A bond fund is a mutual fund, exchange-traded fund (ETF), or closed-end fund that invests primarily in bonds and other fixed-income securities. These funds can be managed actively, where fund managers make decisions on which bonds to buy or sell, or passively, where the fund tracks a specific bond index. The primary goal of bond funds is to generate income for investors while preserving their capital. They provide investors with an opportunity to participate in the fixed-income market without the need to purchase individual bonds. Numerous types of bond funds are available, catering to different investor preferences and risk tolerances. These funds invest primarily in government-issued bonds. These funds invest in U.S. Treasury bonds, which are considered among the safest investments due to the backing of the U.S. government. These funds invest in government bonds issued by countries other than the United States, providing global diversification and exposure to various economic and political environments. Corporate bond funds focus on bonds issued by companies. These funds invest in bonds issued by companies with high credit ratings, indicating a lower risk of default. Investment-grade bonds offer relatively lower yields compared to high-yield bonds. Also known as junk bond funds, these invest in bonds issued by companies with lower credit ratings, indicating a higher risk of default. High-yield bonds offer higher yields to compensate for the increased risk. Municipal bond funds invest in bonds issued by state and local governments. These funds invest primarily in municipal bonds issued within a specific state, offering tax benefits for residents of that state. National municipal bond funds invest in bonds issued by various state and local governments across the United States, providing broader diversification and exposure to different economic conditions. These funds invest in mortgage-backed securities, which are created by pooling mortgages and selling them to investors as fixed-income instruments. Inflation-protected bond funds invest in securities, such as Treasury Inflation-Protected Securities (TIPS), which are designed to offer protection against inflation by adjusting their principal and interest payments based on changes in the Consumer Price Index. Multi-sector bond funds invest in a diversified mix of bonds from different sectors, including government, corporate, municipal, and mortgage-backed securities, offering broad exposure to the fixed-income market. These funds are categorized based on the average maturity of the bonds they invest in. Short-term bond funds typically invest in bonds with maturities of 1-3 years, intermediate-term bond funds invest in bonds with maturities of 3-10 years, and long-term bond funds invest in bonds with maturities of 10 years or more. There are several advantages to investing in bond funds, including: Bond funds provide diversification by spreading investments across a broad range of fixed-income securities, reducing the impact of any single bond default or credit event. Bond funds are managed by professional portfolio managers with the expertise to analyze and select bonds, helping optimize returns and manage risks. Bond funds typically pay interest to investors on a regular basis, providing a steady stream of income. Bond funds primarily invest in fixed-income securities, which tend to be less volatile than equity funds, making them a suitable option for conservative investors looking to preserve their capital. Investing in bond funds carries several risks, including: Bond prices tend to move inversely to interest rates. When interest rates rise, bond prices fall, and vice versa. This means that the value of bond funds can fluctuate based on changes in interest rates. Credit risk refers to the possibility that a bond issuer may default on their interest or principal payments. Higher credit risk bonds, such as high-yield corporate bonds, are more likely to default and can negatively impact a bond fund's performance. Inflation can erode the purchasing power of bond interest payments over time, reducing the real return on investment. Inflation-protected bond funds can help mitigate this risk. Liquidity risk arises when a bond fund may have difficulty selling bonds in its portfolio due to a lack of buyers in the market. This can result in the fund having to sell bonds at a lower price than their fair value, negatively impacting the fund's performance. International bond funds are exposed to currency risk, as fluctuations in exchange rates can affect the value of foreign bonds held in the fund. When evaluating bond funds, investors should consider several key performance metrics: Yield is the income generated by a bond fund, expressed as a percentage of its net asset value. It can help investors gauge the income potential of a bond fund. Duration measures a bond fund's sensitivity to interest rate changes. A higher duration indicates greater price fluctuations in response to interest rate changes. Investors with a lower tolerance for risk should consider bond funds with shorter durations. A bond fund's credit quality is determined by the credit ratings of the bonds it holds. Higher credit quality indicates a lower likelihood of default and can help investors assess the overall risk of a bond fund. The total return is a measure of a bond fund's performance, including both income and capital appreciation. This metric provides a comprehensive view of a bond fund's performance over a specified period. Risk-adjusted performance measures the returns of a bond fund relative to its level of risk. This metric helps investors compare bond funds with different risk profiles on a more level playing field. Expense ratios represent the fees a bond fund charges to cover management, administrative, and other operating costs. Lower expense ratios can lead to higher net returns for investors. There are several strategies that investors can employ when investing in bond funds: Diversification across different bond types, such as government, corporate, and municipal bonds, and varying maturities can help spread risk and optimize returns. Laddering involves investing in bond funds with staggered maturities so that bonds mature at different times. This strategy can reduce interest rate risk and provide a more stable income stream. Investors should decide whether they prefer actively managed bond funds, where fund managers actively buy and sell bonds to outperform a benchmark, or passively managed funds, which track a specific bond index. Tactical asset allocation involves adjusting the allocation of bond funds in a portfolio based on changing market conditions or the investor's risk tolerance and investment objectives. Investors should consider the tax implications of their bond fund investments, particularly with regard to municipal bond funds, which may offer tax advantages. When selecting a bond fund, investors should consider the following factors: Determine your risk tolerance based on your investment objectives, time horizon, and comfort level with potential fluctuations in the value of your investments. Consider your investment goals, such as generating income, preserving capital, or achieving long-term growth, as well as your investment time horizon. When comparing bond funds, evaluate their performance, expenses, and management, among other factors. Review a bond fund's historical performance, including yield, total return, and risk-adjusted performance, to assess its potential for meeting your investment objectives. Compare the expense ratios of different bond funds, as lower expenses can contribute to higher net returns. Evaluate the experience and track record of a bond fund's management team, as well as the fund's investment strategy. Choose a fund family or investment platform that offers a wide range of bond funds and resources, and tools to help you make informed investment decisions. Bond funds are investments that primarily invest in bonds and other fixed-income securities. They provide investors with several benefits, including diversification, professional management, income generation, and capital preservation. Bond funds can invest in various types of bonds, including government, corporate, municipal, and mortgage-backed securities. While there are risks associated with investing in bond funds, such as interest rate, credit, inflation, liquidity, and currency risks, there are strategies that investors can employ to optimize returns and manage risks. When selecting a bond fund, investors should assess their risk tolerance, investment objectives, and time horizon and compare bond funds based on their performance, expenses, and management. Wealth management services can help investors make informed investment decisions and select the right bond funds for their portfolios.What Are Bond Funds?

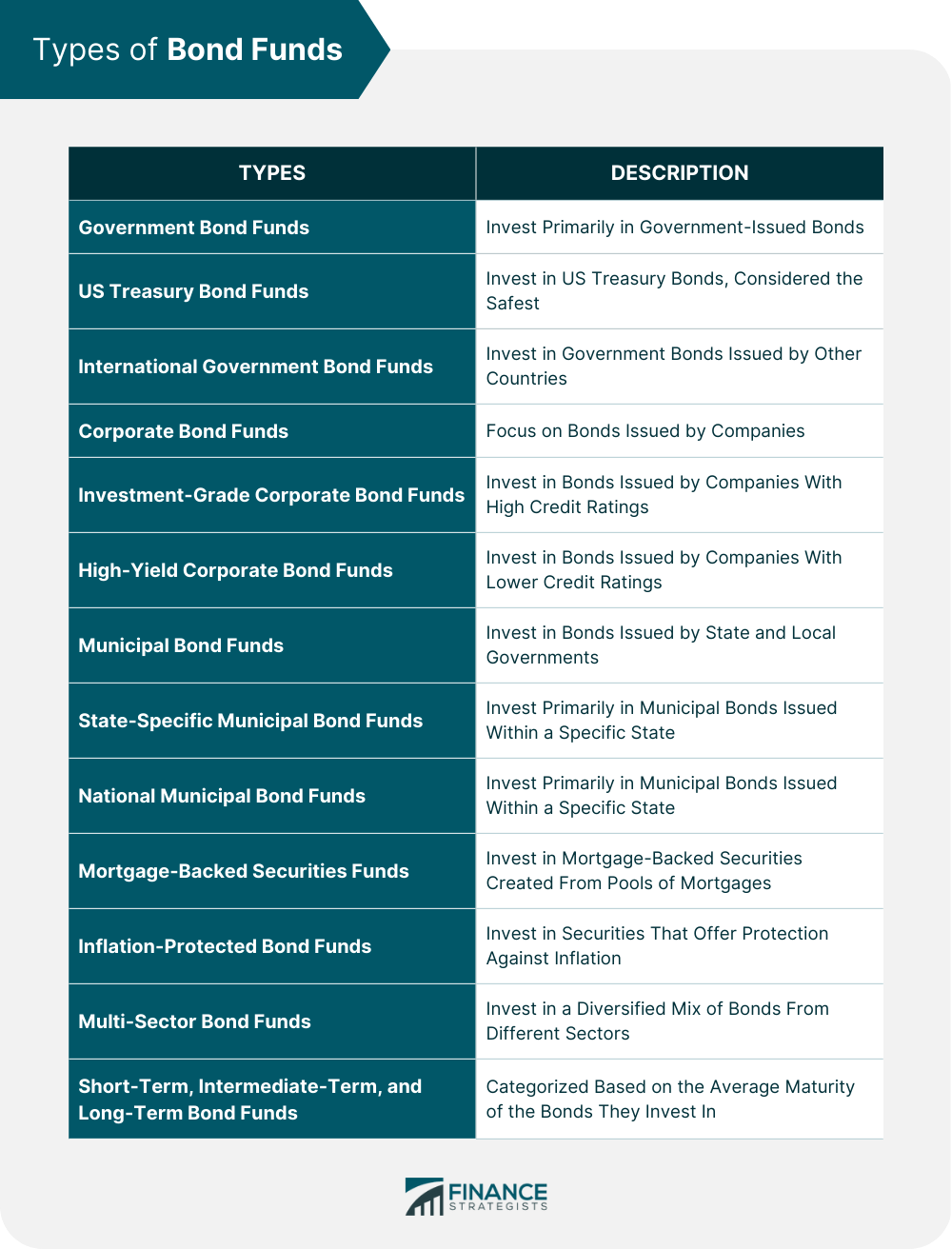

Types of Bond Funds

Government Bond Funds

US Treasury Bond Funds

International Government Bond Funds

Corporate Bond Funds

Investment-Grade Corporate Bond Funds

High-Yield Corporate Bond Funds

Municipal Bond Funds

State-Specific Municipal Bond Funds

National Municipal Bond Funds

Mortgage-Backed Securities Funds

Inflation-Protected Bond Funds

Multi-Sector Bond Funds

Short-Term, Intermediate-Term, and Long-Term Bond Funds

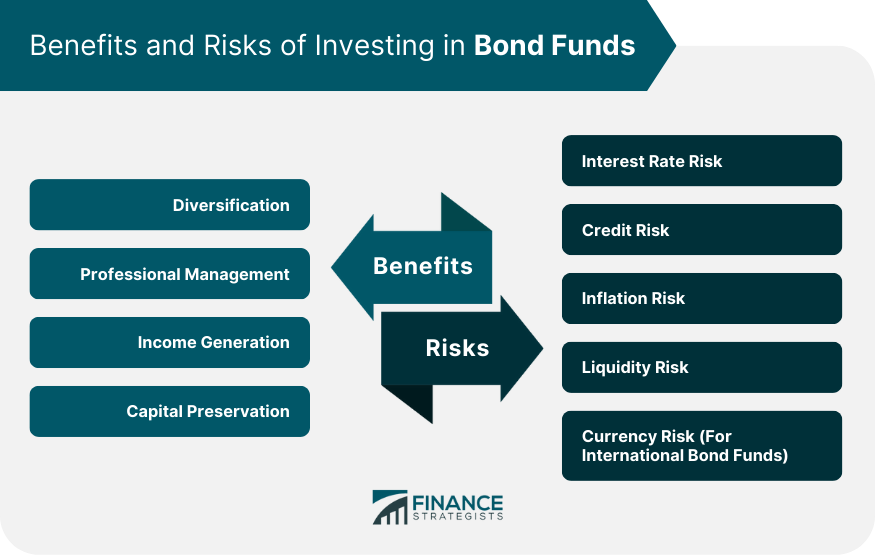

Benefits of Investing in Bond Funds

Diversification

Professional Management

Income Generation

Capital Preservation

Risks Associated With Bond Funds

Interest Rate Risk

Credit Risk

Inflation Risk

Liquidity Risk

Currency Risk (For International Bond Funds)

Performance Metrics and Analysis of Bond Funds

Yield

Duration

Credit Quality

Total Return

Risk-Adjusted Performance

Expense Ratios

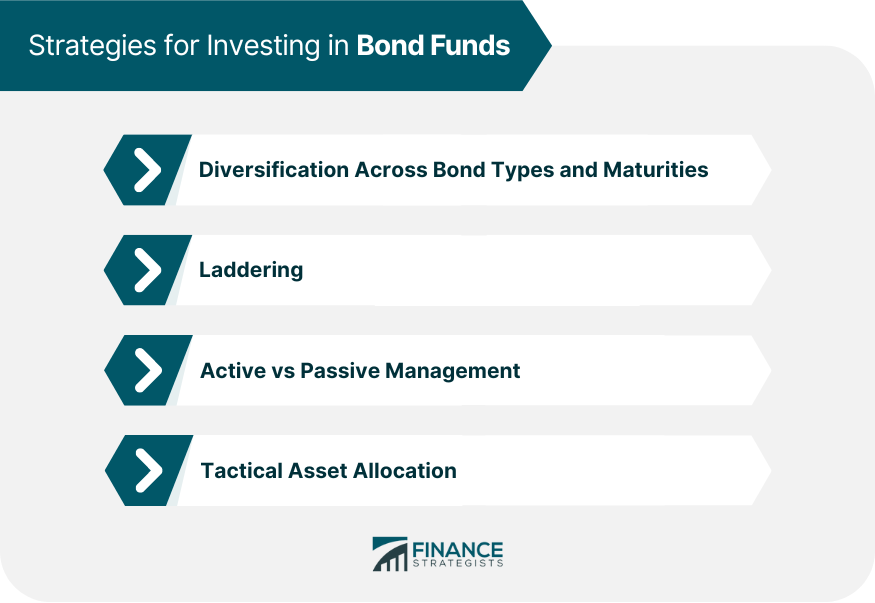

Strategies for Investing in Bond Funds

Diversification Across Bond Types and Maturities

Laddering

Active vs Passive Management

Tactical Asset Allocation

Consideration of Tax Implications

How to Choose a Bond Fund

Assessing Your Risk Tolerance

Evaluating Investment Objectives and Time Horizon

Comparing Bond Funds

Performance

Expenses

Management

Selecting a Fund Family or Platform

Final Thoughts

Bond Funds FAQs

Bond funds are mutual funds, exchange-traded funds, or closed-end funds that primarily invest in bonds and other fixed-income securities. The goal of bond funds is to generate income for investors while preserving their capital.

Bond funds provide several benefits, including diversification, professional management, income generation, and capital preservation. They also offer an opportunity to participate in the fixed-income market without the need to purchase individual bonds.

Bond funds can invest in various types of bonds, including government bonds, corporate bonds, municipal bonds, mortgage-backed securities, and inflation-protected bond funds.

Investing in bond funds carries several risks, including interest rate risk, credit risk, inflation risk, liquidity risk, and currency risk (for international bond funds).

Investors can choose the right bond funds for their portfolios by assessing their risk tolerance, investment objectives, and time horizon, comparing bond funds based on their performance, expenses, and management, and selecting a fund family or investment platform that offers a wide range of bond funds and resources. Seeking the help of a wealth management service can also be beneficial in making informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.