Bitcoin IRAs, also known as Bitcoin individual retirement accounts, are a type of self-directed individual retirement account (IRA) that allows investors to hold bitcoin and other cryptocurrencies in their retirement portfolio. These accounts function similarly to traditional IRAs, but they provide more flexibility in terms of investment options. With Bitcoin IRAs, investors have the ability to invest in bitcoin and other cryptocurrencies instead of traditional assets like stocks, bonds, and mutual funds. Investors can hold bitcoin in their IRA through a Bitcoin IRA custodian, which is a company that specializes in managing cryptocurrency investments for retirement accounts. These custodians ensure that the bitcoin holdings are secure and compliant with IRS regulations. Bitcoin IRAs offer the potential for higher returns, as the value of bitcoin has historically increased over time. However, investing in bitcoin also comes with higher risks, as the cryptocurrency market can be volatile and subject to large fluctuations in value. While Bitcoin is the most popular and widely recognized cryptocurrency, other digital assets can also be held in a self-directed IRA. Some of the popular cryptocurrencies available for IRA investments are: Bitcoin is the first and most well-known cryptocurrency, created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It is often considered the gold standard of cryptocurrencies and holds the largest market share. Ethereum is the second-largest cryptocurrency by market capitalization, launched in 2015 by a group of developers led by Vitalik Buterin. Ethereum is more than just a cryptocurrency; it is a platform for decentralized applications (dApps) and smart contracts. Litecoin is another popular cryptocurrency, created in 2011 by Charlie Lee. It is often referred to as the silver to Bitcoin's gold, with faster transaction times and a larger maximum supply. Several other cryptocurrencies have gained popularity over the years, such as Ripple (XRP), Bitcoin Cash (BCH), and Cardano (ADA). Investors should research and select digital assets that align with their investment goals and risk tolerance. To invest in cryptocurrencies through an IRA, you need to set up a self-directed IRA (SDIRA) with a provider that allows investments in digital assets. When selecting a provider, consider: Types of Providers: Research the different providers in the market, including their reputation, experience, and services offered. Fees and Charges: Compare the fees associated with account setup, maintenance, and transactions, as these can significantly impact your investment returns. Once you have chosen a provider, you will need to open an SDIRA account: Account Types: Select the appropriate account type based on your eligibility and financial goals, such as a Traditional IRA, Roth IRA, or SEP IRA. Account Funding Options: Fund your account through a rollover, transfer, or direct contribution, following the provider's guidelines and IRS limits. A cryptocurrency exchange facilitates the buying and selling of digital assets. Consider the following when choosing an exchange: Popular Exchanges: Research the most reputable and widely-used exchanges, such as Coinbase, Kraken, or Gemini. Security and Reliability Considerations: Evaluate the exchange's security measures, history of breaches or hacks, and user reviews to ensure a safe and reliable platform. A digital wallet is essential for storing and managing your cryptocurrencies: Types of Wallets: Choose between hardware wallets, software wallets, or custodial wallets based on your security needs and preferences. Security Best Practices: Employ strong security measures, such as two-factor authentication, to protect your digital assets. Spread your investments across multiple cryptocurrencies to reduce risk and potential losses in case a single digital asset underperforms. Dollar-cost averaging involves investing a fixed amount at regular intervals, regardless of market conditions. This strategy helps to mitigate the impact of market volatility on your investments. Adopt a long-term investment horizon, focusing on the potential growth and development of the cryptocurrency market rather than short-term price fluctuations. For investors with higher risk tolerance and expertise in the cryptocurrency market, active trading strategies can be employed to capitalize on market fluctuations and generate higher returns. Cryptocurrency markets are known for their extreme price volatility, which can lead to significant fluctuations in the value of your investments. The regulatory environment surrounding cryptocurrencies is still evolving, and changes in laws or regulations could impact the value or legality of your digital assets. Cryptocurrencies are susceptible to hacking, theft, and fraud. Ensure you follow best practices for securing your digital wallet and select reputable exchanges to minimize risks. The IRS treats cryptocurrencies as property for tax purposes. Consult a tax professional to understand the implications of investing in cryptocurrencies through an IRA. Investing in cryptocurrencies through a Bitcoin IRA can help diversify your retirement portfolio, reducing overall risk and potentially enhancing returns. Cryptocurrencies has shown significant growth over the past decade, offering the potential for high returns on investment. Cryptocurrencies like Bitcoin are often considered an inflation hedge due to their limited supply and decentralized nature, which can help preserve the value of your investments over time. Investing in cryptocurrencies through an IRA allows you to defer taxes on gains, or in the case of a Roth IRA, enjoy tax-free growth and withdrawals. Bitcoin IRAs are self-directed individual retirement accounts that allow investors to hold bitcoin and other cryptocurrencies in their retirement portfolio, providing more flexibility in terms of investment options. Investors can hold bitcoin in their IRA through a Bitcoin IRA custodian that ensures their holdings are secure and compliant with IRS regulations. Apart from Bitcoin, other popular cryptocurrencies available for IRA investments are Ethereum, Litecoin, Ripple, Bitcoin Cash, and Cardano. Setting up a Bitcoin IRA involves selecting a self-directed IRA provider, opening an SDIRA account, selecting a cryptocurrency exchange, and securing a digital wallet. Investment strategies for Bitcoin IRAs include diversification, dollar-cost averaging, long-term investment approach, and active trading strategies. While Bitcoin IRAs offer benefits such as portfolio diversification, potential for high returns, inflation hedge, and tax advantages, they also come with risks such as market volatility, regulatory and legal risks, security and fraud risks, and tax implications.What Are Bitcoin IRAs?

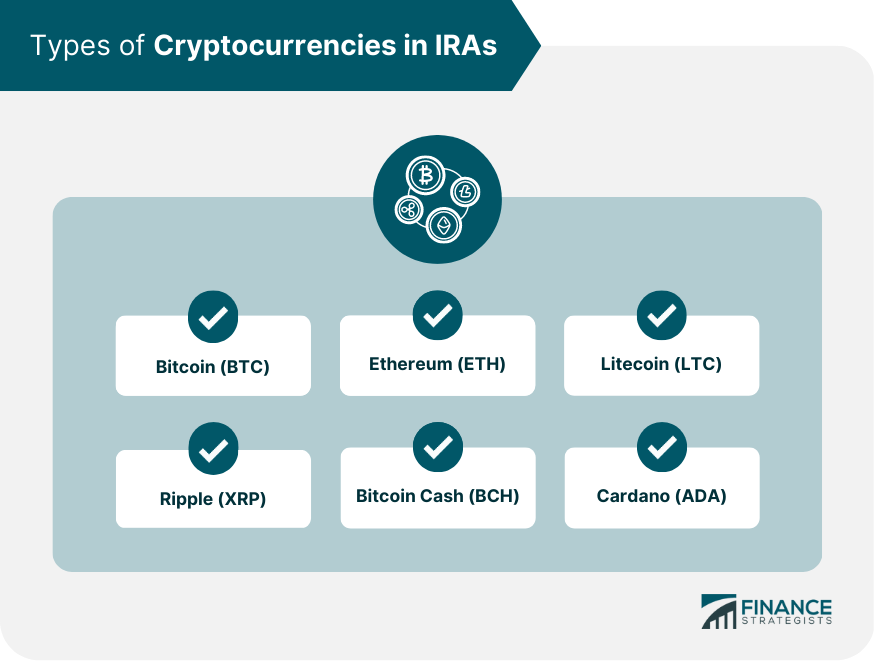

Types of Cryptocurrencies in IRAs

Bitcoin (BTC)

Ethereum (ETH)

Litecoin (LTC)

Other Popular Cryptocurrencies

Setting up a Bitcoin IRA

Choose a Self-Directed IRA Provider

Open a Self-Directed IRA Account

Select a Cryptocurrency Exchange

Secure a Digital Wallet

Investment Strategies for Bitcoin IRAs

Diversification Within the Cryptocurrency Space

Dollar-Cost Averaging

Long-Term Investment Approach

Active Trading Strategies

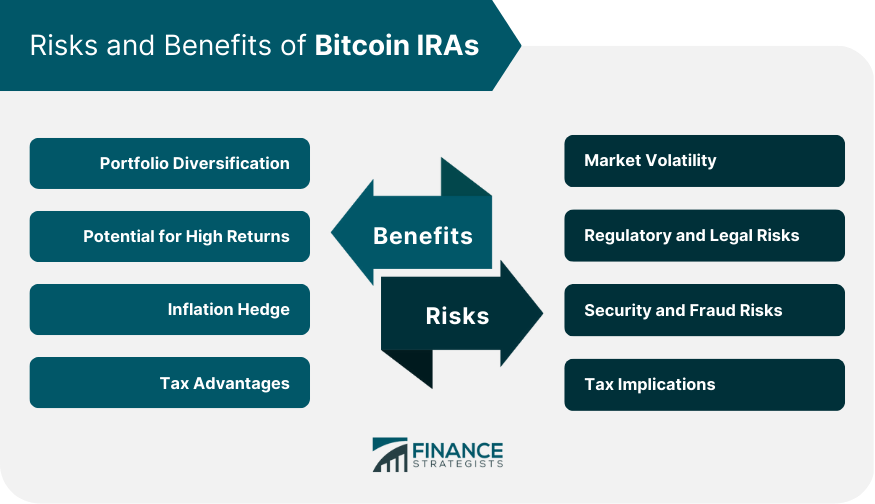

Risks and Challenges Associated With Bitcoin IRAs

Market Volatility

Regulatory and Legal Risks

Security and Fraud Risks

Tax Implications

Benefits of Bitcoin IRAs

Portfolio Diversification

Potential for High Returns

Inflation Hedge

Tax Advantages

Conclusion

Bitcoin IRAs FAQs

Bitcoin IRAs offer several benefits, including portfolio diversification, the potential for high returns, and an inflation hedge. Additionally, they provide the same tax advantages as traditional IRAs, such as tax-deferred growth or tax-free withdrawals, depending on the account type.

To set up a Bitcoin IRA, first choose a self-directed IRA provider that allows investments in digital assets. Open an account, fund it through a rollover, transfer, or direct contribution, and then select a reputable cryptocurrency exchange to purchase your desired digital assets. Lastly, secure a digital wallet to store and manage your cryptocurrencies.

Some investment strategies for Bitcoin IRAs include diversification within the cryptocurrency space, dollar-cost averaging, adopting a long-term investment approach, and employing active trading strategies if you have a higher risk tolerance and expertise in the cryptocurrency market.

The risks and challenges associated with Bitcoin IRAs include market volatility, regulatory and legal risks, security and fraud risks, and tax implications. It is essential to understand these risks and follow best practices to minimize potential losses.

Future trends, such as the increased adoption of cryptocurrencies in mainstream finance, potential regulatory changes, and technological advancements in blockchain and cryptocurrencies, could impact the legitimacy and growth of Bitcoin IRAs. Staying informed about these trends can help you make better investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.