advertising, and training. Sales forecasting methods, such as historical analysis, market research, and expert opinions, aid in predicting future sales. Sales budgeting combines revenue and expenses forecasts to guide resource allocation. By implementing effective sales practices, businesses can optimize performance, increase profitability, and maintain strong customer relationships.Definition of Sales

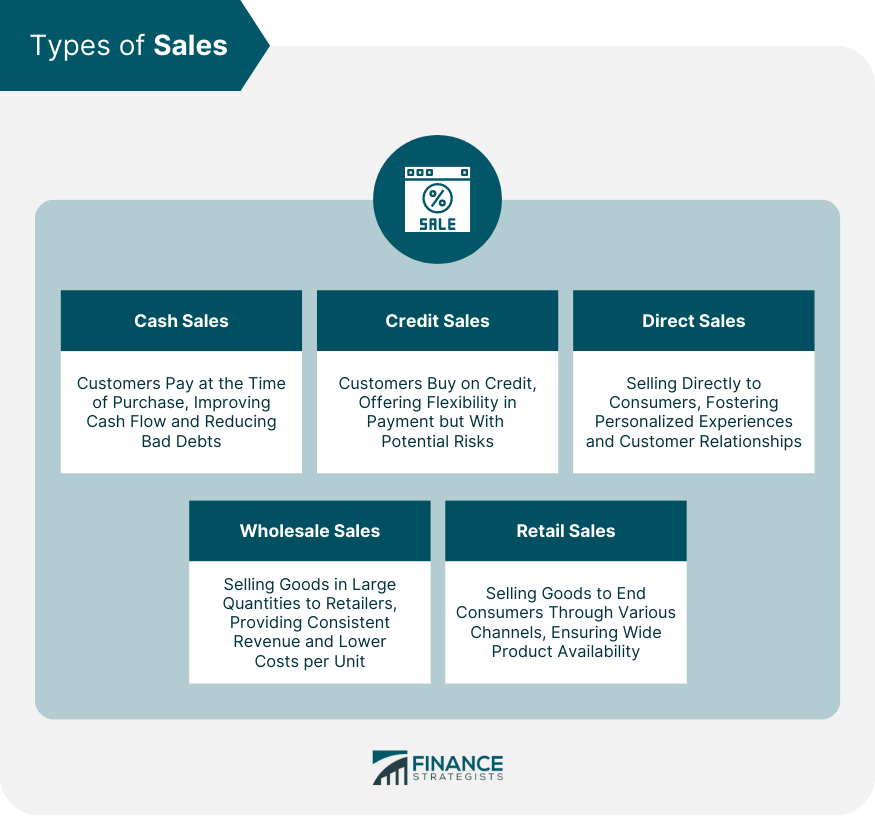

Types of Sales

Cash Sales

Credit Sales

Direct Sales

Wholesale Sales

Retail Sales

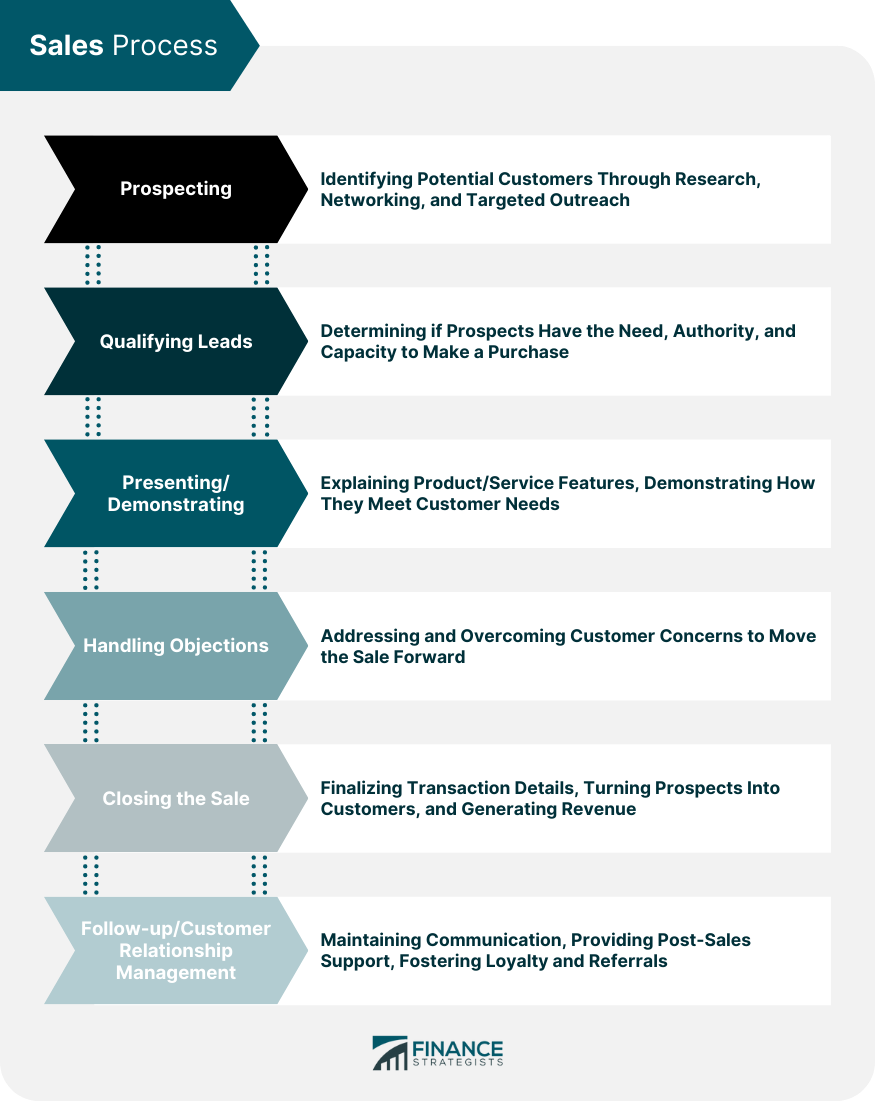

Sales Process

Prospecting

Qualifying Leads

Presenting and Demonstrating

Handling Objections

Closing the Sale

Follow-up and Customer Relationship Management

Key Metrics in Sales

Revenue

Gross Margin

Sales Growth Rate

Customer Acquisition Cost

Customer Lifetime Value

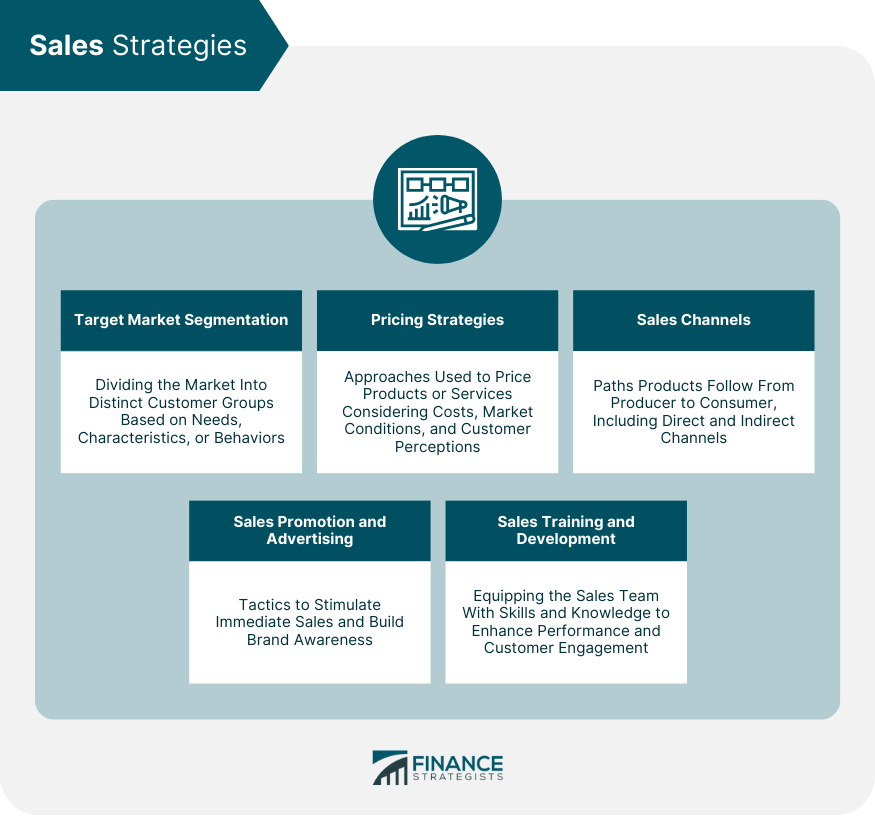

Sales Strategies

Target Market Segmentation

Pricing Strategies

Sales Channels

Sales Promotion and Advertising

Sales Training and Development

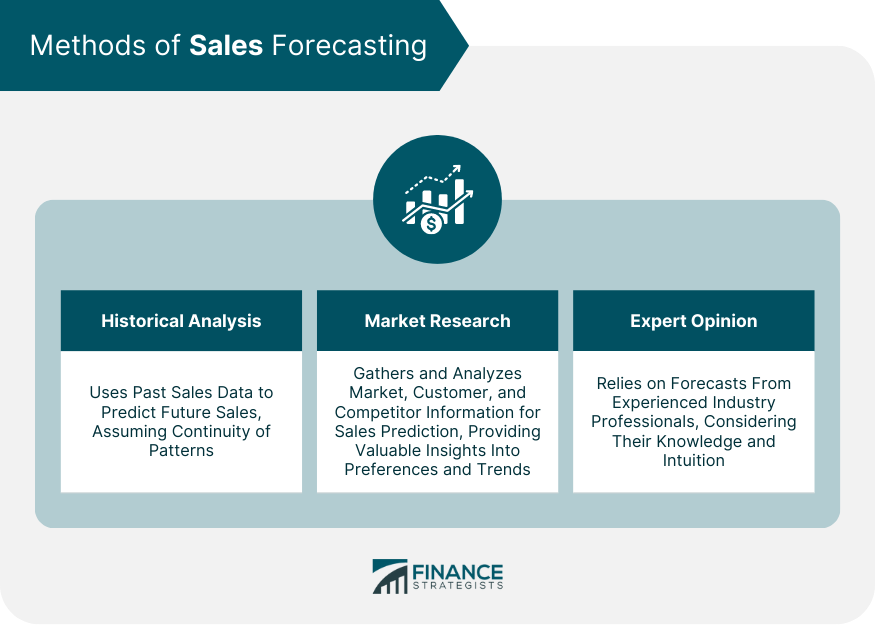

Methods of Sales Forecasting

Historical Analysis

Market Research

Expert Opinion

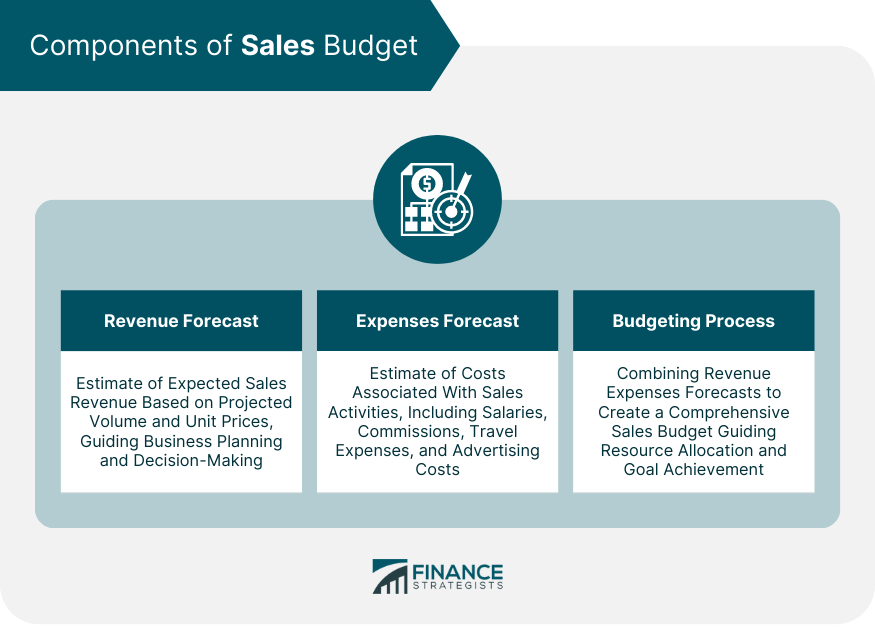

Components of Sales Budget

Revenue Forecast

Expenses Forecast

Budgeting Process

Example

Conclusion

Sales FAQs

Sales refer to the activities undertaken by a company or individual to facilitate the exchange of goods and/or services for money, to generate revenue.

Types of sales include retail sales, wholesale sales, business-to-business (B2B) sales, direct selling, online selling, telemarketing, and others.

Common techniques used in sales include relationship building and rapport building; asking strategic questions; analysis of customer needs; product demonstration; negotiation skills; problem-solving skills; closing techniques; and upselling.

To be successful in sales, important skills include effective communication; the ability to build relationships and trust; knowledge of customer needs and expectations; proficiency in negotiation; problem-solving abilities; a deep understanding of the product or service being sold; persuasive speaking abilities; time management capabilities; an organized approach to tasks; creativity and innovation.

Technology can play a key role in enhancing sales activities by streamlining processes, automating certain tasks, increasing efficiency, providing data-driven insights into customer behavior and preferences, improving customer experience through personalization, enabling faster transaction processing, and providing access to online analytics tools for tracking progress.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.