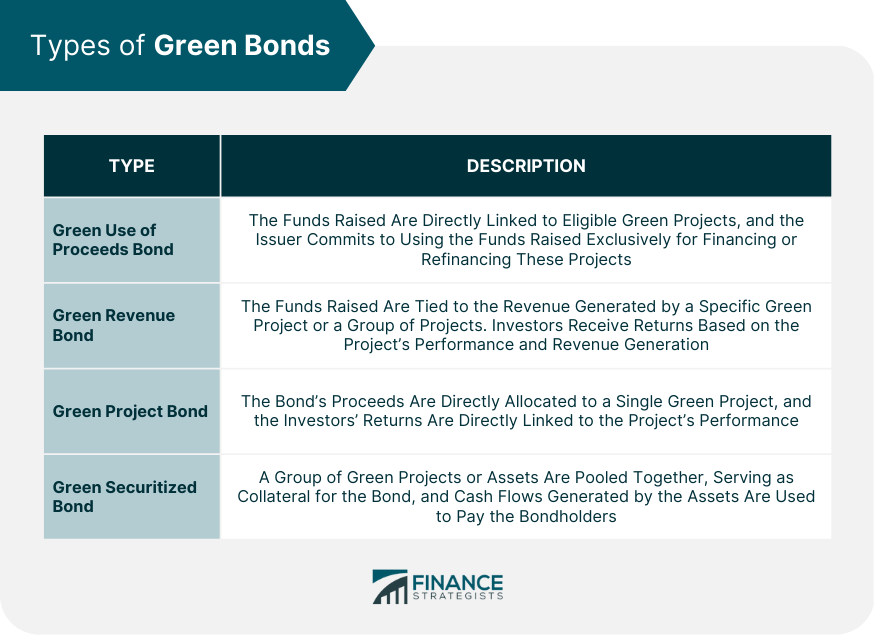

Green bonds are a type of debt instrument specifically designed to finance projects and initiatives that have a positive impact on the environment and contribute to sustainable development. They are issued by governments, corporations, financial institutions, and other entities to fund projects related to clean energy, pollution reduction, sustainable agriculture, and more. Green bonds aim to raise capital for environmentally friendly projects while providing investors with a socially responsible investment option. They play a crucial role in addressing climate change and other environmental challenges by channeling capital into sustainable projects. This type of bond is the most common and directly links the proceeds to eligible green projects. The issuer commits to using the funds raised exclusively for financing or refinancing these projects. In a green revenue bond, the proceeds are tied to the revenue generated by a specific green project or a group of projects. Investors receive returns based on the project's performance and revenue generation. Green project bonds are issued to finance a single green project, with the bond's proceeds being directly allocated to that project. The investors' returns are directly linked to the project's performance. Green securitized bonds are created by pooling a group of green projects or assets, such as renewable energy installations or energy-efficient buildings. The pooled assets serve as collateral for the bond, and the cash flows generated by the assets are used to pay the bondholders. National and local governments can issue green bonds to finance public projects that promote environmental sustainability, such as renewable energy installations, public transportation, or infrastructure improvements. Companies across various industries issue green bonds to finance sustainable projects, such as energy-efficient buildings, clean technology investments, or waste management initiatives. Banks and other financial institutions can issue green bonds to fund their own green lending activities or to finance investments in sustainable projects. International organizations like the World Bank or the European Investment Bank issue green bonds to support global environmental initiatives and sustainable development projects. The green bond market has experienced rapid growth in recent years, driven by increasing demand for sustainable investment options and growing awareness of environmental challenges. This growth is expected to continue as more issuers enter the market and investors increasingly prioritize sustainability in their investment decisions. Some of the key players in the green bond market include major financial institutions, such as the European Investment Bank, the World Bank, and various national governments, as well as large corporations like Apple, Toyota, and Unilever. The green bond market has seen significant growth in regions like Europe, North America, and Asia, with Europe leading the way in terms of issuance volume. However, emerging markets are also beginning to tap into the green bond market, as they recognize the importance of sustainable development. The Green Bond Principles, developed by the International Capital Market Association (ICMA), provide a voluntary framework for issuers to ensure transparency, consistency, and credibility in the green bond market. They cover the use of proceeds, project evaluation, management of proceeds, and reporting. The Climate Bonds Standard, developed by the Climate Bonds Initiative, is a science-based screening tool that helps investors and issuers identify investments that are consistent with a low-carbon and climate-resilient economy. The standard provides sector-specific criteria for green bonds and ensures that funded projects contribute to the global climate goals. To ensure credibility and transparency, green bonds often undergo an external review or verification process by independent third parties. These reviews typically include an assessment of the bond's alignment with the Green Bond Principles or the Climate Bonds Standard, and may involve a second opinion, certification, or rating. Green bonds play a crucial role in financing projects that mitigate climate change, reduce pollution, and promote sustainable development. They help channel much-needed capital into environmentally beneficial projects, contributing to global environmental goals. Issuing green bonds can help attract a broader range of investors, including those with a focus on environmental, social, and governance (ESG) criteria. This can lead to increased demand for the bonds and potentially lower borrowing costs for the issuer. For investors, green bonds offer an opportunity to diversify their portfolios by adding a sustainable and socially responsible investment option. This can help reduce overall portfolio risk while supporting environmentally beneficial projects. Issuing green bonds can help enhance an organization's reputation and demonstrate its commitment to sustainability and corporate social responsibility. This can have a positive impact on brand perception and stakeholder relations. One of the main concerns in the green bond market is the risk of greenwashing, where issuers may overstate the environmental benefits of their projects to attract investors. This can undermine the credibility of the green bond market and hinder its growth. While there are several voluntary frameworks and standards in place, the lack of uniform, mandatory standards can create confusion and inconsistencies in the green bond market. This can make it difficult for investors to compare and evaluate green bonds across different issuers and sectors. Issuing green bonds can involve additional transaction costs, such as those associated with external reviews, certification, or reporting. These costs can be a barrier to entry for some issuers, particularly smaller organizations or those in emerging markets. Although the green bond market has grown significantly, it still represents a small fraction of the overall bond market. This can lead to concerns about liquidity and market depth, which may affect pricing and trading opportunities for investors. Green bonds have emerged as a vital tool for financing sustainable development and addressing pressing environmental challenges. They offer numerous benefits to both issuers and investors while promoting environmentally responsible projects across various sectors and regions. The growing green bond market reflects the increasing importance of sustainable finance in the global effort to combat climate change and support a more sustainable future. Green bonds provide a viable option for raising capital for environmentally beneficial projects, and their continued growth will be essential in funding the transition to a low-carbon, climate-resilient economy. To maximize the potential of green bonds, it is essential to address the challenges and criticisms that currently exist within the market. This includes promoting transparency and consistency through the adoption of uniform standards, combating greenwashing, and expanding the market to new sectors and regions. By doing so, green bonds can continue to play a critical role in financing sustainable development and contributing to global environmental goals.What Are Green Bonds?

Types of Green Bonds

Green Use of Proceeds Bond

Green Revenue Bond

Green Project Bond

Green Securitized Bond

Issuers of Green Bonds

Governments and Municipalities

Corporations

Financial Institutions

Supranational Organizations

Green Bond Market

Market Growth and Trends

Key Players and Market Leaders

Regional Analysis

Green Bond Standards and Certification

Green Bond Principles (GBP)

Climate Bonds Standard (CBS)

External Review and Verification

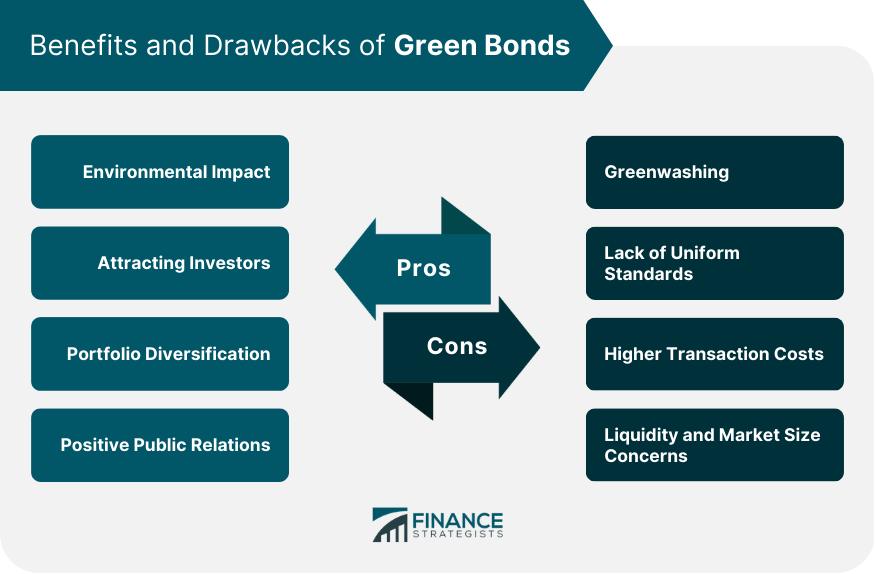

Benefits of Green Bonds

Environmental Impact

Attracting Investors

Portfolio Diversification

Positive Public Relations

Challenges and Criticisms

Greenwashing

Lack of Uniform Standards

Higher Transaction Costs

Liquidity and Market Size Concerns

Conclusion

Recap of Key Points

Importance of Green Bonds in Financing Sustainable Development

Encouraging Further Growth and Adoption

Green Bonds FAQs

Green bonds are a type of fixed-income security that is issued to fund environmentally sustainable projects. These bonds are specifically designed to finance projects that contribute to mitigating or adapting to climate change, preserving biodiversity, and promoting a more sustainable future.

Green bonds work similarly to traditional bonds, but the funds raised are earmarked for environmentally sustainable projects. Investors purchase the bonds and receive fixed interest payments until the bond's maturity date when the principal is repaid.

Green bonds can be issued by a variety of entities, including governments, municipalities, corporations, and financial institutions. The issuer must have a framework in place to ensure the funds raised are used for environmentally sustainable projects.

Investing in green bonds not only supports environmentally sustainable projects but also provides financial benefits such as diversification, potentially higher yields, and low credit risk. Additionally, investing in green bonds can enhance a company's reputation and demonstrate their commitment to sustainability.

The main difference between a green bond and a traditional bond is the use of proceeds. Green bonds are specifically designed to finance environmentally sustainable projects, while traditional bonds may be issued for any purpose. Green bonds also require that the issuer have a framework in place to ensure the funds raised are used for eligible green projects. Additionally, some investors may prefer green bonds due to their potential for positive environmental impact and reputational benefits for the issuer.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.