Taxable municipal bonds are debt securities issued by state and local governments or other government entities to finance public projects that do not qualify for tax-exempt status under federal law. Unlike tax-exempt municipal bonds, the interest income earned from taxable municipal bonds is subject to federal income tax and, in some cases, state and local taxes. These bonds are used to fund projects such as stadiums, pension obligations, refinancing existing debt, or other initiatives that primarily benefit private entities. Taxable municipal bonds is issued when the funds raised from the bond issuance will be used for purposes that do not qualify for tax-exempt status under federal law. For example, financing a stadium or other projects that primarily benefit private entities may require issuing taxable bonds. Additionally, taxable bonds can be used to finance pension obligations or to refinance existing debt. State and local governments, public authorities, and other government entities issue taxable municipal bonds. These issuers may include cities, counties, school districts, public utilities, and special districts. There are several types of taxable municipal bonds, including general obligation bonds, revenue bonds, and Build America Bonds (BABs). General obligation (GO) bonds are backed by the full faith and credit of the issuing government entity. They are repaid through general tax revenues and may require voter approval. The security and repayment of GO bonds come from the taxing power of the issuing government. This means that the issuer pledges its full financial resources to repay the bondholders. In many cases, GO bonds must be approved by voters before issuance, ensuring that the community supports the projects being financed. Revenue bonds are repaid from the revenues generated by the project being financed or from a specific revenue source. The security and repayment of revenue bonds come from the income generated by the financed project, such as tolls from a highway or fees from a water treatment facility. Revenue bonds are often used to fund projects such as airports, toll roads, hospitals, and utilities. Build America Bonds are a type of taxable municipal bond introduced under the American Recovery and Reinvestment Act of 2009. BABs were created to stimulate infrastructure investment and lower borrowing costs for state and local governments during the financial crisis. Issuers of BABs can choose between two options: a tax credit BAB, where investors receive federal tax credits, or a direct payment BAB, where issuers receive direct payments from the federal government. Taxable municipal bonds offer several advantages for both issuers and investors. Taxable municipal bonds often have lower borrowing costs compared to traditional corporate bonds, as they carry lower default risk. Investing in taxable municipal bonds can provide portfolio diversification, as they are not highly correlated with other asset classes. Due to their taxable status, taxable municipal bonds typically offer higher yields compared to tax-exempt bonds, making them more attractive to certain investors. Taxable municipal bonds can be purchased by a wide range of investors, including foreign investors and pension funds, which are not eligible to benefit from tax-exempt bonds. Investing in taxable municipal bonds comes with some disadvantages and risks, including interest rate risk, credit risk, call risk, liquidity risk, and tax implications for investors. Changes in interest rates can affect the market value of taxable municipal bonds, as bond prices typically move inversely to interest rates. Investors holding bonds with longer maturities may experience more significant price fluctuations due to interest rate changes. Credit risk refers to the possibility that the issuer of the bond may default on its payment obligations. Although municipal bonds generally have low default rates, investors should still consider the credit quality and financial stability of the issuer before investing. Some taxable municipal bonds have call provisions, allowing the issuer to redeem the bond before its maturity date. This can be disadvantageous for investors, as they may not receive the full interest payments they initially anticipated. Taxable municipal bonds can sometimes be less liquid than other types of bonds, meaning that it may be challenging to sell the bond at a fair price when needed. Unlike tax-exempt municipal bonds, the interest income generated from taxable municipal bonds is subject to federal income tax and, in some cases, state and local taxes as well. Investors can choose between individual bonds and bond funds when investing in taxable municipal bonds. Purchasing individual bonds provides more control over the selection of specific bonds, while bond funds offer instant diversification and professional management. Before investing, it is essential to evaluate the credit quality of the bond, using credit ratings provided by agencies such as Moody's, Standard & Poor's, and Fitch Ratings. Understanding current interest rates and comparing the yield on taxable municipal bonds to other fixed-income securities is crucial in making informed investment decisions. Investors should consider the tax implications of investing in taxable municipal bonds and incorporate them into their overall tax planning strategy. Including a mix of taxable and tax-exempt municipal bonds in a portfolio can provide diversification and help manage risk. Several trends and developments may impact the taxable municipal bond market, including federal tax policy, infrastructure spending, credit quality trends, and market innovations. Changes in federal tax policy can influence the demand for taxable municipal bonds. For example, lower tax rates may reduce the attractiveness of tax-exempt bonds, increasing demand for taxable bonds. Increased infrastructure spending may lead to a higher issuance of taxable municipal bonds, as state and local governments seek to finance various public projects. Monitoring credit quality trends and potential risks can help investors make informed decisions about their bond investments. New products and innovations, such as green bonds and social impact bonds, may provide additional investment opportunities in the taxable municipal bond market. Taxable municipal bonds play a critical role in public finance, offering a means for state and local governments to fund projects that do not qualify for tax-exempt status. Investors should consider the advantages, disadvantages, and risks associated with taxable municipal bonds when constructing their portfolios. By staying informed about market trends and developments, investors can make better decisions and capitalize on opportunities in the taxable municipal bond market.What Are Taxable Municipal Bonds?

Purpose of Taxable Municipal Bonds

Types of Taxable Municipal Bonds

General Obligation Bonds

Revenue Bonds

Build America Bonds (BABs)

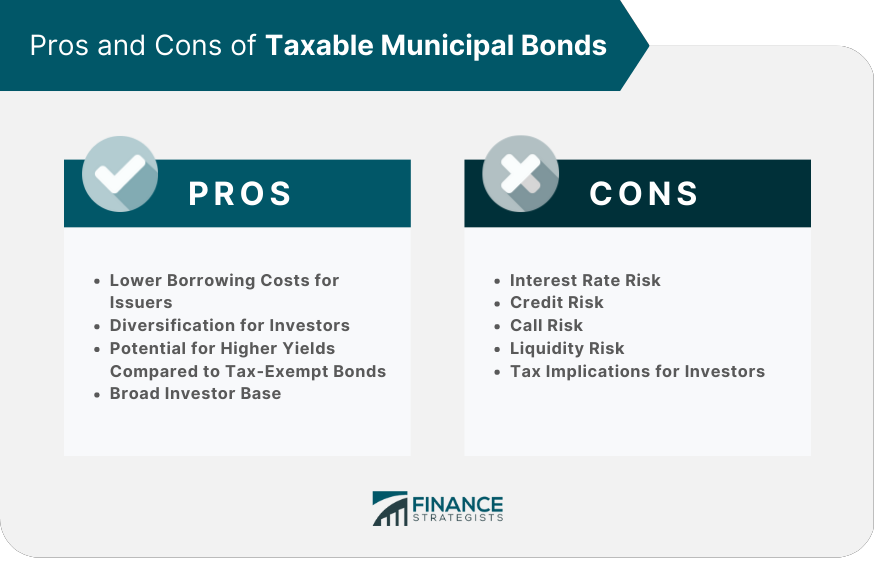

Pros of Taxable Municipal Bonds

Lower Borrowing Costs for Issuers

Diversification for Investors

Potential for Higher Yields Compared to Tax-Exempt Bonds

Broad Investor Base

Cons and Risks of Taxable Municipal Bonds

Interest Rate Risk

Credit Risk

Call Risk

Liquidity Risk

Tax Implications for Investors

Investing in Taxable Municipal Bonds

Individual Bonds vs. Bond Funds

Evaluating Credit Quality and Ratings

Assessing Interest Rates and Yield

Tax Implications and Planning

Diversification Strategies

Market Trends and Developments

Impact of Federal Tax Policy on Demand

Infrastructure Spending and Municipal Bond Issuance

Credit Quality Trends and Potential Risks

Innovations in the Municipal Bond Market

Conclusion

Taxable Municipal Bonds FAQs

Taxable municipal bonds are debt securities issued by state and local governments or other government entities for projects that do not qualify for tax-exempt status under federal law. Unlike tax-exempt municipal bonds, the interest income earned from taxable municipal bonds is subject to federal income tax and, in some cases, state and local taxes.

Projects financed by taxable municipal bonds may include those that primarily benefit private entities, such as stadiums, or those that finance pension obligations or refinance existing debt. Some other examples of projects funded by taxable municipal bonds are airports, toll roads, hospitals, and utilities.

Investing in taxable municipal bonds can offer several advantages, including potential for higher yields compared to tax-exempt bonds, diversification for investors, and a broad investor base that includes foreign investors and pension funds. These bonds can also provide lower borrowing costs for issuers compared to traditional corporate bonds.

The risks of investing in taxable municipal bonds include interest rate risk, credit risk, call risk, liquidity risk, and tax implications for investors. Investors should carefully evaluate the credit quality and financial stability of the bond issuer, as well as consider the potential impact of interest rate changes and tax implications on their investment.

Investors can choose between individual bonds and bond funds when investing in taxable municipal bonds. They should evaluate the credit quality and ratings of the bonds, assess interest rates and yield, consider the tax implications, and diversify their portfolios by including a mix of taxable and tax-exempt municipal bonds. This approach can help manage risk and capitalize on opportunities in the taxable municipal bond market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.