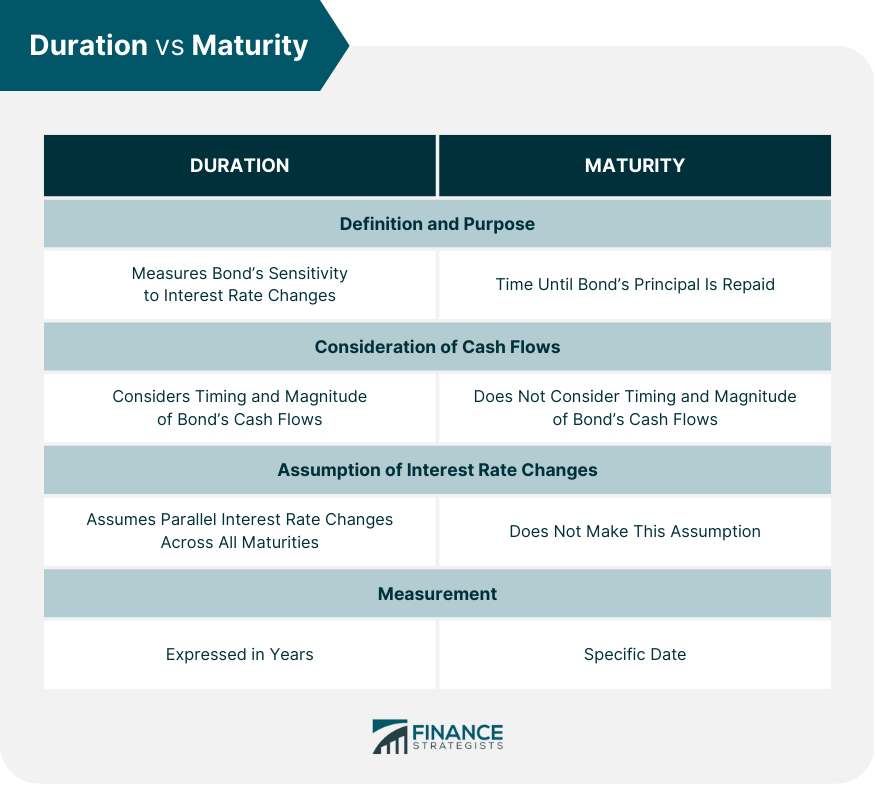

Duration and maturity are two essential financial concepts that investors and analysts use to assess the performance and risk of various investment options. Duration is a measure of a bond's price sensitivity to changes in interest rates, while maturity is the length of time until a bond's principal is repaid. The two concepts are closely related, but they are not interchangeable. Understanding the differences between duration and maturity is crucial for anyone interested in investing in fixed-income securities or managing a portfolio of bonds. Duration measures a bond's sensitivity to changes in interest rates. It estimates how much a bond's price will change for a given change in interest rates. Duration is typically expressed in years. The higher the duration, the more sensitive the bond's price is to interest rate changes, and vice versa. Duration helps manage interest rate risk. The duration calculation is complex and requires understanding the bond's cash flows and the current interest rate environment. However, there are simplified formulas for calculating duration, such as the Macaulay Duration and Modified duration. The Macaulay duration is the weighted average time until the bond's cash flows are received, while the modified duration adjusts the Macaulay duration for changes in interest rates. The relationship between duration and interest rates is inverse. That is, when interest rates rise, bond prices fall, and when interest rates fall, bond prices rise. The magnitude of the price change depends on the bond's duration. Bonds with longer durations are more sensitive to interest rate changes and will experience larger price changes than bonds with shorter durations. Duration helps investors and analysts estimate how much a bond's price will change in response to changes in interest rates. By understanding the duration of a bond, investors can make informed decisions about buying, selling, or holding the bond in their portfolio. Duration is also useful for comparing the interest rate risk of different bonds and for constructing a portfolio of bonds with a desired level of risk. One advantage of duration as a risk measure is that it is easy to calculate and interpret. It provides a single number that summarizes the bond's interest rate risk, making it useful for comparing the risk of different bonds. However, duration has limitations. For example, duration assumes that interest rate changes are parallel across all maturities, which may not be true in the real world. Duration also assumes that the bond's cash flows are fixed, which is not always true for callable or puttable bonds. Maturity is the length of time until a bond's principal is repaid. It is the date on which the bond issuer must repay the bondholder the face value of the bond. Maturity is expressed in years and is essential in determining the bond's price. The maturity choice for a bond is an important consideration for both the issuer and the investor. Short-term maturity refers to a financial instrument or investment that has a relatively short duration until its maturity or expiration date. Generally, short-term maturity refers to a period of less than one year, such as Treasury bills or commercial paper. Investors who choose short-term maturity investments typically seek lower risk and a quicker return on their investment. Medium-term maturity has a duration of one to ten years until its maturity or expiration date. Examples of medium-term maturity investments include corporate bonds, municipal bonds, and certificates of deposit (CDs). Medium-term investments typically offer higher returns than short-term investments but with higher risk. Investors who choose medium-term maturity investments are often looking to balance risk and return and may have medium-term financial goals or cash flow needs. Long-term maturity typically has a duration of more than 10 years. Long-term maturities are used by a variety of individuals and entities, including individual investors, pension funds, endowments, and other institutional investors. These investors are typically looking to build wealth or achieve specific financial goals over a long period of time, and they are willing to accept some level of risk in pursuit of those goals. Like duration, the relationship between maturity and interest rates is inverse. Long-term bonds are more sensitive to interest rate changes than short-term bonds. When interest rates rise, the price of long-term bonds falls more than the price of short-term bonds, and vice versa. This is because long-term bonds have a longer time horizon for receiving their cash flows, so their prices are more affected by changes in interest rates over time. Maturity is an important factor in determining the price and risk of a bond. Investors and analysts use maturity to assess the bond's cash flow profile, liquidity, and credit risk. Bonds with longer maturities are riskier than bonds with shorter maturities because there is more uncertainty about future interest rates and inflation. However, longer-term bonds typically offer higher yields to compensate investors for the additional risk. Maturity is a valuable tool for assessing the risk of a bond. It provides information about the bond's cash flow profile and helps investors and analysts understand its sensitivity to interest rate changes. However, maturity has limitations. It does not consider the timing or magnitude of the bond's cash flows, which can be important factors in determining the bond's price and risk. Maturity also assumes that interest rate changes are parallel across all maturities, which may not be true in the real world. Duration and maturity are both interest rate risk measures that are not interchangeable. The key differences between duration and maturity are: Duration measures the bond's sensitivity to interest rate changes, while maturity is the time until the bond's principal is repaid. Duration considers the timing and magnitude of the bond's cash flows, while maturity does not. Duration assumes that interest rate changes are parallel across all maturities, while maturity does not make this assumption. Duration is expressed in years, while maturity is a specific date. Despite the differences, duration and maturity have some similarities: Both measures are important for assessing interest rate risk and determining the price and risk of a bond. Both measures are used to construct a bond portfolio with a desired risk level. Both measures are affected by changes in interest rates. The choice of whether to use duration or maturity depends on the investor's objectives and the characteristics of the bond. Duration is more appropriate for assessing the interest rate risk of bonds with uneven cash flows or embedded options, such as callable or puttable bonds. Maturity is more appropriate for assessing the cash flow profile and credit risk of bonds with fixed cash flows, such as Treasury bonds. Investors and analysts should consider both duration and maturity when making investment decisions. By understanding the relationship between duration and maturity, investors can construct a portfolio of bonds that meets their risk and return objectives. For example, a portfolio of short-term bonds may have lower interest rate risk than a portfolio of long-term bonds, but it may also offer lower returns. A portfolio of long-term bonds may offer higher returns but may be riskier and more sensitive to changes in interest rates. Duration and maturity are essential financial concepts that investors and analysts use to assess the performance and risk of fixed-income securities. Duration measures the bond's sensitivity to interest rate changes, while maturity is the length of time until the bond's principal is repaid. Both measures are important for constructing a portfolio of bonds with a desired level of risk and return. Understanding duration and maturity is crucial for anyone interested in investing in fixed-income securities or managing a portfolio of bonds. By understanding these concepts, investors can make informed decisions about buying, selling, or holding fixed-income securities and construct a portfolio that meets their risk and return objectives. As investing can be complex and challenging, investors should hire a financial advisor to help them navigate the market and make informed investment decisions in their wealth management. Duration vs Maturity: An Overview

What Is Duration?

Calculation of Duration

Relationship Between Duration and Interest Rates

Uses of Duration in Finance

Advantages and Limitations of Duration as a Risk Measure

What Is Maturity?

Types of Maturity

Short-Term Maturity

Medium-Term Maturity

Long-Term Maturity

Relationship Between Maturity and Interest Rates

Uses of Maturity in Finance

Advantages and Limitations of Maturity as a Risk Measure

Differences Between Duration and Maturity

Similarities Between Duration and Maturity

When to Use Duration and When to Use Maturity

Importance of Considering Both Duration and Maturity When Making Investment Decisions

Conclusion

Duration vs Maturity FAQs

Duration and maturity are two essential concepts in finance that investors and analysts use to assess the performance and risk of fixed-income securities. Duration measures a bond's sensitivity to interest rate changes, while maturity is the length of time until a bond's principal is repaid.

Both measures are affected by changes in interest rates, but the magnitude of the price change depends on the bond's duration or maturity. Longer-term bonds are more sensitive to interest rate changes than shorter-term bonds.

Duration measures the bond's sensitivity to interest rate changes, while maturity is the length of time until the bond's principal is repaid. Duration considers the timing and magnitude of the bond's cash flows, while maturity does not.

Understanding duration and maturity is crucial for anyone interested in investing in fixed-income securities or managing a portfolio of bonds. By understanding these concepts, investors can make informed decisions about buying, selling, or holding fixed-income securities and construct a portfolio that meets their risk and return objectives.

Whether to use duration or maturity depends on the investor's objectives and the characteristics of the bond. Duration is more appropriate for assessing the interest rate risk of bonds with uneven cash flows or embedded options. At the same time, maturity is more appropriate for assessing the cash flow profile and credit risk of bonds with fixed cash flows.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.